Indonesiastock

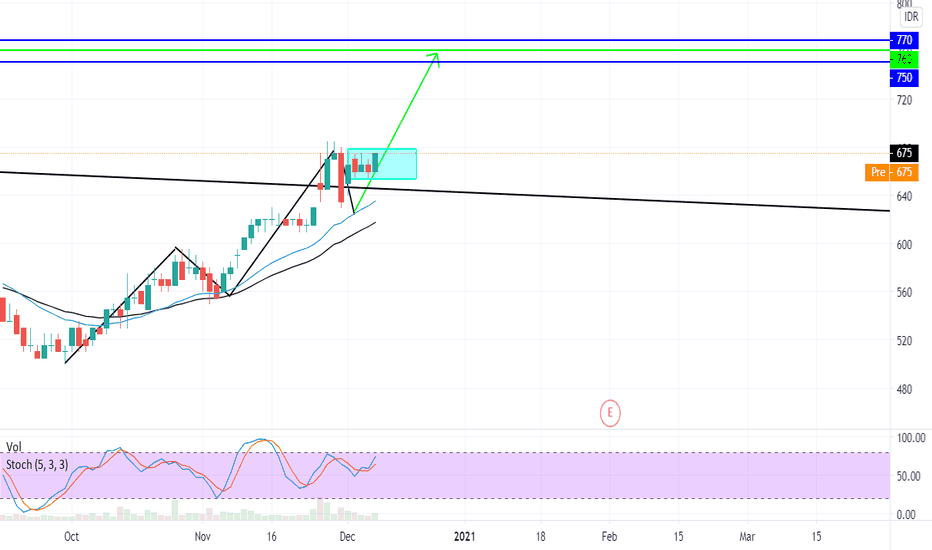

BJTM 13%+ INDONESIA STOCKS EXCHANGEWE KNOW THAT DOW THEORY IS PRIMARY SECONDARY AND PRIMARY AGAIN

THE MARKET ALREADY SECONDARY REACTION AND NOW BJTM IS MAKING A BASE, A BASE IS LIKE A CAGE WHICH THE PRICE TRAP INSIDE THE CAGE, WE HAVE TO WAIT THE CONFIRMATION OF THE BREAKOUT OF THE CAGE, IF BREAKOUT THAN THE PRICE WILL RALLY MAKING HIS PRIMARY REACTION AGAIN,

THE TARGET PRICE AREA WILL BE 750 - 770

AND WHY A GREEN LINE AT 720? WHY THE TARGET PRICCE 750 - 770?

THE REASON IS SIMPLE,

THE GREEN LINE PRICE PROFIT AREA IS BY USING FIBONACCI PRICE PROJECTION (AB = CD) AND IT STOP AT 720, SO IS THE GAP AREA, WE CAN SEE 750 - 770 IS AN OPEN AND CLOSING GAP AREA WHICH CLUSTER TO FIBONACCI AB = CD

STOPLOSS AREA

630

WHY? BECAUSE IF WE BUY AT BREAK OUT AREA, AND THE PRICE ISNT CAPABLE TO RISE, AND DROP TO THE BASE (CAGE) AGAIN AND ALSO BREK THE BOTTOM OF THE BASE WE CAN ASSUME THAT SUPPLY IS MUCH HIGHER THAN THE DEMAND

DISCLAIMER ON!

IDX PGAS : ELLIOTT WAVE ANALYSIS EXPLANATION AND HOW TO USE IT.ELLIOTT WAVE HAVE 5 WAVE BEFORE DO HIS CORRECTIVE WAVE,

PGAS CURRENTLY IN WAVE 3 TO 4

ELLIOTT WAVE, WAVE 1 - 2 ALREADY VALID @0.618

ELLIOT WAVE, WAVE 2-3 VALID 1.618

WE HAVE TO WAIT THE SECONDARY REACTION OF WAVE 3 - 4 @0.382 AND WE CAN ENTER AT THAT POINT WITH BULLISH HARAMI CANDLESTICK (THE INSIDE BAR) OR HAMMER, ENGULFING WHATEVER IT IS FOR THE ENTRY

AND WAVE 4 - 5 LENGTH HAVE TO BE SAME WITH WAVE 1 - 2 (AB = CD)

WE CAN MEASURE WITH FIBONACCI EXTENSION (HARMONIC PRICE PROJECTION) FROM WAVE 0 = A - WAVE 1 = B , AND THE WAVE 4 = C WE CAN SEE THE PRICE WILL STOP AT 2185

AFTER REACHING THAT POINT SHOULD BE A CORRECTIVE WAVE

THIS IS A TUTORIAL OR A SIMPLE WAY TO KNOW OR USE ELLIOTT WAVE

NO POINT OF ENTRY!

JUST A LESSON FOR WAVE ANALYSIS

ADRO BIG RISING WEDGE - ID & EN INDONESIA'S STOCKSEN : WE CAN SEE THAT ADRO IS MAKING A BULLISH CONTINUATION AND NOW IS THE SECONDARY REACTION, BUT IF WE CONNECT BOTH UP AND DOWN TRENDLINE WE CAN SEE ADRO IS FORMING A PATTERN CALLED RISING WEDGE WHICH IS THIS PATTERN CAN MAKE THE PRICE TO A BEARISH MOVEMENT (EITHER SHORT TERM BEARISH OR A LONG TERM BEARISH) ADRO PROBABLY WILL DOWN TO @1000 THIS IS THE FIBONACCI EXTERNAL RETRACEMENT OF 1.618 WITH SUPPORT CLUSTER AFTER HIT @1000 ADRO GOT A VERY BIG CHANCE TO PULLBACK (SECONDARY REACTION FROM BEAR MOVEMENT) AND CONTINUE THE PATTERN. THE SECOND TARGET PRICE FOR ADRO IS @865 THIS IS THE AREA END OF THE RISING WEDGE PATTERN ALSO CLUSTER WITH THE CLASSIC SUPPORT & FIBONNACI 2.618 RATIO.

IMPORTANT NOTE ::::

-IF ADRO NOT YET BREAK THE RISINGWEDGE PATTERN ADRO GOT A CHANCE TO PULLBACK AROUND @1255 (AND ABOVE NOTE IS FOR AFTER THE RISINGWEDGE BREAKOUT.

-AFTER BREAK OUT AND HIT THE FIRST TARGET (@1000) ADRO ALSO CAN REBOUND TO HIS BULLISH PATTERN AGAIN! OR WE CAN SAY THAT THE SECOND TARGET (@865) IS CANCELED

ID : KITA BISA MELIHAT ADRO SEDANG MEMBUAT KELANJUTAN BULLISH DAN SEKARANG SEDANG MENJALANI 2NDARY REACTION, TETAPI JIKA KITA MENGHUBUNGKAN TRENDLINE ATAS DAN BAWAH KITA BISA MELIHAT ADRO SEDANG MEMBUAT SEBUAH PATTERN RISING WEDGE YANG AKAN MEMBUAT HARGA KE BEARISH (ANTARA BEARISH JANGKA PENDEK ATAUPUN JANGKA PANJANG) ADRO AKAN TURUN KE @1000 INI ADALAH AREA FIBONACCI 1.618 YANG BERSINGGUNGAN DENGAN AREA CLASSIC SUPPORT DAN SETELAH MENYENTUH AREA @1000 ADRO PUNYA KESEMPATAN BESAR UNTUK PULLBACK (SECONDARY REACTION DARI BEARISH) DAN MELANJUTKAN PATTERN TERSEBUT. TARGET KE DUA DARI ADRO ADALAH @865 INI ADALAH AREA AKHIR DARI RISING WEDGE TERSEBUT DAN JUGA BERSINGGUNGAN DENGAN AREA CLASSIC SUPPORT DAN JUGA RASIO FIBONACCI 2.618

NOTE PENTING !! ::::

-JIKA ADRO BELUM MENEMBUS RISING WEDGENYA SENDIRI, ADRO JUGA BISA KE AREA @1255(PERNYATAAN ATAS ITU ADALAH SETELAH RISINGWEDGE SUDAH DITEMBUS)

-SETELAH BREAKOUT AND MENCAPAI TARGET PRICE PERTAMA(@1000) ADRO JUGA BISA MEMENTALKAN HARGA BALIK DAN MELANJUTKAN BULLISHNYA LAGI! ATAU BISA DISEBUT TARGET PRICE KE 2 (@865) BATAL

DISCLAIMER

DISCLAIMER

No information published constitutes or offer, or recommendation, or advice, to buy or sell any investment instrument, to effect any transcation, or to conclude any legal act of any kind whatsover.

The information published and opinions expressed are provided by myself (Rupin Goh) for personal use and for educational purposes only and area subject to change without notice. Rupin Goh makes no representations (either expressed or implied) that the information and opinion expressed guarantees accuracy,adequantess or completeness. In particular, nothing contained consitutes financial legal, tax or other advice. nor should any investment or any other decision be made solely based on the content.

All opinion is based upon sources that Rupin Goh believes to be reliable but he have no guarantees that this is the case. therefor, whilst every effort is made to ensure that the content is accurate and complete, Rupin makes no such claim.

Limitation of liability

Rupin disclaims, without limitation, all liability for any loss or damage of any kind including any direct, indirect or consequential damages.

Copyright

All material produced is copyright to Rupin and may not be copied, emailed faxed or distributed without the express permission of Rupin

Notes: all orders are valid until the next report is published, or a trading strategy alert is sent between reports.

USDIDR Points Towards Continuation of WeaknessThe USDIDR also trends with its peers in Singapore and Thailand for continued downward movement. Although weakness in the past week is showing weaker signals in RSI and the bull bear crowd sentiment indicator, nearly all exponential moving averages suggest further continuation of the trend. In spite of this, price action is fast approaching a 2018 trend line which could reappear as long-term support and a reversal, although this is not likely to come to fruition for a number of trading days unless volatility really picks up.

If you would like to see more charts check out www.tradingview.com or if you want more analysis go to www.linkedin.com