GOLD: A Bearish Trading SetupBearish Breakdown Setup

**Summary

Analysing Price action from yesterday we have got a very nice distribution leg push that broke down below our accumulation zone a good indication of downside momentum, therefore the anticipation is that price will retest our BOS an ideal zone to look for bearish setups.

📉 XAUUSD Daily Breakdown Potential setup

🔴 Distribution leg: 3366.425 - 3320.305

📉 Sell level: 3341 (BOS)

🎯 Target 1: R:R 1:2

🎯 Target 2: R:R 1:3

🎯 Target 3: R:R 1:4

🛑 Stop Loss: Above Resistance Zone

🔍 Watch: Failure to break back in = Confirmation

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

Intradaystrategy

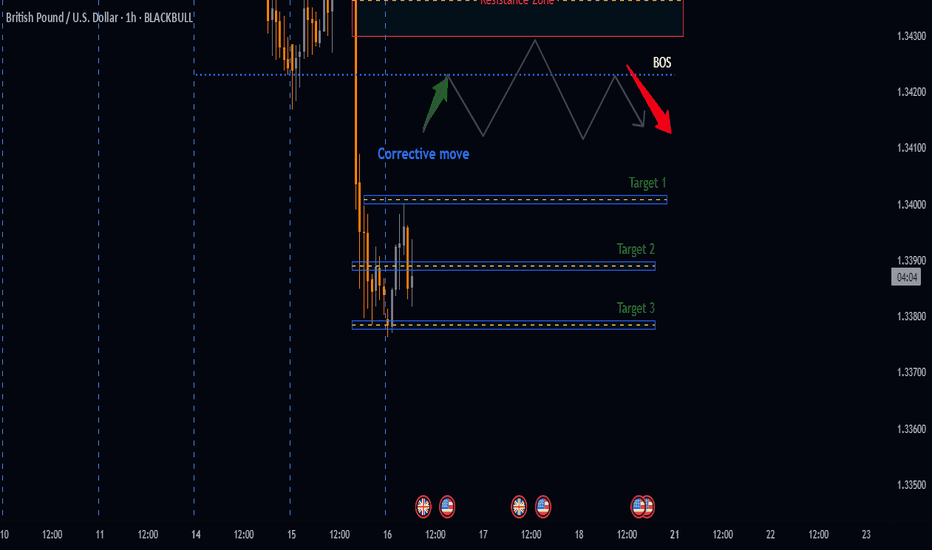

Potential Bearish Setup for GBPUSDBearish Breakdown Setup

**Summary

Analysing Price action from yesterday we have got a very nice distribution leg push that broke down below our accumulation zone a good indication of downside momentum, therefore the anticipation is that price will retest our BOS an ideal zone to look for bearish setups.

📉 GBPUSD Daily Breakdown Potential setup

🔴 Distribution leg: 1.34588 - 1.33785

📉 Sell level: 1.34230 (Confirmed Break)

🎯 Target 1: R:R 1:2

🎯 Target 2: R:R 1:3

🎯 Target 3: R:R 1:4

🛑 Stop Loss: Above Resistance Zone

🔍 Watch: Failure to break back in = Confirmation

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

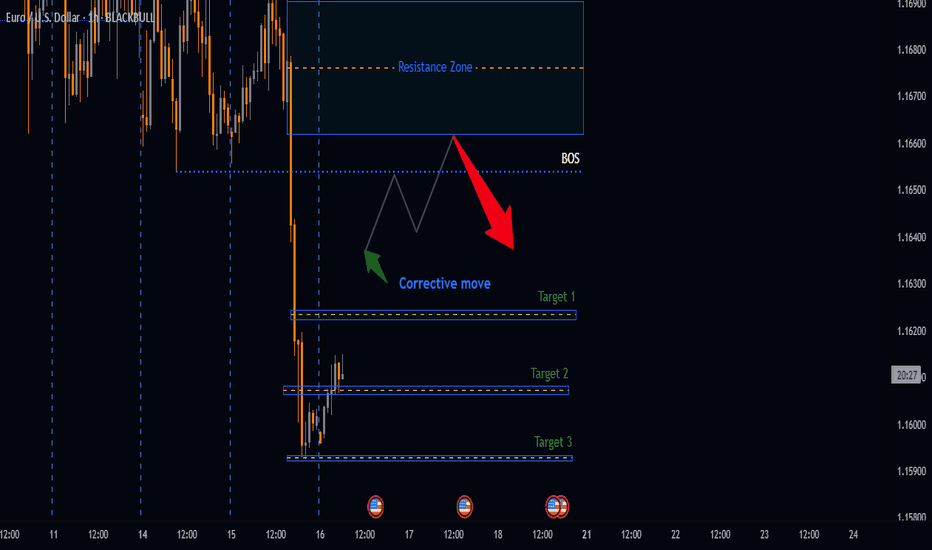

Potential Bearish Setup on EURUSDBearish Breakdown Setup

Summary

Analysing Price action from yesterday we have got a very nice distribution leg push that broke down below our accumulation zone a good indication of downside momentum, therefore the anticipation is that price will retest our BOS an ideal zone to look for bearish setups.

📉 EURUSD Daily Breakdown Potential setup

🔴 Distribution leg: 1.16921 - 1.15924

📉 Sell Below: 1.16540 (Confirmed Break)

🎯 Target 1: R:R 1:2

🎯 Target 2: R:R 1:3

🎯 Target 3: R:R 1:4

🛑 Stop Loss: Above Resistance Zone

🔍 Watch: Failure to break back in = Confirmation

LIKE or COMMENT if this idea sparks your interest, or share your thoughts below!

FOLLOW to keep up with fresh ideas.

Tidypips: "Keep It Clean, Trade Mean!"

Golden Rejection Candle Strategy–Catch Explosive Intraday Moves!Hello Trader!

Are you tired of buying options and watching premiums die slowly?

Or chasing breakouts that reverse the moment you enter?

Here’s your solution – the Golden Rejection Candle Strategy , designed especially for option buyers who want timed entries, fast momentum, and defined risk .

What is a Golden Rejection Candle?

A special candlestick that forms when price hits a strong level (like VWAP, trendline, or demand/supply zone) and gets instantly rejected.

It leaves behind a long wick (shadow), showing that buyers or sellers stepped in with force .

This candle often marks the start of a sharp intraday reversal .

It's not just a random wick — it’s a smart money footprint .

Live Chart Example – Nifty Spot vs Option Premium (23950 CE)

Date: 9th May 2025

Timeframe: 1 min (Spot), 1 min (Options)

Spot Chart Setup: Nifty approached a marked green support zone and created a strong wick rejection with a small body candle — classic sign of buyers defending the level.

Confirmation Candle: The next candle broke above the rejection candle’s high, confirming the reversal setup.

Premium Reaction: On the 1-min ATM Option chart (23950 CE), premiums jumped from 270 to 344 – a clean 26% gain within few minutes.

Risk-Reward Snapshot: Entry was at breakout, SL just below rejection wick, and target hit in a single momentum burst — the kind of move option buyers live for.

How to Trade It as an Option Buyer

Choose the Right Strike: Use ATM or slightly ITM options to get faster movement when price reverses.

Entry Strategy: Wait for the next candle to break the rejection candle’s high/low. No break = No trade.

SL Placement: Keep it just beyond the wick. Small loss if wrong, big reward if right.

Exit Plan: Aim for intraday resistance/support or spike-based exits — option premiums often give quick moves post-rejection.

What NOT to Do:

Don’t enter on the rejection candle itself — wait for confirmation.

Avoid trading this pattern in low volume or middle of the range.

Don’t hold blindly — if premium spikes, take the money and run!

Rahul’s Tip:

“Sudden reversals are where option buyers make money — not slow trends. The rejection candle shows intent. The breakout shows confirmation. Combine both.”

Conclusion:

The Golden Rejection Candle Strategy gives you an edge that most random trades lack — timing, context, and structure.

If you're an option buyer, this can be your go-to setup to avoid traps and enter only when smart money steps in.

No more guessing. No more fear.

Just clean, price-action-based entries that make sense.

👇 Have you ever used rejection-based setups? Drop your favorite trade below! Let’s learn together.

If you found this post valuable, don't forget to LIKE and FOLLOW!

I regularly share real-world trading setups, actionable strategies, and learning-focused content — all from real trading experience , not theory . Stay connected if you're serious about growing as a trader!

Gold prices bottomed out and rebounded, market trend analysis.Analysis of gold trend: From the perspective of market sentiment, interest-free gold as a safe-haven asset has performed strongly this year, with prices soaring by nearly $700 and hitting record highs several times. However, the recent optimistic expectations of easing global economic and trade relations have boosted market risk appetite, and the equity market has generally performed positively. Some funds have flowed out of safe-haven assets such as gold and turned to risky assets, which is also the main psychological factor under pressure on gold prices. If market risk appetite continues to improve, global economic and trade relations further ease, and the US dollar strengthens, gold prices may face greater downward pressure. From a technical point of view, the gold price needs to effectively fall below the $3,265-3,260 range in the short term before a larger correction downward may be confirmed. Once confirmed to fall below, the gold price may quickly fall to the 50% retracement level near $3,225, further pointing to the $3,200 mark. If $3,200 is lost, it will suggest that gold may have peaked in the short term.

Gold opened higher in the Asian session on Monday and continued to fall last week after hitting 3336. The idea of the Asian session was to directly bearish at the analysis point of 3277. After hitting the lowest point of 3268, it fluctuated upward. The European session also fell to 3273 and then rebounded. The highest point in the US session just reached 3336 again, a standard bottoming and rebounding trend. Since it is an adjustment structure, let's re-analyze the idea. The gold price fell at 3500 and rebounded at 3260 last Wednesday. The rhythm was volatile. It rebounded above 3260 many times below and did not cross the first rebound high of 3367 above.

Today, we mainly focus on the closing price. If it stands firmly at the 3313 line, we will adjust our thinking on Tuesday. On the contrary, it will fall back after encountering resistance at 3336, today's opening high, and go to 3278. On Tuesday, we will continue to look at the idea of swinging and falling. Now it is the end of the market, and the market is also falling from a high.

How to Trade After Major News Events – The 15-Min Trap SetupHello Traders!

We all get excited when major news hits the market — whether it’s budget day, RBI policy, US inflation data, or company results . But jumping in too early can be a trap. Smart money often creates fake moves in the first few minutes. That’s where the 15-Min Trap Setup becomes a powerful tool for intraday traders.

Let me show you how to avoid traps and catch real moves after news events.

Why the First 15 Minutes Matter

Emotions are high: Retail traders often react instantly without confirmation. This creates liquidity for big players.

Fake breakouts happen often: Price breaks key levels in the first candle — then reverses and traps traders.

Volume is misleading: The biggest volume often comes early, but the real direction is seen later.

The 15-Min Trap Setup – How It Works

Step 1: Wait for the first 15-minute candle to close after a big news event — don’t trade before that.

Step 2: Mark the high and low of this 15-minute candle.

Step 3: Wait for a fake breakout above or below that range — if price breaks out but quickly comes back inside, it’s a trap.

Step 4: Enter in the opposite direction of the breakout after confirmation — ride the real move.

When to Use This Strategy

Major economic events – like Fed decisions, budget day, inflation data, RBI policies.

Company results – high-impact earnings or news releases.

Gap up/gap down openings after big global cues.

Rahul’s Tip

Don’t react — observe. Let the market show its trap. Big players love early overconfidence. Use their game to your advantage by planning around the 15-min candle.

Conclusion

The 15-Min Trap Setup helps you avoid emotional trades and catch the real move after major news. Be patient, mark your zones, and strike when the trap is confirmed. This simple rule can completely change your intraday game.

Have you ever been trapped in the first candle after news? Let’s share experiences below and grow together!

XAU/USD 05 April 2024 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Gold continues it's bullish run following the Fed's dovish outlook.

Price has printed further highs since yesterday's highs (04-04-2024) where we continue to trade within a fractal high and internal low.

As mentioned on 22/03/2024, Intraday expectation was for price to react H4 POI to then target fractal high, which price did, creating a new highs and still remains the case.

Due to the bullish nature of the market and prices at all time highs, the most prudent approach would be to adopt patience and allow price to print structure as opposed to picking tops.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Price has printed a further bullish iBOS where it continues to print all time highs.

Price is trading within internal low and fractal high.

First structural sign, but not confirmation that pullback has initiated is a bearish CHoCH, which is denoted by a blue dotted line.

Yesterday's intraday expectation was met again.

Intraday expectation would be for price to pull back following bullish iBOS, react at either M15 POI or 50% EQ of the internal structure before price targets weak internal high.

Another likely scenario, and due to the fact that all HTF's need to pull back, is price prints a bearish iBOS on M15 which would mean first structural indication (CHoCH) on H4 that pullback is about to initiate.

M15 Chart:

Bank Nifty Trade Setup (12-June-2023)This will be my personal trade Setup, This is not an advice of any kind to initiate trade according to this setup. This is for only for my learning purpose and maintaining my trading journal.

Bank Nifty selling of and forming shooting star candles... what should we expect ? Is it trend reversal ? or is it profit booking buy previously holding stocks ?

Day traders shouldn't worry about long term...

So for tomorrow this will be my trade setup:

1.) If opens flat which is near trendline or above it and horizontal reistance (44060) and takes support there i will buy for target of 44250.

2.) If opening flat and broke both trendline and resistance of 44060 keep acting as resistance i will short for target of 1st support 43850, then 2nd support 43730.

3.) Big gap up or down will stay away from market unless there is good setup.

Nifty Trade Setup (09-June-2023)This will be my personal trade Setup, This is not an advice of any kind to initiate trade according to this setup. This is for only for my learning purpose and maintaining my trading journal.

Today Nifty gave good setups wasn't able to pre analyze due to work and missed good trade after many days of range bound and gaps. :)

Trade Setup for tomorrow:

1.) If opens flat and took support near trendline and 18580 will look for buy for target of 18700, 18726 and PDH. . if doesn't hold 18580 support will look for shorting for next support place.

2.) If gaps i will wait for good setups to form.

BEL (Intraday) (Swing) [Illiquid Stock]Looks suitable for Intraday.

Since this is an illiquid stock, therefore take the trade on a min 15 min timeframe.

This looks good for the short term too. (Switch to daily timeframe to get a clearer view)

Disclaimer: Not a buy or sell suggestion, this is my analysis shared for educational purposes.

Crypto - Trade SetupMost ALTs haven't tested the main resistance level yet and even though they rejected beneath the resistance still there is a smell of bulls in the price action. Yes not so much interest yet but i'm expecting something more likely upward towards the resistance zone soon. But like i say market emotions change with the time so we must not stay rigid, we need to move along with the market.

Here are the key areas for my trade setup on ENJI against USDT, I'm saying again once the price reaches my zones I'll observe the market emotion clearly then only i get into the trade otherwise I'll look for another trade setup. This is what disciplined traders do so what are you doing ??

My calling : 0.5922

Note : I'll update once the trade setup got triggered!

Disclaimer : I'm not a financial advisor, trade at your own risk.

SPX500: my intraday scenario using 81strategyHi Traders,

This is my view on this pair for the next days on #SPX500 using my 2 intraday strategies.

(I’ve just shared my fully explained 81strategy on Tube)

I remind you that this is only a forecast based on what current data are.

Therefore the following signal will be activated only if specific rules are strictly respected.

If you follow my strategy you will be able to identify the right filters and triggers to enter correctly the market and avoid fake signals.

I really hope you liked this video and I would like to know what do you think about this analysis, so please use the comment section below this video to give me your point of view.

Thank You

———————————

Pit from Trading Kitchen