INTC

INTC: Intel turnaround will take timeAs we have Intel earnings report released on Thursday, it miss on on EPS, but beat on revenue.

as Intel lag the industry, we still waiting some confirmations of positive turnaround, once we get it, we may get it long from this competitive level since P/B below $1.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

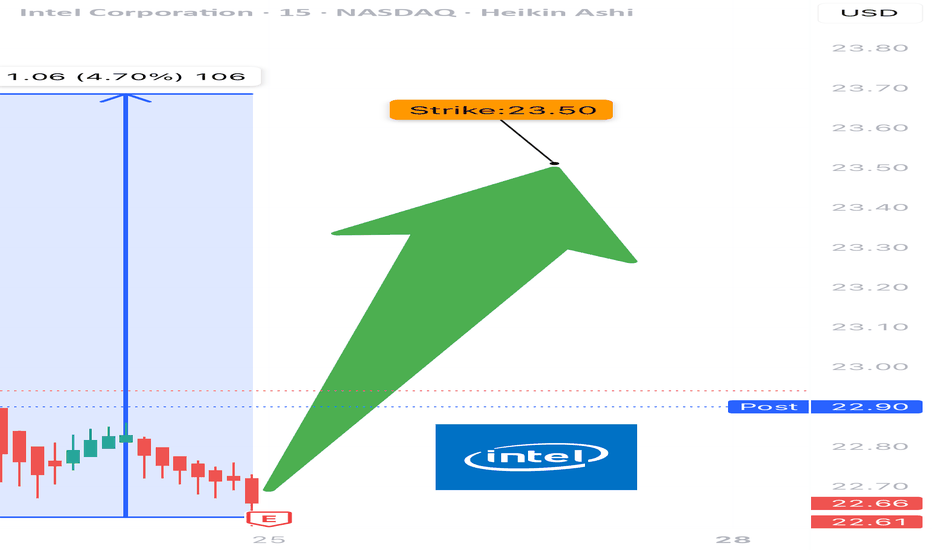

INTC EARNINGS TRADE (07/24)

🚨 INTC EARNINGS TRADE (07/24) 🚨

🎧 Earnings drop after close — here’s the high-conviction setup 📊

🧠 Key Highlights:

• 💥 Surprise Beat Rate: 88%, avg surprise = 419%

• 📉 Margins: Ugly (-36% net margin) but improving sentiment

• 📈 Volume Surge + $24 resistance test = pre-earnings drift 🚀

• 🔎 Mixed options flow → cautious bulls leaning in

• 🎯 Sector: SEMI = 🔀 rotating hard, competition vs AMD/NVDA rising

💥 TRADE SETUP

🟢 Buy INTC $23.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $1.18

🛑 Stop: $0.29

📈 Confidence: 75%

⏰ Entry: Before Earnings (Close 07/24)

📆 Earnings: Today After Market (AMC)

📊 Expected Move: 5%

⚠️ Play the earnings drift → gap up = profit. Miss = cut fast. Risk = defined. Reward = explosive.

#INTC #EarningsPlay #OptionsTrading #IntelEarnings #UnusualOptionsActivity #TechStocks #Semiconductors #TradingView #EarningsSeason #DayTrading #CallOptions

INTC – Breakout Confirmed, Bullish Continuation Inside AscendingIntel NASDAQ:INTC has broken above previous resistance and a descending trendline, confirming a bullish reversal.

Price is currently respecting an ascending channel and forming higher highs and higher lows. The breakout retest around $22.50 has held as new support.

If the current structure remains intact, price could continue toward the $26.00–$26.50 resistance zone. A breakout above this zone opens the door for a move toward $28+.

Key levels:

Support: $22.50 (previous resistance)

Resistance: $26.00–$26.50

Trend structure: Bullish channel

Volume supports the trend, and price is trading above both the 50 SMA and 200 SMA.

📌 Watching for a pullback and continuation move inside the channel.

This is not financial advice. Always do your own research.

Intel Share Price Hits 3-Month High Without Clear CatalystIntel (INTC) Share Price Hits 3-Month High Without Clear Catalyst

Intel Corporation (INTC) stocks rose by over 7% yesterday, making them one of the top performers in the S&P 500 index (US SPX 500 mini on FXOpen). As a result, the stock price reached its highest level in three months.

What’s notable is the apparent lack of clear drivers behind the rally. According to Barron’s, the increase in INTC shares could have been triggered by a rating upgrade from Wall Street analysts or a corporate announcement – yet no such developments have occurred. "Nothing new or fundamental," says Mizuho managing director and technology specialist Jordan Klein.

At the same time, from a technical analysis perspective, the INTC price chart is showing significant developments. Examining these price movements may provide clues as to what’s fuelling the recent rise.

Technical analysis of INTC stocks

For many months, the share price had been confined within a downward channel. However, the psychological level of $20 acted as a strong support – repeated attempts by bears to push the price lower ultimately failed.

Bearish patterns in INTC’s chart may have led to a supply squeeze, as holders were given repeated reasons to sell (particularly against the backdrop of Nvidia’s success). Yet the bullish reversals near the $20 mark suggest that institutional interest was accumulating the stock at what was perceived to be a deeply discounted level – a characteristic sign of the Accumulation Phase in Wyckoff methodology.

It is this lack of available supply that could explain the sudden price rise in the absence of obvious news catalysts.

Since early summer, INTC shares have been making higher highs and higher lows, breaking upwards through the descending channel and beginning to form the early stages of a new bullish trend (highlighted in blue). Should fundamental catalysts emerge in the near term, they may serve as the spark to accelerate this nascent rally.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Intel - The rally starts!Intel - NASDAQ:INTC - creates a major bottom:

(click chart above to see the in depth analysis👆🏻)

For approximately a full year, Intel has not been moving anywhere. Furthermore Intel now trades at the exact same level as it was a decade ago. However price is forming a solid bottom formation at a key support level. Thus we can expect a significant move higher.

Levels to watch: $25.0

Keep your long term vision!

Philip (BasicTrading)

INTC getting ready to start it's upward trajectoryINTC has been ranging and coiling since July of 2024. It finally, is starting to look like bullish movement is about to break upwards.

As you can see, INTC has just broken the downward trend line as well as the triangle pattern. A break and hold above $24.40 would indicate the start of a new uptrend in the chart.

Indications that the stock is gaining bullish momentum on the weekly chart:

The Williams %R is approaching and getting ready to break the 50 line.

The MACD is bullish and approaching the zero line.

The stock has bounced off of the volume shelf on the AVP 4 times and is now breaking out of technical patterns.

Money flow on market cipher B has crossed over green.

EMA's are starting to turn upward to flip bullish.

The marked move on this triangle pattern is approximately $40.

From a fundamental standpoint, Intel is trying to fix the business on two tracks at one time:

1)Near-term – ship competitive AI-centric products now (CPUs, GPUs, Gaudi accelerators) to put revenue and margins back on a growth path.

2) Long-term – reinvent itself as a contract chip-maker (Intel Foundry) so it can win outside customers and leverage its huge fab investments.

Think of it as “sell more chips today, sell more manufacturing tomorrow.”

Let's see Intel can build enough momentum to break this range for the bigger move up. The table is set from a technical standpoint.

Not financial advice. Do your own research.

Bullish Thesis for INTC Intel Stock in 2025If you haven`t bought INTC before the previous earnings:

Now Intel INTC is positioned for a potential turnaround and upside by the end of 2025, driven by strategic leadership changes, foundry business expansion, AI innovation, and favorable geopolitical dynamics. Here’s why INTC could head higher this year:

1. Leadership Transformation and Strategic Vision

The appointment of Lip-Bu Tan as CEO in March 2025 has injected new optimism into Intel’s prospects. Tan is a respected semiconductor industry veteran, and his arrival was met with a 10% jump in INTC’s share price, reflecting renewed investor confidence in the company’s direction.

2. Foundry Business Expansion and Government Support

Intel’s pivot toward a foundry-centric model is gaining momentum. The company is leveraging its U.S.-based manufacturing footprint to attract domestic and international clients, especially as geopolitical tensions and trade restrictions make U.S. chip production more attractive.

There is speculation about strategic partnerships, such as TSMC potentially acquiring a stake in Intel’s foundry operations, which could accelerate technology transfers and client wins.

The U.S. government is likely to continue supporting domestic semiconductor manufacturing through incentives and tariffs, directly benefiting Intel’s foundry ambitions.

3. AI and Next-Gen Product Launches

Intel is aggressively targeting the AI and data center markets. The upcoming Jaguar Shores and Panther Lake CPUs, built on the advanced 18A process node, are set for release in the second half of 2025. These chips will be available not only for Intel’s own products but also for external clients like Amazon and Microsoft, expanding the addressable market.

Intel’s renewed focus on AI accelerators and competitive cost structures could help it regain share in high-growth segments.

4. Financial Resilience and Market Position

Despite recent setbacks, Intel remains a dominant player in the PC CPU market and continues to generate substantial revenue, outpacing some key competitors in the latest quarter.

Analysts have revised their short-term price targets upward, with some projecting INTC could reach as high as $62—a potential upside of over 170% from current levels.

Forecasts for 2025 suggest an average price target in the $40–$45 range, with bullish scenarios pointing even higher if execution on foundry and AI strategies meets expectations.

5. Technical and Sentiment Factors

While technical analysis currently signals caution, the $18.50–$20 zone has provided strong support, and any positive news on foundry contracts or AI wins could catalyze a breakout from current consolidation patterns.

Market sentiment has shifted more positively following the CEO change and strategic announcements, suggesting the potential for a sustained rebound if Intel delivers on its promises.

In conclusion:

Intel’s combination of visionary leadership, foundry expansion, AI innovation, and favorable geopolitical trends sets the stage for a potential stock price recovery by the end of 2025. With analyst targets and investor sentiment turning more bullish, INTC presents a compelling case for upside as it executes its turnaround strategy

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Intel (INTC) Shares Drop Over 6% in a DayIntel (INTC) Shares Drop Over 6% in a Day

As shown on the Intel (INTC) chart, after Tuesday’s candle closed above $21, the price dropped sharply on Wednesday. INTC was the worst-performing stock of the day among the components of the S&P 500 index (US SPX 500 mini on FXOpen).

Why Did INTC Shares Fall?

The decline is linked to growing competitive pressure. According to media reports:

→ On one hand, AMD continues to rapidly expand its share of the server CPU market. A report by Mercury shows that the company already controls 40% of the segment and could match Intel as early as next year.

→ On the other hand, Nvidia is preparing to launch two accelerated processing units (APUs) for the consumer market, which will combine CPU and GPU capabilities in a single product.

Technical Analysis of the INTC Chart

In 2025, the price remains:

→ within a broad downward trend (marked in red);

→ supported by the $18.50–$20 zone.

Meanwhile, price fluctuations in May and June are forming a narrowing triangle (marked in black). Following the recent negative news, it is possible that INTC shares could fall towards the lower boundary of the triangle — or even retest the psychologically important $20 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Important Support and Resistance Zones: 23.03-28.93

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(INTC 1D chart)

It shows an upward trend above the 18.69-21.33 zone, which is a medium- to long-term buy zone.

However, you need to be relaxed because it needs to rise above 28.93 to turn into an uptrend.

The 28.93 point is the HA-Low indicator point on the 1M chart, and it is expected that a breakout trade will be possible when it breaks above this point.

Since the price is located below the M-Signal indicator on the 1M chart, you should respond quickly and briefly with short-term trading while observing the situation.

Therefore, if you were unable to purchase in the mid- to long-term purchase section,

1st: M-Signal indicator on the 1M chart

2nd: 28.93

You can proceed with a purchase when it shows support near the 1st and 2nd above.

If it falls below 18.69, you should stop trading and observe the situation.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Intel - This might be the bottom!Intel - NASDAQ:INTC - might create a bottom:

(click chart above to see the in depth analysis👆🏻)

For almost an entire year, Intel has been consolidating at a major horizontal support. Considering the previous significant bloodbath, Intel might soon find its bottom, which is inevitably followed by a major bullish reversal. After all, market structure is slowly shifting bullish.

Levels to watch: $20.0, $25.0

Keep your long term vision!

Philip (BasicTrading)

INTEL INTC Short setup target 15.29Fibonacci technical analysis : Intel Corporation NASDAQ:INTC has already found resistance at the Fib level 61.8% (23.07) of my Down Fib. The May 30th Daily candle has closed below retracement Fib level 23.6% (19.73), confirming a sell signal. A Bear Flag pattern has also formed. My Down Fib guides me to look for NASDAQ:INTC to eventually go down to hit first target at Fib level -27.2% (15.29).

NASDAQ:INTC – Target 1 at -27.2% (15.29), Target 2 at -61.8% (12.26) and Target 3 at -78.6 (10.79)

Stop loss slightly above the 50.0% retracement Fib level (22.04).

Enjoy the trading process and take time to smell the roses🌹

INTC Weekly Options Trade Plan 2025-05-26INTC Weekly Analysis Summary (2025-05-26)

Model Summaries

Grok/xAI Report

Technicals: INTC at $20.05, below 10/50 EMAs on M5 and well below 200 EMA; RSI(10) ~36 signals bearish momentum; MACD negative; price near lower Bollinger Band. Sentiment: VIX elevated at 22.29; mixed news but bearish outweighs bullish; options max pain at $21 may cap upside. Recommendation: Buy $20.00 weekly put at $0.41; profit target $0.62 (50% gain); stop-loss $0.20 (50% premium loss); hold to May 30 expiry. Confidence 65%.

Claude/Anthropic Report

Technicals: Strong short‐ and medium‐term bearish (price below all EMAs, RSI ~36–38, MACD negative, volume spike confirms selloff). Sentiment: Rising VIX, negative headlines, heavy put OI at $20 strike. Max pain $21 above spot. Recommendation: Buy $20.00 weekly put at $0.41; primary target $0.62 (50% gain), secondary $0.72; stop‐loss 25% premium ($0.31) or if INTC >$20.15; exit by Wed EOD. Confidence 72%.

Gemini/Google Report

Technicals: Bearish on M5 and daily (below 10/50/200 EMAs, RSI weak but not deeply oversold, bearish MACD). Sentiment: VIX rising; negative news flow; put demand greater than calls; max pain less relevant vs. momentum. Recommendation: Buy $19.50 weekly put at $0.22–$0.25 limit; profit target $0.44 (100% gain); stop‐loss $0.11 (50% premium) or if INTC >$20.40; size 1 contract for small account; exit EOD. Confidence 75%.

Llama/Meta Report

Technicals: Daily and M5 bearish (price below all EMAs, MACD negative); RSI ~38 suggests possible bounce but trend remains down; price near lower Bollinger Band. Sentiment: VIX up; mixed news but bearish tilt; max pain $21 unlikely this week. Recommendation: Buy $20.00 weekly put at $0.41; profit target $0.615; stop‐loss if INTC >$20.50; hold to expiry. Confidence 70%.

DeepSeek Report

Technicals: Bearish momentum (below all EMAs, negative MACD, daily RSI ~38); support at $20.02–$20.03 and lower band at $19.41. Sentiment: Elevated VIX; mixed news; heavy put OI at $20 strike; call interest at $21 as resistance. Recommendation: Buy $20.00 weekly put at $0.41 midpoint; profit target $0.62 (50%); stop‐loss if INTC >$20.10; close by Thursday EOD. Confidence 65%. Areas of Agreement and Disagreement

Agreement

All models view INTC as bearish into weekly expiry. Consensus on buying puts, with most favoring the $20.00 strike. Targeting a 50% gain on premium and risking ~25–50% premium loss. Entry timing at market open and holding into expiry or early in the week. Elevated VIX and heavy put open interest reinforce bearish bias.

Disagreement

Gemini prefers the $19.50 put for greater leverage vs. $20.00 put. Stop‐loss levels vary: from $20.10 up to $20.50 underlying or premium-based stops. Exit timing differs: some through expiry, others midweek to reduce theta decay. Profit‐target aggressiveness: 50% vs. 100% gains. Conclusion

Overall Market Direction Consensus: Bearish

Recommended Trade

Strategy: Buy single-leg naked put Option: INTC 2025-05-30 expiry, $20.00 strike put Premium: $0.41 per contract Entry Timing: At market open Profit Target: $0.62 (≈50% premium gain) Stop Loss: $0.20 (≈50% premium loss) Size: 1 contract Confidence Level: 70%

Key Risks and Considerations

Short-term oversold RSI may trigger a bounce around $20.00 support. Max pain at $21.00 could exert slight upward pressure if market stabilizes. Volatility drop (VIX normalization) could compress option premiums (vol crush). Weekly options have rapid theta decay; managing timing is critical. Liquidity and bid-ask spreads may widen at open—use limit orders.

TRADE_DETAILS (JSON Format)

{ "instrument": "INTC", "direction": "put", "strike": 20.0, "expiry": "2025-05-30", "confidence": 0.70, "profit_target": 0.62, "stop_loss": 0.20, "size": 1, "entry_price": 0.41, "entry_timing": "open", "signal_publish_time": "2025-05-26 09:30:00 UTC-04:00" } 📊 TRADE DETAILS 📊 🎯 Instrument: INTC 🔀 Direction: PUT (SHORT) 🎯 Strike: 20.00 💵 Entry Price: 0.41 🎯 Profit Target: 0.62 🛑 Stop Loss: 0.20 📅 Expiry: 2025-05-30 📏 Size: 1 📈 Confidence: 70% ⏰ Entry Timing: open 🕒 Signal Time: 2025-05-26 11:39:04 EDT

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Intel Breakdown Alert! Bearish Setup with High R:R Opportunity !📉 Intel Corporation (INTC) – Bearish Setup Analysis

Timeframe: 4H | Ticker: NASDAQ:INTC | Exchange: NASDAQ

🔍 Technical Breakdown

We are currently observing a potential bearish reversal on Intel Corp. following a clear breakdown from a rising parallel channel on the 4H chart.

🟦 Pattern Observed

Price was previously moving within a rising channel, forming higher highs and higher lows – a typical short-term bullish structure.

Recently, price broke down below the lower boundary of this channel, signaling a potential shift in momentum from bullish to bearish.

📌 Trade Setup

Entry Zone: Between $20.22 – $20.06

Price is currently trading in this zone, presenting a potential short entry opportunity following the channel breakdown.

Stop Loss: $21.77

Placed above the previous resistance zone and the broken channel. If the price reclaims this level, the bearish thesis is invalidated.

Final Target: $17.70

This level represents a key support zone from previous price action and aligns with potential measured move from the channel breakdown.

✅ Why This Setup?

Channel Breakdown

A break below a well-defined channel often marks a change in trend. This gives a high-probability setup for trend reversal traders.

Bearish Momentum Confirmation

After the breakdown, price failed to reclaim the channel, and is now trading below the prior support, flipping it into resistance.

Risk/Reward Ratio

This setup offers an excellent R:R ratio, with downside potential toward $17.70 and a relatively tight stop just above the failed structure.

Market Structure Alignment

Lower highs and lower lows now appear to be forming post-breakdown, further confirming a potential bearish move ahead.

📉 Bias: Short

📈 Invalidation: Break and close above $21.77

🎯 Target: $17.70

🧠 Disclaimer: This is not financial advice. Always do your own research and manage your risk accordingly. Trade safe!

Bullish Semiconductors? SOXX The semiconductors NASDAQ:SOXX definitely tend to lead the market In bull rallies. I still think this saying will hold true for several years.

The NASDAQ:SOXX is flirting with some pretty decent resistance. This would be a perfect spot for sellers to exit and price action to digest recent gains.

If the chart plays out like I think it will, we should have a decent pullback in this area which could create an epic inverse head right shoulder. This pattern would be a very bullish setup that could take us into new All Time Highs in 2026.

This is a weekly pattern so allow the chart some tike to play out.

Intel Corporation | INTCIntel reported second quarter earnings on Thursday, showing a return to profitability after two straight quarters of losses and issuing a stronger-than-expected forecast. the stock rose 7% in extended trading.

Here’s how Intel did versus Refinitiv consensus expectations for the quarter ended July 1:

Earnings per share: 13 cents, adjusted, versus a loss of 3 cents expected by Refinitiv.

Revenue: $12.9 billion, versus $12.13 billion expected by Refinitiv.

For the third quarter, Intel expects earnings of 20 cents per share, adjusted, on revenue of $13.4 billion at the midpoint, versus analyst expectations of 16 cents per share on $13.23 billion in sales.

Intel posted net income of $1.5 billion, or 35 cents per share, versus a net loss of $454 million, or a loss of 11 cents per share, in the same quarter last year.

Revenue fell 15% to $12.9 billion from $15.3 billion a year ago, marking the sixth consecutive quarter of declining sales.

Intel CEO Pat Gelsinger said on a call with analysts the company still sees “persistent weakness” in all segments of its business through year-end, and that server chip sales won’t recover until the fourth quarter. He also said that cloud companies were focusing more on securing graphics processors for artificial intelligence instead of Intel’s central processors.

David Zinsner, Intel’s finance chief, said in a statement that part of the reason the report was stronger than expected was because of the progress the company has made toward slashing $3 billion in costs this year. Earlier this year, Intel slashed its dividend and announced plans to save $10 billion per year by 2025, including through layoffs.

“We have now exited nine lines of business since Gelsinger rejoined the company, with a combined annual savings of more than $1.7 billion,” said Zinsner.

Revenue in Intel’s Client Computing group, which includes the company’s laptop and desktop processor shipments, fell 12% to $6.8 billion. The overall PC market has been slumping for over a year. Intel’s server chip division, which is reported as Data Center and AI, saw sales decline 15% to $4 billion plus Intel’s Network and Edge division, which sells networking products for telecommunications, recorded a 38% decline in revenue to $1.4 billion.moreover Mobileye, a publicly traded Intel subsidiary focusing on self-driving cars, saw sales slip 1% on an annual basis to $454 million and Intel Foundry Services, the business that makes chips for other companies, reported $232 million in revenue.

Intel’s gross margin was nearly 40% on an adjusted basis, topping the company’s previous forecast of 37.5%. Investors want to see gross margins expand even as the company invests heavily in manufacturing capability.

In the first quarter, the company posted its largest loss ever as the PC and server markets slumped and demand declined for its central processors. Intel’s results on Thursday beat the forecast that management gave for the second quarter at the time.

Intel management has said the turnaround will take time and that the company is aiming to match TSMC’s chip-manufacturing prowess by 2026, which would enable it to bid to make the most advanced mobile processors for other companies, a strategy the company calls “five nodes in four years.” Intel said on Thursday that it remained on track to hit those goals.

Nvidia has had an amazing run, but any emerging technology, such as AI, which is bottlenecked by a single company will have issues in growth. Consulting firm McKinsey has pegged the AI market to be worth $1 trillion by 2030, but also that it was in an experimental and in early phases of commercial deployment.

While Nvidia will likely retain its leadership in GPU hardware as applied to AI for the foreseeable future, it is likely that other hardware solutions for AI systems will also be successful as AI matures. While technologist may quibble on specifics, all major AI hardware today are based on GPU architectures, and as such I will use the terms and concepts of AI hardware and GPU architecture somewhat interchangeably.

One likely candidate for AI related growth may be AMD (AMD), which has had GPU products since acquiring ATI in 2006.However, unlike Nvidia, which had a clear vision for of general-purpose GPU products (GPGPU), historically, AMD had largely kept its focus on the traditional gaming applications. AMD has developed an AI architecture called XDNA, and an AI accelerator called Alveo and announced its MI300, an integrated chip with GPU acceleration for high-performance computing and machine learning. How AMD can and may evolve in the AI may be subject of a different article.

Another contender for success in the AI applications using GPU is Intel, who is the focus of this article. Intel has maintained a consistent, if low key focus on GPU hardware focused on AI applications over the last decade. Intel’s integrated HD Graphics is built into most modern processor ICs; however, these are insufficient compared to dedicated GPUs for high-end inferencing or machine learning tasks.

It has 2 primary GPU architectures in production release:

In 2019 Intel Corporation acquired Habana Labs, an Israel-based developer of programmable deep learning accelerators for the data center for approximately $2 billion. Habana Labs’ Gaudi AI product line from its inception focused on AI deep learning processor technologies, rather than as GPU that has been extended to AI applications. As a result, Gaudi microarchitecture was designed from the start for the acceleration of training and inferencing. In 2022 Intel announced Gaudi2 and Greco processors for AI deep learning applications, implemented in 7-nanometer (TSMC) technology and manufactured on Habana’s high-efficiency architecture. Habana Labs benchmarked Gaudi2’s training throughput performance for the ResNet-50 computer vision model and the BERT natural language processing model delivering twice the training throughput over the Nvidia high end A100-80GB GPU. So, Gaudi appears to give Intel a competitive chip for AI applications.

Concurrent with the Habana Labs’ Gaudi development, Intel has internally developed the Xe GPU family, as dedicated graphics card to address high-end inferencing or machine learning tasks as well as more traditional high-end gaming. Iris® Xe GPU family consists of a series of microarchitectures, ranging from integrated/low power (Xe-LP) to enthusiast/high performance gaming (Xe-HPG), data center/AI (Xe-HP) and high-performance computing (Xe-HPC). The architecture has been commercialized in Intel® Data Center GPU Flex Series (formerly codenamed Arctic Sound) and Intel® Arc GPU cards. There is some question on Xe GPU future and evolution. Intel has shown less commitment to the traditional GPU space compared to Gaudi. Nonetheless, it does demonstrate Intel ability to design and field complex GPU products as its business requires.

Intel has many other AI projects underway. The Sapphire Rapids chips implements AI specific acceleration blocks including technology called AMX (Advanced Matrix Extensions), which provides acceleration inside the CPU for efficient matrix multiplications used in on-chip inferencing and machine learning processing by speeding up data movement and compression. Intel has supporting technologies such as Optane, which while cancelled as a production line, is available for their needs of a high-performance non-volatile memory, one of the intrinsic components in any AI product.

Based on the above, Intel appears to have competitive hardware solutions, however if we look at Nvidia success in AI, it is a result of a much a software and systems focus as it is the GPGPU hardware itself. Can Intel compete on that front. Ignoring for the moment that Intel has a huge software engineer (approx. 15,000) resource, it also has- access to one of the leading success stories in perhaps the most competitive AI application – self driving cars.

Mobileye, who was acquired by Intel in 2017, has been an early adopter and leader, with over 20 years of experience in automotive automated driving and vision systems. As such, Mobileye has a deep resource of AI domain information that should be relevant to many applications. Mobileye has announced that it is working closely with Habana, as related divisions within Intel. While Intel is in the process of re-spinning out Mobileye as public company, Mobileye Global Inc. (MBLY), at present Intel still owns over 95% of shares, keeping it effectively an Intel division.

In looking at Intel, we have a company with the history, resources, and technology to compete with Nvidia and infrastructure. They have made significant investment and commitment to the emerging AI market, in times when they have exited other profitable businesses. It should also be understood that AI related product are a small percentage of overall Intel revenues (INTC revenue are more than twice NVDA, even if NVDA has 6x its market cap), and continues to keep its primary business focus on its processor and foundry business.

Hopefully for shareholders, Intel continues to push their AI technology and business efforts. Their current position is that this is strategic, but Intel is in a very fluid time and priorities may change based on business, finances, and of course the general interest and enthusiasm for AI. It is always worth noting that AI as a technical concept is mature, and appears to be cyclical, with interest in the technical community rising and falling in hype and interest once every decade or so. I remember working on AI applications, at the time labeled as expert systems in the 1980s. If we are currently at a high hype point, this may be temporary, based on near term success and disappointment in what AI does achieve. Of course, as always, “this time is different” and the building blocks of effective AI systems currently exist, where for previous iterations, it was more speculative.

MBIO MFI deepest red!!Potential lifetime buying opportunity on this if it is not just another WallStreet scam.

I'm stacking for potential upside targets in 1-3 years are $30, $90, $210 & higher.

Often I buy the deepest red and 50% of the time it works half of half the time.

1. MFI effin deep in the red

2. RSI potential double bottom on both 3 week and higher charts

3. 99.99% of all investors are under and burnt by WallStreet

4. TTM squeeze is showing large potential on timeframes 55D, 21D, 9D, 3D, 10 Hour is a FIRE setup.

5. Accum/Distrib pump is at a healthy retracement on multiple larger time frames.

This can lay flat for months and or go to ZERO.

NOT FINANCIAL ADVICE!!!

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.83.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel toward total collapse.

The business is struggling too. Intel missed the AI boom entirely, its Foundry division is faltering, and revenues are shrinking. Before 2020, it posted annual earnings of $10–$20 billion; over the past year, it recorded $10 billion in losses. With $105 billion in net equity—mostly tied to hard assets that are tough to liquidate without losses—Intel’s financial cushion could erode quickly if more problems surface.

Will It Go Bankrupt?

Bankruptcy is possible but improbable. As a critical chip producer, Intel is too vital to U.S. interests to fail outright. I predict a government bailout, though shareholders would likely be wiped out.

TECHNICAL ANALYSIS

Since its bull market ended in 2000—25 years ago—Intel has been locked in consolidation. Now, the price is breaking down on high volume.

It’s trading below the 200-month moving average (MA200 Monthly), a key long-term support level that confirms a bear market.

The consolidation resembles an Elliott Wave ABC correction, with Wave B peaking in 2020. Since then, the price has declined in what appears to be an impulsive Wave C, forming an Ending Diagonal.

When prices break downward from Ending Diagonals—especially alongside a 25-year consolidation breakdown, as is likely here—the move is often swift and severe.

If the price exits both the consolidation and the Ending Diagonal, there’s virtually no support until the $4–$5 range. A market-wide crash could drive it as low as $1.

Intel - This Stock Is A Goldmine!Intel ( NASDAQ:INTC ) perfectly respects all structure:

Click chart above to see the detailed analysis👆🏻

Over the past couple of years Intel clearly established a significant downtrend, dropping about -70% after we saw the previous all time high. This bearish pressure is now ending though and if Intel manages to create a bullish reversal break and retest, a new uptrend is starting to form.

Levels to watch: $25

Keep your long term vision,

Philip (BasicTrading)