Industry

Stellantis Long Play despite the tariffsI'm a deep value investor.

Current price 8.58 euros per share

I've been looking at Stellantis for a while now and I've done a deep dive in the company's financial and its fundamental value. It's my opinion that the company is fundamentally strong but being traded at a lower price right now. it has dropped 65% since last year and almost 6% today.

The 65% drop has been a significant overreaction to the a missed earnings forecast which has been due to forign currency depriciation in turkish lira (once you do a deep dive in the company's accounts). but the company is still significantly profitable and has a growing revenue and earnings forecast.

Today's 6% drop is an understandable yet overreaction to trump's tariffs as most of the company's buiness is done outside the US and they are betting big on EU and GB car sales (and have been growing in it)

Bottom line is the company is currently priced way below its intrinsic value. its beeing traded at 0.3 times its book value while automotives are being traded at an average 1.7 time book value, and its price to earnings ration (at this time) is 4.57 while automotives average P/E is 11.79 (slightly lifted by TSLA but still)

I'm expecting a target of 12.6 euros per share within the next 6 months.

If you didn't see my last position on CMC markets see my account.

SPX to dump 30% - 50% for Inflated Expectations in 2026I like to say the narrative follows the price . This was bound to happen after such an overheated year, couple years. Blame whomever you want, in the end its your wallet if you aren't ready to have your expectations met.

Best case scenario, the breakout of macro is confirmed after the retest (blue arrows). Worst, more likely case, it smashes down to confirm a double bottom with a strong foundation to form a macro support. The sawtooth can provide opportunities for volatile scalps, but its gonna get gnarly I can already tell.

Porsche (PAH3): German Auto Industry under pressureLooking at Porsche on the monthly chart, we’re analysing its entire price history since becoming a publicly listed company in April 2001. After a massive rally to its peak at €160, the stock experienced a sharp decline back to its IPO levels. Since then, it has traded within a well-defined range between €94 (range high) and €35 (range low), with the mid-range around €65.

Each time the range low was reached, the price subsequently moved back toward the range high, demonstrating the typical characteristics of a range-bound market. Now that Porsche is back at the range low, coupled with the RSI at its second-lowest level ever, we see this as a strong opportunity to gain some exposure to the German automotive market.

Admittedly, the German auto industry is under pressure, with Porsche's deliveries to China down 29% year-over-year. Chinese EVs are currently outpacing German luxury cars in technology, making it difficult for Porsche to regain market share. However, this level represents one of the best opportunities for a swing trade.

If the range low is broken and prices drop to COVID-era levels, Porsche would face significant challenges, requiring major developments to recover. For now, we expect a move back toward the range high over time. While this is a long-term play given the monthly timeframe, it offers a promising swing trade setup.

Key Levels:

Range Low: €35

Mid-Range: €65

3M (MMM): Patience Before Next StepsWall Street analysts estimate that 3M will report quarterly earnings of $1.66 per share next week, reflecting a significant 31.4% year-over-year decline. Revenues are projected at $5.79 billion, down 27.7% compared to the same quarter last year.

As we mentioned previously, we have not yet set a clear limit for 3M and continue to monitor its chart closely. The current structure suggests that the alternative scenario, where wave 1 is positioned higher, appears increasingly likely. However, a significant surge beyond this point does not seem probable at this time.

We’re keeping a close watch to determine where this wave 1 establishes its top before making any further moves. Patience remains key as we refine our conclusions on NYSE:MMM ’s next steps.

Exxon Mobil (XOM): Preparing for a Q1 2025 SetupHeading into Q1 2025, we believe NYSE:XOM could present a promising buying opportunity, and we are preparing a setup to align with our bias. Since April, we have been closely monitoring Exxon Mobil, and the technical picture continues to gain clarity as the stock respects both the range middle and range high. The wave ((b)) overshot wave A by a significant margin but still within acceptable limits for a flat correction.

Since the overshoot in early October, NYSE:XOM has seen a substantial decline—falling 17% over 75 days, a significant move for this stock. The primary driver behind this decline seems to be ongoing shareholder challenges. Over the last three years, Exxon Mobil has resisted calls for meaningful carbon emissions reductions, instead doubling down on traditional oil and gas operations. Legal action against shareholder activists pushing for emissions reduction targets has only added to the controversy, with proposed changes falling short of expectations.

The shareholder concerns highlight a critical point: some voting patterns defy logic when aligned with long-term goals. Questions remain about whether Exxon Mobil should, or can, prepare for a carbon-neutral future. The widely publicized shareholder vote in 2021, which many hoped would lead to substantial changes, seems to have produced minimal practical outcomes.

Despite these issues, we see potential for NYSE:XOM to resolve its challenges in the near future. From a technical standpoint, we observe a strong likelihood of a wave C drop into the $101–$92 range, which aligns with the 61.8%–78.6% Fibonacci retracement levels. This would be a key area to begin building a position.

Chevron (CVX): Bottom in Sight?Chevron ( NYSE:CVX ) has maintained a wide range between $167 and $137 since March 2022, with one notable push above this range likely corresponding to the completion of wave 3. The focus is now on identifying the wave 4 bottom, which we anticipate to form between the 50-61.8% Fibonacci retracement levels, or $128–$113. This range is supported by key technical indicators, including a High Volume Node Edge and a Point of Control (POC) within this area, adding significant confluence.

From a macroeconomic perspective, Chevron faces challenges from declining crude oil prices, which is impacting investor sentiment. Despite a brief surge in oil-and-gas stocks following Donald Trump’s victory, this momentum has not sustained across the sector. Broader bearish factors such as weak Chinese demand, global overproduction, and OPEC’s indecision on further cuts add to the uncertainty. Bullish bets on oil due to geopolitical tensions have largely underperformed over the last two years, further pressuring the commodity and Chevron.

Should NYSE:CVX reclaim the range high at $167, it could signal a trend reversal, suggesting the wave 4 bottom may already have formed at $135.55, the last significant low. However, if the resistance holds, further downside into the targeted area seems likely.

We will continue monitoring how global tensions, oil price fluctuations, and broader market conditions impact Chevron’s performance. Until then, patience is key as we await a clear signal.

3M (MMM): Building a Bullish Case Despite HeadwindsWith 3M's earnings yesterday, it’s the perfect moment to analyze the stock and assess the upcoming opportunities. The company is expected to have benefited from its restructuring actions, such as headcount reduction, likely lowering costs and improving margins this quarter. Its disciplined spending and restructuring savings could also boost profitability.

Despite these positive factors, challenges in 3M’s packaging and expression, along with home and auto care divisions, may drag down its performance. Lower consumer retail spending on durable goods is expected to impact its Consumer segment's results.

From a technical standpoint, 3M’s surge from the support zone recently was strong enough to shift the weekly trend from bearish to bullish. Such a structural change on the weekly chart is significant, as it's not common to see such a clean trend reversal. However, as often happens with sharp upward movements, we are now seeing a bearish divergence on the RSI. This divergence doesn’t mean a pullback is imminent but suggests that one could happen eventually.

Looking at the daily chart, there may be potential for 3M to move higher if wave 1 isn’t complete. Even if earnings were positive, we should still witness a pullback. We are looking to build a position by layering bids at key levels. Our first target entry is the gap high, followed by the gap low, which aligns with the 50% Fibonacci level. If the price continues to drop, we’ll continue adding bids down to the 78.6% Fibonacci retracement level. Our stop loss will be set below wave (2) to safeguard the trade. A break below this level would invalidate the bullish outlook and could result in a drop to $56, though this scenario seems less probable for the near future.

Digital Dreams, Nuclear Reality: Is AI Sparking a Revolution?In an unprecedented fusion of cutting-edge technology and atomic power, Oracle's latest venture illuminates the extraordinary energy demands reshaping our digital landscape. The tech giant's bold decision to power its next-generation AI facilities with nuclear reactors signals more than just an infrastructure upgrade – it represents a fundamental shift in how we approach the intersection of computational power and energy resources.

The numbers tell a compelling story: with data centers already consuming more electricity than entire nations and AI operations demanding exponentially growing power supplies, traditional energy solutions are proving insufficient. Oracle's gigawatt-scale ambitions, powered by small modular reactors, showcase an innovative response to this challenge, potentially revolutionizing how we fuel our digital future.

As tech titans race to build increasingly powerful AI systems, Oracle's nuclear gambit raises fascinating questions about the future of technological progress. Will this marriage of nuclear power and artificial intelligence unlock unprecedented computational capabilities, or are we witnessing the dawn of a new era where the limits of power generation become the primary constraint on digital innovation? The answer may reshape not just the tech industry, but the very framework of our energy infrastructure for generations to come.

Tesla (TSLA): Stuck in a Range after Robo Taxi rumors fizzledAfter being stopped out on our second entry in Tesla, it's time to take another look, although it has been quite uneventful since the big rise on the Robo Taxi rumors back in July. It was a classic “buy the rumor, sell the news” event, showcasing how markets tend to price in events well ahead of their occurrence. Musk's statement that Cybercab production could begin "before 2027" is also seen as highly questionable, given his history of missed deadlines.

Tesla recently got approval from local authorities near its gigafactory in Berlin to move forward with its three-stage expansion plan. Despite protests from locals, this approval allows the company to start building infrastructure for storage facilities, a battery cell test lab, and logistics areas. All of this will take place on land already owned by Tesla. Whether this expansion will be beneficial or problematic for the company remains to be seen in the coming months.

Currently, we still have our limit order from $177 running, and things are looking alright. To better illustrate the situation, we added a fresh chart of Tesla’s range, which clearly shows the situation. After reclaiming the range middle in July, Tesla briefly dipped below but rebounded perfectly from $183, a critical POC (Point of Control). Since July, Tesla hasn’t made any new higher highs, nor has it made lower lows, placing the stock in a tight range. If Tesla loses the range middle, we could see a drop to $183 or even $160. On the upside, breaking above the range high would be essential for further momentum.

It's crucial to focus on higher time frame levels and avoid getting caught up in short-term news or noise. We’ll continue to monitor Tesla’s key levels and update you if any significant movement occurs. 🤝

BMW (BMW): Navigating Through Uncertainty in the Auto MarketThe German automotive industry is currently facing significant challenges, from rising production costs and the transition to electric vehicles to increased competition from China. Despite these hurdles, we believe that most of the negative factors are already priced into the market.

From a technical perspective, we’re zooming out to get a broader view of BMW. Ignoring the COVID-19 dip, BMW has been ranging between 55€ and 113€ for an extended period. We anticipate that this range will continue, as markets tend to range 70% of the time. Right now, BMW is at a critical level, either bottoming out for the fourth time or, more likely, preparing to break below and collect the sell-side liquidity that has accumulated over the past three years.

Our plan is simple: We’re monitoring this closely, with alerts set to notify us if the stock dips below this level. Should this occur, we’re looking at a potential entry near 62€. We will update you with our strategy once this scenario unfolds.

Barrick Gold (GOLD): Major Upward Moves AheadBarrick Gold, NYSE:GOLD , a prominent mining corporation, has recently achieved a noteworthy milestone by reclaiming a critical trendline on the weekly chart and stabilizing between the 78.6% and 88.2% Fibonacci retracement levels. Our initial investment was strategically placed at $14.77, located within the highest volume area observed since 2008 according to the volume profile. This positioning suggests a strong foundation for potential growth.

Should the gold price continue to rise and we surpass this high-volume area, Barrick Gold could experience a parabolic surge. This potential is amplified by the industry’s relatively small scale and the minimal capital required to significantly influence market dynamics. Our analysis indicates a robust support at the Wave 2 and minor Wave (ii) levels, consistent with our entry point (refer to the Daily Chart).

Having successfully reclaimed this trendline, we are now anticipating a substantial upward trajectory with an immediate target of $55.95, correlated with a solid dividend yield of 2.2%. Currently, our position is optimized to maximize returns from these dividends.

As we navigate through Wave II, our projections show a potential breakthrough beyond the $56 threshold, positioning Barrick Gold as a highly desirable investment option. With an optimistic projection of reaching up to $280 from our entry price and a calculated downside risk of only 20%—associated with the tail end of this significant volume cluster (standard normal distribution)—our strategy is well-poised for market success.

At the dawn of trading today, the dynamics around our Level (ii) entry were crystal clear. We retested and successfully held above the subordinate trendline at the 78.6% retracement level. Furthermore, we have not only reclaimed a more significant trendline from the weekly chart at an elevated level but also breached and are currently retesting another key trendline at subordinate Level (i). It is critical for maintaining our bullish outlook on Barrick Gold that we stay above this advanced trendline.

Since our entry, the stock has already appreciated by 20%. However, we are poised for even greater achievements and remain vigilant for further market developments. Expect an updated report from us as soon as additional data becomes available.

Navigating the Chip Maze: Should You Invest in Synopsys?Navigating the Chip Maze: Should You Invest in Synopsys?

Synopsys, a titan in the Electronic Design Automation (EDA) landscape, offers intriguing prospects for investors curious about the semiconductor industry. But before diving in, let's unpack the company, analyze its potential, and explore options – with a strong disclaimer: trading is inherently risky and not suitable for everyone.

Synopsys: Powering the Chip Revolution

Founded in 1986, Synopsys has carved a niche by providing essential tools and services for chip design and verification. Imagine them as the architects and inspectors of the tiny brains powering our devices. Their clients? Tech giants like Apple, Intel, and Samsung, relying on Synopsys for efficient, secure chip development.

Products and Services:

EDA Tools: The bread and butter – software enabling chip design, simulation, and verification.

Silicon IP: Pre-designed building blocks, saving chipmakers time and money.

Software Security and Quality: Tools to identify and fix vulnerabilities in software, crucial in an increasingly interconnected world.

Financials and Performance:

Revenue: $5.3 billion (FY 2023)

Net Income: $1.2 billion (FY 2023)

Ratings: Leader in Gartner's Magic Quadrant for EDA, "100 Best Companies to Work For" by Fortune

So, Buy, Sell, or Hold?

This is where things get tricky. Analysing publicly available information can't guarantee future performance. Several factors could influence Synopsys' stock price:

Overall Semiconductor Market: A booming market benefits Synopsys, but downturns can impact sales.

Technological Advancements: Staying ahead of the curve in EDA is crucial, and continuous innovation is key.

Competition: Other EDA players like Cadence Design Systems pose constant competition.

Options Trading: A Calculated Gamble?

Remember, options involve significant risks. Buying call options bets on a stock price increase, while put options profit from a decrease. With expirations ranging from 1-12 months, you choose your timeframe and risk tolerance. However, options decay in value over time, and misjudgment can lead to substantial losses.

The Verdict: Do Your Research, Proceed with Caution

Synopsys is a prominent player in a growing industry, but the decision to invest ultimately rests on your individual financial goals and risk appetite. Conduct thorough research, understand the risks involved, and never invest more than you can afford to lose. Consider seeking professional financial advice before making any investment decisions.

Risk Warning

Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses.

Risk Warning: Trading is Not for Everyone

It's essential to emphasize that trading stocks and options carries inherent risks. Market volatility, unpredictable events, and human error can lead to significant losses. Therefore, it's crucial to undertake thorough research, understand the underlying risks, and only invest funds that can be comfortably afforded to lose.

------------------------------------

Rating: STRONG BUY

Risk Disclaimer!

The article information and the data is for general information use only, not advice!

---------------------------------------------------------------------

Risk Warning Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses. Risk Disclaimer! General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss!

Moncler: A Stylish Investment on the RiseHello investors,

In this report, we dissect the financial intricacies of a prominent stock, leaving no detail unexplored. From market capitalization and price-to-earnings ratio to revenue conversion and cash reserves, we analyze every facet to equip you with strategic insights. We'll go beyond the numbers and charts, painting a vivid picture of the company's financial health. Moreover will be also sharing with you at the end what is my personal expert opinion and future outlook for the financial details of Moncler.

Moncler is a luxury fashion company with a market capitalization of 16.875 billion EUR. It currently trades at a Price to Earnings (P/E) ratio of 31.05, which indicates that investors are willing to pay 31.05 times the company's earnings per share (EPS). The current Basic EPS (TTM) stands at 2.01 EUR.

Now, let's dive into the Revenue to Profit Conversion for the year 2022:

- Total revenue: 100%

- Gross profit: 68%

- EBITDA: 40%

- Net income: 23%

The Revenue to Profit Conversion indicates that Moncler is generating a reasonable amount of revenue, but the conversion of that revenue into profits is somewhat lower. This could be an area of concern for investors, as a higher gross profit and net income conversion would generally be preferred.

Next, let's examine Moncler's financial health based on key financial metrics for the years 2018 to 2022:

- Debt: The company's debt has increased over the years, reaching 912.78 million EUR in 2022. This increasing debt level is a point of caution and needs to be monitored closely, as it may affect the company's financial flexibility.

- Free Cash Flow: Moncler has shown a fluctuating trend in free cash flow, with significant variations from year to year. While the H1 2023 free cash flow stands at 492.72 million EUR, this could impact the company's ability to invest in growth opportunities or return value to shareholders.

- Cash and Equivalents: Moncler has maintained a relatively stable level of cash and equivalents over the years, which provides a degree of liquidity and financial strength.

Now, let's analyze the Financial Position based on the figures from 2022:

- Short-term Assets: 1.62 billion EUR

- Short-term Liabilities: 963.71 million EUR

- Long-term Assets: 3.02 billion EUR

- Long-term Liabilities: 773.31 million EUR

Moncler's financial position seems relatively strong, with a higher value of assets compared to liabilities, both in the short and long term. However, it's important to keep an eye on the company's debt levels and how they might impact its financial position in the future.

Regarding the company's earnings per share (EPS) history and projections:

- EPS in 2020: 1.18 EUR

- EPS in 2021: 1.53 EUR

- EPS in 2022: 2.24 EUR

- H1 2023: 0.54 EUR

Moncler has shown an increasing trend in EPS, which is generally positive. However, the H1 2023 EPS has seen a decline compared to the previous year. This dip could be due to various factors, and it's crucial to closely monitor the reasons behind it to assess its potential impact on future performance.

Now, let's review the financial statements for H1 2022, H2 2022, and H1 2023:

- H1 2022:

- Total revenue: 918.38 million EUR

- Gross profit: 576.21 million EUR

- Operating income: 180.17 million EUR

- Pretax income: 168.54 million EUR

- Net income: 211.25 million EUR

- H2 2022:

- Total revenue: 1.68 billion EUR

- Gross profit: 1.19 billion EUR

- Operating income: 594.38 million EUR

- Pretax income: 578.79 million EUR

- Net income: 395.44 million EUR

- H1 2023:

- Total revenue: 1.14 billion EUR

- Gross profit: 731.59 million EUR

- Operating income: 217.79 million EUR

- Pretax income: 206.47 million EUR

- Net income: 145.35 million EUR

Moncler's financial statements show an overall positive trend in revenue, gross profit, and net income. However, the H1 2023 figures indicate a decline in net income compared to H2 2022. It's essential to assess the reasons behind this decline and evaluate whether it's a short-term setback or a potential cause for concern.

Future Outlook:

As for me, my rating for Moncler stock would be cautiously optimistic. The company has demonstrated strong financials, stable cash reserves, and a consistent revenue stream. The increasing EPS until 2022 indicates growth and profitability.

However, there are some concerns that need to be closely monitored. The rising debt level and fluctuating free cash flow could impact the company's ability to invest in growth initiatives or handle unforeseen economic challenges.

The decline in H1 2023 net income raises questions about the company's performance during this period. To make a more accurate assessment, it's crucial to investigate the reasons behind this decline and evaluate the company's strategies for addressing potential challenges.

In conclusion, Moncler appears to be a solid luxury fashion company with growth potential, but potential investors should conduct thorough research and analysis to make informed decisions. The financial health and future outlook should be continually monitored, considering the evolving market conditions and economic landscape.

Disclaimer : Please note that the future behavior of the stock is subject to market volatility, industry trends, and global economic conditions. I highly recommend you guys staying updated with the company's quarterly reports and financial statements for a more accurate evaluation of its performance and prospects. Additionally, all of the information that I used can be found in the trading view app related to MONC financial details.

WGO Winnebago Industries Options Ahead of EarningsAnalyzing the options chain of WGO Winnebago Industries prior to the earnings report this week,

I would consider purchasing the 65usd strike price Puts with

an expiration date of 2023-7-21,

for a premium of approximately $3.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

SNAX IS it ready for another explosive move?SNAX went up 5X last November after favorable earnings. It is a penny stock and inclined to

volatility. The following could support another explosive move:

(1) it just printed another favorable earnings report.

(2) it crossed the mean anchored VWAP band

(3) price is above the POC line of the volume profile and in the high volume area.

(4) the RSI indicator shows relative strength crossed over 50.

(5) bullish momentum is demonstrated by a green engulfing candle after several days

of sideways consolidation.

(6) price crossed through the basis midline of the Bollinger Bands typically considered by some

to be an entry signal.

As a penny stock this is a risky trade but as such is also carrying a high reward potential.

I will take a long position and contribute to the bullish momentum. I plan to make at least

100% on this trade if not more. I will set a stop loss of 10% to give the volatility some room.

SCHN Schnitzer Steel Industries Options Ahead Of EarningsLooking at the SCHN Schnitzer Steel Industries options chain ahead of earnings , I would buy the $35 strike price Calls with

2023-4-21 expiration date for about

$0.27 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

UBIX is a Silent bomb! This is why:The collaboration with the Acceleration Group: Surveillance footage notarized by silent notary (build on the Ubix network) is a huge accomplishment!

The Acceleration Group is far from a small company if you know what it is.... Just insane!

Also the collaboration with Langia, just amazing...!

The REAL USE CASE the Ubix Network Team is providing is just stunning!

People, UBX is/was hidden for a reason. I have no doubt this protocol is going to explode in the near future. It provides an actual real life use cases on global scale... And will provide much more in the future.

The growth of the protocol is from self speaking. USE CASE + USE CASE + USE CASE + GLOBE = ECONOMIC GROWTH TREMENDOUSLY!

Fundamental UBIX passes the test!

Mind blowing!

Atlasusdtatlas star is a game based on Solana ecosystem! it has a huge potential to grow in Long term investment ..

this is a now project but it has had a successful IDO on Solana recently .

is have a great vision , check the atlasstar website and learn more about game and team

it does not list on Binance yet!

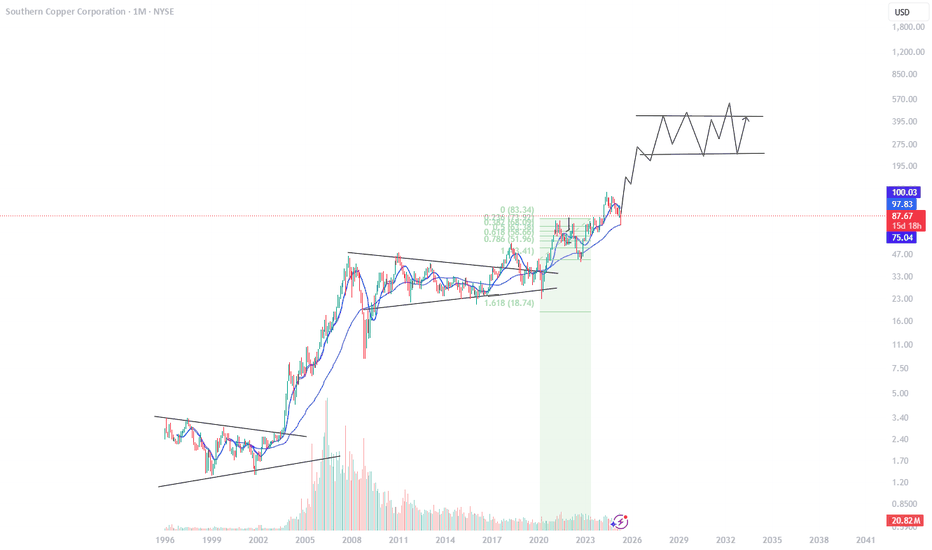

All time high break!In my "Copper could go to $8, $20 even" idea published on March 13th I explained I was looking to buy copper, and expected it to go up over more than a year.

I wanted to see the price consolidate over a longer time than what it did and ideally closer to all time high.

It is still possible that it will, just like gold did, after going up significantly above ATH, just like gold did.

I missed out on buying during consolidation but I FOMO'ed on the ATH breakout, I'm a bit mad because I went in with only half size; I have no problem taking bad trades with full size but when I FOMO I take smaller bets even though I keep winning, the margin restrictions do not help also to be fair, once again thank you useless regulators.

In the long term as I said in previous ideas, Copper $8 easy, even $20. If Yellen & the FED follow the example of Rudolf Havenstein copper $20,000,000 why not 😀

How does the CME limit up work when there is hyperinflation? Or strong inflation and strong price appreciation?

NOW is the time to ask this question, it's like with negative Oil prices, you had to think about it BEFORE the events, not AFTER.

Prices could get frozen. We are far from this happening, it will not happen overnight and implied volatility does not simple go from 0 to 100 overnight.

For now we keep an eye on volatility and when it starts getting extreme we look for answers. And we never go all in so even if prices get frozen all our capital won't be.

With Oil I was relieved to see the CME made an announcement that prices could go negative, days before it did. I checked before buying (I was trying to take advantage of the contango).

What happens when prices keep going up is not clear, but if and when volatility starts increasing dramatically the CME and maybe our brokers will let us know.

Remember Oil volatility increased very progressively.

The second question is in the short term, meaning the next couple of weeks or even months, where could the price be heading?

Will it just continue higher and higher or will it do a spike as it's doing now, then have a big correction around ATH?

To help answer this question we can look at other commodities, first gold.

But copper is not gold, it is an industrial metal, used for real, no one is accumulating copper as a store of value.

So next let's take a look at lumber which everyone knows has been going and going and going.

Lumber: retest, but only after going ridiculously high. I copper did this... I'd be happy.

We can look at a couple more examples, the price action is repetitive.

And what best to compare to copper than copper itself?

The price before the 2005-2008 copper bull run was choppy, and it stayed choppy for a while after going past all time high.

It's logical and obvious. Participants do not magically go from uncertain to mega bullish overnight, and the public (nobs) do not simply all "hear about copper" AND buy overnight.

Everyone I think knows about Bitcoin, most of the public heard about it progressively over september-december 2017, mostly the last 2 months.

Some day someone might have heard from a colleague "hey have you heard about this Bitcoin thing?", it's progressive not instantaneous.

And then the public, "mainstreet", joined Bitcoin from late 2017 to early 2019, so over a 1 and a half year period.

The price of copper was vertical before passing all time high. So I expect it to continue on the same trajectory. Simple. Just like Lumber last year.

It's funny to compare copper and lumber, when Lumber past ATH in 2020 it did a doji on the daily chart, with the body in the middle, and copper just had the exact same candle on ATH last week on the 4 hour chart.

Lumber is a MACHINE which has been offering the rich a crazy risk to reward.

Most of us are poor plebes that cannot afford to buy a full lot of lumber (worth $100K-$200K you have to multiply the price by 110) with a risk of $10,000 and potentially much more on a gap. Plus most retail brokers do not even offer lumber.

But we can buy copper mini or even micro lots. Which brings us to the third question. Where to buy?

We already started to answer this question and looked at some examples.

In reality I see only 2 ways to buy (be it spot or a call):

- On a retest of ATH

- FOMO, for example on a 1 hour red candle

There is nothing in between for me, if the price reverses then I would expect it to go all the way down to ATH (implied volatility, support and all).

Considering how the price has been behaving I'd expect something similar to lumber daily chart but on the 4 hour chart.

I would buy any inside bar for example. Possibly even any 1 hour red candle. And as it goes up keep buying more.