S&P 500 Daily Chart Analysis For Week of April 25, 2025Technical Analysis and Outlook:

In this week's trading session, the Index did steady to higher prices, distancing itself from the rendered obsolete Mean Resistance level of 5455 and targeting the next significant mark identified as Outer Index Rally 5550. This trend lays the groundwork for a continued upward movement; however, there is also a considerable risk of a sharp pullback to the Mean Support level of 5370 after reaching the Outer Index Rally at 5550.

Contrariwise, it is essential to acknowledge the possibility of upward momentum continuation resulting in meeting the primary target Outer Index Rally 5550 by challenging the Mean Resistance of 5672 and extending toward additional levels: Mean Resistance 5778 and Outer Index Rally 5945.

Inflationhedge

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 25, 2025Technical Analysis and Outlook:

Bitcoin experienced a significant rally in this week's trading session, breaking through all identified Mean Resistance levels: 86400, 90600, and 94500. This breakout led to the completion of the Interim Coin Rally at 88400. As a result, the newest identified Interim Coin Rally at 95000 has also been completed, indicating a possible pullback to the Mean Support at 92000 and a further decline potential toward an additional Mean Support target at 88500. However, it's important to recognize the chance of upward momentum emerging from a retest of the completed Interim Coin Rally at 95000, which could advance toward the next Interim Coin Rally at 100000.

S&P 500 Daily Chart Analysis For Week of April 17, 2025Technical Analysis and Outlook:

In the recent shortened trading session, the Index recorded steady to lower prices, distancing itself from the Mean Resistance level of 5455, as indicated in the previous week's Daily Chart analysis. This trend establishes a foundation for continuing the downward trajectory, targeting the Mean Support level 5140. Should this downward momentum persist, further declines may extend to the next Mean Support level of 4970 and ultimately reach the completed Outer Index Dip at 4890.

Conversely, it is essential to acknowledge the possibility of upward momentum at the current price level, which may challenge the Mean Resistance of 5455 and extend toward the Outer Index Rally at 5550.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 18, 2025Technical Analysis and Outlook:

During the price movements observed throughout the week, Bitcoin has remained close to the previous Mean Support level of 85200 and appears poised to initiate an upward breakout, targeting the newly developed Mean Resistance level of 86400. This breakout may facilitate a retest of the completed Interim Coin rally at 88400, with additional expansions of targets also being a possibility. It is critical to acknowledge that potential for downward momentum may arise from a rechallenge of either the Interim Coin Rally at 88400 or the Mean Resistance at 86400.

S&P 500 Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

During the current trading session, the Index has recorded lower opening prices, thereby completing our key Outer Index Dip levels at 5026 and 4893, as previously highlighted in last week's Daily Chart analysis. This development establishes a foundation for a continuous upward trend, targeting the Outer Index Rally at 5550, with an interim resistance identified at 5455. Should this upward momentum persist, further extension may reach the subsequent resistance levels of 5672 and 5778, respectively. However, it is essential to note that a downward momentum may occur at the very significant completion target level of the Outer Index Rally at 5550, with the primary objective being a Mean Sup 5140 and retest of the completed Outer Index Dip at 4890.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 11, 2025Technical Analysis and Outlook:

In this eventful trading week, Bitcoin surpassed our key and completed Outer Coin Dip 78700 and another Outer Coin Dip 74500 target. As a result, we have robust rally development, and current development suggests a continuing rally as it aims to target a Mean Resistance level of 85200 and to retest the completed Interim Coin Rally 88400. There is also potential for additional target expansions. It is essential to note that a downward momentum may arise from the rechallenge of the Interim Coin Rally 88400 and/or the Mean Resistance at 75200.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of April 4, 2025Technical Analysis and Outlook:

In the course of this week's trading activities, we noted a successful retest of the Interim Coin Rally at 88400, with particular emphasis on the Mean Support at 82500. This development indicates the potential for an extension in a trajectory toward the previously established Outer Coin Rally at 78700. An upward momentum may originate from the Mean Support at 82500 and/or the Key Support at 79000/completed Outer Coin Dip at 78700.

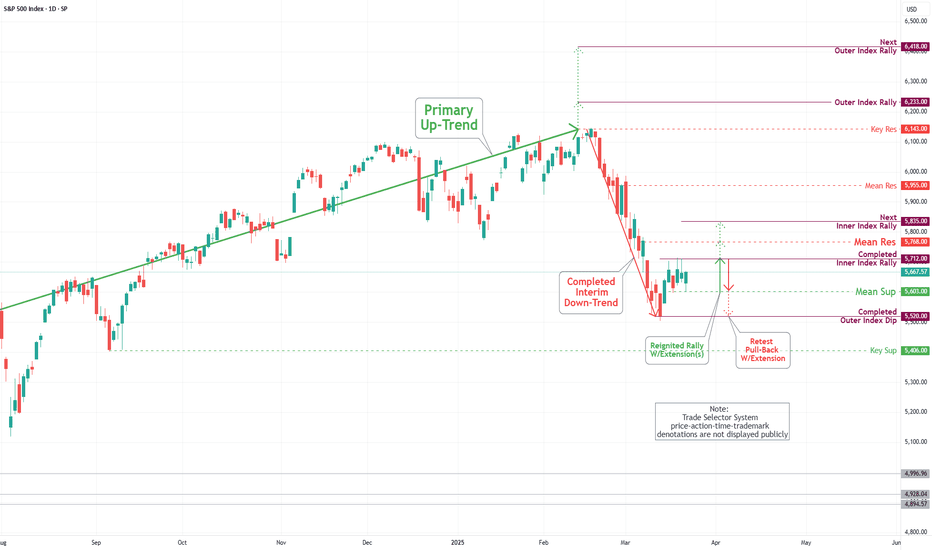

S&P 500 Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

During this week's trading session, the Index gapped higher, passing our completed Inner Index Rally of 5712 and setting a Mean Resistance of 5768. This target was accompanied by considerable reversal, ultimately causing a downward movement. On the final trading day of the week, the Index underwent a pronounced decline, resulting in a substantial drop that surpassed the critical target of Mean Support set at 5603. The Index is positioned to retest the completed Outer Index Dip level of 5520. An extended decline is feasible, with the possibility of targeting the subsequent Outer Index Dip at 5403 before resuming an upward rally from either of these Outer Index Dip levels.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 28, 2025Technical Analysis and Outlook:

Bitcoin underwent several significant peaks as it completed the Interim Coin Rally 88400. Subsequently, it experienced a decline, moving towards the Mean Support 82500, with the possibility of extending its trajectory to retest the previously completed Outer Coin Rally 78700. An upward momentum may be initiated from the Mean Support of 82500 or the Key Support of 79000/completed Outer Coin Dip of 78700.

S&P 500 Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

During the course of this week's trading session, the S&P 500 achieved the designated target for the Inner Index Rally at 5576, which occurred midweek. This target was accompanied by considerable volatility, ultimately hindering upward movement. On the week's final trading day, the index experienced a notable decline, resulting in a significant drop that reached our critical target, Mean Support, at 5603.

Consequently, the index is now poised to target a retest of the Inner Index Rally level 5712, with a subsequent potential target identified at the Mean Resistance level 5840. It is essential to consider that upon reaching the Inner Index Rally target of 5712, a decrease in the current price level is anticipated, which may lead to a retest of the Mean Support at 5601. Furthermore, an extended decline is possible to revisit the completed Outer Index Dip at 5520 before the resumption of an upward rally.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 21, 2025Technical Analysis and Outlook:

This week's trading session demonstrated considerable volatility in Bitcoin's price action. The cryptocurrency made multiple attempts to attain our Interim Coin Rally 88400, yet it ultimately remained at the same level as the week commenced. The current analysis suggests that Bitcoin must reach our Mean Support of 82500 before initiating an upward progression aimed at the Interim Coin Rally of 88400 through the Mean Resistance of 87000. Furthermore, a retest of the completed Outer Coin Dip 78700 is essential before the emergence of a significant rally.

S&P 500 Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

During the recent weekly trading session, the S&P 500 reached the designated target of the Outer Index Dip at 5576, showing considerable volatility. On the last day of the trading session, the index experienced a significant rebound, leading to an impressive upward trajectory from that position. As a result, it is now aiming for the Inner Index Rally target set at 5712, with a potential subsequent target identified at the Mean Resistance level of 5840. Therefore, upon reaching the Inner Index Rally target 5712, or if there is a decline from its current price level, the index is expected to retest the completed Outer Index Dip at 5521, potentially reinstating the upward rally.

EUR/USD Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

As indicated in the analysis from the previous week, the Euro has commenced an upward trend, successfully retesting the completed Inner Currency Rally at 1.086 and advancing toward the Mean Resistance level at 1.093. Consequently, the currency is currently experiencing a retreat and is directing its focus toward the Mean Support level at 1.078, possibly declining further to the Mean Support level at 1.061. Conversely, should the anticipated downward trend fail to materialize, it is plausible that the Eurodollar will retest the Mean Resistance level at 1.093 and subsequently aim for the completed Outer Currency Rally level of 1.124, traversing Key Resistance at 1.119 along the way.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 14, 2025Technical Analysis and Outlook:

In the current week's trading session, Bitcoin has made multiple hits by retesting our completed Outer Coin Dip 78800 on Sunday and Monday. Consequently, the cryptocurrency has experienced a significant uptrend, reaching the inverse (Resistance) Mean Sup 84700 level. This upward oscillation indicates a potential for further price rally and suggests a likelihood of advancing toward the target designated as the Interim Coin Rally 88400. Such developments could facilitate an extension toward the supplementary target of Mean Res 94500 and beyond. If there is a decline from Interim Coin Rally 88400 or its current price level, the coin is expected to retest the completed Outer Coin Dip 78700, potentially reinstating the upward rally.

S&P 500 Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the recent weekly trading session, the S&P 500 successfully retested the Mean Resistance level of 5967; however, it subsequently experienced a significant decline. This decline brought the index back to the Mean Support level of 5860 and further down to the next major Key Support level of 5710. After this downturn, the index established a new critical support level at 5683. It is now positioned to target the Mean Resistance level of 5840. Should the index initiate an upward movement from its current position and successfully surpass this key resistance, it may continue to ascend toward the subsequent Mean Resistance level of 5955.

Conversely, suppose the index experiences a decline from the retested level of 5840. In that case, it will likely target the Mean Support level of 5683, with a further descent to an Outer Index Dip of 5576.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of March 7, 2025Technical Analysis and Outlook:

In the trading session for this week, we observed significant volatility characterized by considerable fluctuations, ultimately culminating in the completion of the coin Interim Coin Rally 94500. The coin experienced a substantial increase, reaching our Mean Resistance level of 92600, before encountering a steep pullback that resulted in its stabilization at the starting point of Mean Support of 84700.

This upward fluctuation indicates a potential for higher prices and suggests a likelihood of retesting the target Mean Resistance levels at 90600, coinciding with the conclusion of Interim Coin Rally 94500. Nonetheless, a retest of the Key Support level at 79000 and the completed of the Outer Coin Dip 78700 may occur prior to any further upward momentum.

S&P 500 Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

In the recent weekly trading session, the S&P 500 did not succeed in retesting the Mean Resistance level of 6082. Instead, the index experienced a notable decline, reaching the Mean Support level of 5939 and narrowly approaching the Key Support level of 5827.

Following this downturn, a significant rebound occurred, resulting in the establishment of a new Mean Support level at 5860. The index is now positioned to target the Mean Resistance level of 5967. Should the index initiate an upward movement from its current level and successfully surpass the critical Mean Resistance of 5967, it may continue to rise toward the Mean Resistance level of 6032, potentially reaching the Key Resistance level of 6143.

Conversely, if the index declines from its present position, it may create a retest pullback to revisit the Mean Support level of 5860 before resuming further upward momentum.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 28, 2025Technical Analysis and Outlook:

At the beginning of the week, Bitcoin was observed trading at a lower level, close to the Mean Support level of 95700. It could not reach our predetermined Mean Resistance level marked at 98300, which can be attributed to a substantial decline that occurred, resulting in the completion of our Outer Coin Dip between 89000 and 78700. Following this decline, Bitcoin experienced a robust rebound to the Mean Resistance level of 86200. This upward trend indicates the potential for higher prices as it will target Mean Resistance levels at 89200 and 92600, respectively. However, a retest of the Key Support level at 79000 must occur before further upward movement may take place.

LONG ON GOLDGold has fell almost $100 or 1000 pips since Monday from its high.

Its currently at a major demand level that was created 2/7/25 that caused it to rise $100 points to 2/24//25.

History from 2/7/25 looks like it will be repeating itself.

Dollar (DXY) looks bearish and PCE news comes out at 8:30 for Inflation which I believe will come out bad causing the dollar to tank and gold as well as the indices to rise.

I will be buying gold looking to catch that $100 move or 1000pips.

See you at the Top! OANDA:XAUUSD

S&P 500 Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

In the most recent weekly trading session, the S&P 500 surpassed our completed Outer Index Rally threshold of 6120, rendering the Key Resistance at this level obsolete. Nevertheless, following a significant price reversal, the index breached the Mean Support level of 6049 and is approaching the critical support level established at 5995. The index could decline further, potentially reaching the Mean Support level of 5939 and the Key Support at 5827.

Should the index initiate an upward movement from its current position or the Mean Support level of 5995, it may ascend to the newly established Mean Resistance level of 6082, potentially extending toward the Key Resistance level of 6143.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 21, 2025Technical Analysis and Outlook:

During last week's trading session, Bitcoin was unable to reach our designated Mean Resistance level at 101300 and has remained stagnant near the Mean Support at 95700. This trend indicates a potential continuation of the pullback, which may cross-check the Mean Support level at 95700, with the prospect of further decline toward the Outer Coin Dip identified at 89000 via additional Mean Support levels at 94400, and 92500. Conversely, should the anticipated pullback not materialize, Bitcoin may experience upward momentum, thereby testing the newly established Mean Resistance level at 98300. This development could facilitate an extension toward 101500 and beyond.

S&P 500 Daily Chart Analysis For Week of Feb 14, 2025Technical Analysis and Outlook:

During the recent weekly trading session, the S&P 500 effectively reached and tested the critical Key Resistance level at 6083. It retested the completed Outer Index Rally at 6120, indicating a potential continuation of the bullish trend toward the intermediate target of 6233. However, a market pullback is anticipated due to this price action. Current analyses suggest that the designated downward target is set at the Mean Support level of 6049, with potential extensions to 5995, 5936, and the Outer Index Dip at 5878.

Bitcoin(BTC/USD) Daily Chart Analysis For Week of Feb 14, 2025Technical Analysis and Outlook:

During this week's trading session, Bitcoin has remained closely aligned with the completed Outer Coin Dip at 96000. This development suggests a potential pullback to retest the Mean Support level at 91800, with the possibility of further decline down to the Outer Coin Dip marked at 89000 before a possible resurgence in the bull market.

On the other hand, if the anticipated pullback does not occur, the cryptocurrency may experience upward momentum, retesting the Mean Resistance level at 101300. This could lead to an extension toward challenging the completed Outer Coin Rally at 108000 through Key Resistance at 106000.