How invalidation of a short setup becomes a long setupExplanation of the Trading Setup Based on the Chart:

"Short Re-test" Signal Creates Two Scenarios:

Plan A: When a "Short re-test" signal appears, it indicates potential resistance and a possible continuation of the downward move. You can short with the expectation that sellers will dominate and push the price lower.

Plan B: Alternatively, you prepare for a breakout, where price moves above the resistance formed by the "Short re-test" signal. This indicates a potential trend reversal or continuation of bullish momentum.

In this case, Plan B was triggered, leading to a textbook breakout above the resistance zone.

Breakout Confirmation and Retest Setup:

After the breakout, the price moved higher and provided a "Buy re-test" signal. This is a classic example of a breakout retest pattern, where the price pulls back to test the broken resistance, which now acts as support, before continuing upward.

Multiple "Buy Re-test" Signals Strengthen the Trend:

Following the initial breakout and retest, the chart shows multiple green "Buy re-test" signals along the way. Each signal marks a new key support level, confirming bullish control and the reliability of the uptrend.

Notice how each of the three key supports held, demonstrating strong demand at these levels and affirming the strength of the bulls.

Key Takeaways:

The initial "Short re-test" signal gave traders the opportunity to anticipate both a short continuation or a bullish breakout.

Once the breakout occurred, it was followed by a strong series of retests, giving traders multiple low-risk entry points to go long.

Holding key support levels after each "Buy re-test" signal validated the bullish momentum, creating high-confidence long setups as the trend progressed.

This setup exemplifies how combining breakout strategies with retest confirmations can lead to profitable trades while maintaining manageable risk.

Contact me to get a trial of that Impulse Master indicator

Invalidation

SP500 / US500Did we get a right shoulder invalidation of the possible SP500 head and shoulders patterns?

It is quite early to suggest that. We need the right shoulder to prove itself and work as support to give me more conviction.

As long as we stay on top of the right shoulder ~4470 I am carefully bull.

If we fall back under it I'm waiting for a test of the neckline ~4340. In this situation price probably would break it and tests the big support 4195 area.

As long as we stay on top of the ~4180 I am long term bull

If you trade use stop losses!

1st mistake novice traders do is that they don't use them and gets their ass burned!

-PalenTrade

Ocean Protocol - 2 scenarios Currently looking for longs on $OCEAN

Scenario A

- retest breakout level and diag in yellow (618 fib) and invalid on a loss of diag and upper yellow

- target range eq for ~10% and target supply/resistance in red zone above and final target at range high

Scenario B

- we lose the diag and hold lower yellow area atop HTF demand (red line making this trade specifically invalid)

- same targets

Both scenarios could get front-ran, but I am not willing to enter a trade here as if it continues to push with shallow retracements I don't like the risk R/R and no clear invalidation.

Laddering my TP's 50% -> 40% -> 10% or something similar depending on PA at the time.

#Bitcoin $BTC becoming safer asset than #Gold ??In previous times of turmoil, any investor was considered wise to place money into gold vs. fiat or any other investment vehicles. However, this comes with many issues, including accessibility, transportation, etc. So, in my opinion, Bitcoin (with its limited supply coupled with high demand, easy access, and easy transportation) will become considered the safest of the "safe-haven" assets. This chart shows the performance of Bitcoin breaking trend, while invalidating a bearish pennant, during a time when one would assume that money would be moving into Gold instead. For me, personally, this shows that this shift is starting to play out. And, while there still may or may not be a rise in $BTC, the value-loss potential of Bitcoin will become much lower, compared to all other assets.

**This is my opinion based on data. This is not financial advice.**

BTC swing short trade on crab to 34k-44kAfter a rejection near the key level of 47k and a daily close under the 50% fib retrace of the 36k low to 46k high, I suspect we may face another correction.

This is all under the guise that the recent uptrend was a 3-wave move, with a wick under 39.4k confirming the corrective move. So far it hasn't done so, but with a daily close under the 50%fib retracement, it is leaning more bearish.

Good entries for a short would be along the white solid trendline hovering ~41.5k. Since we haven't wicked under the 39k high on feb 1st, the stop loss should be near 47k. But with take profit nearing 34k to 37k, its set at 44k to maintain a 2 r/r ratio. tp is derived from possible retests around the -1stdev of the yearly vwap at 37k, and the two orange PoC lines noted on the chart.

The BBWP indicator below has inputs set to a Daily chart relative to the current 4hr chart. Bouncing off of the 20 reading could bring more volatility, but it is not yet confirmed. Btc could consolidate a bit until a move to the white trendline ~41k.

MA of the RSI on the weekly has yet to crossover from being under 50 for a while. It's very close to doing so, but at the same time given the outlook on lower time frames, there's room for the signal to head down to the green BB. Given the weekly bull divergence signal and the gravestone doji candle from the prev. week, I'm learning overall crabbish for now with a lean toward the bears.

Trade:

entry @ 41k

sl @ 45k

tp1 @ 37k

tp2 @ 34k

SUPPORT

-1 stdev of yearly vwap @ 37.2k

Cycle wave PoC's @36k & 33.7k

Yellow dashed trendline

-2 stdev of yearly vwap @ 28.5k

RESISTANCE

negative slope White trendline ~41.5k

yearly vwap & PoC of the downtrend from 69k to 33k low @ 47k

+1,+2 stdev of yr vwap noted on chart

INVALIDATIONS

closing over 42k before breaching 44.7k high

29k low of 2021

Gold Short Term Sell IdeaD1 - Price is currently holding in a key resistance zone.

Potential bearish divergence.

H1 - Bearish divergence.

Until the invalidation level holds my short term view remains bearish here.

If we get a valid breakout below 1850 level we may then consider it as a validation for this short term bearish view.

SHIBUSDT Breaking Main SupportIt's looking like the long position here may have been invalidated. Although, with a bounce of the upper line of the descending wedge, it may still be valid. However, if this breaks downward into the wedge and breaks the second support level, I wouldn't be looking to go long until price reaches the target-buy-zone shown on the chart. With a bounce off the upper line of the wedge, and with a move back above the main support level, I would be looking to get back into a long position. This not financial advice. DYOR

SXP POSSIBLE LONG & SHORT SCENARIOSXP is currently trading under resistance, A move down will see us revisit support at $1.3 level, while a break above current resistance @ $2.6 and a successful retest would see us revisit price levels of $4.1 and higher. If there's anything losing my $1000 capital has taught me, it's wait for confirmation always. Starting again with $40. Hoping to turn this into at least $500 before EOY. Sidelined since the start of september.

Stay Safe folks and don't FOMO.

CAN WE BUY XAUUSD?SWING TRADING JOURNAL

Bullish invalidation still intact, so I still bullish for XAUUSD and this is my plan

I will;

BUY XAUUSD somewhere at Green Box (try to buy as low as possible)

SL BELOW Red Line

Final TP at Blue Box

Manage this trade with your trading style, maybe you want to;

1. Close your position early (at 1R, 2R or any profit level)

2. Move your SL to break even

3. Scale out

4. Trailing stop

5. Re-entry if bullish structure still valid

6. etc

No Profit Guarantee, Good Luck!

EW Analysis: EURCAD With Bullish Setup FormationHello traders!

Today we will talk about EURCAD, its price action from technical point of view and wave structure from Elliott Wave perspective. We want to show you what are best setups for trading in real time.

Well, we will focus on a lower time frame, a 4h chart, where we can see nice, clean and impulsive five-wave rise from the lows, which in Elliott Wave theory suggest the bottom, at least a temporary one.

Five-wave cycle has to be labeled with the first higher degree leg A/1 and we know that after every five waves, a three-wave a-b-c corrective pullback follows in wave B/2 which is usually followed by a third leg C or 3.

So, it doesn't matter if we will see a bullish reversal with 1-2-3-4-5 waves up or just a corrective A-B-C movement. In both cases we can expect at least one more push to the upside.

Current three-wave a-b-c corrective decline within wave B/2 looks to be unfinished, but keep an eye on golden 61,8% Fibonacci retracement, where we also see equality measurement of waves a=c, so ideal support would be in 1.4950 - 1.4900 zone. However, it's already at the former wave "iv" support, so in case of an earlier jump up above 1.5100 level, then bulls within wave C/3 would be already in play.

Of course, we may see even even bigger, deeper and more complex correction in B/2, but have in mind that count would be invalited only below 1.4725 previous lows level.

Traders, we hope you liked that article.

Be humble and trade smart!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

EW Analysis: NEOUSD Can See A Deeper Corrective DeclineHello traders!

Today we will talk about cryptocurrencies, specifically NEO and its price action from Elliott Wave perspective.

NEOUSD made an impulsive five-wave cycle from March lows, which suggests a bullish reversal at least in three waves A/1 - B/2 - C/3. Since the beginning of June, seems like NEO is making a three-wave a-b-c correction, where wave "c" is still missing. So, don't be surprised if we see another decline towards projected 8.0 - 6.0 support zone around important 61,8% - 78,6% Fibonacci retracement and this is where a higher degree wave B/2 correction may come to an end, which can be followed by strong and impulsive bounce back to highs for wave C/3. In case if we see something deeper and more complex, invalidation level remains at 4.0!

Be humble and trade smart!

If you like what we do, then please like and share!

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.

INTCTouched the down trend line right at beginning of day and right at the end of day. Still leaning to downside.

I know others may have different counts but for me, I’m keeping my count unless we get a higher high above 61.49 for a possible invalidation.

Currently still holding onto small short position I entered other day.

Broken Handle suggests sideways price channel incomingIncreased volatility has led to broken supports, making the cup n handle formation less likely.

While price could still find a bottom just above 7900, its unlikely to result in bullish action to test the previous high above 10K.

We have pushed past the 0.5 Fib between 6500 and 10300, yet no dead cat bounce into support to suggest a reversal to form a bottom. Its likely we will see another down leg after brief consolidation in the near term, bringing us closer to low 7K, and maybe a bottom at 6700

Look for pull back to mid 8K before making a weak top around 8700, missing a test of previous hgh, then dumping again to low 7K.

If you are still in long position, keep it, but opening a new position or adding to long position is very risky.

Algorithm Builder - INDICES - DOW JONES - Review Oct 18th, 2019Hello traders

I. Daily tutorial publishing challenge officially begins

Starting today, I'll be publishing every night what were the setups given by the Algorithm Builder Indices .

----------------------------------------------------------------------------------------------------

You'll find more information about that script in this script signature.

----------------------------------------------------------------------------------------------------

II. Wisdom of the day

Last Friday was the Triple witching hour day. That is the day where the US contracts come to expiration on the US market - this event happens once a month.

Hopefully, only once a month, because this day is often particularly hard for traders to trade.

Those days are the expiration of three kinds of securities:

1. Stock market index futures;

2. Stock market index options;

3. Stock options.

The simultaneous expirations generally increases the trading volume of options, futures and the underlying stocks, and occasionally increases volatility of prices of related securities.

III. Signals of the day

2.1 Morning trade

We had a difficult move to take because in front of multi-timeframes resistances. What I usually do, is to wait for a pullback near the EMA 20 which has a few huge benefits:

- generally gets me a better entry price (lower for a long, higher for a short)

- reduce the distance between my entry price and stop-loss - hence reducing the risk of the trade

The Algorithm Builder - INDICES calculates the stop-loss internally, based on the price where the signal appears

2.2 Afternoon trades

1. 8:45 am

The first SHORT was given against the leading trend. Around 2:45 pm the background is green, meaning the leading trend is still bullish but as we got a short trade, we had to take it.

Plus we were just below a ton of supports which tells us that a pullback near the EMA 20 is really required.

Before getting invalidated by the brown vertical bar, we had an 84 pips opportunity .

It's usually a good practice to set the stop-loss to breakeven or exit completely a position before the opening at 9:30 am.

We often see violent and unpredictable wicks a few minutes before and after the US stocks open.

2. 4:05 pm (UTC+2)

The IDEAL scenario for the Algorithm Builder. Leading trend is red, short signal, no supports near, a great setup with a decent risk-to-reward ratio.

When we're in the same direction as the leading trend and the next algorithmic SMAs are a bit far, those are the moments where I know that my reward is far greater than my risk.

Would I overleverage or increase my position size drastically anyway knowing this is the Triple witching hour day? Maybe not :)

Maybe I should have (kidding) :( ... it was a 162 pips move :)

All the best,

Dave

What is an Hard Exit ? and a few notes on trading managementHi everyone

Today I'm traveling so can't really share a script because A) it's not coded B) I'm tired C) no inspiration today so instead, I'll be spreading a bit of wisdom (if I may call it like that)

I see a lot of traders out there solely depending on two main signals to exit a position :

1) A signal in the opposite direction

2) A stop loss to exit a position (fixed, or trailing)

Those two points are a very good practice but what if you could exit a position before "sh*t will hit the fan" (pardon my french).

For instance, you enter a trade, you see it's going against you, you're down 2% and your stop-loss is only a few % more away.

Thanks to your experience, you know that when one of your trade goes down below a given threshold, it will wreck (= rekt in crypto terminology) you even deeper with a high probability. Obviously, sometimes it will, sometimes it won't and you'll never figure out the right stop loss level to handle all the edge cases...

Let's now introduce the concept of a hard exit . What is it exactly? In short (no pun intended.... actually yes it was...), now thanks to your experience, you know that whenever a given indicator gives an opposite signal, you'll have to exit your trade if you don't have a positive trade balance. If positive, you know, that you should either set your stop loss to breakeven (entry-level of your trade) or exit it completely.

When such a scenario happens, maybe sometimes, it's better to exit a trade completely when you have that signal before going to bed...

Hands up anyone who took a trade before sleeping, thinking they'll wake up way richer and finally discovered they got margin called? or lost way too much money because their stop loss wasn't hit because that mean broker decided to use the "SUPER WRECKING SLIPPAGE" function to go beyond your stop loss... Your stop loss is looking at those candlesticks going above and doesn't understand what's going on...

The example in the screenshot is very interesting. Let's assume a very simple strategy using the supertrend. When it's green, we go long, when it's red, you go..... (finish it)

You noticed that the MACD Zero Lag will often allow you to exit the position before your stop loss will be hit and before the trade will go in the opposite direction. Sometimes, it won't save you any $$ doing so... but most of the time it will save you a few % of capital per trade and this will add up very quickly. (imagine saving a few percents or capital per trade multiplied by dozens of trades)

I'm not advising to use the correlation between the Supertrend and the MACD Zero Lag here. This is just an educational example :)

Warren Buffett said this: “Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1”.

We all believe we're smarter than the average but 95% of us is losing on the market... this doesn't add up :) 95% is losing... let that sinks in.

Does it mean that most of the things you read on Trading Twitter about guys taking leveraged trades and waking up with a brand new Lamborghini might be a fake story? (rhetoric question)

Am I saying that you should close your trades before sleeping if not already winning? (rhetoric question again)

"But sir I'm sure of those trades, I know the market, I'll be promised to go to the Valhalla by John McCaffee if I hold this XVG, XRP and TRX positions" (no one actually told me this that way but that's what I hear when someone finds reasons to keep losing trades overnight/over weekends)

Those people generally have a plan in mind and they want to stick with it. Either because they're scared to exit and to see then their trade going in the desired direction... or because they're too stubborn. And even then, if you have a system giving you a few signals and you count on each of them to pay your rent.... you're doing that trading thing wrong my friend

Either way, you have the choice between not losing or risking to lose big but maybe winning when you'll wake up. The best traders I know constantly doubt, optimize their strategies but never assume the market will favor them, not even once. However when they see a great potential profitable setup with an amazing Risk:Reward, they know that's with those trades, they'll have to go real BIG (betting the house, the wife, the kids, the car, ...) but certainly not with the already losing trades and hedging before sleeping ... (who...came up with those expert advisors using martingale during sleeping hours...very dangerous... )

If you wonder who I am to give all those lessons and scripts.

I worked in a bank alongside traders for years, and I saw hundreds of traders/investors losing everything and I mean they lost more than their trading capital.

This is truly sad because trading is a psychological game between you and the casino (market). We surely have more hedge than playing cards in a casino for sure thanks to technical analysis and that's why I got so deep into TA 6 years ago, made it a full-time job in a bank and learned everything I could to secure my trades/investments and become an emotionless machine when trading.

That's why I made the Algorithm Builder, to remove most of the psychological aspect. This made my own and my clients' trading way more enjoyable.

More to come about it tomorrow or the day after.

Wishing you a great end of your day

Dave

____________________________________________________________

Be sure to hit the thumbs up

- I'm an officially approved PineEditor/LUA/MT4 approved mentor on codementor. You can request a coaching with me if you want and I'll teach you how to build kick-ass indicators and strategies

Jump on a 1 to 1 coaching with me

- You can also hire for a custom dev of your indicator/strategy/bot/chrome extension/python

- if you like my work and wants to buy me some coffee :

- BTC TipJar: 3MKDve7stWTe1io99oFxeQXvP8XB4zCQ8m

- LTC TipJar: MC5oeBAhw9BLqyi65TR3J1Lid8io9uHADw

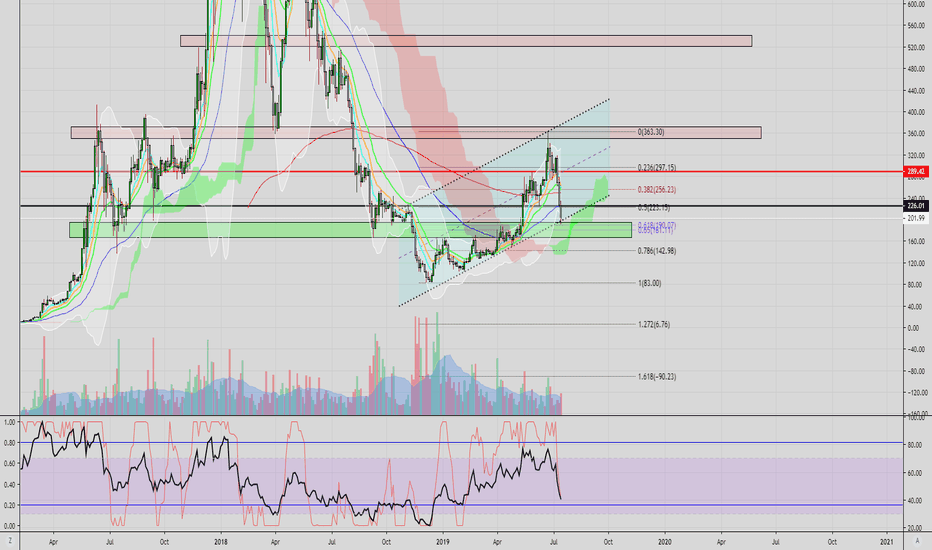

ETH Update: At support again, but will it hold?Again, we are at another strong support area. It also includes the golden pocket of fib retracement from the $83 low all the way to the $363 high. The cup and handle it scrap since the cup has retraced too far. RSI is bearish again as well. We may get some choppiness/sideways movement for as we sit closely between strong support and strong resistance. I'm probably going to make another buy in this range.

NZDUSD - H1 - Potential Bullish Bat? Check your data!!We are potentially tracing out a bullish bat formation here on the NZDUSD hourly chart. There is a veeery deep C leg though so make sure you check your data on your specific trading platform . For me, this pattern is still valid but could be a different story entirely on other brokers/platforms.

AUDUSD Short: Looking for a Bargain Against InvalidationThe AUDUSD rally is not over yet. We know this because highs have been breached and a triple combination correction has revealed itself. However, it is nearing its final rally up against the EW invalidation level. I would love to short form here with a high R/R and a big target. Updates to come as the tide rolls!