Investor

Digital Turbine, Inc. (APPS)As a Whole formation, it looks to me the nearest Scenario is we Completed Major 1st Wave at 102$ , In my opinion as a technical analyst in charts and technical formations, in addition to the corrective formations I have encountered many times before, we have completed the correction of a leg of a major correction for the second large wave at $1.18. We are entering the early stages of the second leg, which I expect 99% will go to its final target at $141 by 2027. However, the closest level in 2025 is $25, and perhaps with significant news like a partnership and investment with major companies, it might hit the target of $49 by early 2026. The correction as a whole is called the minor or accelerating correction A B C.

Target Prices and Expected Periods: -

1 Month = 25$

6 - 9 Months = 49$

12 - 15 Months = 141$

APPS has a High Technical Rating by Nasdaq Dorsey Wright.

Earnings announcement* for APPS - Jun 16, 2025

What buying opportunity! $ICLRNASDAQ:ICLR

Calling all long term investors.

This is a mega long term buying opportunity.

- 9 consecutive months of selling

- Mega 2008, 2020 support trend line

- Huge FIBONACCI retrace of entire stock market trading history

- Oversold technical chart

- positive divergence on daily/ weekly time frames

If you tuvk this away for 3-5 years you'll likely be very happy.

GBPMXN LONG OUTLOOK BULLISHstarting from a 3 month view of currency pair and dissecting it to monthly and lastly the weekly chart. Outlook is showing some support and is showing potential move to upside as you can see from analysis where my support and resistant areas are also trend channels, what do you guys think?

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

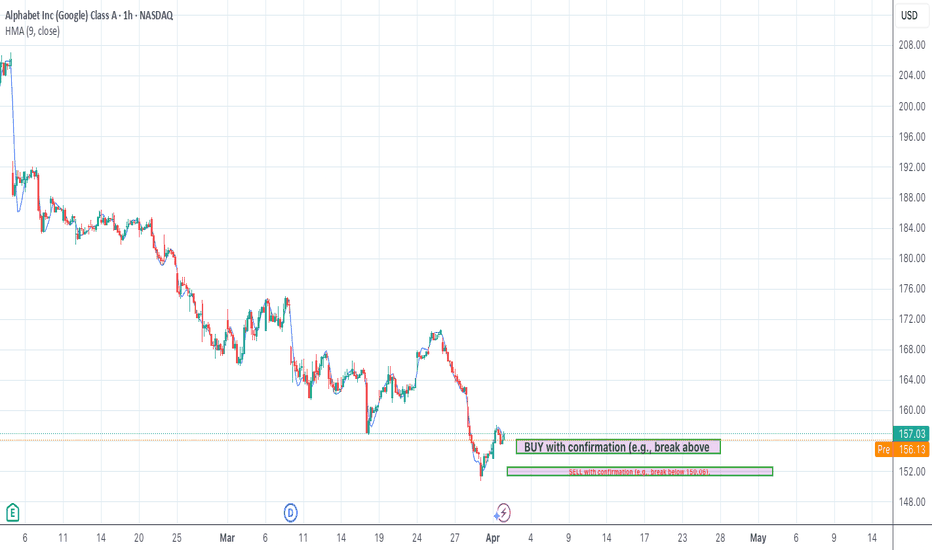

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).

BUY INVE_AOn INVE_A, you can see that the price is showing a great potential to go higher especially after the last LQ sweep we got and now it started pushing towards the level 355.0.

If you're welling to buy, or you already bought and you don't know which level exactlt to target or where to close, now you got the answer to it!

Follow for more!

Get in at the ground level? So many people would love to make money from the markets yet they end up losing instead, this should not be the way

With dedicated focus, I've had tenacity to withstand everything that the market had to throw at me, and can finally say I'm in a position whereby I've risen up on top

If you are tired of struggling on the market and instead would like the markets to work for you, please reach out to me so we can start a conversation

BRK.B ratio to SPX daily.Hello community,

I had fun doing the ratio between Warren Buffett's stock and the SP500 via the SPX, since the beginning of the year.

The result on the graph, i.e. 5.11% in favor of Warren.

Grandpa Warren, still holds the road, despite his 94 years.

Experience and wisdom have struck again.

Bravo the artist.

Make your opinion, before placing an order.

► Thank you for boosting, commenting, subscribing!

Gold Market Analysis and Sell Signal Report

Current Resistance Level

Gold (XAU/USD) has recently encountered resistance at the 2361.00 level. This resistance has been tested multiple times, suggesting potential downward movement if it holds.

Technical Analysis Overview

- **Resistance Level:** 2361.00

- **Support Levels:** Key support levels to watch include 2356.00, 2351.00, and 2346.00.

- **Trend Analysis:** The trend shows potential bearish signals if gold fails to break above the 2361.00 resistance level.

Sell Signal Details

- * *Entry Price:** 2361.00

- **Take Profit Levels:**

- **T1:** 2356.00 (50 pips)

- **T2:** 2351.00 (100 pips)

- **T3:** 2346.00 (150 pips)

- **Stop Loss:** 2371.00 (100 pips)

#### Market Sentiment

Investors are advised to consider the strong resistance at 2361.00 as a potential point for initiating sell positions. With the entry point at 2361.00, the outlined take profit levels provide a structured approach to maximizing gains while minimizing risks.

Risk Management

It is crucial to adhere to the stop loss at 2371.00 to protect against potential upside risks. This strategy ensures that losses are limited, while the potential for profit remains high given the strong resistance level.

Investors FAQ: Providing the Best Analytics

Investors FAQ is committed to providing top-tier analytics and signals for forex trading. Our comprehensive market analysis and carefully curated signals are designed to help traders make informed decisions and maximize their trading potential.

Risk Disclaimer

Trading in forex and commodities carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in forex or commodities, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with forex and commodity trading and seek advice from an independent financial advisor if you have any doubts.

---

#GoldAnalysis #ForexTrading #SellSignal #MarketAnalysis #InvestorsFAQ #TradingSignals #RiskManagement #TechnicalAnalysis #Forex #Commodities

Please ensure you adapt your trading strategy according to your risk tolerance and market conditions. Happy trading!

Nzdcad Nzdcad has been trending for a while, I'm looking for a pull back to my demand zone, and I will initiate a buy trade, my stop loss will be below my demand zone while my take profit will be at recent high.

TRADING THE FINANCIAL MARKETS IS A DANGEROUS GAME ALWAYS USE STRICT RISK MANAGEMENT PROTOCOLS AND ALWAYS DYOR!!!

How does inflation affect the stock market?The world’s financial environment has become incredibly tangled and multifaceted. The global availability of information to investors, particularly in rural areas, thanks to the internet, has caused investor sentiment to shift from an emotional response to an analysis and data-driven one.

Inflation serves as a prime example of this. In the past, most individuals viewed inflation as an indication of an unhealthy economy.

However, in the present day, investors have become more knowledgeable about economic cycles and are capable of making sound investment decisions at each stage of a country’s economy.

Therefore, today, we will discuss inflation in general and evaluate its influence on the stock markets in India. Let’s start with a topic on How does inflation affect the stock market.

What is Inflation?

In simple words, inflation refers to the gradual increase in the prices of goods and services. As the inflation rate rises, so does the cost of living, resulting in a decrease in purchasing power.

As an example, suppose bananas were priced at Rs.100 per kilo in 2010. In an inflationary economy, the cost of bananas would have increased by 2020.

Let’s assume that the price of a Banana is now Rs.200 per kilo in 2020. Thus, in 2010, with Rs.1000, you could buy 10kg of Banana.

However, in 2020, due to the decrease in purchasing power caused by inflation, you would only be able to buy 5kg of Bananas for the same amount.

To understand inflation in detail, let’s have a look at what is the reason behind inflation. So, there are two major factors behind an increase in the rate of inflation in the economy.

1) Demand > Supply

One reason for an increase in the inflation rate is when the average income of individuals in an economy rises, and they want to purchase more goods and services.

During such times, the demand for these products and services can exceed their supply, resulting in a scarcity of these goods and services. Consequently, buyers are willing to pay more for them, which leads to a general increase in prices.

2) Increase in the cost of production

Another reason for an increase in the inflation rate is when the cost of production of goods and services increases due to an increase in the costs of raw materials, labour, taxes, etc.

While this leads to an increase in the cost of production, it also causes a decrease in the supply of these goods and services. With the demand remaining constant, the prices tend to increase.

Inflation and the Indian Stock Markets:

The price of a share in the stock markets is determined by the interplay of demand and supply, which is influenced by a variety of factors, including social, political, economic, cultural, and so on.

Anything that affects investors can have an impact on the demand and supply of stocks, and inflation is no exception. Here is a brief overview of the impact of inflation on stock markets:

1. The Purchasing Power of Investors

Inflation, by definition, is a rise in the prices of goods and services, and it is also an indicator of the diminishing value of money.

Therefore, if the inflation rate is 5%, then Rs.10, 000 today will be worth Rs.9, 500 after one year. If the inflation rate increases to 10%, then the same amount will be worth even less in the future.

So, as the inflation rate increases, the purchasing power of investors decreases. This decrease in purchasing power can directly impact the stock market since investors would be able to purchase fewer stocks for the same amount.

2. Interest Rates

When the inflation rate rises, the Reserve Bank of India ( RBI ) often increases interest rates for deposits and loans. This move is intended to encourage people to save money and limit excess liquidity, thereby reducing the inflation rate.

However, as loans become more expensive, the cost of capital for companies also increases. Consequently, the projected cash flows of companies are valued lower, which can lead to lower equity valuations.

3. Impact on Stocks

As the increase in the inflation rate, speculation about the future prices of goods and services can create a highly volatile market environment. Since prices are rising, many investors may speculate that companies will experience a drop in profitability. As a result, some investors might decide to sell their shares, leading to a drop in their market price.

However, other investors who remain optimistic about the company’s future profitability may continue to buy these stocks, which can create a volatile environment in the stock market.

Value stocks tend to perform well during times of inflation because they are often more established companies with stable earnings and a history of paying dividends, making them more attractive to investors seeking steady returns. In contrast, growth stocks are often newer companies with higher potential for future earnings, but they may not have established cash flows to support their valuations.

When inflation rises, investors may become more risk-averse and prioritize stable, predictable returns over potential growth, leading to a decline in demand for growth stocks and a corresponding drop in their market prices.

4. Long-term benefits of increasing inflation rates on stock markets

A certain level of inflation is required for an economy to grow, as it encourages spending and investment. A moderate and controlled rise in inflation rates can lead to an increase in the income of the people and help in boosting the economy.

However, if the inflation rate goes beyond a certain limit, it can have a negative impact on the economy. Therefore, it is crucial to maintain a balance between inflation and economic growth.

Conclusion:

Investors should analyse the trend of inflation rates in recent years before making any investment decisions. Sudden spikes in inflation rates may cause uncertainty and volatility in the stock markets, while a gradual and steady rise in inflation rates can provide a conducive environment for businesses to grow and expand, leading to higher stock valuations. Additionally, investors should consider investing in sectors that perform well in an inflationary environment, such as energy, commodities, and real estate.

___________________________

💻📞☎️ always do your research.

💌📫📃 If you have any questions, you can write me in the comments below, and I will answer them.

📊📌❤️And please don't forget to support this idea with your likes and comment

EURUSD Jan 8th-12th 2024 Weekly Trade Setup-LONGJan 8th-12th 2024 Weekly Trade Setups

See blue long trade

1. Long Play: C- Probability due to being counter swing and counter Internal. The main reason to trade this would be the trade has momentum more bullish than bearish.

2. This would be an investor trade. Very Long Term

Entry Price: 1.08729

Stop Loss: 1.05789

Take Profit: 1.13105 or trail the trends and scale in when all risk is off the table

Please Follow me: I would love to scalp live on tradingview

Jan 8th-12th 2024 Weekly Chart Analysis

1. Price is in the weekly internal break of structure (See Green 1 for Reference) and ranging between the equilibrium of the weekly Ibos strong (See 2 for Reference) and the weekly Ibos low Weak (See 3 for reference)

2. Price is currently in the weekly A.1 Supply Zone with momentum to the upside. (See 1 for reference)

3. Price has had a change of character to the bullish upside in the weekly I-Bos swing range (Between 2 & 3)

4. As of Jan 06rd 2024 the weekly i-bos (Green 2 for reference) is protected and is the strong structure .

5. As for my risk management framework price is more likely to us this supply zone (W A.1) to generate a move to the downside using the buy-side liquidity to induce market participates.

6. The Framework is to trade from strong protected orderflow (square zone with W on right hand side See black* to the left hand side) for reference)

Weekly Chart Signal Trade idea- Multi-time frame AUDUSD Jan 04th 2024

1. The weekly swing is bearish on the weekly time frame. (See green 1 for strong market structure)

A. I expect price to move through my risk management strategy to move from 1 to the 2 on the weekly timeframe

2. Price is currently in the equilibrium between the weekly high strong (see green 3 & 4 for reference)

Price is more likely to move from strong market structure to weaker structure. This is how I based my phases of the market.

3. Price is currently in C.4 supply zone and is trending bullish for the Change of Trend (CHoCH)

4. Trade Ideas (Investor trade plan)

A. I could short trade with a risk entry at the short trade at Black 5

B. I Could also go to a lower time frame and wait for a confirmation entry for a higher probability trade

XRP Monthly Breakout to happen by 2025XRP Monthly Breakout to happen by 2025

Here are some targets I expect to see with my XRP bags in the next 2-3 years tops.

Ripple Stock Market IPO, BTC Halving, Providing Economic Solutions to Liquidity Crisis, and Regulatory Compliance will all be reasons XRP has thee most anticipated runs of all history.

Brad G has kept his confidence in the community and team, with rumors of an Escrow Burn (I dont think will happen) It could bring the price to even higher levels than shown in my NFA prediction.

The community is in fear due to the SEC continuing to keep their noses too close to our industry, but what people don't seek to understand is why they're still here.

XRP has passed BTC before in Market-cap and regulators became worried back then.

The community has continued to grow and support the team which makes me think the SEC speculation is merely FUD. They are worried about potential overtakings of the Swift system and they don't want to make any stands because then they would lose the grey area they're currently trying to exploit. The lawsuit had something to do with Ripple, XRP is totally different.

XRP is a utility token trying to solve thee biggest problems such as our financial system. The SEC and democratic party are okay with printing money to stifle innovation in America.

When this begins to happen again, flood of money should flow out of the government who is acting off of mainly borrowed money because they're broke and people will begin to lose trust and faith.

FDIC concerns could also cause banks to require XRP in order to help with liquidity!

Always do your research and never click random links !!!

Keep your wallets safe this bull run and be smart!!

Understanding Long-Term SPX500 & QQQ Cycle PhasesMy continued effort to share my research, experience, and expectations with the TradingView community has allowed me the freedom to create forward-looking content to help traders/investors understand the real risks/opportunities going forward.

If my research is correct, then next 5+ years will be incredibly difficult for skilled traders/investors. I don't believe the US markets will enter a real organic growth phase until after 2025 (possibly in 2026 or later).

There are many reasons for this extended contraction phase in the US/Global markets. Most importantly is a broad cycle phase related to societal changes. Secondly, we have a Sine-wave structure that confirms a contracting price phase needs to reach a base/equilibrium before it will be able to extend into an organic growth phase.

As a trader, investor, or just someone trying to protect your family, your home, your children, and more, you need to understand the value of PROTECTING CAPITAL before taking on foolish risks. That is exactly what I'm trying to help you manage and understand - where opportunities exist in the markets over the next 5 to 15+ years.

Watch this video, then click on my profile to watch some of my other TradingView videos.

We live in a world where what happened 3 weeks ago is almost forgotten. These cycle phases exist, continue to drive price setups/trends, and will continue.

Are you ready for what's next?

Intel (INTC) -> Don't Forget This StockMy name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitalize on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on Intel.

Looking back at January of 2023 - after a massive dump during 2022 - Intel stock perfectly retested and started to reject a major monthly structure level at the $27 level.

With the next clear resistance level being at $46 I am now expecting more upside on Intel stock before we could then see a short term rejection away from the $46 resistance area.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡