Indonesia

COVID-19 check-in on Singapore, Malaysia, Indonesia and ChinaSimilarly to previous scan set up...

Singapore numbers are rising, heads up given weeks ago, and still continue to rise... once the MACD histogram crosses above zero, it is highly likely to be the next wave.

Having said that, you can see China’s chart is just about starting up (ahead for Singapore), and after Chinese New Year, would likely be a spike or Wave 2 in motion, IMHO, it has already started for China.

Indonesia is accelerating again in their initial wave...

Malaysia is deep into Wave 2 and has not peaked out yet.

Risks are there, and honestly does not appear that a vaccine would quell the pandemic. Perhaps mitigate the spread and moderate its acceleration somewhat. So be prepared. We are getting data heads up weeks, maybe months in advance.

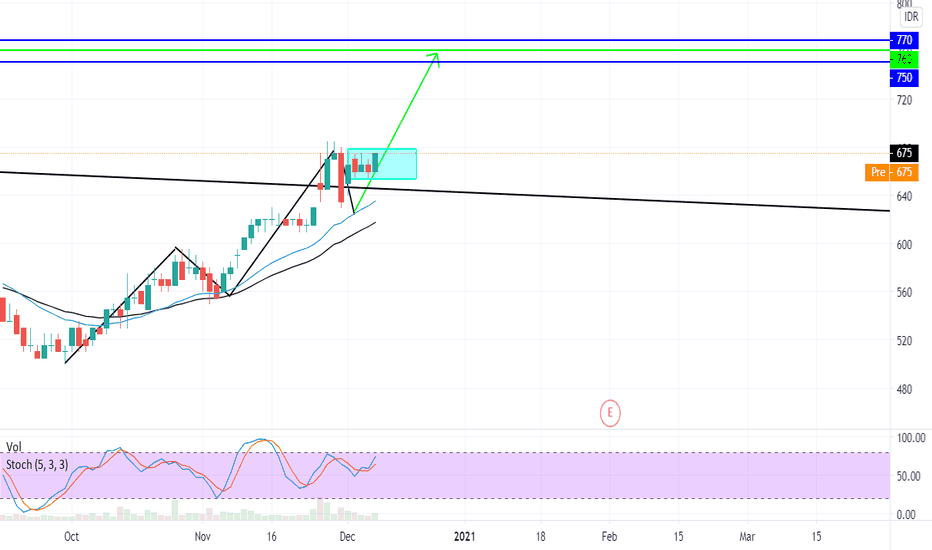

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

THE FLAG PATTERN BTPS ROAD TO 4790BTPS FORMING A PATTERN CALLED BULLISH FLAG,

THIS PATTERN CAN LEAD BTPS TO @4790 (BUT HAVE TO BREAK THE FLAG TRENDLINE FIRST!)

AFTER BREAK AND THAT DAY THE CANDLE CLOSED ABOVE THE TRENDLINE IS THE KEY TO 4790

AFTER BREAK AND RALLY, PRICE HAVE TO RE-TEST (PULLBACK/SECONDARY REACTION) TO THE TRENDLINE.

CUTLOSS AREA @ 3930 OR BREAK THE LOWER TRENDLINE OF THE BTPS.

DISCLAIMER ON !

KAEF BULLISH PENNANT IDONESIA STOCKS EXCHANGEA BULLISH PENNANT IS A PATTERN OF CONTINUATION, KAEF ALREADY FORMED AND BREAK THE PENNANT TRENDLINE, WHICH WILL LEAD KAEF TO AROUND 3750-3800 FOR THE FIRST TARGET PRICE.

BEFORE START BULLISH IT MIGHT BE A PULL BACK TO THE AREA I MARK WITH A BLUE RECTANGLE (@3300~) IDX:KAEF

THE FIRST TARGET PRICE IS 3750 - 3950 (REASON: PENNANT TARGET PRICE)

THE SECOND TARGET PRICE IS 4170 - 4240 (REASON : FIBONACCI XAY : 1.618 CLUSTER WITH HARMONIC PRICEPROJECTION (HPP) : 78.6%)

THE LONG TERM IF THE TARGET PRICE ALL TIME HIGH WILL BE 4860 - 4970 (XAY : 2.618 CLUSTER WITH HPP : 1.272)

THE STOP LOSS AREA : 3090

DISCLAIMER ON!

TLKM - BULLISH REVERSAL - DOW THEORY (INDONESIA STOCKS EXCHANGE)TLKM BULLISH REVERSAL

AFTER SEVERAL ROUGH MONTHS OF ITS BEARISHNESS, TLKM START REVERSE TO BULLISH, FROM DOW THEORY WE KNOW THAT MARKET MOVE IN A PRIMARY, SECONDARY AND FOLLOWED BY PRIMARY AGAIN JUST LIKE AB = CD, TLKM ALREADY DO HIS PRIMARY AND SECONDARY BULLISH REACTION, NOW TLKM START TO FORMING HIS PRIMARY REACTION WHICH WILL LEAD TLKM TO AROUND 3700 - 3720

WHY THAT AREA?

THE REASON IS

1. WE CAN SEE A GAP AROUND 3700

2. THE GOLDEN RATIO OF 1.618 FIBONACCI EXTERNAL RETRACEMENT ALSO STOP AT 3720 (XAY).

SO THE FIRST POINT AND SECOND POINT CLUSTER AT THE SAME TIME

CUT LOSS AREA SHOULD BE

3150

REASON : 2ND SWING LOW ALREADY MAKE A HIGHER LOW AND IF BREAK THE FIRST LOWER LOW THEN IT MIGHT GO TO 3060 AND GO UP TO CHASE THE 3700 TARGET

3060 IS THE AREA OF FIBONACCI XAB FOR THE FIRST PRIMARY OF THE BULLISH

DISCLAIMER ON !

WKST OTW GAP AREA IDN STOCKSWKST IS MAKING AN ABCD PATTERN OR PRIMARY - SECONDARY -PRIMARY AND NOW SHOULD MAKE A SECONDARY REACTION BEFORE GOING UP TO ITS TARGET PRICE AT 940 ~ 1010 AREA.EVEN THOUGH THE WEEKLY CHART IS BEARISH TREND, WE CAN PLAN A SHORT TERM TRADE (AFTER THE SECONDARY REACTION IS CREATED OR WE HAVE TO DECIDE WILL THE MARKET DIRECTLY GO TO 940 - 1010 AREA?, WE CAN USE SMALLER TIMEFRAME AND SEE THE CANDLE MOVEMENT TO DECIDE (PROFESSIONAL ONLY!) , BECASUSE 940 ~ 1010 AREA IS A GAP AREA WHICH WE BELIEVE GAP AREA MUST CLOSE!

AMRT AnalisisAnalisa untuk AMRT akan mengalami tren bearish sampai pada 710, kemudian masih akan ada kemungkinan berlanjut dan menjadi fase breakout sampai pada 685. Tapi disisi lain juga AMRT akan mengalami rebound pada 710 akan menjadi tren revesal sampai pada 725. Kemungkinan untuk terjadinya breakout bullish sangat minim karena history tren market dari AMRT mengalami fase sideways.

COVID-19 Scanning outlook for US, SG, MY and IDJust compiling a snapshot chart of the COVID-19 confirmed cases of US, SG, MY and ID.

These charts are avail in TradingView and if you are worried about the situation getting better or worse, you can use the MACD to give an indication.

Remember that these charts track the Confirmed cases, so the charts will only increase, else flatline.

Here we see how SG has flatlined much, such that the MACD is falling.

Contrary to that, the US numbers are escalating again, and MACD clearly shows it is in Wave 1.3

Indonesia is increasing, but the rate is moderating at best.

And in Malaysia, it is escalating so fast, it is almost going parabolic. The MACD accentuates the rising differences per week on week.

All these can give a better outlook into the fear of future lockdowns, and perhaps Forward economic status.

Hope this helps!

B.A.C BANK OF AMERICA DESCENDING BROADENING WEDGE (END & ID) BANK OF AMERICA : BAC DESCENDING BROADENING WEDGE

EN : WE CAN SEE THAT BAC IS FORMING A PATTERN CALLED DESCENDING BROADENING WEDGE THIS PATTERN IS A STRONG BULLISH PATTERN, WE HAVE TO WAIT UNTIL CANDLE BREAKOUT FROM THE PATTERN, THERES GOT A CHANCE THAT BAC WILL DO HIS DOWN MOVEMENT TO AROUND 23.95 - 22.58 AREA

THE REASON IS SIMPLE

1. STOCHASTIC OSCILLATOR HIT THE OVER BOUGHT AREA

2. WE CAN SEE THE SWING HIGH AT TOP ON 3 SEPT 2020 LOWER HIGH (LOWER PEAK) AT STOCHASTIC MAKING A LOWER HIGH (LOWER PEAK) AND 12 OCT LOWER HIGH AGAIN (LOWER PEAK) BUT THE STOCHASTIC IS HIGHER HIGH (HIGHER PEAK) SO A BEARISH DIVERGENCE IS FORMED THIS MEAN BAC WILL DO HIS DOWNSIDE MOVEMENT

SURE BAC WILL CONTINUE HIS BULLISH THAT WE CAN SEE AT WEEKLY CHART THE TREND IS STILL BULLISH

IF THE BREAKOUT HAPPENED BAC TARGET PRICE WILL BE AT 27.75 THIS IS THE PATTERN TARGET PRICE

BAC ALSO WILL CONTINUE ITS BULLISHESS UNTIL 30.45 AND 34.05 BECAUSE OF THE GAP AREA BUT MAYBE IT TOOK TIME FOR CLOSE THIS GAP EITHER 2021 OR 2022

THANKS. …

ID: KITA BISA MELIHAT BAC SEDANG MEMBUAT PATTERN YANG DISEBUT DESCENDING BROADENING WEDGE PATTERN INI ADALAH PATTERN BULLISH, KITA HARUS MENUNGGU SAMPAI DENGAN CANDLE BREAK OUT DARI TRENDLINE DBW INI, TETAPI SEBELUM NAIK AKAN TERJADI PENURUNAN HARRGA KE ANTARA 23.95 – 22.58

ALASANNYA SIMPLE

1. STOCHASTIC OSCILLATORNYA SUDAH MENCAPAI TITIK JENUH PEMBELIAN

2. KITA BISA LIAT SWING HIGH YANG DIATAS PADA 3 SEPT MEMBUAT LOWER HIGH(LOWER PEAK) DAN DI STOCHASTIC JUGA MEMBUAT LOWER HIGH (LOWER PEAK) DAN PADA 12 OCT MEMBUAT LOWER HIGH LAGI TETAPI STOCHASTICNYA MEMBUAT HIGHER HIGH (HIGHER PEAK) JADI TERJADILAH BEARISH DIVERGENCE INI BERARTI BAC AKAN ADA PENEURUNAN HARGA

TENTU BAC AKAN MELANJUTKAN BULLISHNYA DAN KITA JUGA BISA MELIHAT PADA WEEKLY CHART TREND BULLISH MASIH ADA

JIKA BREAKOUT TERJADI MAKA TARGET PRICE BAC AKAN PADA 27.75 INI ADALAH TARGET PRICE PADA PATTERN TERSEBUT.

BAC JUGA AKAN MELANJUTKAN BULLISHNYA SAMPAI DENGAN 30.45 DAN 34.05 DIKARENAKAN GAP AREA TERSEBUT TETAPI ITU MEMERLUKAN WAKTU UNTUK MENUTUPI GAP TERSEBUT ANTARA TAHUN 2021 ATAUPUN 2022

SEKIAN TERIMAKASIH

BY RUPIN GOH

DISCLAIMER

No information published constitutes or offer, or recommendation, or advice, to buy or sell any investment instrument, to effect any transcation, or to conclude any legal act of any kind whatsover.

The information published and opinions expressed are provided by myself (Rupin Goh) for personal use and for educational purposes only and area subject to change without notice. Rupin Goh makes no representations (either expressed or implied) that the information and opinion expressed guarantees accuracy,adequantess or completeness. In particular, nothing contained consitutes financial legal, tax or other advice. nor should any investment or any other decision be made solely based on the content.

All opinion is based upon sources that Rupin Goh believes to be reliable but he have no guarantees that this is the case. therefor, whilst every effort is made to ensure that the content is accurate and complete, Rupin makes no such claim.

Limitation of liability

Rupin disclaims, without limitation, all liability for any loss or damage of any kind including any direct, indirect or consequential damages.

Copyright

All material produced is copyright to Rupin and may not be copied, emailed faxed or distributed without the express permission of Rupin

Notes: all orders are valid until the next report is published, or a trading strategy alert is sent between reports.

REKOMENDASI SAHAM GARUDA INDONESIATEKNIKAL :

- sempat sideways di level fibo 0,23

- trendline kuning berhasil ditembus

- terdapat resisten di kotak kuning

FUNDAMENTAL

- Presiden Amerika kemungkinan terpilih adalah Biden

- Vaksin Covid ditemukan lagi

REKOMENDASI BUY LIMIT ON 200-220 (WAIT), ATAU INSTAN BUY JIKA TEMBUS 300 TARGET PRICE :

- 400, reason : golden fibo

- 500, reason : support become resistent

- 600-650 resason : resisten tertinggi sebelumnya