Insider-buying

Acreage Holdings - Insider Open-Market Stock PurchaseJuly 15, 2019 (GLOBE NEWSWIRE) -- Acreage Holdings, Inc. (“Acreage”) (OTCQX: ACRGF) today announced Kevin Murphy, Chairman, and Chief Executive Officer of Acreage Holdings, executed an open market stock purchase for 154,000 shares through the OTCQX on July 12th.

The transaction, valued at more than US $2,000,000, was executed on the OTCQX open market on Friday, July 12th. The 154,000 shares acquired represented more than 72% of the average daily trading volume on the OTCQX.

“With the downturn in industry stock prices recently, this was an opportunity to show investors that Acreage management is committed to creating long-term shareholder value,” said Murphy. “We remain focused on executing on our strategic plans, including fully leveraging the power of Canopy’s IP. Additionally, we have been in dialogue with executives from both Canopy and Constellation, and I can assure all of our investors that all three companies remain fully committed and excited about our recently executed agreement.”

ITCI bullish call activity and insider buyingITCI is moving mostly horizontally lately, and there's definite room for downside to its channel bottom around 10.40, so this is a risky play. However, a large stock purchase a couple days ago by one of the board of directors triggered a large volume of bullish option activity. Possibly the director purchased stock in anticipation of forthcoming clinical trial results that he expects to be positive. Watch this one closely and look for an opportunity to buy nearer the channel bottom. Alternatively, wait for upside channel breakout.

ITCI has generally poor analyst ratings and negative earnings. However, it's made progress toward profitability and generally delivered earnings beats in recent quarters. It next reports on August 6.

$VTVT more upside with Insider buying & MacAndrew acquire sharesVTVT had news on Phase 2 study and it spiked 21%

It close pretty strong as it stayed within the 5min chart break out zone.

Possible runner tomorrow or a few days as I do see accumulation going on.

Reason:

1. Indicators is still strong and positive with RSI divergence on daily. MACD positive

2. Price still within the channel of support.

3. Overall, the company has been doing well. No debt and sales are starting to look promising. The offering last year has made this VTVT more attractive and institutional buyer has purchased in late dec 2018 www.sec.gov

Also, insider had also purchase shares: finviz.com

Swing idea: Enter near orange line / SL at Red line

Daytrade Idea: Enter at break of 3.10 with tight SL or wait to enter break of the trend line (blue)

Over 3.23 will probably go parabolic so set your stops and scale out to take profits.

REMEMBER:

1. have a strategy entering and exiting

2. cut your losses fast (or avg down if you've plan to enter with smaller size)

3. honor your stops

CRMD - Technical Indications for Impending BreakoutI'm in at 1.34. Notes given on the chart. Conduct your own due diligence.

DISH - insider buyingDishnetwork DISH one of few with upward movement this week.

VIX rising again today, so is DISH.

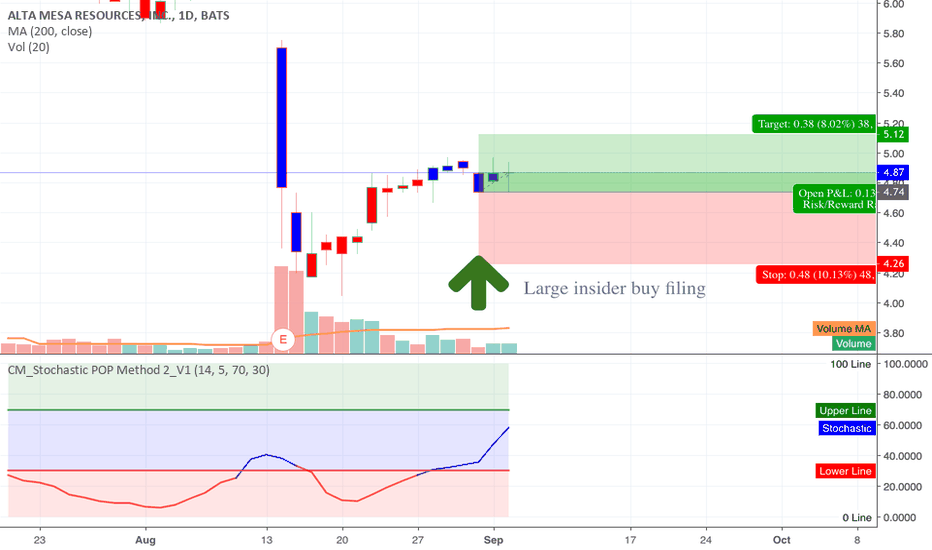

Large insider buy filing in AMRBayou City Energy Management LLC increased their ownership by 12%. They purchased 422,000 shares worth $2,065,360 at an average price of $4.89. At the moment of filing the shares were priced at $4.74. Take profit at 8%, stop loss at 10%, close automatically after 14 days.

PTLA Very large buy by on InsiderI like charts that look like this with insider buying.

It seems ripe to reverse trend.

Tread you path

MXWL Insider tradingThey already made about 10% but so many insiders buying at the bottom it has to mean something.

Looks like a bit of consolidation then hopefully shoot up.

Tread your path