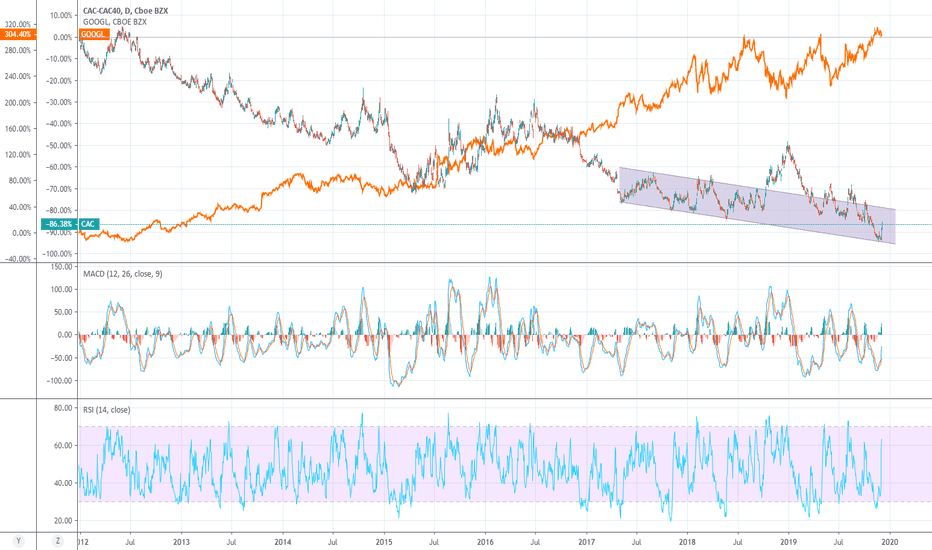

Indices Europe

CAC 40 Index - heading towards 2012 lowEurope Markets entering strong bearish momentum.

France is at the beginning of the COVID-19 Pandemic, number of infected people expect to grow exponentially in the upcoming weeks.

France, Spain, Germany following Italy's state of emergency.

We expect now a lower low of the CAC 40 Index.

At the correction move to 4600, we can start shorting the Index with the price target of 2012's low at 2800.

Europe will enter in recession if serious state economic measures are not taken.

"Two of the EU's biggest states, France and Spain, have followed Italy in announcing emergency restrictions to combat the spread of coronavirus. France, a country of 63.5 million, ordered the closure of all non-essential places used by the public from midnight (23:00 GMT)." 15 March - bbc.com

Let me know your view in the comments down below!

CAC 40 At Crucial Support CAC40 opened With massive Gapdown trapping all the bulls at higher level

This must have forced the small leveraged Trader to exit Their Position at the lower rates forcing the index downwards.

Index can Face Heavy Selling Pressure from tops

All the trapped brave Traders who didn't exit their position in today's fall will be waiting for their prices on the higher side.

So Sell on rise pattern could be seen in this index

CAC40 Is currently trading Below its 100 EMA at crucial Support Level of previous swing low.

Fresh Sell Off Can be Seen Below The swing low till 5720 Levels which is 200 EMA and 4th Decembers Low.

#CAC40, The big landslide has begun?We are still a long way from getting the double top pattern confirmation but we have an interesting start here, just in case the CAC40 dropped below 5000 points so the trend change will be final.

RSI + Stochastic 2 These indicators indicate more room for declines.

Target: $ 5450

US could impose 100% tariffs on French goods after Google taxWhat was President Macron thinking about designing a tax for tech companies... A quick reminder, it will be separated in two categories — marketplace (Amazon’s marketplace, Uber, Airbnb…) and advertising (Facebook, Google, Criteo…). Despite the fact it wasnt planned specifically for American companies, the vast majority of big tech companies that operate in France are American. Thus, a company that generates more than €750 million in global revenue and €25 million in France, will have to pay 3% of the French revenue in taxes.

As expected, the U.S. Trade Representative claimed that“France’s Digital Services Tax (DST) discriminates against U.S. companies, is inconsistent with prevailing principles of international tax policy, and is unusually burdensome for affected U.S. companies.” And, as a result, now we might see tariffs that could be as high as 100% on French goods (wine, cheese, handbags…).

What is going to happen now? Frnce will say that the response will be equally damaging, but i personally doubt they manage to impose significant tariffs unless the whole European Union agrees to cooperate and istart acting. However, even in this case no one can guarantee that th EU will achieve something worthwhile... So, with a high probability we will see another decrease in the Cac-40.

New Bubble ?The CAC 40 is trading near new high at 5730 after breaking a major resistance at 5650 becoming now a support, the trend is Bullish but the question is how far can we go in this new bubble ?

5800 ? or more or we will come back to 5650 ?

so my strategy is to wait for a close above 5700 to go long to target 5760 -5770

but if we close below I am neutral till the break of 5650