Indonesia COVID-19 - the next wavePresuming that the testing is done properly, the daily chart is indicating that the next COVID wave is upon Indonesia in its initial stages already.

Mid-June 2021 should see the wave hit the shores hard, and media coverage appear then...

Stay safe and be well my Indonesian friends!

Indonesia

INDONESIA COVID-19 - the next wave part IIWas just speaking to a friend in Jakarta. As expected it is getting worse, and hospitals are about 90% max capacity. the chart had projected the wave since 24 May.

And now is projecting that by mid-July 2021, it would have exploded and overflowing.

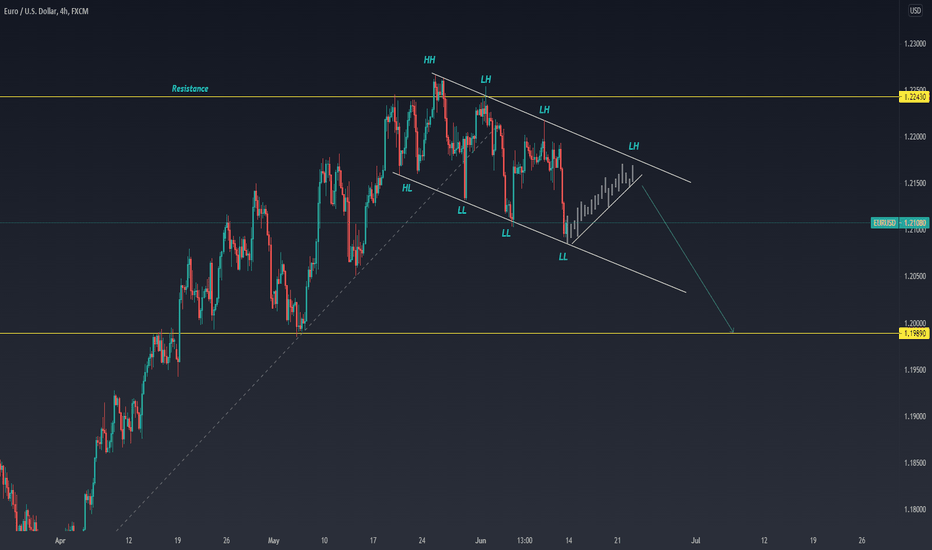

EURUSD AnalysisEURUSD fell quite strongly on Friday' and break its support and form a new low .

In the previous movement the price declined after touching the resistance area.

Then the price broke through its up-trendline and formed a lower low.

We can expect the price to make some correction first before another downside movement.

sell can be done after the price breaks the correction area and targeting the next support/yellow line.

AUDCAD Daily ABCDOn the daily chart the price completed the ABCD Pattern in the support area.

From here we look for opportunities for a bounce from support.

Currently the price is still correcting and we can wait for the price to break this correction area

before deciding to buy.

we are also have a bullish divergent on MACD.

If the price manages to get out of this correction channel, then the opportunity to go up is very open

COVID-19 tracking SG and her neighbours (MY, ID and TH)Looking at the weekly charts...

1. All, except ID, are increasing in Wave 3, with differing levels of acceleration.

2. ID may be having an uptick...

3. SG's momentum is still strong for another two weeks at least.

4. Both My and TH have strong momentum to further increase. MY's situation is bad enough with TH's situation being worse.

Overall, the three neighbours have at least another 2-4 weeks of the wave to ride out; of which the northern two probable take months more...

PS. Previously described, the MACD and MACD Histograms are very useful in projecting the virus infection waves. Used here for personal monitoring and analysis. What this simple tool identified does is to allow an advantage to be ahead of the curve instead of being behind it chasing the virus as it silently sweeps across the population.

IDX: DOID - May-2021IDX:DOID

DOID has been one of the favorite second-liner stocks in the IDX.

In the past, the 260-264 (yellow circle) area has been the target for this stock.

DOID reached the highest price of 466 on 08 December 2020. Since then, 328-332 is the important Support-Resist area (high area) for DOID.

DOID formed a Double Bottom pattern between 29 January to 09 March 2021, and the target has been achieved on 12 March 2021.

Price continuously building an uptrend momentum with the highest price at 460 (Extension 3.618 from the last small swing low) and forming a Head and Shoulder pattern with the red ray as the neckline.

The Neckline has been tested with Three Candles (19-21 April) and is currently forming sideways between 342-376.

The head and shoulder pattern target will be at 284 (last low of Double Bottom Pattern).

Disclaimer is always on.

Trade at your own risks.

IDX: AKRA - May 2021IDX:AKRA

At a glance: AKRA is still building up momentum to break out the down trendline formed since late 2017.

False Breakout occurred on the 3rd Week of March 2021.

False Breakout confirmed by Rule of Three methods where the candle only lasted 2 days above the down trendline.

In my perspective, there is a flat range for this stock in the area of 3110-3300-3490

Price needs to break out 3300 as the strongest resistance with good volume.

If the price can break out 3300, an Inverted Head and Shoulders pattern is confirmed.

The target for the small swing reversal aligned with the Retracement target at 3510-3520.

Stop Loss if the price goes lower than 3080.

Disclaimer is always on.

Trade at your own risks.

IDX: AALI - May-2021AALI

Astra Family in the CPO Industry

Yesterday's (04-May-2021) confirmed the reversal for the shorter downtrend line. When the candle breakout the trend line, we can use the Fibonacci Retracement to predict the target of the price by following its retracement.

I predict that the reversal of this stock is quite strong to reach the 0.500 retracements at 10450 because the commodity itself is supporting the reversal.

The price will then retrace to 0.382 retracements at 10125 before continuing the minor uptrend momentum and aim to reach the 10775 as the final target from the smaller retracement.

There are basically two scenarios that I imagined. We can use the support from the Volume Profile analysis for the pullback target.

Support from Volume Profile is the red and blue thick horizontal line.

I would love to see the shape of candle formation will be the inverted head and shoulders before the prices move higher.

By the time prices reach the target of small retracements (pink Fibonacci Retracement), the candles are broken out from the larger downtrend line to draw the 2nd retracements (bigger retracements) - colored in an orange line. I expect a slow movement due to the historical consolidation area in this section.

A yellow background marks the consolidation area. From the chart, we can see that this consolidation area is located between 0.618 to 1.000 retracements for the small Fibonacci in pink color and between 0.382 to 0.618 retracements for the larger Fibonacci in orange color.

If we combined all the predictions above, the upper resistance of the consolidation area would be the final target for the price action.

As we can see, there is a potential clustering area of the Fibonacci Retracement and Inverted Head and Shoulders target highlighted in the green color.

Don't forget that all the scenarios above are only predictions, or I might say what I love to see in the future. Cheers!

Disclaimer is always on.

Trade at your own risks.

IDX: AALI - may-2021IDX:AALI

Astra Family in the CPO Industry

Yesterday's (04-May-2021) confirmed the reversal for the shorter downtrend line, when the candle breakout the trend line, we can use the Fibonacci Retracement to predict the target of the price by following its retracement.

I predict that the reversal of this stock is quite strong to reach the 0.500 retracements at 10450 because the commodity itself is supporting the reversal.

The price then will retrace to 0.382 retracements at 10125 before continuing the minor uptrend momentum and will aim to reach the 10775 as the final target from the smaller retracement.

BDMN BUY at TrendlineDisclaimer : This content is intended to be used and must be used for information and education purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. Accordingly, the writer will not be liable in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information.

PTBA Potential Buy Position Disclaimer : This content is intended to be used and must be used for information and education purposes only. It is very important to do your own analysis before making any investment based on your own personal circumstances. Accordingly, the writer will not be liable in respect of any damage, expense or other loss you may suffer arising out of such information or any reliance you may place upon such information.