NordKern - XAUUSD InsightNordKern | Simplified Insight OANDA:XAUUSD Short Opportunity Ahead

Gold saw a sharp surge in price today, primarily driven by political headlines that temporarily shook market sentiment. To be specific:

📅 Jul 16, 2025 – 16:56 CET

CBS Reports: Trump asked Republican lawmakers whether he should fire Fed Chair Jerome Powell. This headline alone triggered an intraday spike of +$52/oz in gold as markets priced in increased macro and institutional risk.

As previously stated "Context Matters."

While the President cannot remove the Fed Chair without cause, even the suggestion introduces uncertainty and undermines confidence in the Fed’s independence especially ahead of a high-stakes election cycle.

However, further developments quickly followed: 📅 Jul 16, 2025 – 17:58 CET

Trump: “Firing Powell is highly unlikely.” 📅 Jul 16, 2025 – 18:06 CET

Trump: “Reports on me firing Powell are not true.” With this clarification, the initial rally appears overstretched and sentiment-driven, leaving room for a corrective pullback as the market digests the full picture.

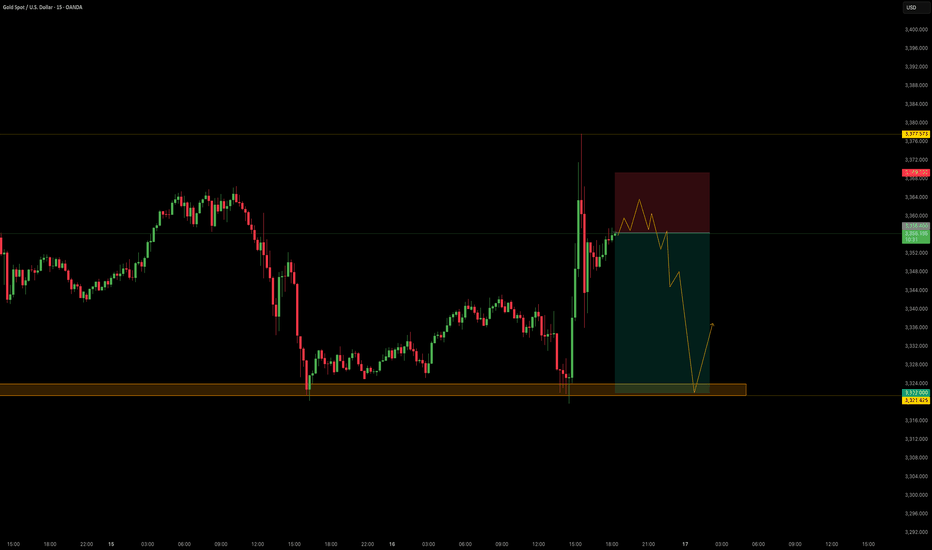

Trade Setup - Short Bias

Parameters:

Entry: 3356.40

Stop Loss: 3690.30

Take Profit: 3322.00

Key Notes:

- The spike was headline-driven and not supported by policy shift or macro data.

- Trump’s denial removes much of the political risk premium that had been briefly priced in.

- Watch for momentum fading near resistance and confirmation via intraday structure.

This remains a tactically driven setup. Manage risk appropriately and stay alert for any renewed political developments.

Insight

A heartfelt message from human to human. A life lesson. Disclaimer: This video is not an analysis video so for those looking for a TSLA analysis here feel free to skip over.

This video is a heartfelt message from one human to others - I learned some important lessons this morning about haters and about myself and I was given beautiful insight from G-D which will make me a better human being going forward.

To those who come back time and time again to support me, I can't tell you enough how much I appreciate your appreciation - I truly spend my time making these videos to help you.

I continue to pray that G-D silences my soul to those who hate and curse me.

Thank you for listening and I will now get back to the analysis side of this business!

Guide to Altcoin Growth ExplosionsThe whispers of "altseason" echo through the cryptosphere, igniting the imaginations of investors with visions of explosive altcoin growth. But what exactly is this mythical period, and how can you navigate its thrilling (and potentially treacherous) waters?

Deciphering the Altcoin Landscape:

Imagine Bitcoin as the majestic oak, anchoring the crypto forest with its established presence. Altcoins, on the other hand, are the diverse flora teeming around it, each offering unique characteristics and purposes. From the DeFi tokens powering decentralized finance to the meme-fueled Dogecoin, the altcoin landscape is a vibrant tapestry of innovation and experimentation.

Understanding Altseason's cycle:

Think of altseason as the spring bloom of the crypto market. Just as flowers burst forth with vibrant colors, altcoins experience a surge in growth during this period. This happens when investors, having secured profits from Bitcoin's rise, seek new avenues for higher returns, shifting their focus to altcoins.

Catching the Altseason Wave:

While predicting the exact arrival of altseason is like trying to pinpoint the exact moment a flower blooms, there are key indicators you can watch:

The Bitcoin Dominance Symphony:

When Bitcoin's market share (dominance) starts to dip, it's often a sign of capital flowing towards altcoins. Track this metric closely, as it can be an early harbinger of the altseason melody.

The Altcoin Season Index: This handy tool (link provided in the original article) acts like a conductor, orchestrating an index that reflects altcoin performance against Bitcoin. A score above 75% might signal the start of the altseason concerto.

Choosing Your Altcoin Stars:

Don't be swayed by the allure of the season alone! Before diving in, carefully consider these factors:

Market Capitalization: Look beyond the current valuation and examine historical trends. Has the market cap experienced significant fluctuations? A stable market cap indicates a more established project.

Project Innovation: Does the project address a real-world problem or offer a unique value proposition? Don't get swept away by hype; true innovation has staying power.

The Orchestra Behind the Project: A strong, transparent team and an engaged community are essential for long-term success. Look for projects with a clear roadmap and a team that inspires confidence.

Tokenomics: Understanding the Score: This refers to the coin's supply, distribution, and release schedule. How will the release of new coins impact the price? A well-defined tokenomic model fosters trust and sustainability.

Trading Volume Harmony: Don't limit yourself to the major exchanges. Explore diverse platforms to potentially discover hidden gems with lower trading volume but high growth potential.

Learning from the Past, Embracing the Future:

While past performance isn't a crystal ball for the future, analyzing top gainers from previous altseasons (like Gala, Axie Infinity, and Solana in 2021) can offer valuable insights. Remember, the crypto market is a dynamic ecosystem, and new projects with groundbreaking ideas are constantly emerging.

The Power of Research: Your Guidebook to Altseason:

ETH-BTC pair :

The ETH/BTC pair is one of the most important indicators to watch when trying to determine when altseason will begin. This is because Ethereum is the second-largest cryptocurrency by market capitalization, and it is often seen as a bellwether for the rest of the altcoin market.

When the ETH/BTC pair is rising, it means that Ethereum is outperforming Bitcoin. This is often a sign that investors are becoming more bullish on altcoins, and that altseason may be on the horizon.

Conversely, when the ETH/BTC pair is falling, it means that Ethereum is underperforming Bitcoin. This can be a sign that investors are becoming more risk-averse, and that altseason may be coming to an end.

Altseason can be a lucrative opportunity, but venturing in without proper research is like navigating a dense forest blindfolded. Utilize the wealth of information available in the crypto community, explore various tools and resources, and conduct your own due diligence before making any investment decisions.

Diving into 2021's explosive altseason: check out these top performers:

Gala (GALA) +10891.26%;

Axie Infinity (AXS) +10598.52%;

Solana (SOL) +7998.67%;

Fantom (FTM) +7155.14%;

Polygon (MATIC) +6805.13%;

Rari Governance Token (RGT) +5491.43%;

Terra (LUNA) +5071.23% (well, it was there);

Dogecoin (DOGE) +3855.02%;

PancakeSwap (CAKE) +2963.16%;

The Sandbox (SAND) +1896.16%.

*Data taken from coinmarketcap.

Remember, altseason is not a guaranteed path to riches. Invest responsibly, stay informed, and enjoy the journey! The crypto market is an ever-evolving landscape, and altseason offers a unique opportunity to witness and potentially participate in its growth. By understanding the fundamentals, making informed choices, and staying adaptable, you can navigate this dynamic season with knowledge and potentially reap the rewards.

P.S. Share this article with your crypto-curious friends and start your own discussions about altseason!

Altseason on the Horizon? 🌕Exciting times are upon us in the world of cryptocurrencies! Ethereum (ETH) has recently broken out of a significant triangle pattern, and there's a compelling possibility that a similar pattern may soon emerge in the ETH/BTC pair. This development could signify the beginning of a mini altseason – an exciting prospect for crypto investors. 🎉

ETH's Triumph:

Ethereum's breakout from a long-standing triangle pattern has sent ripples through the crypto market. It's a bullish move that indicates renewed interest in the second-largest cryptocurrency by market capitalization. 📈

The ETH/BTC Pair:

Now, let's turn our attention to the ETH/BTC trading pair. Historically, altcoins tend to flourish when they outperform Bitcoin. A breakout of a similar triangle pattern in this pair could potentially signal a shift in market dynamics. 🔄

Implications for Altseason:

Here's why this matters: if Ethereum, often seen as a bellwether for altcoins, starts to outperform Bitcoin, it could mark the beginning of a broader altseason. During an altseason, many alternative cryptocurrencies (altcoins) experience significant price surges, presenting intriguing opportunities for investors. 🚀

Trading Strategy:

Keep an Eye on ETH/BTC: Watch for signs of a breakout in the ETH/BTC pair. Look for increased trading volume and clear confirmation of an upward trend.

Diversify Your Portfolio: If altseason does materialize, consider diversifying your portfolio to include promising altcoins that align with your investment strategy.

Stay Informed: Keep abreast of market news and developments that could impact cryptocurrency prices.

Conclusion:

While crypto markets are inherently volatile, technical patterns and market dynamics can provide valuable insights. Ethereum's breakout from the triangle pattern and the potential ETH/BTC breakout are exciting indicators.

Remember, cryptocurrency investments carry risks, so always exercise caution and perform thorough research before making any decisions.

Could this be the start of an altseason that leads to new opportunities and gains? Stay tuned, and let's see where the crypto journey takes us! 🌟

❗️Get my 3 crypto trading indicators for FREE! Link below🔑

Bitcoin Potential Bottom and the End of 4 Years CycleHello all, Lets surf the chart!

The bottom is not yet in, no one can argue. Though catching the bottom is not a key here because we can not predict the depth of the decline, to identify the low it is necessary to time the best buy for long term hold (for the x gains) and trade for short term. In short, risk and reward potential.

Time is an important factor which allows me to be a student of cycles especially the one with Bitcoin.

Is it a perfect indicator?

Not perfect but good. Knowing that the Bitcoin cycle started in Dec 2018 lows and confirmed in Feb 2019 gives us the idea that Q4 2022 is the end of BTC 4 Years Cycle and could extend to January 2023. In this range we could expect lows and that buying this dip could be a good risk/reward for the long term.

As bitcoin price starts a steady grind to its new cycle, I will begin to share my ideas as I walk through it. Hope we learn together from here onwards.

Sharing from the chart are scenarios of the different possibilities I am expecting for Bitcoin regardless of the fundamentals and why this level is significant in the upcoming days.

For 20 weeks or so, Bitcoin remains above strong support at 18k to 20k, this is the key level from the 2017 cycle top so it is imperative that the demand in this area is high since it is known that Bitcoin can NEVER go below its all time high.

However, 18k support is broken and price crashes to sub 15k in one day. The probability of going lower is increasing given bitcoin history of 85% - 90% drawdowns which can send it to 10k to 13k area. PLUS the increasing market sentiment, FTX crash, its contagion in the ecosystem and Bitcoin is dead right at the timing band of 4 years cycle lows.

Will it bounce from here?

If we look at 2017 top to bottom (black arrows), it took 52 weeks to complete and then followed by 8 weeks of accumulation before the bounce. Note also is the amount of capitulation in all the lows (red arrows) and it is decreasing as time goes by.

It is in 53 weeks now and considering the above scenarios, two things to expect.

Zooming out the current price action, BTC found support at 15k with daily closing at sub 16k. I expect it to test 18k, a support now turned resistance and if rejected, it will then go back down to 15k and range bound from there.

Above $18200, it's a LONG spot. But if 15k is broken then the continuation of the downtrend is likely to be at 13k to 14k where it could find immediate support in the short term.

This is it for now. Thank you for reading and will update soon. Appreciate the comments, supporting ideas as well as contradicting ideas.

UBER 30 Day LookoutDaily Candle Prediction

I think you saw the high for a minute on UBER. I think it is going to come down amd fill the gap before it catches itself on the next meaningful uptrend. I think the next uptrend is going to have some momentum going forward.

I would look at $26 / buy in for a good support level

This is not financial advice, I have never been trained to do this

Consistent Profitability, how long does it take?How long does it take to become consistently profitable as a trader? This is one of the most searched questions in the Internet when it comes to trading and the beauty is there's no right answer. When you do receive an answer, it's miss leading to beginners and everyone gets confused. There's a solid chance that you've looked at this before, or perhaps you just seen the title of this post and clicked on it. How long this is going to take you to master the arts of the market. There's a good chance you sat there and questioned, "what am I doing? how long are we going for? What should I be goal setting in terms of time with trading?" if you see yourself in this position or you've seen it previously, I finally have the answer you need to hear.

How long does it take you to become consistent and profitable trading?

As long as it takes.

There's so many different sources which claim so many different time limits that it takes to master Forex trading or crypto trading or industry, trade, whatever it might be your embarking on. All of them say the same around two to three years to become a consistent and experienced professional. Yet, where are they getting this data from? I know traders that master trading within six months. I also know other traders that traded for six years and couldn't get the look of it. There's no time frame to put on trading in terms of success and consistency. It isn't a university course, we don't sit down and do all the course procedures and even if we do, the bare minimum, still graduate in three years. That's not how trading works.

The question you should be asking isn't how long is this going to take me to master, but rather how many hours are you going to put into it. Day in, day out, how much work are you going to do? That is what will determine how long it takes you to become successful in this industry. There's so many people that will see 2 and a half years to become successful trader, then they trade half heartedly as if it is a hobby. They don't concentrate too much. They just trade here in there. Two and a half years pass and they'll call themselves seasoned professionals because they have been in the market for 2 1/2 years. Yet they couldn't show a single piece of consistency within their trading. Then there's other traders that put in hard work. I'm talking 8 hours a day of pure grueling backtesting, trade management, risk management, analyzing everything, and they put an exponential amount of work in and in six months they can outperform anyone else who's ever step foot in the market.

Time is not an important factor. The amount of work you are putting in is the important factor. Yes, time will tell whether or not you can be successful in this industry, but if you're measuring time based off of when you've been interested or when you've been trading a little bit and rather than the actual hard, grueling hours that you're putting into trading. Then you will never get to that level you want to get too. You have to put in the hard yards.

This industry is very advertised as easy, simple and the money making machine. There's a number of different factors in which we can blame for that, but we're not going to dive into that today. What I want to share with you is this is not easy. This is actually one of the hardest professions you could ever do, because work doesn't just stop, we don't just clock off and get paid the same amount every week. It's all dependent on the amount of time and effort you put into the market.

Do you want to be profitable and consistent in trading? Then put in the hard work. Stop Googling how long it's going to take. Stop having a look at other people's success stories. Knuckle down and put in the hard work. Then in two years, three years, six years, 10 years, whatever it's going to take. Look back and be proud. When someone asks you how long did it take you? Don't answer about six years or two years, be honest. How many hours did you have to invest? How hard was the work?

EURUSD…PatienceWait for the reversal. I could see price getting sandwiched in between the 1Hr channel and the top of the Daily channel. I’m going to wait to see which one wins before making any trading decisions today. If I was a betting man, I’d go short, but this isn’t a casino. Wait for the break and catch the retest, that’s today’s plan.

BID AND ASK BASICS📚

🔴In all markets, there is a price at which a market participant is willing to buy an asset and a price that suits the seller. At the same time, traders intend to carry out a purchase and sale transaction only within the amount that is profitable for them.

⚠️In the foreign exchange market, the ask line is the cost of buying an asset or the price that is set by the broker in the Buy order.

⚠️Bid - accordingly, the cost at which the broker opens a sell order when accepting an application for the sale of currency from a trader.

❗️The spread is the difference between ask and bid prices. To be more precise, the spread is the difference between the best bid and ask offers for a specific asset over a certain period. Thus, the spread is dynamic, changing over time. The spread value is formed by the initial value set by the broker, as well as due to the volatility of the currency. The spread can vary from 0.1 to 100 points.

✅In the market of physical goods, a similar example can be given: a seller and a buyer, haggling, narrow the difference between prices that satisfy them, bringing them to one at which they make a deal.

✅In the foreign exchange market, the spread between prices is the commission charged by the broker. It should be borne in mind that the broker takes a commission regardless of the volume of the transaction and its result.

Potential H&S + Market insightI'm bullish for the long term. After the golden cross, the trend changed bullish for me. The overall market direction is continued growth with volatile movement. We have a ton of growth occurring in both developments with blockchain platforms and market structure. In 2017, we have seen blockchain platforms issue tokens promising to deliver what Bitcoin cant. It's typical in the technical industry to over-promise and underdeliver, especially with those that have a lack of experience.

Short term:

Head and shoulders could form which could cause the price to correct down to ~$6500 support area. This would be an acceptible situation considering market upswing after the golden cross. The past performance shows that Bitcoin often gravitates towards the 200 MA after a golden cross occurs.

Long term:

Looks like we are on the path for the next cycle of adoption.

Security tokens platforms like Tzero are working with US legislature and its only a matter of time before visible progress will be made. In the background, their hands are tied due to the outdated laws which impact retail investors. One of those laws is the requirement to become an accredited investor to participate. Furthermore, the requirement to hold for 1-year lockup. I would expect new regulations to add a more relaxed tone for retail flexibility to participate.

It's a good thing regulators are taking their time. After all, their goal is to help protect investors. Once the market matures to the state where investors have protections in place, the market will explode.

Additionally, the continued legitimacy of crypto markets adds excitement to global trade. One shift that will occur is the ability to obtain a digital token prooving ownership of stocks. Most retail investors don't even know what a stock certificate looks like. Talk about a potential double spend issue. Retail investors will catch on and start demanding ownership proof of their stocks. This is where security tokens will shine.

The Facebook token will have challenges without clear guidelines from regulators. I find it odd that others are not chatting about this. Soon they will. For instance, Facebook might find the need to perform a global rollout of new crypto related services. The bottleneck they most likely will experience is the vast array of governance policies between countries.

Facebook will most likely accelerate favorable global governance.

Mobile adoption is occurring, allowing unified global access. Most of us in the space fully understand wallet management. The issue is for the common everyday user, they need ease of use with protection. During this next adoption phase, expect refined user experiences. If you seek inspiration, take a look at Samsung, they already started with the latest release of the s10 lineup. Samsung made sure to include Blockchain support, native to the hardware. It's a matter of time before Facebook, Samsung, and more release crypto related services.

Enterprise adoption is expected to grow with a massive swell of services that will end up proving Blockchain means business. New frameworks will mature to assist in enterprise adoption.

Government and corporate debt matters. It seems realistic to assume that one day a global debt crisis will occur. Bitcoin could help alleviate world debt. In today's digital age, education is readily available and governments around the world know this; they will play as smart as possible and accumulate to prepare for their debt buyout.

I think it's clear that my view remains bullish for the long term. In the meantime, I plan to take advantage of swing trades following technical indicators.

Good luck to all!

A Litecoin perspective to light up your dayDear Traders/Followers,

Hereby a chart to share with you. LTC/USD ratio. As I have been accumulating Litecoin silently in the past months the time seems finally ripe for extensive movement. As to be seen in the chart, it is both the end aswell as the beginning of the old and new crash cycle. Chasing these cycles seems to pay off big time, while the psychological aspect might be killing- it is of essence to stay rational and buy where the dumb money is to be found.

As credited by Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family: "The time to buy is when there's blood in the streets."

Furthermore LTCBTC ratio seems extremely ripe. REMEMBER, once LTC moves- it will be incredibly swift. Leaving those who want to jump in on the train too late to join.

Trade cautiously and enjoy,

Gabriel Molenkamp