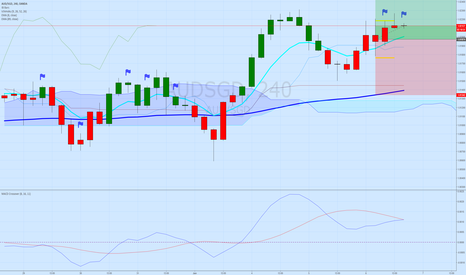

ETHUSD: Lower High Obvious But Don't Ignore Support Zone.ETHUSD update: Price has reached the bearish trend line and is now hesitating. This is not unusual and was expected, that is why we placed our swing trade target at 540. The question is: what is price more likely to do from here? Lower low? Higher low? Or continuation higher?

In case you have not been following our swing trade on S.C., it reached its 55 point profit target 2 days ago. The selection of that target was partly based on the bearish trend line.

The bearish trend line has been slightly compromised, but not enough to change our short term outlook. Bearish structure still dominates the short term momentum and until that changes, we are going to be very conservative as far as putting on new swing trades and their respective profit targets.

The short term bearish argument is as follows. If the 516 inside bar low is taken out, followed by the newly established bullish trend line, then this market is more likely to retest the 458 reversal zone boundary. In an extreme sell off, price can even test the 423 reversal zone boundary. This is the type of price action we wait for when it comes to our inventory building strategies.

Again, the selling scenarios are all IFs. Meanwhile, price is still within a broad support zone. The 544 to 464 area is the .618 of a recent bullish structure. As imprecise as this area may be, it cannot be ignored. It does present a chance that a higher low or failed low formation can materialize here. This is what the bears are not seeing and will be seriously caught off guard. Great scenario for people who hold inventory.

Another sign that canot be ignored is if the bullish trend line stays intact. A long signal off of the current inside bars can also catch many by surprise. If this happens, it will most likely be lead by a similar signal in BTC.

In summary, before any of these markets show real signs of recovery, they need to take out their trend resistance levels. In this case it is the 625 level which is the .382 of the recent bearish structure. Until then, we are likely to see wide range bound markets that do not make any real progress.

At S.C., we are not convinced of a completley bearish market because of 2 conditions. The first is the general bullish price location. The second is the premise that this market is forming a broad higher low formation which is also still in line with the Elliott Wave count I posted recently.

This type of environment is not without its opportunities, but patience and realistic expectations are key. We let the market tell its story and adjust to it, always evaluating the risks vs. potential rewards. No matter where it goes, we have a plan of action for that scenario.

Your own plan will serve you better than anything else. As I have been reminding our followers at S.C., use quiet time to plan ahead and to expand your knowledge. You will be much better prepared for when these markets get busy and the reactionary crowd returns.

Inside Bar

AMD inside day after new high of a decade!Patience for AMD investors got paid off greatly as it just made a new high of a decade!

These days, these bullish ideas,from 10 followers to 1000 followers, first of all I would like to thank my family...........( ok stop it lol)

I still got some from 10.00 that was already taking profit several time and the trailing out below the 14.3 pivot.

Here is a good example about how to "add position with profit".

The main logic is ---> Take every trade as individual event!

I won't be affected by my 10.00 positions to think like --"only idiots will buy at this spot for me, buy low is much smarter bro!"

I'll be like--"hey here is an inside day after new high of a decade trade, it's exciting to participate the trend!!"

So it's a totally different trade from my original positions and they'll have different out ;

And I like this set-up here so much!

Of course, if it breaks to the downside before breaking to the upside, this trade doesn't exist anymore!

Let's see how it goes!

GM inside day, relative strength or not?Stock futures slumps for more than 1% in Asia market today.

Also, GM got an inside day here;

Yesterday it tried to break the 45.00 fig level and the bearish bat but failed, if the bulls are able to break the inside day,

the momentum probably is able to takeover the size.

Generally I am quite bullish in GM as it's ridiculously cheap with 6-7x multiples and solid dividends, so I'll skip the set-ups to short.

While, with regard to the potential gap down (with the market), the 1st point for this trade is to see if the inside day low 43.35 is broken.

If not, that means GM shows great relative strength against the market, which is great for this trade!

If it breaks the inside day low before breaking the inside day high, this trade doesn't exist anymore.

Let's see how it goes!

ETHUSD: Slow But Still Poised To Test 544 Resistance Area.ETHUSD update: Lack of follow through makes this coin a tough one to hold for a swing trade long, but it is still in a good position to rally. While short term structure remains bearish, do not lose sight of the broad higher low formation that appears to be in progress.

The structures that prompted us at S.C. to call for a swing trade long are still in place. The failed low off of the 458 reversal zone boundary, the break of the high of the bullish pin bar and the 544 to 464 support zone location.

The tricky part has been the recent bearish inside bar formation, but if the 521 high is taken out, this market can push back up to the 625 resistance.

At S.C., the swing trade that we are in is betting on the broad higher low formation relative to the 374 low. Higher lows often lead to higher highs. Even though at this magnitude, it will not happen in a straight line. Once the formation is in play, the short term probabilities will shift decisively to the bullish side.

A close above the bearish trend line at the 544 area will be the first sign. And a decisive close above 625 will be the second. When will this market behave this way? I have no idea. All I know is that at current levels, the probability of a larger magnitude retrace is greater.

Keep in mind, our current swing trade has a target lower than these levels. We will keep targets conservative until after the market proves that a broader recovery is in play. At that point, any new trades will feature targets that are more appropriate for that type of environment.

In summary, all eyes are on BTC. The reason why I even write about this market and its levels is just to quantify the reward/risk of our specific swing trade.

The fact that an inside bar has formed and there is price hesitation are bullish signs. As long as price does not break below 450, chances are better that this market retests the 544 bearish trend line.

I gauge probabilities relative to the price action presented on a chart. I do not "predict" anything, instead I just listen and adjust as the market instructs me to. Standard oscillators are not the most effective tool to discover this perspective. Information based on raw price action is.

GBPUSD Harmonic patterns combination and this inside 4hrGBPUSD has a great harmonic patterns combination recently,

the bearish one perfectly caught the slump after Draghi's speaking.

Now it hit the bullish one and formed an inside 4hr, with abundant 8ema correction zoom.

That will be an interesting but risky long, while it's a good combination of harmonic patterns, inside bar, and EMA correction.

So I'll pay careful attention if it's able to break to the upside, if it breaks to the downside before breaking to the upside, this trade doesn't exist anymore.

Let's see how it goes!

US30 daily chart -- 6 trading opportunities and my ranking. Last time the triple inside bar trade worked perfectly.

There are several potential trades here

1 & 2 are bearish harmonic patterns

3 & 4 are supply/demand, both are very important.

and yesterday was an inside day, which gave the 5&6 trading opportunities.

Among these trades,

1&3 will have a combination near 26000 fig, which probably is the best trade on this chart;

4 ranked 2nd, with regard to the current uptrend and the bearish 2, I want to long by some buy low strategies.

2 is against the current momentum, if it hit 2 today that means the 5 breakout has already taken place, which will be contradict with each other.

If I really have to choose a preference, the inside day breakout may be still more attractive to me.

As for 6, I don't really like to take a inside day breakdown in an uptrend.

So my preference ranking for these trade is 1=3>4>5>2>6 lol.

Preference pretty much will affect the risk appetite and whether to take the trade or not.

Let's see how it goes!

EOSUSD Inside day, kinda a experimental trade!There were many cryptos having inside days yesterday.

Technically speaking, this bat pattern drawn has already failed;

while it didn't break 10.00 fig and it has this inside day after breaking the X point.

People may get emotional when their positions got stopped out and bounced right after they realized their loss.

That may become a potential buying momentum for this inside day breakout (those who got stopped out retake the trade)

It's still a very interesting inside day to watch.

Of course, if it breaks to the downside first, this trade doesn't exist anymore.

Let's see how it goes!

ETHUSD Bullish bat pattern and demand zone combination,but....ETHUSD has a bullish bat pattern and demand zone combination with potential entry @ 515-525.

To lean on the 500 fig support is also another plus for this trade;

While, there probably will be a huge minus for this trade, it's the potential inside week.

If it's able to form an inside week, this combination long will be against the momentum of the inside week breakdown.

If it can hit this area and formed a 4H reversal sign, still a worth noticing trade, but based on the potential inside week breakdown,

it worth less risk to trade as there is contradiction between my own system.

Let's see how it goes!

EUR/CAD Long Set UpEUR/CAD had broken upper inside bar @ 1.51551

Entry Level

Option A

EP @ 1.51189

TP @ 1.53006 / @ 1.52279

SL @ 1.50098

Risk vs Reward

1 : 1.66 / 1

Another TP to look @ 1.54070 based on the previous broken upper inside bar @ 1.51650

Option B

EP @ 1.51552

TP @ 1.53006

SL @ 1.50098

Risk vs Reward

1 : 1

US30 Triple inside day breakout long opportunityActually we have a specific term to describe a triple inside bar, but I don't think that's proper here so let's still call it a triple inside bar lol.

As an intraday trader, a daily chart inside bar breakout usually implies a pretty large risk that exceed the normal risk amount.

While of course, I would love to participate in this "triple inside day" long.

Accordingly, I'll look for any possible intraday set-up to long US30 today before / after the market opens.

Let's see how it goes!

GBPCAD inside day after 21ema correctionGBPCAD has an inside day in a downtrend after 21ema correction.

What's more, this breakdown may also be played as a 1.7200 fig breakdown (although fig is not as important in Forex as in stocks lol).

Accordingly, this inside day is a typical "follow the trend" trade that I would only be willing to short the breakdown.

If it breaks to the upside first, this trade doesn't exist anymore.

Let's see how it goes!

MA inside week in front of supply zone, too high to buy?Last year, at least 7 out of 10 stocks looked like this MasterCard weekly chart.

While it's a totally different concept compared to what the market happened.

With the Q1 market fluctuation, MA showed great relative strength to remain a intact weekly uptrend!

It solved the 1st thing-- I don't want to short the supply zone nor the inside week breakdown at all !

2nd question: how about the inside week breakout, is this too high to buy?

The hard part for this setup is that it can only get its 1st kick after it made new all time high.

Other than that, I actually like this long a lot!

Here we got 2 options:

1. wait for the weekly breakout and trade the intra-day bullish setup

2. trade the inside week and put the 1st kick at the supply zone @182.5, and execute careful risk-reward stop!

Let's see how it goes!

BTCUSD: Bearish Trend Line Encourages Test Of Low 7Ks.BTCUSD update: Price action is some what quiet near the most recent peak. There is an inside bar now present on this time frame which can turn into a sell signal quickly. As I wrote in my report on S.C. earlier today, the bearish trend line is still in effect.

Lower highs often lead to lower lows. This market is in a tricky area. If buyers hold up, price can produce a shallow higher low and squeeze higher and break the bearish trend line.

If price takes out the 7413 inside bar low, that can invite further bearish momentum which can take price back to the low 7Ks. Based on the technical structures in place, it appears price is more likely to lean more toward the bearish side on the short term.

I am all for being bullish, but two things need to happen in order to prove this market is in a sustained rally. First, the trend line needs to be cleared. Second, the 8185 resistance level needs to be taken out. This is the .382 of the recent bearish structure.

Keep in mind price can go as low as 6904 which is the reversal zone boundary and still be in a position to reverse sharply. It is a matter of waiting for the price action to confirm.

In my earlier report on S.C., I also compare inventory building with swing trading. If this market pushes the 7K low, there will be an opportunity for both types of strategies.

In summary, at this point I am just waiting for the next swing trade while accumulating other coins for long term inventory. S.C. is where I will share the next trade idea for this market.

ETHUSD: Swing Trade Long And Facing The Bearish Trendline.ETHUSD update: A swing trade idea was triggered at the break of 543.50 which was published on S.C. earlier today. There is also a follow up article that explains the reasoning behind the trade.

As you can see, the trade is in the green for now. This retrace should not come as a suprise though. We have been writing about the support zones and risk of short squeeze for at least a week. When price reaches a predetermined level like the 544 to 464 support (.618 of recent bullish structure), it helps us to lean more toward expecting a reversal. Even when there is no sign of one which has been the case for the previous few days. It begins with probability and then is followed by pattern recognition.

As far as where this market can go, the next resistance is 625 (.382 of recent bearish structure). There is no guarantee that price will go there, but in terms of proportion, this level is within reason. On S.C., I wrote about a specific target and why we chose that level.

Keep in mind, there is a bearish trend line that is still in play. This is why we choose to lean more toward the conservative side when determining where to begin exiting the position. Can price retest the high 600's? Anything can happen, but we focus on probability, not profit.

If the market chooses to continue to run, there will be plenty of opportunity to lighten up on the position and let some ride.

In summary, this is a swing trade. It differs greatly from a position trade because of it's shorter term nature and specifically defined risk. We have also been building inventory during the general pessimism across a portfolio of coins, not just this one. When markets are ugly, that is the time to accumulate. When they look the greatest, that is the time to unload. In order to operate in line with this concept, you must separate yourself from your own natural impulses.

Natural impulses like buying a market at the high, or being bearish at the low is further amplified by all of the hype, drama and social noise. Price is the best piece of information we can get, it is just a matter of learning how to listen to it.