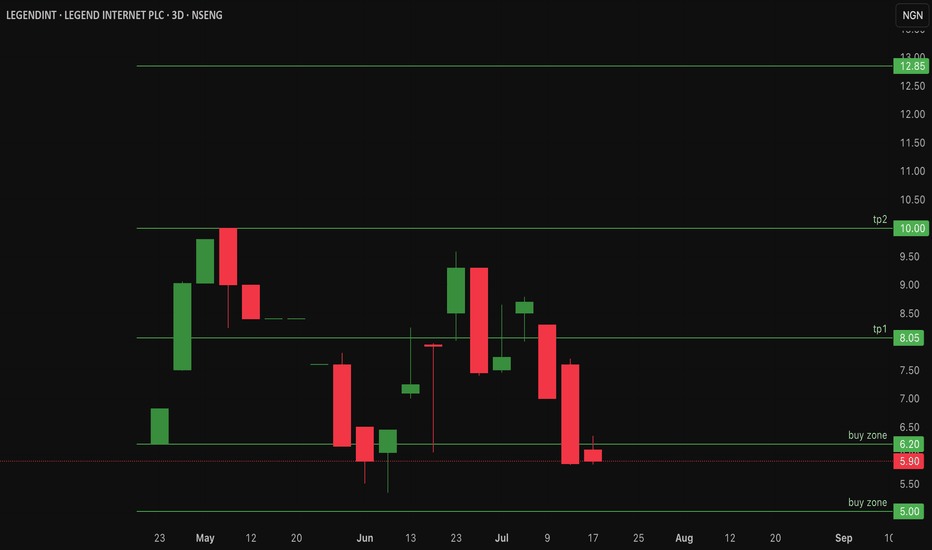

$legendint Could LegendInt be undervalued? - 40% RetracementLegend Internet Plc on the Nigerian Stock Exchange (NGX) was listed on April 24, 2025, under ticker LEGENDINT. The company offers fiber-to-the-home (FTTH) services in Abuja and digital products like LegendMail and MailPay.

IPO price: ₦5.64 per share, closed first trading day at ₦6.20. Previously NSENG:LEGENDINT has reached an all time high of 10naira/share and has currently retraced over 40%

Current price: 5.90

As a newly listed small-cap, it faces low visibility and high volatility, contributing to weak investor demand and price devaluation. It would be interesting to see what the future holds for #legendint.

Upside resistance at 8naira and 10naira per share

Buy zone range is between 5 -6.2naira/share

Price action looks like an inverse cup and handle pattern - Not a bullish pattern!

Invalidation for this Legend Idea is under 5naira per share!

Internet

Ethereum Looks Identical to Early-Day AmazonToday I look at Ethereum versus early-day Amazon and the similarities between the internet bubble and the 2021 crypto bubble. Everyone talks about how the internet bubble popped, but few people talk about what came afterward. There was a strong recovery in the markets, and the internet was mass adopted by the public—along with the technology of home computers.

I believe we are heading into a mass adoption phase for crypto. We've had a bubble-and-pop scenario, and now that major institutions are investing in crypto, we are set up for mass adoption—very similar to what happened with home computing and the internet as a technology. I see Ethereum as being the "Amazon" of this new wave, and Bitcoin as being the "Apple." Big things are coming in these markets.

As always, stay profitable.

– Dalin Anderson

NetEase: Upward Surge!NTES generated a strong upward impulse, surging nearly 15% higher, including a gap-up. This brought the stock noticeably closer to the high of the green wave , which should ideally form just below the resistance at $134.44. After this peak, we anticipate significant sell-offs down to the $53.09 support level, where the beige wave II should conclude. Since a sustainable uptrend should follow this low, we have highlighted a magenta Target Zone (coordinates: $59.67 – $27.95), which is suitable for long entries. Once the zone is completed, the price should reach levels above the resistance at $134.44 during the subordinate green wave . This mark also plays a role in our alternative scenario (probability: 38%). If the price rises above the $134.44 resistance without previously reaching the Target Zone, we will have to consider an alternative corrective wave structure, with the price currently in the green wave alt. .

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Deep Dive into Internet Capital Markets (ICM) - New Narrative Revolution or Speculation?

Internet Capital Markets (ICM) is an emerging concept in crypto, allowing developers and startups to raise capital directly from communities via blockchain and social platforms like X (formerly Twitter). ICM tokenizes ideas, apps, and projects, bypassing traditional intermediaries such as venture capitalists.

Key Concepts & Mechanisms of ICM

ICM is founded on decentralization and social dynamics:

Tokenization & Democratized Capital:

Any user can launch a token representing their idea using platforms like Believe.app, simply by posting on social media with specific tags (e.g., "$TICKER + project name"). This dramatically simplifies fundraising, reducing barriers and costs.

Bonding Curve Pricing:

Initial liquidity and token pricing are set automatically through a bonding curve mechanism, increasing token prices as demand grows.

Trading on DEX:

Tokens typically move to decentralized exchanges (e.g., Meteora) once achieving market caps around $100,000, boosting liquidity and investor accessibility.

By May 2025, over 9,000 tokens have launched, total market capitalization surpassed $350M, with trading volumes reaching $411.6M.

Market Leaders & Success Stories

Believe app:

Dominant ICM platform, with over 3,192 tokens launched and 107,078 traders.

$LAUNCHCOIN:

Native token of Believe app, achieving $250M market cap and 18% growth in 24 hours.

Other notable projects:

$DUPE: Aggregator for product analogues ($63M market cap)

$NOODLE: Crypto analogue of popular game agar.io ($3.1M market cap)

$GOONC, $BUDDY: Highly volatile, speculative tokens popular among traders.

Driving Factors Behind ICM’s Popularity

ICM’s rapid growth is fueled by:

Investment Democratization:

Eliminating geographical and financial barriers.

Speculative Potential:

Opportunities for substantial profits (up to 50,000% ROI in 24 hours).

Social Mechanics & Simplicity:

Viral growth via platforms like X (Twitter).

Solana's Technological Edge:

Low transaction fees ($0.00025) and high transaction speeds (up to 65,000 TPS).

ICM Prospects: Optimism vs Risks

Optimists foresee a revolutionary expansion of capital access, driving Web3 and dApp innovations. Pessimists, however, highlight risks:

Extreme Volatility:

Tokens like $NOODLE dropped 61% in 24 hours.

Regulatory Uncertainty:

Lack of clear regulations, especially in the US, poses significant startup risks.

Speculative Nature:

Critics label ICM as "meme coins under a new name," noting limited intrinsic value in many projects.

Long-term success hinges on sustainable projects emerging and clarity on regulatory frameworks.

Impact on Real World Assets (RWA)

ICM holds potential for reshaping tokenized real-world assets (e.g., real estate, bonds, art):

Positive Impacts:

Lower entry barriers, increased liquidity, and new tokenization models for intellectual property or future revenues.

Current Limitations:

Technological and regulatory constraints currently limit integration of complex RWAs with ICM.

Future Potential:

Over the next 3-5 years, integration could strengthen significantly, contingent upon regulatory clarity.

How to Profit from the ICM Trend?

Key earning strategies include:

Token Creation & Sales:

Launching tokens on platforms like Believe.app, earning up to 50% in trading fees.

Early-stage Investing:

Buying tokens pre-DEX launch, offering high-risk/high-reward potential.

Short-term Trading:

Exploiting token volatility on DEXs for rapid profits.

Participating in Airdrops:

Obtaining free tokens from emerging projects.

Infrastructure Development:

Building analytical tools and integrated wallets, attracting venture funding or tokenization.

Diversification, monitoring social engagement, and avoiding questionable projects are essential risk mitigation strategies.

Future Challenges & Opportunities

ICM faces notable challenges:

Regulation:

Uncertainty and potential legal sanctions remain significant risks.

Market Volatility:

Requires sophisticated analysis and cautious strategies.

Integration with AI:

Leveraging artificial intelligence for trading optimization and market analytics can offer substantial competitive advantages.

Navigating the landscape requires balancing innovation and regulatory compliance for sustainable growth.

Conclusion

Internet Capital Markets represents a revolutionary approach to capital formation, transforming traditional fundraising. Despite impressive growth and potential, careful navigation is needed due to high volatility and regulatory uncertainties. Platforms like Believe.app demonstrate model viability, yet long-term success will depend on achieving a balance between meaningful project value and clear regulatory frameworks.

ICM uniquely blends innovation and speculation. Time will tell whether it becomes foundational within the financial ecosystem or simply another speculative crypto bubble.

Best regards EXCAVO

Spotify (SPOT) – Sustainable Business Model Amid Tariff WarsKey Supporting Arguments

Spotify’s business model is resilient enough to rising tariff barriers between countries and economic downturns

Spotify and other music streaming platforms are undercapitalized and may demonstrate substantial growth in 2025, driven by increasing subscription prices.

Investment Thesis

Spotify (SPOT) stands as the world’s leading global audio streaming platform, boasting over 600 million active users, around 265 millions of whom are paying subscribers. The company’s primary revenue stream is derived from premium subscriptions, which constitute approximately 88% of its total revenue, with advertising revenue comprising the remaining 12%. This model offers the company relative stability amidst ongoing tariff tensions.

Amidst global economic instability and the threat of escalating trade wars, Spotify emerges as a safe haven for investors. Spotify’s audio streaming platform is not reliant on the supply of physical goods, rendering it immune to tariff barriers. The high entertainment value, the ingrained habit of daily usage, and the superior quality of the platform ensure a strong subscriber base, even during times of economic uncertainty. 88% of Spotify’s revenue is derived from paid subscribers, while advertising revenue accounts for only about 12%. This revenue structure makes the company more resilient to downturns in consumer demand and reduced advertising budgets. Approximately 40% of Spotify’s revenue is generated in the U.S. and 10% in the UK, with the remainder coming from other markets worldwide. This geographic diversification mitigates vulnerability to localized economic shocks.

The music streaming sector is undercapitalized. This industry is undergoing transformation. Initially, competition among music streaming platforms was centered on mass user acquisition, often keeping prices low to attract listeners away from piracy services. However, beginning in 2022 and through 2023, a wave of price increases was initiated by all major industry players, including Spotify, Apple, Amazon, and YouTube. As users have grown accustomed to paid subscriptions and their loyalty has increased due to enhanced user experiences, the cost of switching between platforms has risen substantially. This has empowered streaming services, particularly Spotify, to raise prices without experiencing significant audience loss. We anticipate that subscription price increases will be a primary driver of the company’s revenue and margin in 2025.

Our two-month price target for the SPOT stock is $650, with a “buy” rating. We recommend setting a stop-loss order at $500.

Alikze »» Jasmy | Ascending channel - 1W🔍 Technical analysis: Ascending channel - 1W

📣 BINANCE:JASMYUSDT currency was examined on the daily time frame. In the previous analysis, it was noted that it is in a concentration that touched the targets specified in the ascending channel upon exiting it.

🟢 Currently, in the weekly time frame, after reaching the final target in the previous analysis, it encountered selling pressure, which is now below the middle area of the ascending channel.

💎 If it encounters selling pressure again in the middle of the channel, the correction to the channel bottom area can continue, which will be a broken pullback to the swing, and then, if there is demand and support in the channel bottom area, it can continue its growth to the ceiling of the first ascending channel.

💎In addition, if the first channel breaks, it can continue its growth to the large supply area of the second ascending channel ceiling, as wide as the channel width.

»»»«««»»»«««»»»«««

Please support this idea 💡 with a LIKE 👍 and COMMENT 💬 if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email 📧 in the future.

Thanks for your continued support.🙏

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

$GRASS Surges Amid Airdrop Controversy, Eyeing Bullish BreakoutThe $GRASS token has been making waves in the crypto space, with an ambitious vision to build the internet's first user-owned, open-scale web-crawling network. Aiming to democratize the control of information, Grass Network is setting out to rival the tech giants that currently monopolize web-crawling capabilities, empowering its community of over 3 million users to scrape vast amounts of data for AI applications. Despite facing technical setbacks, recent trading activity and price action suggest the token has strong bullish potential.

The Vision Behind Grass Network

Grass Network intends to disrupt the centralized control over the internet’s knowledge graph, a lucrative arena currently dominated by only two corporations with the infrastructure to crawl the entire web. Unlike its predecessors, Grass is creating a decentralized, user-owned knowledge graph by mobilizing millions of users as nodes, contributing to a vast pool of internet-scale data for AI models. This transformative vision holds immense potential, as decentralized data access could power AI development while keeping the control in the hands of the community.

Recent Price Action and Airdrop Controversy

The price of $GRASS has seen volatility following an 8% surge, currently trading around $0.871075. This increase comes on the heels of an airdrop intended to reward early adopters, distributing 10% of the total supply to users on the Solana network. However, the airdrop encountered significant issues: Phantom Wallet, a widely used Solana wallet, faced technical downtime as a result of the surge in demand. Users experienced system crashes, difficulties in accessing their tokens, and inaccurate balances, which prompted criticism of Grass Network’s preparedness for handling large-scale operations. Phantom Wallet has since restored functionality and announced that its team would continue monitoring the situation closely to ensure stability.

Despite these issues, trading volume has spiked by 125%, reaching $244 million. The surge in demand indicates strong community interest and engagement, although the technical glitches reveal the challenges Grass Network must overcome to manage such events at scale.

Technical Analysis

Analyzing the chart, $GRASS/USD is forming a symmetrical triangle pattern—a structure that often precedes a breakout. This pattern suggests price consolidation, potentially leading to a significant upward or downward movement. For $GRASS, several indicators point towards a bullish breakout:

1. Symmetrical Triangle Pattern: The pattern’s upper trendline serves as resistance, and a breakout above this line would signal a bullish continuation.

2. Relative Strength Index (RSI): The RSI currently sits at 53, well below the overbought level of 70. This value implies that $GRASS has room to continue its upward movement before facing overbought conditions, potentially supporting a bullish breakout if volume increases.

The Road Ahead: Can $GRASS Reach New Highs?

Despite trading at around $0.871075, $GRASS previously saw highs of $10 in pre-market trading on some exchanges, suggesting that investors believe in its long-term potential. The price range of $1 to $2 is within reach, as $GRASS can rally if trading volume and investor interest continue to grow. A breakout beyond the symmetrical triangle's upper boundary could reignite the bullish narrative and lead to a campaign towards $5 in the coming months.

Key Price Targets:

- Near-term target: $1.00 if $GRASS successfully breaks the upper trendline of the triangle pattern.

- Medium-term target: $2.00 if demand remains strong, especially with the increased visibility and interest following the airdrop.

- Long-term target: Potential revisit of $5, driven by Grass Network’s success in delivering on its vision and expanding its user base.

Conclusion

The Grass Network stands as a pioneering initiative, aiming to revolutionize how web data is accessed and owned. Despite facing challenges during its recent airdrop, the network’s decentralized, user-powered vision continues to attract significant interest from the crypto community. With favorable technical indicators and a unique use case that aligns with the decentralized ethos of blockchain, $GRASS has room to grow. Investors should keep a close watch on trading volume, key technical patterns, and updates from Grass Network to assess the potential for further bullish movement.

In sum, $GRASS is more than just a cryptocurrency—it represents a shift towards a decentralized, user-controlled knowledge ecosystem. For traders and investors, the current technical setup presents promising opportunities, particularly if Grass Network addresses operational issues and continues to expand its influence in the blockchain space.

Kraneshares China Internet ETF | KWEB | Long at $26.00The "beginnings" of a change in the downward trend of China's tech stock market may be starting to unfold. The price of Kraneshares China Internet ETF AMEX:KWEB has finally reconnected with my selected simple moving average (SMA) which often means further price consolidation or future price breakout from the overall mean. I'm not saying this will happen immediately and this particular SMA likes to be tested to "fake out" buyers and sellers (sometimes over months or years). Plus, there are price gaps in the low BER:20S on the daily chart that often get filled before a run. But for the early birds out there, like myself, AMEX:KWEB at $26.00 is in a personal buy zone as a starter position.

Target #1 = $30.00

Target #2 = $37.00

Target #3 = $49.00

Target #4 = $100.00 (very long-term view...)

ICP Desc. Triangle Breakout + Rectangle, Targets $16.3 and $20BITGET:ICPUSDT broke out of its descending triangle and has successfully retested the resistance.

The triangle target is $20 🎯

Not the cleanest breakout, and lacking volume. Also, a case could be made for a rectangle pattern with a $14 resistance, so the safe play would be to wait for a daily close above that level.

The rectangle offers a second target: $16.3 🎯

This is also a previous resistance and could offer a good area to secure some profits.

Not Financial Advice

Are #Stocks expensive? No measured against M2 money supplyThe 2000 Top was still the "real" peak of the US stock market

Built obviously on the expectation that the internet would change the world and teh global economy.

This highlights how the market foresees the future and how market participants are forward looking.

The #DownJones index is still 50% down form that peak

on this chart you can multiple chart patterns tat have played out previously

HVF's, double top, head & shoulder tops, and inv H&S bottoms

currently in a 22 year continuation inv head and shoulders which is still in progress

my stance is Top in April/May 24 .... downdraft into the election and a run up for 2/3 years into the Giga Uber TOP

Internet Computer $13.00 ➥ $23.00The cryptocurrency Internet Computer (ICP/USDT) is forming an interesting entry point for buying upon a price breakout of $13.325 on the Bybit exchange on the 12-hour timeframe.

The stop is set below $12.659.

The nearest target area is $23. The long-term target could reach $99, according to orders on Coinbase.

ICP Detailed ChartAs mentioned before, ICP coin broke out from $3.50 and reached the range of $9-10. Later, I shared another analysis and mentioned that it was trying to return from around $9.80, and if it can hold here, it could go up to $15, but if it can't, we might see a reversal around $7.50. I tried to explain this more clearly and explicitly in this chart. If the market is still in a bullish season, ICP will initially attempt the $13-15 range. If it can break this range and continue the uptrend, it will target the $20-22 range.

As the year-end approaches, it's advisable to be cautious. Generally, the market experiences a drop before the year-end. However, the expectation of the Bitcoin ETF is keeping the market strong.

I wish everyone good luck and a happy new year.

ICP Did It! What is Next?In my previous analysis, I had mentioned that ICP coin would rise from $3.60 to $8.20. Despite ICP dropping from $500 to $3, it is still a strong project and my favorite coin. Unfortunately, due to VC involvement, the coin that had fallen so much has finally started to show a strong uptrend.

What is next? RSI is oversold, and price made a huge pump (+%50) since yesterday. Therefore, I believe ICP will make some corrections. As I point it out in the graph, if it starts to do some correction, I believe around 7.50$, we will see some reversal to go up to 15$. If it doesn't stop here, it can directly go to 15$, but I believe it will rejected from there and will do some corrections. In that case, I will publish a new analysis.

This is my trial. Not a financial advice.

#ICP/USDT 2D (#BinanceFutures) Big falling wedge break & retestInternet Computer seems to have found bottom on historical demand zone, RSI entered oversold territory, recovery towards 100EMA would make sense.

⚡️⚡️ #ICP/USDT ⚡️⚡️

Exchanges: Binance Futures

Signal Type: Regular (Long)

Leverage: Isolated (1x)

Amount: 9.4%

Current Price:

3.804

Entry Targets:

1) 3.390

Take-Profit Targets:

1) 6.098

Stop Targets:

1) 2.305

Published By: @Zblaba

CRYPTOCAP:ICP #ICPUSDT #InternetComputer #Dfinity #Web3

Risk/Reward= 1:2.5

Expected Profit= +79.9%

Possible Loss= -32.0%

internetcomputer.org

dfinity.org

Starlinkusdt ,,, technical analyst Starling, after its correction,

this currency was able to get out of the Kumo cloud,

it can be the end of the correction and repeat the previous goals.

🔥 ICP Triangle Break Out: Going Down!Around a month ago I made an analysis on ICP where I discussed the triangle pattern on the chart. Back then, ICP was doing great, but I still anticipated it to go down and find resistance.

After a few weeks of trading we got down to the bottom support, and eventually (today) broke through it. The bears got the overhand at the moment.

With a lot of alts currently performing badly and BTC moving down, I don't see ICP going back up in the short-term. Bearish targets in blue.

ICP Looking for 9-10 $ICP has inverted H&S formation in weekly chart and it aims for 9-10$.

As we can see it tried the Minor support several times and got a good response so far.

If it can exceed the minor resistance, then we can expect the price will grow up to 9-10$.

Let's hope this coin can perform well in the Bull market.

This is not a financial advice. It is just a trial. You can check my previous analysis from the links below.

Comcast (CMCSA) bearish scenario:The technical figure Channel Up can be found in the daily chart in the US company Comcast Corporation (CMCSA). Comcast Corporation is the largest American multinational telecommunications conglomerate. It is the second-largest broadcasting and cable television company in the world by revenue (behind AT&T), the largest pay-TV company, the largest cable TV company and largest home Internet service provider in the United States, and the nation's third-largest home telephone service provider. It provides services to U.S. residential and commercial customers in 40 states and the District of Columbia. The Channel UP broke through the support line on 22/02/2023. If the price holds below this level, you can have a possible bearish price movement with a forecast for the next 23 days towards 34.83 USD. According to experts, your stop-loss order should be placed at 40.74 USD if you decide to enter this position.

Comcast Corp has cut its stake in BuzzFeed Inc by 8.5% since the end of January, cashing in on a rally in the shares of the digital media company on reports of a plan to partner with OpenAI, the artificial intelligence firm behind ChatGPT.

It has so far sold more than 11 million BuzzFeed shares since Jan. 30, reducing its stake to 15.5% from 24%. The sale fetched Comcast about $28 million, according to a Reuters calculation.

It sold roughly four million shares for an average price of around $2.90 apiece at the end of January, and most recently dumped another 500,000 shares for an average of $2.05 a share, filings by Comcast showed.

NBCUniversal, Comcast's entertainment unit, had invested $200 million in BuzzFeed in 2015 and injected another $200 million in 2016, valuing the company at around $1.7 billion.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carries a high level of risk. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and on such sites. Furthermore, one understands that the company carries zero influence over transactions, markets, and trading signals, therefore, cannot be held liable nor guarantee any profits or losses.