GOLD (XAU/USD): detailed breakdown. What is the next step?As it can be clearly observed from the 3H timeframe graph, after breaking out of the ascending channel illustrated on the chart, the price has managed to re-test the area of the 0.618 Fibonacci retracement level and complete the break+retest pattern.

At the moment, the price is trading within the borders of the rectangular range portrayed on the graph. Considering the strength of the USD and the recent price development of GOLD, we are pretty positive that bearish impulses will continue from here on.

With the Stop Loss above the upper barrier of the consolidation box, we are entering short positions and aiming for the bottom of the ocean.

Investroy

USD/CHF: a 200-pip bullish move is on the way. Do not miss it!As it can be observed from the 3h timeframe graph, the price is currently sitting on a previous zone of resistance which now acts as an area of support. We can identify several attempts of the price trying to break below this level but failing and leaving long wick candles. This gives us confidence that a potential bottom has been formed and the price is preparing to keep pumping to the upside from here.

We are closely observing the situation and waiting for the right time to enter long positions and aim for the 0.986 zone of resistance as illustrated on the chart.

EUR/USD: detailed mark-up. Solid drop inbound?As it can be inferred from the 3h timeframe graph, after ranging within the borders of the sideways-moving range illustrated on the chart, the price has spiked above the upper boundary of it and rejected the area of previous support which now acts as a resistance that lines up with the 0.382 Fibonacci retracement level.

From here, we are closely monitoring the situation and awaiting more bearish confirmations before going short and aiming for the zone of support plotted on the graph.

EUR/GBP: possible drop till the lower boundary of the channel As it can be observed from the 2H timeframe graph of EUR/GBP, an ascending channel has been formed and the price has rejected the upper boundary of it. Currently, we can witness how the recent candle has closed below the local area of support and is now re-testing the same zone. From here, we are closely monitoring the price development and waiting for short confirmations before entering SELL positions and aiming for the lower barrier of the channel.

How to calculate which lot size to useAs mentioned several times before, we risk 1% of our total trading capital per transaction. In simple terms, we risk 1 egg out of the 100 that we have in the basket in an attempt to get more eggs.

However, even though the average price mark where we place our Stop Loss is 30-60 pips away from the entry price, SL levels set differ from one trade to another, and different currency pairs have various differences in pricing (major pairs have small differences for the most part, while minor and cross-pairs have big gaps in pricing).

This article will demonstrate 3 random scenarios and illustrate which lot sizing is needed to be used based on the Stop Loss set and the percentage of the total capital risked while taking into account the size of the trading account. All numbers are imaginary in order to diversify the visualisation of the portrayed examples and give a better understanding of the case.

Enjoy the idea and don't forget to drop your questions in the comment box below!

EUR/GBP: a detailed chart breakdown. Charge up short positions!As it can be observed from the 8H timeframe chart, the price has rejected the 0.871 key area of resistance and started printing bearish moves.

At the moment, we can notice how the price is rejecting the local area of resistance and possibly forming a top before continuing its bearish impulsive movements.

All in all, we are expecting for the price to keep decreasing and reach the area of previous resistance which now serves as support that lines up the 61.8% Fibonacci retracement level.

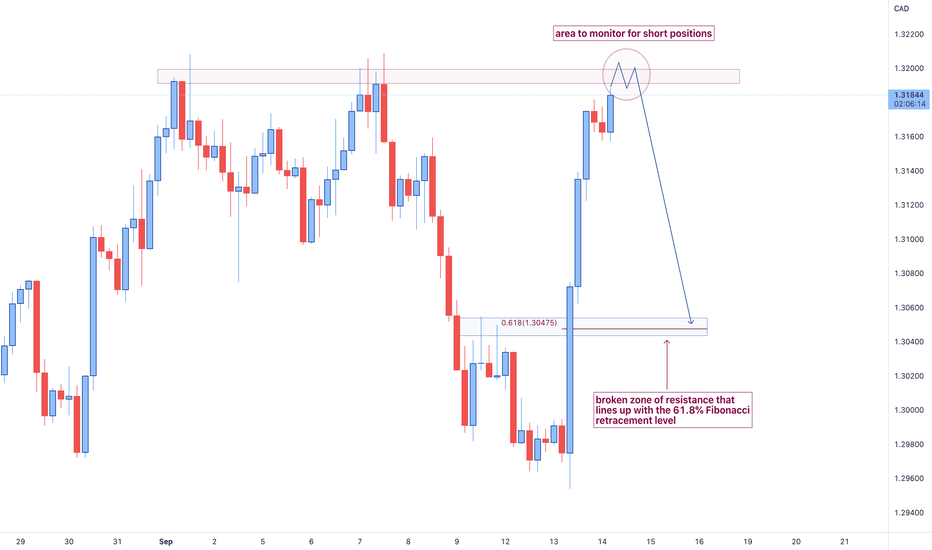

USD/CAD: a possible short-term SELL positionAs it can be noticed from the 4h timeframe chart, the price has made a massive impulsive bullish move to the upside and has now approached a key level of resistance.

After an impulsive move, a correctional leg should follow. Thus, we are patiently waiting for the price to form a valid top at the local key zone before charging up for a short-term bearish rally.

We are targeting the area of previous resistance which has now turned into support that lines up with the 0.618 Fibonacci retracement level.

USD/CHF: a 300+ pip "BUY" opportunity As it can be inferred from the H8 timeframe graph of USD/CHF, the price is currently re-testing an area of crucial support. After the boundary of the descending channel that is pictured on the graph was broken, we were closely monitoring the price action and expecting for the price to re-touch the current local area of support.

Now that we can notice some candlestick confirmations, we are aiming for entering long positions and targeting the area of resistance illustrated on the chart.

EUR/USD: accumulation, manipulation, distribution Looking at the H8 timeframe chart of EUR/USD, it can be inferred how nicely the price is lining up. By using the simple "accumulation, manipulation, distribution" strategy, we will attempt to forecast the future price movement of this pair.

With time and experience, it is relatively easy to spot familiar historical patterns. For example, the current price development strongly resembles what occurred a month ago. As it can be noticed from the graph, after ranging between the borders of the sideways-moving rectangular box plotted on the chart, the price managed to grab liquidity above the upper boundary of this box and then drop all the way down impulsively.

Observing the situation that we have at the moment, we may notice how the both cases are similar. After ranging for some period of time, the price is now attempting to break out of the rectangular box. Most likely, these moves will result in failing to break the upper boundary of the box and leaving wick candles to take out early entrants.

After closely monitoring the situation around the local zone, we will expect for the distribution phase to kick in, and hence, look for short positions.

EUR/USD: bullish moves are not over with!Looking at the recent price development, we may observe how the 0.99 area of support has been impulsively bounced off from.

Plus, the 1.01 - 1.012 area of previous support which now acts as a level of resistance has not been re-tested yet.

Therefore, considering the above-stated facts, we believe there is more room for the price to keep rising to the upside.

Of course, the long-term sentiment remain bearish. Thus, after the short-term bullish moves are done with, we will aim for middle-term SELL positions.

GBP/JPY: have eyes on this correctional move!As it can be observed from the 8H timeframe chart, the price has rejected the area of resistance plotted on the chart. Looking at the recent price development, we can notice how a massive impulsive bullish run has taken place after the breakout of the descending channel portrayed on the graph.

Currently, it can be inferred that the price is headed towards the downside to complete the correctional move of the recent impulsive move.

We believe the price will keep dropping and reach the target set

USD/CHF: possible opportunities to SELL and aim for good returnsAfter rising for quite a while, the price has finally reached an important area of resistance.

Looking at the historical price action, we can observe how a nice double top was formed earlier in July of this year before a bearish rally happened.

Paying a close attention to the current price development, we can infer that there is a high possibility for another double top to be formed before an upcoming drop.

Once enough confirmations are provided, we will be looking into entering short positions and aiming for the area illustrated on the chart as an initial target.

EUR/GBP: detailed chart breakdown. What to expect this week?Setup #1 : EUR/GBP

As we can notice from the graph, the price has had a massive bullish run to the upside. We also know that after an impulsive move, a correctional one is needed.

At the moment, the price is forming a top at the area of resistance that is illustrated on the chart before charging up for bearish moves. A double top pattern has been formed, which means people have already started executing short positions.

Zooming in, we can see how the price is attempting to pullback and re-touch the same level before potentially dropping.

Thus, we are gonna closely monitor the price action, give some space for development, and execute once enough confirmations have been provided.

Our Target Profit will be set at the previous level of resistance that lines up with the 61.8% Fib.

EUR/USD: a quick intraday setupThe sentiment of EURUSD remains bearish, and hence, we are looking for short positions. At the moment, we can observe how a massive bullish candle is attempting to break above the sideways-moving mini-range. We believe that the purpose of this move is to grab liquidity above the local zone before dumping all the way down till the zone indicated on the chart and even further below.

Either way, we will closely monitor the price action and wait for more confirmations before executing short positions and aiming for the target level plotted on the graph.

USD/CAD: bounce off the 50% Fibonacci level. Charge up the longsAs it can be inferred from the graph, the price is currently correcting the impulsive move that took place last week and approaching the 50% Fibonacci retracement level.

From there, we will monitor the price action and expect for the price to keep rising and reach the area of resistance plotted on the chart.

FROM HERO TO ZERO: A COMPLETE GUIDE ON HOW TO BLOW YOUR ACCOUNTHappy new trading week, friends! As you can tell the text above is a satire. However, unironically some of us still make the mistakes above that take you from Hero to Zero. What are the most common mistakes we can avoid in our trading journey? Let's take a look.

1. Taking revenge or jumping into the market because you think you found the trade of your life is the worst thing you can do to yourself. Stay unbiased and keep that clear state of mind.

2. Don’t forget about Stop losses, losing 1% of your account is recoverable, but when you go into more than 10% drawdown, it gets mathematically and psychologically impossible to get back on the horse.

3. Take one trade at a time. The profits will come, focus on the journey.

4. Having trading plan is important but sticking to it is even more crucial. Most losses that I’ve seen come from trades that have been out of the trading plan and didn’t meet one the several entry criteria.

5. There are really good authors on TradingView, but once again they share “Opinions”. Always have your perception of market and stick to it.

6. If you need confluence, please stick to TradingView. The platform has a good ratio of professionals on it, unlike Reddit or any other forums where a 13 year old will convince you that lithium ion batteries are the future.

7. Check your fundamentals, they are as important as technicals.

8. Indicators are fine to use, but they’re like some authors, you still need your own voice of rationality.

9. Some traders spend too much time on external factors, looking for the most perfect trade of their lives, which will, unfortunately, never come. Work with the available market conditions.

10. Yes, having a larger screen does help. Dropping 10.000$ on equipment doesn’t help. This could have been an extra 1.000$+ per month to your income if it was deposited to your account. Keep it optimized.

GBP/USD (cable): short-term growth pendingAs it can be inferred from the 8H timeframe chart, the price has formed a double bottom pattern on a strong level of support. Considering the fact that after an impulsive move, a correctional one is needed, we are expecting for the price to keep rising and reach the area of the STF LL as plotted on the graph to compensate for the massive bearish drop that has occurred.

4 COMMON YET EFFECTIVE TRADE ENTRIESHappy Chewsday, traders! Some of you reached out and asked for more educational articles and we’re here to deliver. Relatively simple but important topic of entries is going to be lightly covered today. The image above should be pretty self-explanatory, but to cover it in more details: There are 4 main entry types.

- Range fadde is when we buy the bottoms and sell the tops of the range. Usually the box/rectangle isn’t large, so the risk-reward ratio is just not there for many traders. However, you can definitely put the stop loss a few pips out of the range and maximize the ratio.

- Reversal is an entry at the most recent extreme, key level. Quite popular approach, but personally, it usually goes against our fight club rule #1: “never fight the trend, he’s your friend”. We do; however, look out for multi-day/week key levels in our ideas as well.

- Breakout is an entry as the price breaks out of a range or any pattern. Very reliable option for beginners that are obsessed with finding repetitive reoccurrences in the market. For example, you can sell at the neckline of head and shoulders pattern and successfully profit from that. It is important to keep in mind that, the more complicated patterns you “notice”, the less people use them, thus, devaluing the importance of it.

- Pullback is an entry after a minor reversal or retest. Statistically speaking, this is one of the most frequent entries utilized by us. It’s simple and you still follow the trend. Draw your key points, look for proper Fibonacci levels and make sure it’s not a complete trend reversal. Of course, you’ll miss out on a few pips this way, but this might change your long-term profit statement.

What’s your favorite entry type?

USD/CHF: completion of the H&S pattern en route. Bullish viewThe price has reached an important intraday zone of resistance. Our bias for this pair remains bullish and we are looking for BUY entries. However, the current area is not a suitable one to go long from. Thus, we are waiting for the price to re-visit the 0.949 area of support and complete the formation of the right shoulder of the inverse H&S pattern before entering BUY positions and aiming for the two targets identified on the chart.

EUR/GBP: slight pullback before further drop?As it can be clearly inferred from the 8H timeframe chart, the price has spiked above the upper boundary of the descending channel plotted on the chart to grab liquidity and immediately dropped back. At the moment, we can see that the price is being unable to push lower and needs some pullback to recharge for further bearish moves.

Thus, we are waiting for the price to visit the 0.848 - 0.849 area of resistance before entering short positions and aiming for the 0.835 zone of support.

EUR/USD: approaching a critical low. A short-term buy setupAs it can be inferred from the 8h timeframe graph of EUR/USD, the price is slowly approaching a critical zone of support where the USD equals the EUR and is even more appreciated. Looking at the technical side of events, after an impulsive move, a correctional one should follow. Although our sentiment remains bearish on this pair, we are expecting for some pullback happen before deeper moves to the downside resume. Thus, we are monitoring the area highlighted on the chart for BUY positions and setting our target at the zone of previous support which nows acts as resistance.

Happy trading, family!

USD/CHF: detailed multi-timeframe analysis. Where to next?Taking a look at the WEEKLY timeframe chart, we can see how the price has bounced off the major zone of support plotted on the graph.

Zooming down to lower timeframes, it can be observed that the price is on the verge of breaking above the local zone of resistance (from both fundamental and technical perspectives). From there, we will give the price some room to consolidate and develop before looking into entering long positions and aiming for the two targets illustrated on the chart.

EUR/JPY: amazing bullish scenario on the wayFirstly, looking at the higher timeframe charts, it can be clearly observed that the sentiment of the market is bullish. Thus, the direction is identified - uptrend.

Zooming into the DAILY (D) timeframe graph, we can notice how the 133.3 price level is acting as a strong zone of support and being rejected. Looking even closer, it can be inferred that the price has failed to create new Lower Lows and has formed a double bottom instead. Therefore, we are pretty positive that the price will keep rising from here on and reach the area identified on the chart.