INTC: Intel turnaround will take timeAs we have Intel earnings report released on Thursday, it miss on on EPS, but beat on revenue.

as Intel lag the industry, we still waiting some confirmations of positive turnaround, once we get it, we may get it long from this competitive level since P/B below $1.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Intel

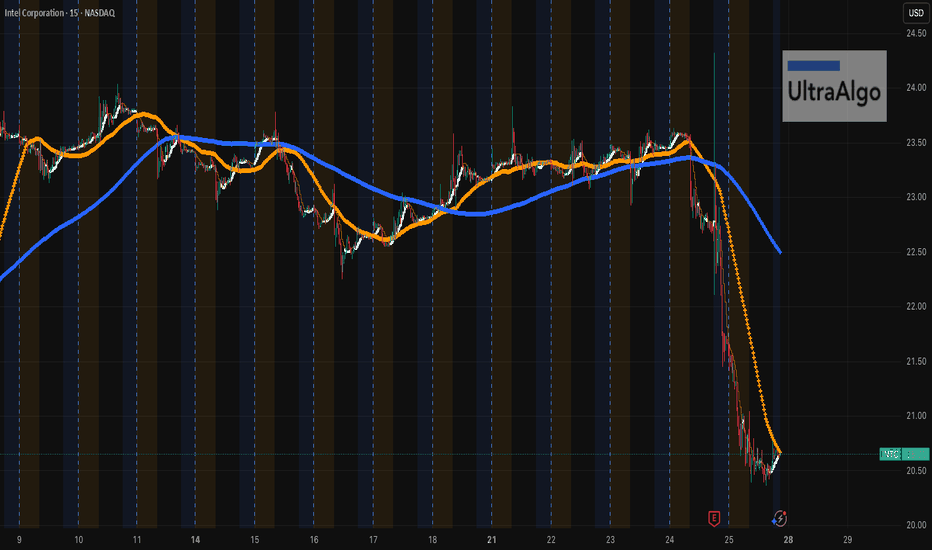

$INTC Got Smacked. Relief Bounce or Trap?Yikes. NASDAQ:INTC just faceplanted from $23.50 straight down to $20.50. It’s peeking its head up now. If you’re playing the bounce, be nimble — this thing’s still bleeding on the higher timeframes. Don't get in unless you see more pickup and buy signal.

UltraAlgo caught the drop early. If it crosses $20 could go down deeper.

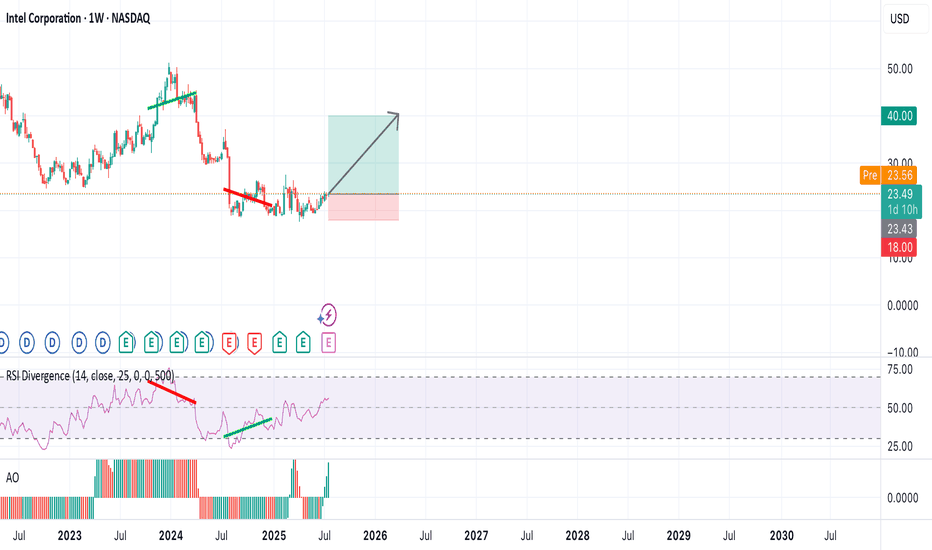

Intel to 40. A bet on America's chip when the chips are downIntel is an interesting stock. I made a bet on it this week. It’s very cheap trading at book value. Lots of bad news has destroyed this stock while other chip stocks are at all time highs. With a new CEO running the show and investing in next gen chip production, I think he turns it around.

I think it's at 40 within a year, and makes new all time highs after that.

Intel Share Price Hits 3-Month High Without Clear CatalystIntel (INTC) Share Price Hits 3-Month High Without Clear Catalyst

Intel Corporation (INTC) stocks rose by over 7% yesterday, making them one of the top performers in the S&P 500 index (US SPX 500 mini on FXOpen). As a result, the stock price reached its highest level in three months.

What’s notable is the apparent lack of clear drivers behind the rally. According to Barron’s, the increase in INTC shares could have been triggered by a rating upgrade from Wall Street analysts or a corporate announcement – yet no such developments have occurred. "Nothing new or fundamental," says Mizuho managing director and technology specialist Jordan Klein.

At the same time, from a technical analysis perspective, the INTC price chart is showing significant developments. Examining these price movements may provide clues as to what’s fuelling the recent rise.

Technical analysis of INTC stocks

For many months, the share price had been confined within a downward channel. However, the psychological level of $20 acted as a strong support – repeated attempts by bears to push the price lower ultimately failed.

Bearish patterns in INTC’s chart may have led to a supply squeeze, as holders were given repeated reasons to sell (particularly against the backdrop of Nvidia’s success). Yet the bullish reversals near the $20 mark suggest that institutional interest was accumulating the stock at what was perceived to be a deeply discounted level – a characteristic sign of the Accumulation Phase in Wyckoff methodology.

It is this lack of available supply that could explain the sudden price rise in the absence of obvious news catalysts.

Since early summer, INTC shares have been making higher highs and higher lows, breaking upwards through the descending channel and beginning to form the early stages of a new bullish trend (highlighted in blue). Should fundamental catalysts emerge in the near term, they may serve as the spark to accelerate this nascent rally.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Intel - The rally starts!Intel - NASDAQ:INTC - creates a major bottom:

(click chart above to see the in depth analysis👆🏻)

For approximately a full year, Intel has not been moving anywhere. Furthermore Intel now trades at the exact same level as it was a decade ago. However price is forming a solid bottom formation at a key support level. Thus we can expect a significant move higher.

Levels to watch: $25.0

Keep your long term vision!

Philip (BasicTrading)

Bullish Thesis for INTC Intel Stock in 2025If you haven`t bought INTC before the previous earnings:

Now Intel INTC is positioned for a potential turnaround and upside by the end of 2025, driven by strategic leadership changes, foundry business expansion, AI innovation, and favorable geopolitical dynamics. Here’s why INTC could head higher this year:

1. Leadership Transformation and Strategic Vision

The appointment of Lip-Bu Tan as CEO in March 2025 has injected new optimism into Intel’s prospects. Tan is a respected semiconductor industry veteran, and his arrival was met with a 10% jump in INTC’s share price, reflecting renewed investor confidence in the company’s direction.

2. Foundry Business Expansion and Government Support

Intel’s pivot toward a foundry-centric model is gaining momentum. The company is leveraging its U.S.-based manufacturing footprint to attract domestic and international clients, especially as geopolitical tensions and trade restrictions make U.S. chip production more attractive.

There is speculation about strategic partnerships, such as TSMC potentially acquiring a stake in Intel’s foundry operations, which could accelerate technology transfers and client wins.

The U.S. government is likely to continue supporting domestic semiconductor manufacturing through incentives and tariffs, directly benefiting Intel’s foundry ambitions.

3. AI and Next-Gen Product Launches

Intel is aggressively targeting the AI and data center markets. The upcoming Jaguar Shores and Panther Lake CPUs, built on the advanced 18A process node, are set for release in the second half of 2025. These chips will be available not only for Intel’s own products but also for external clients like Amazon and Microsoft, expanding the addressable market.

Intel’s renewed focus on AI accelerators and competitive cost structures could help it regain share in high-growth segments.

4. Financial Resilience and Market Position

Despite recent setbacks, Intel remains a dominant player in the PC CPU market and continues to generate substantial revenue, outpacing some key competitors in the latest quarter.

Analysts have revised their short-term price targets upward, with some projecting INTC could reach as high as $62—a potential upside of over 170% from current levels.

Forecasts for 2025 suggest an average price target in the $40–$45 range, with bullish scenarios pointing even higher if execution on foundry and AI strategies meets expectations.

5. Technical and Sentiment Factors

While technical analysis currently signals caution, the $18.50–$20 zone has provided strong support, and any positive news on foundry contracts or AI wins could catalyze a breakout from current consolidation patterns.

Market sentiment has shifted more positively following the CEO change and strategic announcements, suggesting the potential for a sustained rebound if Intel delivers on its promises.

In conclusion:

Intel’s combination of visionary leadership, foundry expansion, AI innovation, and favorable geopolitical trends sets the stage for a potential stock price recovery by the end of 2025. With analyst targets and investor sentiment turning more bullish, INTC presents a compelling case for upside as it executes its turnaround strategy

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Important Support and Resistance Zones: 23.03-28.93

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(INTC 1D chart)

It shows an upward trend above the 18.69-21.33 zone, which is a medium- to long-term buy zone.

However, you need to be relaxed because it needs to rise above 28.93 to turn into an uptrend.

The 28.93 point is the HA-Low indicator point on the 1M chart, and it is expected that a breakout trade will be possible when it breaks above this point.

Since the price is located below the M-Signal indicator on the 1M chart, you should respond quickly and briefly with short-term trading while observing the situation.

Therefore, if you were unable to purchase in the mid- to long-term purchase section,

1st: M-Signal indicator on the 1M chart

2nd: 28.93

You can proceed with a purchase when it shows support near the 1st and 2nd above.

If it falls below 18.69, you should stop trading and observe the situation.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

Intel - This might be the bottom!Intel - NASDAQ:INTC - might create a bottom:

(click chart above to see the in depth analysis👆🏻)

For almost an entire year, Intel has been consolidating at a major horizontal support. Considering the previous significant bloodbath, Intel might soon find its bottom, which is inevitably followed by a major bullish reversal. After all, market structure is slowly shifting bullish.

Levels to watch: $20.0, $25.0

Keep your long term vision!

Philip (BasicTrading)

INTEL INTC Short setup target 15.29Fibonacci technical analysis : Intel Corporation NASDAQ:INTC has already found resistance at the Fib level 61.8% (23.07) of my Down Fib. The May 30th Daily candle has closed below retracement Fib level 23.6% (19.73), confirming a sell signal. A Bear Flag pattern has also formed. My Down Fib guides me to look for NASDAQ:INTC to eventually go down to hit first target at Fib level -27.2% (15.29).

NASDAQ:INTC – Target 1 at -27.2% (15.29), Target 2 at -61.8% (12.26) and Target 3 at -78.6 (10.79)

Stop loss slightly above the 50.0% retracement Fib level (22.04).

Enjoy the trading process and take time to smell the roses🌹

INTC Weekly Options Trade Plan 2025-05-26INTC Weekly Analysis Summary (2025-05-26)

Model Summaries

Grok/xAI Report

Technicals: INTC at $20.05, below 10/50 EMAs on M5 and well below 200 EMA; RSI(10) ~36 signals bearish momentum; MACD negative; price near lower Bollinger Band. Sentiment: VIX elevated at 22.29; mixed news but bearish outweighs bullish; options max pain at $21 may cap upside. Recommendation: Buy $20.00 weekly put at $0.41; profit target $0.62 (50% gain); stop-loss $0.20 (50% premium loss); hold to May 30 expiry. Confidence 65%.

Claude/Anthropic Report

Technicals: Strong short‐ and medium‐term bearish (price below all EMAs, RSI ~36–38, MACD negative, volume spike confirms selloff). Sentiment: Rising VIX, negative headlines, heavy put OI at $20 strike. Max pain $21 above spot. Recommendation: Buy $20.00 weekly put at $0.41; primary target $0.62 (50% gain), secondary $0.72; stop‐loss 25% premium ($0.31) or if INTC >$20.15; exit by Wed EOD. Confidence 72%.

Gemini/Google Report

Technicals: Bearish on M5 and daily (below 10/50/200 EMAs, RSI weak but not deeply oversold, bearish MACD). Sentiment: VIX rising; negative news flow; put demand greater than calls; max pain less relevant vs. momentum. Recommendation: Buy $19.50 weekly put at $0.22–$0.25 limit; profit target $0.44 (100% gain); stop‐loss $0.11 (50% premium) or if INTC >$20.40; size 1 contract for small account; exit EOD. Confidence 75%.

Llama/Meta Report

Technicals: Daily and M5 bearish (price below all EMAs, MACD negative); RSI ~38 suggests possible bounce but trend remains down; price near lower Bollinger Band. Sentiment: VIX up; mixed news but bearish tilt; max pain $21 unlikely this week. Recommendation: Buy $20.00 weekly put at $0.41; profit target $0.615; stop‐loss if INTC >$20.50; hold to expiry. Confidence 70%.

DeepSeek Report

Technicals: Bearish momentum (below all EMAs, negative MACD, daily RSI ~38); support at $20.02–$20.03 and lower band at $19.41. Sentiment: Elevated VIX; mixed news; heavy put OI at $20 strike; call interest at $21 as resistance. Recommendation: Buy $20.00 weekly put at $0.41 midpoint; profit target $0.62 (50%); stop‐loss if INTC >$20.10; close by Thursday EOD. Confidence 65%. Areas of Agreement and Disagreement

Agreement

All models view INTC as bearish into weekly expiry. Consensus on buying puts, with most favoring the $20.00 strike. Targeting a 50% gain on premium and risking ~25–50% premium loss. Entry timing at market open and holding into expiry or early in the week. Elevated VIX and heavy put open interest reinforce bearish bias.

Disagreement

Gemini prefers the $19.50 put for greater leverage vs. $20.00 put. Stop‐loss levels vary: from $20.10 up to $20.50 underlying or premium-based stops. Exit timing differs: some through expiry, others midweek to reduce theta decay. Profit‐target aggressiveness: 50% vs. 100% gains. Conclusion

Overall Market Direction Consensus: Bearish

Recommended Trade

Strategy: Buy single-leg naked put Option: INTC 2025-05-30 expiry, $20.00 strike put Premium: $0.41 per contract Entry Timing: At market open Profit Target: $0.62 (≈50% premium gain) Stop Loss: $0.20 (≈50% premium loss) Size: 1 contract Confidence Level: 70%

Key Risks and Considerations

Short-term oversold RSI may trigger a bounce around $20.00 support. Max pain at $21.00 could exert slight upward pressure if market stabilizes. Volatility drop (VIX normalization) could compress option premiums (vol crush). Weekly options have rapid theta decay; managing timing is critical. Liquidity and bid-ask spreads may widen at open—use limit orders.

TRADE_DETAILS (JSON Format)

{ "instrument": "INTC", "direction": "put", "strike": 20.0, "expiry": "2025-05-30", "confidence": 0.70, "profit_target": 0.62, "stop_loss": 0.20, "size": 1, "entry_price": 0.41, "entry_timing": "open", "signal_publish_time": "2025-05-26 09:30:00 UTC-04:00" } 📊 TRADE DETAILS 📊 🎯 Instrument: INTC 🔀 Direction: PUT (SHORT) 🎯 Strike: 20.00 💵 Entry Price: 0.41 🎯 Profit Target: 0.62 🛑 Stop Loss: 0.20 📅 Expiry: 2025-05-30 📏 Size: 1 📈 Confidence: 70% ⏰ Entry Timing: open 🕒 Signal Time: 2025-05-26 11:39:04 EDT

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Intel Corporation | INTCIntel reported second quarter earnings on Thursday, showing a return to profitability after two straight quarters of losses and issuing a stronger-than-expected forecast. the stock rose 7% in extended trading.

Here’s how Intel did versus Refinitiv consensus expectations for the quarter ended July 1:

Earnings per share: 13 cents, adjusted, versus a loss of 3 cents expected by Refinitiv.

Revenue: $12.9 billion, versus $12.13 billion expected by Refinitiv.

For the third quarter, Intel expects earnings of 20 cents per share, adjusted, on revenue of $13.4 billion at the midpoint, versus analyst expectations of 16 cents per share on $13.23 billion in sales.

Intel posted net income of $1.5 billion, or 35 cents per share, versus a net loss of $454 million, or a loss of 11 cents per share, in the same quarter last year.

Revenue fell 15% to $12.9 billion from $15.3 billion a year ago, marking the sixth consecutive quarter of declining sales.

Intel CEO Pat Gelsinger said on a call with analysts the company still sees “persistent weakness” in all segments of its business through year-end, and that server chip sales won’t recover until the fourth quarter. He also said that cloud companies were focusing more on securing graphics processors for artificial intelligence instead of Intel’s central processors.

David Zinsner, Intel’s finance chief, said in a statement that part of the reason the report was stronger than expected was because of the progress the company has made toward slashing $3 billion in costs this year. Earlier this year, Intel slashed its dividend and announced plans to save $10 billion per year by 2025, including through layoffs.

“We have now exited nine lines of business since Gelsinger rejoined the company, with a combined annual savings of more than $1.7 billion,” said Zinsner.

Revenue in Intel’s Client Computing group, which includes the company’s laptop and desktop processor shipments, fell 12% to $6.8 billion. The overall PC market has been slumping for over a year. Intel’s server chip division, which is reported as Data Center and AI, saw sales decline 15% to $4 billion plus Intel’s Network and Edge division, which sells networking products for telecommunications, recorded a 38% decline in revenue to $1.4 billion.moreover Mobileye, a publicly traded Intel subsidiary focusing on self-driving cars, saw sales slip 1% on an annual basis to $454 million and Intel Foundry Services, the business that makes chips for other companies, reported $232 million in revenue.

Intel’s gross margin was nearly 40% on an adjusted basis, topping the company’s previous forecast of 37.5%. Investors want to see gross margins expand even as the company invests heavily in manufacturing capability.

In the first quarter, the company posted its largest loss ever as the PC and server markets slumped and demand declined for its central processors. Intel’s results on Thursday beat the forecast that management gave for the second quarter at the time.

Intel management has said the turnaround will take time and that the company is aiming to match TSMC’s chip-manufacturing prowess by 2026, which would enable it to bid to make the most advanced mobile processors for other companies, a strategy the company calls “five nodes in four years.” Intel said on Thursday that it remained on track to hit those goals.

Nvidia has had an amazing run, but any emerging technology, such as AI, which is bottlenecked by a single company will have issues in growth. Consulting firm McKinsey has pegged the AI market to be worth $1 trillion by 2030, but also that it was in an experimental and in early phases of commercial deployment.

While Nvidia will likely retain its leadership in GPU hardware as applied to AI for the foreseeable future, it is likely that other hardware solutions for AI systems will also be successful as AI matures. While technologist may quibble on specifics, all major AI hardware today are based on GPU architectures, and as such I will use the terms and concepts of AI hardware and GPU architecture somewhat interchangeably.

One likely candidate for AI related growth may be AMD (AMD), which has had GPU products since acquiring ATI in 2006.However, unlike Nvidia, which had a clear vision for of general-purpose GPU products (GPGPU), historically, AMD had largely kept its focus on the traditional gaming applications. AMD has developed an AI architecture called XDNA, and an AI accelerator called Alveo and announced its MI300, an integrated chip with GPU acceleration for high-performance computing and machine learning. How AMD can and may evolve in the AI may be subject of a different article.

Another contender for success in the AI applications using GPU is Intel, who is the focus of this article. Intel has maintained a consistent, if low key focus on GPU hardware focused on AI applications over the last decade. Intel’s integrated HD Graphics is built into most modern processor ICs; however, these are insufficient compared to dedicated GPUs for high-end inferencing or machine learning tasks.

It has 2 primary GPU architectures in production release:

In 2019 Intel Corporation acquired Habana Labs, an Israel-based developer of programmable deep learning accelerators for the data center for approximately $2 billion. Habana Labs’ Gaudi AI product line from its inception focused on AI deep learning processor technologies, rather than as GPU that has been extended to AI applications. As a result, Gaudi microarchitecture was designed from the start for the acceleration of training and inferencing. In 2022 Intel announced Gaudi2 and Greco processors for AI deep learning applications, implemented in 7-nanometer (TSMC) technology and manufactured on Habana’s high-efficiency architecture. Habana Labs benchmarked Gaudi2’s training throughput performance for the ResNet-50 computer vision model and the BERT natural language processing model delivering twice the training throughput over the Nvidia high end A100-80GB GPU. So, Gaudi appears to give Intel a competitive chip for AI applications.

Concurrent with the Habana Labs’ Gaudi development, Intel has internally developed the Xe GPU family, as dedicated graphics card to address high-end inferencing or machine learning tasks as well as more traditional high-end gaming. Iris® Xe GPU family consists of a series of microarchitectures, ranging from integrated/low power (Xe-LP) to enthusiast/high performance gaming (Xe-HPG), data center/AI (Xe-HP) and high-performance computing (Xe-HPC). The architecture has been commercialized in Intel® Data Center GPU Flex Series (formerly codenamed Arctic Sound) and Intel® Arc GPU cards. There is some question on Xe GPU future and evolution. Intel has shown less commitment to the traditional GPU space compared to Gaudi. Nonetheless, it does demonstrate Intel ability to design and field complex GPU products as its business requires.

Intel has many other AI projects underway. The Sapphire Rapids chips implements AI specific acceleration blocks including technology called AMX (Advanced Matrix Extensions), which provides acceleration inside the CPU for efficient matrix multiplications used in on-chip inferencing and machine learning processing by speeding up data movement and compression. Intel has supporting technologies such as Optane, which while cancelled as a production line, is available for their needs of a high-performance non-volatile memory, one of the intrinsic components in any AI product.

Based on the above, Intel appears to have competitive hardware solutions, however if we look at Nvidia success in AI, it is a result of a much a software and systems focus as it is the GPGPU hardware itself. Can Intel compete on that front. Ignoring for the moment that Intel has a huge software engineer (approx. 15,000) resource, it also has- access to one of the leading success stories in perhaps the most competitive AI application – self driving cars.

Mobileye, who was acquired by Intel in 2017, has been an early adopter and leader, with over 20 years of experience in automotive automated driving and vision systems. As such, Mobileye has a deep resource of AI domain information that should be relevant to many applications. Mobileye has announced that it is working closely with Habana, as related divisions within Intel. While Intel is in the process of re-spinning out Mobileye as public company, Mobileye Global Inc. (MBLY), at present Intel still owns over 95% of shares, keeping it effectively an Intel division.

In looking at Intel, we have a company with the history, resources, and technology to compete with Nvidia and infrastructure. They have made significant investment and commitment to the emerging AI market, in times when they have exited other profitable businesses. It should also be understood that AI related product are a small percentage of overall Intel revenues (INTC revenue are more than twice NVDA, even if NVDA has 6x its market cap), and continues to keep its primary business focus on its processor and foundry business.

Hopefully for shareholders, Intel continues to push their AI technology and business efforts. Their current position is that this is strategic, but Intel is in a very fluid time and priorities may change based on business, finances, and of course the general interest and enthusiasm for AI. It is always worth noting that AI as a technical concept is mature, and appears to be cyclical, with interest in the technical community rising and falling in hype and interest once every decade or so. I remember working on AI applications, at the time labeled as expert systems in the 1980s. If we are currently at a high hype point, this may be temporary, based on near term success and disappointment in what AI does achieve. Of course, as always, “this time is different” and the building blocks of effective AI systems currently exist, where for previous iterations, it was more speculative.

MBIO MFI deepest red!!Potential lifetime buying opportunity on this if it is not just another WallStreet scam.

I'm stacking for potential upside targets in 1-3 years are $30, $90, $210 & higher.

Often I buy the deepest red and 50% of the time it works half of half the time.

1. MFI effin deep in the red

2. RSI potential double bottom on both 3 week and higher charts

3. 99.99% of all investors are under and burnt by WallStreet

4. TTM squeeze is showing large potential on timeframes 55D, 21D, 9D, 3D, 10 Hour is a FIRE setup.

5. Accum/Distrib pump is at a healthy retracement on multiple larger time frames.

This can lay flat for months and or go to ZERO.

NOT FINANCIAL ADVICE!!!

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.83.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTEL BUY 2030Claro, aquí tienes el texto completamente limpio, sin negritas ni símbolos especiales:

---

Preliminary Projection: Intel's Potential Workforce Transformation (2025–2030)

As Intel continues its restructuring and integrates more AI-driven systems into its operations, significant changes are expected in its workforce distribution. The following outlines an estimate of the potential job displacement or transformation due to artificial intelligence by 2030.

Area: Manufacturing

- Percentage of total employees: 35% (approximately 40,000)

- Percentage potentially replaceable by AI: 70%

- Estimated replaceable jobs: 28,000

Area: Administration

- Percentage of total employees: 20% (approximately 23,000)

- Percentage potentially replaceable by AI: 55%

- Estimated replaceable jobs: 12,500

Area: Engineering

- Percentage of total employees: 30% (approximately 34,000)

- Percentage potentially replaceable by AI: 20%

- Estimated replaceable jobs: 6,800

Area: Sales and Marketing

- Percentage of total employees: 15% (approximately 17,000)

- Percentage potentially replaceable by AI: 40%

- Estimated replaceable jobs: 6,800

Total estimated jobs that could be automated or transformed by AI: approximately 54,000, representing around 47 percent of Intel’s current workforce.

---

Key Intel Facilities Focused on AI-Driven Automation

Ohio, USA – Ohio One Campus

Investment: Over 28 billion dollars

Purpose: To become the world’s largest chip manufacturing hub for AI by 2027

Key technologies: Advanced automation, digital twins, and AI systems to optimize production and operational efficiency

Source: Reuters

Hillsboro, Oregon, USA – D1X Factory

Function: Research and development center for next-generation manufacturing technologies

Key technologies: AI-powered predictive maintenance, computer vision, and real-time analytics to improve efficiency and quality

Source: Intel Newsroom

These facilities reflect Intel’s strategic transition toward leading in both semiconductor innovation and intelligent manufacturing. The company’s integration of artificial intelligence across its industrial operations is expected to drive productivity, reduce costs, and reshape its employment structure.

---

¿Quieres que lo convierta ahora en PDF, en PowerPoint o en algún diseño tipo folleto?

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel toward total collapse.

The business is struggling too. Intel missed the AI boom entirely, its Foundry division is faltering, and revenues are shrinking. Before 2020, it posted annual earnings of $10–$20 billion; over the past year, it recorded $10 billion in losses. With $105 billion in net equity—mostly tied to hard assets that are tough to liquidate without losses—Intel’s financial cushion could erode quickly if more problems surface.

Will It Go Bankrupt?

Bankruptcy is possible but improbable. As a critical chip producer, Intel is too vital to U.S. interests to fail outright. I predict a government bailout, though shareholders would likely be wiped out.

TECHNICAL ANALYSIS

Since its bull market ended in 2000—25 years ago—Intel has been locked in consolidation. Now, the price is breaking down on high volume.

It’s trading below the 200-month moving average (MA200 Monthly), a key long-term support level that confirms a bear market.

The consolidation resembles an Elliott Wave ABC correction, with Wave B peaking in 2020. Since then, the price has declined in what appears to be an impulsive Wave C, forming an Ending Diagonal.

When prices break downward from Ending Diagonals—especially alongside a 25-year consolidation breakdown, as is likely here—the move is often swift and severe.

If the price exits both the consolidation and the Ending Diagonal, there’s virtually no support until the $4–$5 range. A market-wide crash could drive it as low as $1.

Intel - This Stock Is A Goldmine!Intel ( NASDAQ:INTC ) perfectly respects all structure:

Click chart above to see the detailed analysis👆🏻

Over the past couple of years Intel clearly established a significant downtrend, dropping about -70% after we saw the previous all time high. This bearish pressure is now ending though and if Intel manages to create a bullish reversal break and retest, a new uptrend is starting to form.

Levels to watch: $25

Keep your long term vision,

Philip (BasicTrading)

INTC Intel Price Target by Year-EndIntel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers.

Intel’s turnaround strategy, focused on rebuilding its foundry business and strengthening its position in the AI and data center markets, is starting to show signs of progress. The company’s push into advanced chip manufacturing and strategic partnerships with major tech firms have positioned it for improved revenue growth in the coming quarters.

Technically, the triple bottom pattern indicates strong buying interest at current levels, reinforcing the case for a potential breakout. Combined with the improving outlook for chip demand and Intel’s strategic shift toward AI, a price target of $28 by the end of the year appears achievable. This would represent approximately 15% upside from current levels.

Investors should monitor Intel’s progress in its foundry business and AI initiatives, as any positive developments in these areas could accelerate momentum toward the $28 target.

Intel: "So the last shall be first..."As the Holy Bilble says in Matthew 20:16, "So the last shall be first, and the first last: for many be called, but few chosen."

We agree. After our analysis, one stock comes into focus: INTEL - a long-term buy candidate. Investment horizon: 5-10 years, the right time to get in could be now.

This is not a buy recommendation, just an exchange of ideas. You have to use your own analysis and your own head and make your own decisions.

INTEL ($INTC) – BOUNCING BACK OR STUCK IN TRANSITION?INTEL ( NASDAQ:INTC ) – BOUNCING BACK OR STUCK IN TRANSITION?

(1/9)

Q4 2024 revenue beat forecasts at $14.3B (vs. $13.8B est.), up 7% from Q3 but still -7% YoY—highlighting Intel’s ups and downs. Looking ahead? Q1 2025 guidance points to $11.7-$12.7B in revenue and break-even EPS, hinting continued headwinds. Let’s dive in! 🔎

(2/9) – EARNINGS SNAPSHOT

• Q4 non-GAAP EPS: $0.13 (beat by $0.01), down sharply from $0.54 a year ago

• GAAP earnings hurt by $15.9B in impairment + $2.8B restructuring charges

• Gross margin set to drop from 42.1% to 36% next quarter—Ouch!

(3/9) – SIGNIFICANT FINANCIAL EVENTS

• Exploring AI chip partnership w/ TSMC: Could bolster Intel’s AI presence

• Targeting SEED_TVCODER77_ETHBTCDATA:10B in cost cuts by 2025, citing big strides in Q3 2024

• Foundry services sees $4.5B revenue in Q4, improved operating loss due to EUV wafer mix—positive sign ⚙️

(4/9) – CONTEXT & CHALLENGES

• 2024 free cash flow: - $15.1B (vs. +$21.4B in 2020)—hurts liquidity 💸

• Declining YoY revenue + margin pressure reflect stiff competition & big CapEx

• Intel pivoting to AI & foundry services, but near-term growth remains sluggish

(5/9) – SECTOR COMPARISON

• Forward P/E ~16, trailing P/E ~72.50 = low profitability vs. AMD/NVIDIA’s sky-high multiples

• P/B ~1.06, P/S ~1.5-2 → Intel looks “cheap” compared to peers (e.g., NVIDIA P/S ~20+!)

• Stock’s -51.67% over the last year, underperforming the semiconductor sector (+96.5%) 😬

(6/9) – UNDERVALUATION OR VALUE TRAP?

• Analysts’ intrinsic value: ~$19.37-$31.27 vs. current ~$20.97 → near fair value or slightly undervalued 🤔

• But big risks: negative cash flow, competitive drubbing from AMD/NVIDIA, repeated delays…

• The market’s discount might be warranted given Intel’s execution hurdles

(7/9) – KEY RISKS

• Competitive Pressures: AMD & NVIDIA dominating AI/data center 💻

• Execution Delays: Roadmap slips for Panther Lake (2H 2025) & Clearwater Forest (2026)

• Financial Strain: High CapEx, negative FCF, suspended dividend in 2024 🚧

• Macro & Geopolitics: Trade tensions (esp. in China) + economic headwinds

(8/9) – SWOT HIGHLIGHTS

Strengths:

Established brand, PC/server CPU leader

Foundry expansion, AI PC push

Cost cuts boosting operational efficiency

Weaknesses:

Market share losses, negative FCF

Delays in product launches, high CapEx

Complex design + manufacturing model

Opportunities:

AI & foundry growth via TSMC tie-ups

Government support (CHIPS Act)

Undervaluation if turnaround succeeds

Threats:

Fierce competition ( NASDAQ:AMD , NASDAQ:NVDA )

Regulatory & trade risks (China)

Rapid AI market evolution leaving Intel behind

(9/9) Is Intel the next big turnaround story or a sinking ship?

1️⃣ Massive comeback—AI + foundry = unstoppable!

2️⃣ Meh—They’ll recover somewhat, but not lead the pack

3️⃣ Doom—Delays, negative FCF, stiff competition… pass

Vote below! 🗳️👇

Intel Time To Wake UpIntel, which has received a very strong reaction, I think it will now try the above prices. Especially the last 3 dips it made look good. We can also expect a rapid rise when it breaks the falling resistance. I think pullbacks will be a buying opportunity. The 29 area awaits as a serious resistance.