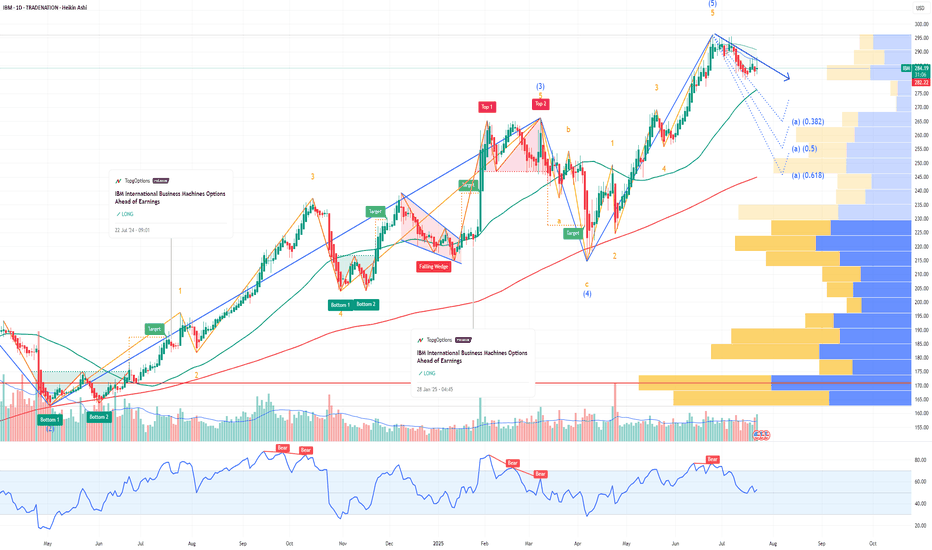

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Internationalbusinessmachines

IBM: Still BullishAfter the increases over the recent weeks, we still place IBM within the magenta wave (3) and expect a bit more bullish headroom in the short term. However, in our medium-term alternative scenario, we would see a larger pullback with the green wave alt. . Such a detour is considered 30% likely and would be confirmed by a drop below the support at $260.48.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Breaking: International Business Machine (NYSE: $IBM) Tanks 6% International Business Machine Corporation, (NYSE: NYSE:IBM ) together with its subsidiaries, provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally Plummets 6% in early premarket trading on Thursday albeit reporting better-than-expected earnings and revenue for the first quarter on Wednesday.

Earnings Overview

a. Earnings per share: $1.60 adjusted vs. $1.40 expected

b. Revenue: $14.54 billion vs. $14.4 billion expected

Revenue increased 0.6% in the quarter from $14.5 billion a year earlier, according to a statement. Net income slid to $1.06 billion, or $1.12 per share, from $1.61 billion, or $1.72 per share, in the same quarter a year ago.

For 2025, IBM reiterated its expectation for $13.5 billion in free cash flow and at least 5% revenue growth at constant currency. At current exchange rates, currency will provide 150 basis points of benefit for 2025 growth, down from the company’s forecast of 200 basis points in January.

IBM has been an outperformer this year as the broader market has sold off due largely to concerns around President Donald Trump’s tariffs and their potential impact on the economy. As of Wednesday’s close, IBM shares were up 11%, while the Nasdaq was down almost 14%.

The stock slipped 6% in extended trading on Wednesday, extending the loss to Thursday's premarket session. NYSE:IBM shares need to break pass the $266 resistant to negate any bearish barriers. Failure to break pass this level could resort to consolidatory move to the $216 support point.

IBM Share Price Falls Following Earnings ReportIBM Share Price Falls Following Earnings Report

Yesterday, after the close of the main trading session, International Business Machines (IBM) released its Q1 earnings report, exceeding Wall Street analysts’ expectations in several key areas. According to FactSet:

→ Earnings per share came in at $1.60 (forecast = $1.42), although this was below last year’s figure of $1.68.

→ Quarterly revenue reached $14.54 billion (forecast = $14.39 billion), marking a 1% increase year-on-year.

Initially, IBM shares rose on the news, but then dropped by approximately 6% during after-hours trading, according to Google Finance.

This suggests that today’s trading session may see IBM shares open below the $230 mark.

Market participants may have been disappointed by the following:

→ IBM’s mainframe business (large-scale computing systems designed for high-volume data processing) continued its decline, falling by 6% year-on-year.

→ Revenue from software and consulting divisions increased, but only by 3% compared to the same period last year.

→ The revenue forecast for Q2 stands at $6.6 billion – a 3% decline relative to the same quarter in 2024.

Technical Analysis of IBM Share Price

The chart shows signs of seller activity above the psychological level of $250. As indicated by the arrows, the price attempted several rallies above this level with varying momentum, but each time retreated back.

At the same time, price fluctuations formed a downward channel, which was extended to the downside in early April amid news regarding new tariffs in international trade.

Price stabilisation observed between 15–17 April suggests that supply and demand were temporarily balanced ahead of the earnings release. However, the negative market reaction to the report may shift sentiment and act as a catalyst for further price movement towards the lower boundary of the channel, around the key support level of $215.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 230usd strike price Calls with

an expiration date of 2025-1-31,

for a premium of approximately $5.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 250usd strike price Calls with

an expiration date of 2025-3-21,

for a premium of approximately $8.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBM reaches all-time highs amid strategic shiftsIBM captured significant attention in August 2024, driven by pivotal developments that underscore the company’s strategic realignment and technological innovation. The decision to close its research and development centre in China, which will impact over 1,000 employees, is part of a broader global restructuring aimed at sharpening its focus on burgeoning sectors like artificial intelligence (AI) and cloud technology. This move reflects IBM's commitment to consolidating its resources towards high-growth areas.

Adding to the momentum, IBM's presentation at the Hot Chips 2024 conference showcased its latest advancements in processor technology. The introduction of the Telum II processor and Spyre gas pedal marks a significant leap in computing power and energy efficiency, particularly for AI tasks, which are becoming increasingly crucial across industries.

These initiatives indicate IBM's ongoing efforts to fortify its leadership in AI and cloud technologies, signalling a future solid trajectory despite the reductions in other operational areas.

Technical analysis of International Business Machines Corp. (NYSE: IBM)

Exploring potential trading opportunities based on the current technical indicators of IBM's stock:

Timeframe : Hourly (H1)

Current Trend : the daily trend is upward, with the hourly chart showing a correction phase following extended growth

Short-term Target : immediate resistance is at 194.50 USD, which is the current target of the correction phase

Medium-term Target : a break above the resistance at 199.00 USD could pave the way for a rise to 210.00 USD

Key Support : positioned at 194.50 USD

Reversal Scenario : a break below key support at 194.50 USD could negate the bullish outlook, potentially leading to a decline towards 193.50 USD

IBM's shares are experiencing robust growth, hitting all-time highs. The stock's trajectory suggests that with the continuation of a favourable economic environment, there is potential to breach the 210.00 USD mark and achieve further gains. Investors and traders should monitor these levels closely as IBM continues to navigate strategic transitions and capitalise on its technological advancements.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65.68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

IBM International Business Machines Options Ahead of EarningsIf you haven`t sold IBM before the previous earnings:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 185usd strike price Calls with

an expiration date of 2024-9-20,

for a premium of approximately $7.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought the dip on IBM:

Then analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 170usd strike price Puts with

an expiration date of 2024-5-17,

for a premium of approximately $2.29.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

IBM Stock Slides 9% After Confirming $6.4B HashiCorp BuyoutInternational Business Machines Corp. (NYSE: NYSE:IBM ) encountered a stormy start to the trading day as its shares tumbled more than 8% in premarket trading on Thursday. The computing and consultancy giant grappled with challenges in its consulting business, fueled by enterprise spending constraints amid an uncertain economic backdrop and rising interest rates.

The tepid performance in IBM's consulting segment, marked by weaker demand for smaller discretionary projects, sent shockwaves through the market. Despite a 5.5% growth in its software business and a strategic $6.4 billion acquisition of cloud software company HashiCorp (NYSE: NASDAQ:HCP ), NYSE:IBM fell short of Wall Street expectations with total revenue of $14.46 billion, slightly below estimates.

Analysts at J.P. Morgan highlighted the unexpected deterioration in IBM's consulting division, while acknowledging the potential for a turnaround fueled by the company's backlog. However, the magnitude of IBM's consulting slowdown overshadowed the software acceleration, prompting concerns among investors.

The confirmation of IBM's acquisition of HashiCorp for $6.4 billion added complexity to the narrative, with the deal expected to close by the end of 2024. While NYSE:IBM anticipates the acquisition to be accretive to adjusted EBITDA within the first 12 months post-closing, investors remained cautious amidst uncertainties surrounding regulatory approval and integration challenges.

IBM's CFO, James Kavanaugh, cited macroeconomic uncertainty as a key factor driving prudent customer discretionary spending, echoing concerns about tightening budgets amid economic headwinds.

Despite posting adjusted earnings of $1.68 per share for the first quarter, beating analysts' forecasts, IBM's revenue miss and consulting woes cast a shadow over its financial performance. The company's stock price plummeted to $168.51 in after-hours trading, erasing some of the gains it had accrued over the past year.

Investors closely monitored IBM's chart patterns, with the $165 level emerging as a critical support area amidst the selling pressure. The stock's trajectory, characterized by a breakout from a multi-month rising wedge followed by a retreat to its lower trendline, underscored the volatility and uncertainty surrounding IBM's prospects.

The challenges posed by enterprise spending constraints and executing its growth strategy amidst macroeconomic headwinds, investor sentiment remains pivotal in determining the company's trajectory in the coming quarters.

IBM Set to Buy HashiCorp at About $35 a ShareIBM ( NYSE:IBM ) is reportedly on the brink of acquiring HashiCorp ( NASDAQ:HCP ), a renowned cloud software provider. The potential acquisition, as reported by the Wall Street Journal, has sent shockwaves through the tech industry, igniting both excitement and speculation among investors and analysts alike.

HashiCorp, based in San Francisco, has garnered significant attention for its innovative software solutions tailored to assist developers in managing infrastructure across various public cloud platforms, including heavyweights like Amazon Web Services and Microsoft Azure. With a market capitalization of approximately $5 billion, HashiCorp stands as a prime target for acquisition, particularly in light of its recent surge in stock value following the news of the potential deal.

IBM's strategic pivot towards software-centric operations, with a notable focus on artificial intelligence, has been steadily unfolding over recent years. The reported acquisition of HashiCorp aligns seamlessly with this trajectory, presenting IBM with a golden opportunity to bolster its cloud offerings and reinforce its competitive edge in the rapidly evolving tech landscape.

While both NYSE:IBM and HashiCorp have remained tight-lipped regarding the specifics of the purported deal, industry insiders anticipate that the acquisition could command a premium above HashiCorp's pre-report stock valuation. This speculation underscores the strategic significance of the move for IBM, which aims to not only expand its product portfolio but also leverage HashiCorp's expertise to drive innovation and capture greater market share in the burgeoning cloud market.

For NYSE:IBM , the potential acquisition of HashiCorp represents more than just a strategic investment; it symbolizes a decisive step towards solidifying its position as a key player in the cloud computing arena. With IBM's first-quarter earnings on the horizon, all eyes are on the tech giant as it navigates the complexities of finalizing the reported deal while continuing to deliver value to its shareholders and stakeholders.

As the tech industry braces for further developments, one thing remains certain: IBM's pursuit of HashiCorp signifies a bold stride towards shaping the future of cloud computing, underscoring the company's unwavering commitment to innovation and growth in an ever-evolving digital landscape.

HashiCorp ($HCP) Stock Up 26% on Report of IBM Buyout Shares of HashiCorp ( NASDAQ:HCP ), a cloud software maker, surged by up to 26% following media reports that IBM was in discussions to acquire the company. HashiCorp's software aids developers in setting up and managing infrastructure in public clouds operated by companies like Amazon and Microsoft. The software also provides organizations with security credential management services for which they pay HashiCorp.

According to sources who wished to remain unnamed, a potential deal could be reached within the next few days. This report has been neither confirmed nor denied by either HashiCorp ( NASDAQ:HCP ) or IBM representatives.

While HashiCorp ( NASDAQ:HCP ) went public on Nasdaq in 2021, the company was founded in 2012 and has grown considerably since. In the fiscal year ending January 31st, the company earned $583 million in revenue, alongside a net loss of almost $191 million. The annual report shows that HashiCorp's revenue increased by nearly 23% during that period, compared to IBM's 2% in 2023. IBM executives cited a difficult economic climate during a conference call with analysts in January. IBM will report its earnings on Wednesday.

Cisco held $9 million worth of HashiCorp ( NASDAQ:HCP ) shares at the end of March, according to regulatory filings. In 2019, Cisco reportedly held early discussions about acquiring HashiCorp ( NASDAQ:HCP ).

Technical Outlook

HashiCorp ( NASDAQ:HCP ) share IS up 26% due to the buyout news trading above the 200, 100, and 50-day Moving Average (MA) respectively. The stock has a Relative Strength Index (RSI) of 70.24 indicating bullish momentum.

IBM - The Forgotten StockHello Traders, welcome to today's analysis of International Business Machines.

--------

Explanation of my video analysis:

All the way back in 2012 IBM created a major top formation by breaking below strong support at $180 and we saw a significant decline in stock price from there. After we then saw a reversal and a breakout in 2022, IBM is certainly back to a bullish market. I am now waiting for a retest of the breakout level mentioned in the analysis to then look for long continuation setups.

--------

I will only take a trade if all the rules of my strategy are satisfied.

Let me know in the comment section below if you have any questions.

Keep your long term vision.

IBM Stock Surges on AI Momentum: Eyes on $200

In a remarkable turn of events, IBM ( NYSE:IBM ) is making waves in the financial markets as its stock soars on the back of robust fourth-quarter earnings and an optimistic full-year revenue outlook. The surge, driven by escalating demand for the tech giant's artificial intelligence (AI) products and consultancy services, is propelling NYSE:IBM shares towards a potential breakout from a rising wedge pattern, with analysts eyeing the tantalizing $200 mark.

Better-Than-Expected Performance:

NYSE:IBM 's fourth-quarter performance has exceeded market expectations, with adjusted earnings coming in at $3.87 per share, surpassing the projected $3.78. The company demonstrated an 8% expansion in the bottom line compared to the same period the previous year. Meanwhile, quarterly revenue reached $17.38 billion, outstripping analysts' forecasts of $17.30 billion and marking a 4% growth from the preceding quarter.

AI Takes Center Stage:

A significant catalyst behind IBM's stellar performance is the soaring demand for its AI solutions and consultancy services. The company reported a doubling of its generative AI book of business from the third quarter, attributing this surge to lucrative consulting and software deals. The infrastructure business played a pivotal role, witnessing a 3% revenue increase from the previous year, fueled by the growing adoption of servers and storage solutions supporting AI applications.

Distributed Infrastructure Shines:

Within the infrastructure division, the distributed infrastructure category emerged as a standout performer, registering an impressive 8% growth. This surge was primarily driven by robust sales of IBM's Power processing chips, underscoring the company's strength in delivering cutting-edge technology solutions.

Optimistic Outlook:

Looking forward, NYSE:IBM is not resting on its laurels. The company is projecting a full-year revenue guidance for 2024 ranging between 4% to 6%, surpassing the 3% expectation held by analysts. Despite acknowledging the persistent challenges in the economic environment, NYSE:IBM remains optimistic about technology budgets in 2024, anticipating them to maintain levels similar to the previous year. This optimism is expected to propel corporate sales, further bolstering the company's financial standing.

Technical Analysis: Breaking the Wedge:

NYSE:IBM 's stock has demonstrated a consistent uptrend since May of the previous year, with a minor retracement to the 200-day moving average in October. Now, we anticipate a potential breakout from a rising wedge pattern. Today, NYSE:IBM stands at the cusp of scaling new heights, possibly reaching a 10-year high. If the momentum continues, the $200 level could pose as a critical resistance point, harking back to the stock's record high set in March 2013.

Conclusion:

NYSE:IBM 's impressive financial performance, driven by the burgeoning demand for its AI offerings, positions the company as a formidable player in the tech industry. As the stock eyes a potential breakout, investors are watching closely, wondering if NYSE:IBM can surpass the $200 milestone and continue its upward trajectory. The convergence of strong financials, robust AI business, and positive market sentiment paints a compelling picture for NYSE:IBM 's future prospects in the ever-evolving landscape of technology and innovation.

Meta and IBM Team up Against Dominant Big Tech PlayersIn a prominent push toward open-sourcing artificial intelligence, IBM and Meta on Tuesday launched a group called the AI Alliance, an international coalition of corporations, universities and organizations that are collectively committed to "open science" and "open technologies."

The Alliance, according to a statement, will be "action-oriented," and is meant to better shape the equitable evolution of the technology.

Some prominent members of the organization include AMD, Cornell University, Harvard University, Yale University, NASA, Hugging Face and Intel.

The goal of the group, according to a statement, is to enhance responsible innovation by ensuring trust, safety and scientific rigor. To achieve that goal, it will push for the development of benchmarks and evaluation standards, support AI skill-building around the world and highlight members' use of responsible AI.

Ripple's Metaco Floats Game-Changing Safety Tech With IBMRipple Labs-owned subsidiary Metaco has joined hands with IBM to create a major top tier tech for digital asset safety.

Ripple Labs’ wholly-owned subsidiary Metaco recently joined hands with IBM to introduce Hyper Protect Offline Signing Orchestrator (OSO), a new technology that will facilitate the deployment of cold storage for digital assets.

The Metaco and IBM Solution Deviates from the Norm

The launch of the advanced technology which was announced by IBM is targeted at addressing the requirements of top-tier banks and financial institutions. Markedly, the tool is a clear deviation from the conventional manual process of executing cold storage transactions. Moreso, it offers protection for high-value transactions by creating extra layers of security.

Other features of the IBM OSO are disconnected network operations, time-based security, and electronic transaction approval by multiple stakeholders. Per IBM’s announcement, “OSO is designed to address limitations of current cold storage offerings for digital assets, including the need for people to perform manual procedures for the execution of a cold storage transaction.”

Apart from all of the aforementioned features, Hyper Protect OSO breaks the communication barrier between applications that have been designed to not interact directly due to certain security concerns. Precisely, it provides a policy engine which acts as a bridge between these different applications, facilitating secure and efficient digital asset transactions.

More Proactive Partnerships

Metaco and IBM worked together with other entities to ensure that the newly launched tool is in alignment with client requirements. Metaco Harmonize provides a highly robust and secured orchestration platform for digital asset applications. At the same time, it intends to leverage this novel solution for its operations.

Adrien Treccani, founder and CEO at Metaco stated that it is the company’s responsibility to deliver cutting-edge digital asset security to Metaco clients, especially due to its position as a trusted provider of institutional grade custody infrastructure. Furthermore, Treccani acknowledged IBM’s reliability over the years as a partner.

The strategic partnership with IBM is one of Metaco’s numerous alliances to push advanced technologies and cryptocurrency. Standard Chartered’s Zodia Custody joined Metaco recently to roll out a new crypto custody solution. The offering gives institutions easy access to crypto storage and settlement, with complete security.

BM Unveils) Ground-breaking AI Chip: North PoleThe team is already several years into developing the next iteration of the potentially revolutionary NorthPole chip.

NorthPole achieves an astounding 25 times higher energy efficiency metric and boasts 22 times lower latency metrics compared to relevant benchmarks.

This implies the potential for post-GPU performance at significantly reduced energy costs.

Researchers have described NorthPole’s energy efficiency as “mind-blowing,” as reported in Nature

IBM Options Ahead of EarningsIf you haven`t sold IBM here:

Then analyzing the options chain of IBM International Business Machines Corporation prior to the earnings report this week,

I would consider purchasing the 135usd strike price Puts with

an expiration date of 10/20/2023,

for a premium of approximately $4.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

IBM: Processing… 💻IBM is still processing wave b in red – the second step of a three part downwards movement, which should soon lead to the low of wave B in turquoise. As soon as wave B in turquoise is complete, the share should turn upwards to climb above the resistance at $139.47. There, IBM should conclude wave 2 in green before a significant downwards movement should take hold. However, there is a 35% chance that IBM could rise above $139.47 directly to develop a new top of wave alt.A in turquoise first before turning downwards again.

International Business Machines (IBM) Analyze!!!💻International Business Machines Corporation is an American multinational technology corporation headquartered in Armonk, New York, with operations in over 171 countries.

IBM was able to make a Head and Shoulders Pattern near the resistance line and resistance zone.

IBM broke the neckline & support line at the same time, and I expect that IBM will go down at least to the support zone and Head and Shoulders Pattern's Target.

International Business Machines(IBM) Analyze (IBMUSD), Daily Timeframe⏰ (Heikin Ashi).

Do not forget to put Stop loss for your positions (For every position you want to open).

Please follow your strategy, this is just my idea, and I will be glad to see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

IBM USD NYSE: NEW ALL TIME HIGHS COMING, ASCENDING CHANNEL ??IBM has been in an ascending channel formation for a while now. We've had two touches and I believe there is one more then a correction to the bottom support line before the decision of whether this channel will break to the upside or whether we will break to the downside. Thats years away and we can revisit that then but for now it looks like IBM is about to make a nice move to the upside to new all time highs in the $300 dollar range. The MACD is curled and primed and the BBWP shows volatility is expanding while the RSI is kinda neutral but headed upwards. I think a nice move in the works, and it has probably already started. This is not financial or trading advice, this is just my opinion and what I am doing. Leave a comment below and follow me for more! Thank you and good luck!

High risk setup for IBM long. IBMShort term outlook only.

Goals 130, 133. Invalidation at 181.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

IBM on the rise (don't mind the past). IBMImmediate targets 142, 149, 153. Invalidation at 114.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe