INR

USD INR Short term bearish USD INR Short term bearish. Likely to touch support levels.

Short to Rs.75 then Long from Rs.75 to Rs.77

ridethepig | The Revolutionary IdeasA good time to update the chart in Indian Equities (NIFTY) for those following the EM story...

If you take a closer look at the below diagram " Top is in for the year.. " you will see that it is above all directed against an arithmetic conception of the 5 wave sequence from the cycle lows.

What is crucial is simply the greater or lesser degree of mobility which the Indian currency has possessed from both the monetary and fiscal side; if intervention occurs from the CB it is going to mark the end of the weakness for India, and unlock a new chapter for the next generation! What it boils down to is always the "intrinsic value" of the local economy (deriving from the global skeleton present) which is a cumulative count of productivity, confidence and similar matters of form.

There is a strategy which every hypermodern investor should take note of. I mean the continuity of the advance from 8542 support. Once the support began holding, then and only then may we consider the mass as more attractive because only then have the elements been mobilised. The previous swing did not fail to excite lively interest, since the previous update the INR weakness is now starting to show signs of exhaustion and should be treated with extreme caution.

In spite of fine play, the INR is protected at the highs and is giving Shaktikanta Das a free hand to play monetary policy on the retrace. How can India mess this up? ... An elegant breakup in Indian Equities over the coming years does not seem too fancy!

As usual thanks for keeping your support coming with likes, comments, charts, questions and etc!

US 30 Short at 32 with SL 34.50We are doing Analysis of US30 on 1 Hour Timeframe.

The projected target from the breakout is usually the vertical distance from the high to the bottom .

Note: This is only for Educational Purpose this is not an Investment advice.

Please support the setup with your likes, comments and by following on Trading View.

Thankyou

Ankur Verma

Twitter : Ankurverma3838

CrudeOil Mcx Short at 2450 with SL 2630We are doing Analysis of CrudeOil MCX on 1 Hour Timeframe.

The projected target from the breakout is usually the vertical distance from the high to the bottom .

Note: This is only for Educational Purpose this is not an Investment advice.

Please support the setup with your likes, comments and by following on Trading View.

Thankyou

Ankur Verma

Twitter : Ankurverma3838

ridethepig | India Closing the ChapterIn this positional chart, the INR is entering back into the game, whilst USD is nearer the end and thus already well-developed. That is decisive. So the more distant EM currencies like INR actually will act as a trump card and assist in diverting flows from the king, but like all trumps we must use them sparingly: do not jump the gun is the rule. The diverting exchange of Covid flows was simply the prelude to the king (USD) marching home, which will follow in the coming weeks/months.

Indian Equities were denied the advance as anticipated, the trip towards the lows was somewhat time-consuming and the travelling companion INR was too dilatory....As the currency devalued as did local stocks...

In any case, the correct procedure is getting our companion (INR) and using it as a weapon to wield influence and thank holders for their loyalty. We should make good use of the cheap currency and the move that now follows by looking to sell the highs in USDINR for a move not too late after. The trip we are planning for should be carefully prepared before pulling the trigger, if possible make use of any overshoots in USD (remember we still have the 1.05/1.06 unlocked in EURUSD for reference on G10). All that before playing the diversionary swing!

Softer oil will help Indian significantly as the deprecation pressure on INR was starting to crack through the economic defence. India will need an appetising fiscal policy and less reluctance from the CB to intervene. These are starting to enter into play and can be a major game changer for India in the coming months.

Singapore Dollar RangeboundSGDINR is trading in the 50.1 to 53.89 range (shown in the box). It will continue to be range bound until there is a breakout. I anticipate an upside breakout eventually. The target then will be the equivalent to the box height. But the timeline will be much shorter.

NeatTrade

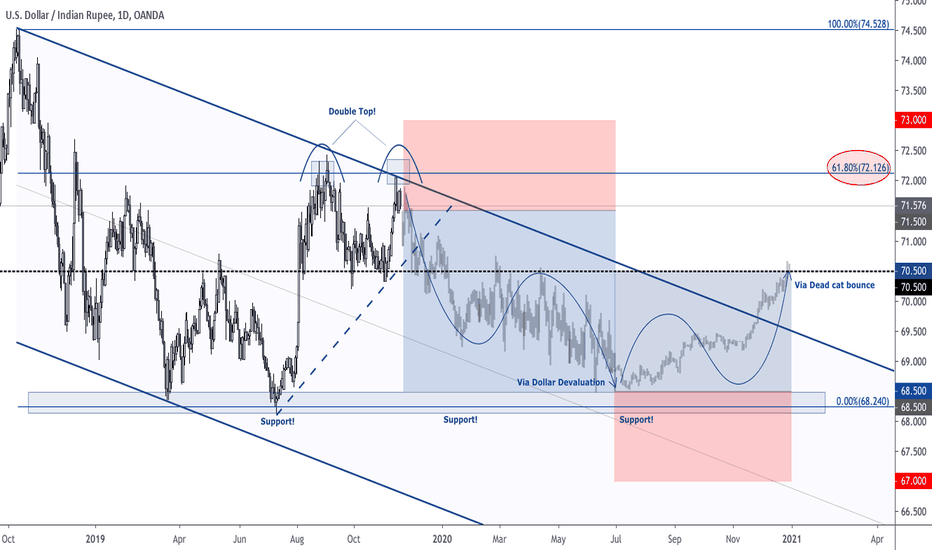

#USDINR | Double TopPlease support this idea with LIKE if you find it useful.

Price was rejected by the horizontal resistance which gives us a Double Top pattern, also we have an RSI is in an overbought zone. The price can retest the previous resistance of the Channel (currently support), so we can initiate a short position with a stop-loss above horizontal resistance

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

USDINR | Channel's Resistance BrokenPlease support this idea with LIKE if you find it useful.

Price broke the Channel's resistance zone. Price was trading with good volumes inside the channel, which points out it could be an accumulation. When price fixes above we can initiate a long position

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.

Another inverted H & S pattern that looks goodWhilst not visible on the chart the inverted H & S pattern has formed with support around the 78.6% fib retracement (of the move up that commenced in October 2016). This looks set for a move up. Keep an eye on the daily RSI which is at 67 though the weekly RSI is well under control.

USD/INR: Uptrend about to resume?The USD/INR (Indian Rupee) pair triggered a bullish wedge pattern recently and entered into a consolidation.

The price is now trading near the 38.2% Fib level which aligns with a horizontal support level, signaling a potential continuation of the underlying downtrend.

Notice that the pair hasn't reached the profit target projected by the wedge pattern yet, which lies around the 73.50 level.

We are following this setup in our Telegram group and wait for a buy confirmation

USDINR Daily Chart: An ending diagonal coming home?USDINR seems to have completed a 5 wave move as per ending diagonal pattern shown as 1-2-3-4-5, and also an impulse wave of higher degree shown as (1)-(2)-(3)-(4)-(5). Can expect a fall to 70.41 by 30/08 - 04/09

A move above 72.30 invalidates the pattern.

Wave count in Nifty too supports short term weakness.