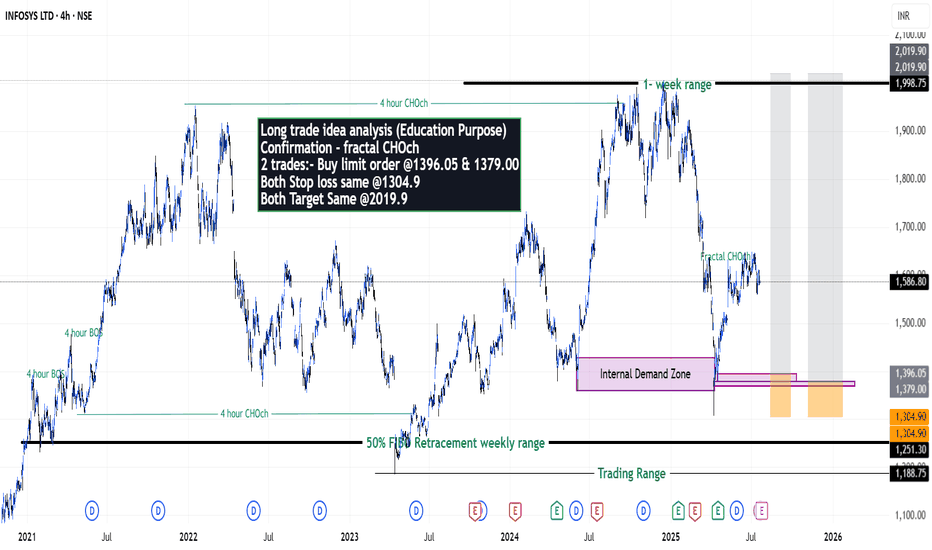

Infosys on getting ready for new high? - {20/07/2025}Educational Analysis says that Infosys (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Stock brings to the table for us in the future.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFITS OR LOSS on trades you take from my setup educated analysis.

My Analysis is:-

Short term trend may be go to the Internal demand zone.

Long term trend breaks the creates all time new high.

Long trade idea analysis (Education Purpose)

Confirmation - fractal CHOch

2 trades:- Buy limit order @1396.05 & 1379.00

Both Stop loss same @1304.9

Both Target Same @2019.9

Happy Trading,

Stocks & Commodities TradeAnalysis.

Infosystradeidea

INFOSYS 📊 Chart Analysis – Infosys Ltd (INFY)

Currently, the stock is testing a key resistance zone between ₹1620–₹1630.

If the price breaks and closes above this resistance, it can signal a strong bullish breakout.

---

💼 Trade Setup (Based on Cup and Handle Pattern):

Entry (Buy): On a closing above ₹1640

Stop Loss: ₹1570

Target 1: ₹1700

Target 2: ₹1780

---

This is a classic Cup and Handle breakout setup, which often indicates the start of an upward trend.

If you find this helpful and want more FREE forecasts in TradingView, Hit the 'BOOST' button

Drop some feedback in the comments below! (e.g., What did you find most useful?

How can we improve?)

Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week

DISCLAIMER: I am NOT a SEBI registered advisor or a financial adviser. All the views are for educational purpose only

INFOSYS trading analysisInfosys the IT giant of India is going to form a reverse cup with handle chart pattern. The company although giving consistent profits has not formed a new high in the previous 2.5 years. Now after forming this chart pattern it may break its previous high. The buy point is 1910 an selling point is 2500. This will give a 31% return. The stock will achieve this target before 2025 Diwali giving a 30% return in approximately 15-16 months.

Hope you like my analysis.

Please do your own analysis before investing.

Do like and follow and share among your friends and family.

Thank you.

Navigating Infosys: A Trade Insight

Currently, Infosys is making its way down to a 15-minute Demand Zone. Let's unpack this potential trade:

Zone Quality Check 🕒:

The 15-minute Demand Zone Infosys is approaching exhibits notable strength, characterized by a robust follow-through. This suggests a compelling setup for potential trades.

Intermediate Frame Exploration 🔄:

Zooming out to the 75-minute Intermediate Time Frame (ITF), Infosys finds itself comfortably within the zone, with the trend pointing upward. This aligns well with the broader context.

Daily Location Analysis 📊:

Shifting to the daily timeframe, which acts as our higher time frame (HTF) for location analysis, we find Infosys trading in an affordable area. This positioning enhances the appeal of the trade execution.

Trade Execution Plan 🎯:

Here's the plan:

- Entry: Enter at the 15-minute Demand Zone or slightly above AROUND 1445.

- Stop Loss: Place it below the 15-minute Demand Zone.

- Target: Aim for a minimum risk-to-reward ratio of 1:3.

🚀 Trade Insight:

This trade aligns well with the strength of the 15-minute Demand Zone, the upward trend in the 75-minute timeframe, and Infosys' affordable position on the daily chart.

📝 Note: This analysis is for educational purposes only. I'm not a SEBI registered analyst.

Trade Smart, Execute Confidently! 💹✨

SNOW another technology company tolerating Bidenonomics LONGSNOW on the 4H is seen trending from from earnings in May with the great top line

and okay bottom line with a big uptrend into a sideways wide range channel.

It is now low in the channel but still above the long term anchored mean VWAP which

is the logical stop loss for any long trade setup. Confluent support is the POC line

of the visible volume profile with the upper high volume profile providing the

the expected range of a long trade. The Volume Price Trend indicator

and the MACD are synergistic in their confirmation. Fundamentally, SNOW is in

the AI revolution and its role in streamlining processes and lowering costs for the government

and businesses. The logical target here, the second deviation above mean VWAP presently

at the 193.45 price level. This line pushed the price back down 4 times in the past 8 weeks.

I see the quick 10% upside as good for a long trade knowing well-managed options

trade could produce 100-150% easily in capitalizing on AI software tech and the heavy

hitters of the new NASDAC leading the index higher and faster. What a great concept

more snow while the climate heat wave is unrelenting. I will enter here with a sizeable

stock trade while considering a 10-30 DTE call option to catch the ride toward the

target mentioned here.

INFOSYS a GOOD Buy from present levelINFOSYS is a top it services company in the world with consistent profits and has been a multibagger for many. It is currently 31% down from lifetime high which makes it a good bet in the short term. If has broken all its previous lifetime highs in the past to make a new lifetime high and this time also it will maintain its track record. It is a 44% gain to lifetime high.

{INFY BACK IN ACTION} :(EXPECTED RISE 6.5%)

Price has reated to a Demand in Higher Timeframes, after reacting Price has violated a Daily Supply confirming an UpMove, post violating the Daily Supply Price has formed a Daily Demand and has reacted to it, Was a perfect buy for yesterday, expecting Price to reach the Resistance formed in the opposite @ 1355.00, therefore a total of 6.5% from CMP till the TGT of the trade.

ENJOY THE RIDE ! ! !

INFY Infosys Limited Options Ahead Of EarningsLooking at the INFY Infosys Limited options chain ahead of earnings , I would buy the HKEX:20 strike price Calls with

2023-10-20 expiration date for about

$0.45 premium.

If the options turn out to be profitable Before the earnings release, i would sell at least 50%.

Looking forward to read your opinion about it.

INFOSYS, TECHNICALS and its WAVES!!INFOSYS is showing a RSI DIVERGENCE, with H&S.

i have drawn correction waves, after that it needs to get its bull run, since from past few days, nifty IT, IS getting corrected a lot, because of American news, so this made its bearish trend to continue, and reach its support(which started before the bull run).

this month will be a bearish nature of INFOSYS.

Infosys levels & strategy for coming days?Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please consult your financial advisor before trading.

Dow Jones has taken nose dive and closed with deep cut of 1000 plus points and Nasdaq closed below 500 plus points based on outcome of Jackson Hole meeting.

Is Infy trading in support zone & ready to take reversal to support index? or

Will these negative market sentiments push Infy & other IT stocks further down?

Is Infosys trading direction is negative? Infy has formed inverse flag & pole pattern. Will Infy achieve pattern target in coming days?

Shall we look sell on rise strategy till global cues are negative?

Shall we invest in Infy in small-small chunks for long term in case of decent corrections/near 52 W low from current levels?

Please do share your comments as well. Wish you all a very happy, healthy & profitable days ahead!

Infosys levels & strategy for coming days?Dear traders, I have identified chart levels based on my analysis, major support, and resistance levels. Please note that I am not a SEBI registered member. Information shared here for educational purpose. Please consult your financial advisor before trading.

Dow Jones has taken nose dive and closed with deep cut of 1000 plus points and Nasdaq closed below 500 plus points based on outcome of Jackson Hole meeting.

Will these negative market sentiments push Infy & other IT stocks further down?

Is Infosys trading direction is negative? Infy has formed inverse flag & pole pattern. Will Infy achieve pattern target in coming day?

Shall we look sell on rise strategy till global cues are negative?

Shall we invest for long term in case of decent corrections near 52 W low from current levels?

Please do share your comments as well. Wish you all a very happy, healthy & profitable days ahead!

Infosys Futures Key Trading level 28th June 2022Infosys Futures Key Trading level 28th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Infosys Futures Key Trading level 27th June 2022Infosys Futures Key Trading level 27th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.

Infosys Futures Key Trading level 24th June 2022Infosys Futures Key Trading level 24th June 2022

Disclaimer: These levels are purely based on Price action/demand and supply zones & and consumed only for educational purpose & should not be taken as buy/sell recommendation. I will not be responsible for any loss/profit incurred if anyone takes trades based on my views.

Please consult your Financial Advisor before making any trading decision.

Leave a comment that is helpful or encouraging. Let's master the markets together.