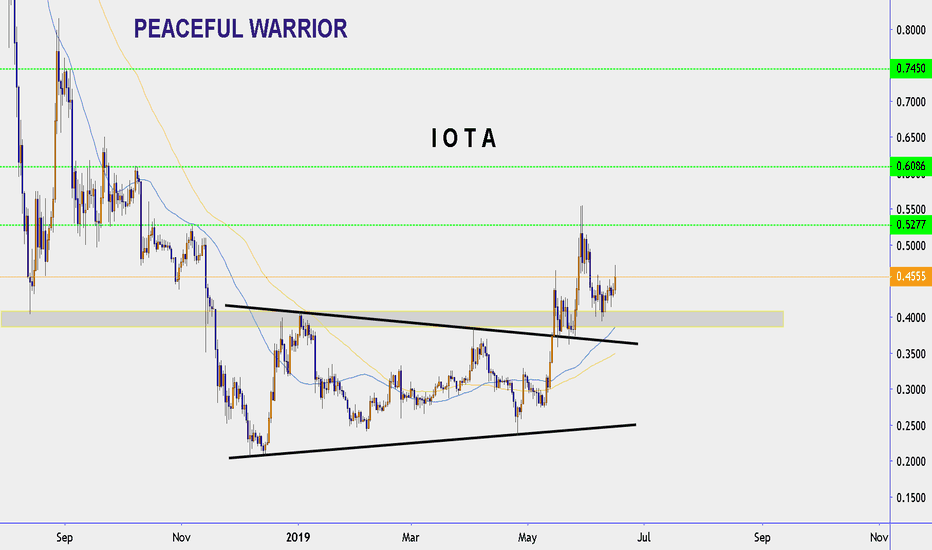

IOTUSD Heavy bullish sentimentIOT has broken above the 1D Channel Up that started the strong uptrend early in January.

Levels to watch:

- The price not only crossed above the Channel Up on the 1D chart but also broke the 0.618 Fibonacci retracement level.

- It is comfortably above both the MA50 and MA200 and in fact a Golden Cross may be due.

- The 0.3150 four month Resistance broke.

- The RSI on the highest values since December 2017.

Projection:

- This is a strong bullish signal with IOT potentially turning parabolic here. The targets are the next Fibonacci retracement levels: 0.786 = 0.4200 and 1.000 = 0.5580.

If you like this idea give us a like, follow and share your thoughts in the comments section below. Remember to stay tuned for future technical analysis , news, updates, and more from PrimeXBT!

IOT

#EthereumClassic #ETC- From The Guy Who Called #BTC Under 2.68#EthereumClassic #ETC- From The Guy Who Called #BTC Under 2.68

This article will mostly focus on key characteristics and fundamentals that I used to make up my LONG investment thesis for #EthereumClassic #ETC

I used the title " #EthereumClassic #ETC- From The Guy Who Called #BTC Under 2.68 " as a reference to my previous article which focused around #Litecoin before it made a 8x move and a New All Time High. I feel #ETC has the same potential for a similar type move if not more.

Hypothesis

I think #EthereumClassic has been one of the most overlooked and undervalued in the top 20 coins by market cap and thus is extremely undervalued. Using predictive logic I am calling for the #Classicening

*Make Note*

(#ETC is trading around 5.40 USD AND #ETH is trading around 154 USD as I write this.)

I won’t go into an extensive historical overview of the history of #ETC #EthereumClassic vs the fork #ETH #Ethereum . Just remember #ETC is the original chain and #ETH is the fork.

I will note some of the key differences and upcoming developments that lend to my Bullish thesis for #EthereumClassic and to support the potential event that I call the #Classicening . (Remember I was the first to call the #Flappening for #LTC)

The #Classicening which will occur when the price of #EthereumClassic (#ETC) surpasses the price of the fork #Ethereum (#ETH)

Discussion

#EthereumClassic (#ETC) is Decentralized, Immutable, Censorship Resistant and has a fixed monetary supply of 210 Mil

#Ethereum (#ETH) is centralized with a proven history of mutability and HAS NO FIXED monetary supply

Q: You might ask why does #Ethereum the fork have a higher market cap currently then #EthereumClassis?

A: The simple answer is hype

A new and uneducated investor class bought the sizzle not the steak. #Ethereum’s price was mainly fueled by the 2017 #ICO (Initial Coin Offerings) craze. Where people mostly had to buy #ETH to participate in these #ICO’s aka. #shitcoins

On the other hand, #ETC didn’t have the hype or the marketing associated with #ICO’s so largely went unnoticed.

Assumption : The new investor class will mature and become more knowledgeable choosing not to invest based on hype but on a coins utility and merit.

Justification 1. For the Classicening

EthereumClassic (ETC) is extremely undervalued because it didn’t participate in the mania of the #ICO craze and thus has been overlooked. As price discovery happens, demand will increase while supply is capped and thus price shall rise.

Meanwhile #Ethereum (ETH) whose price was once fueled by the #ICO craze, now experiences constant oversupply as #ICO projects fight for survival continue to have to sell to keep the lights on or exit scam. No fixed supply and constant selling pressure

Justification 2. For the Classicening

EthereumClassic (ETC) will remain Proof of Work (POW).

Time tested history

#ETC will be the only Decentralized (POW) non-fragmentedTuring complete Blockchain. with a fixed supply.

#ETC will benefit from the addition of hash and mind-space as miners and developers are leaving #ETH and joining #ETC

Ethereum (ETH) will move to Proof of Stake (POS)

No proven history as stated by Vitalik

“There is risk in the transition from PoW to PoS, and PoS has a shorter history to evaluate”

This is not to mention the inherent problems for investors dealing with possible tax ramifications with staking which could further weaken investor demand.

Justification 3. For the Classicening

EthereumClassic (ETC) will have a platform for developers with emphasis on high value and security. This will translate to more DEV’s choosing #ETC to build security focused #Dapps

Ethereum (ETH) will attempt to scale (Something it keeps promising but yet to accomplish) and provide performance on a untested POS chain with more unknown vulnerabilities

Justification 4

EthereumClassic (ETC) is in a very unique position to be successful with a strategy of interoperability vs most coins approach to be the one and only coin (Maxilism)

Instead it will benefit from the utility it can provide across multiple chains including ETH and be a integral part of the larger eco-system

Ethereum (ETH) with sights to be the dominant chain and development history of building on house of cards it increases #ETH chance of a systematic risk. Its development is centrally guided around Vitalik’s vision, this represent another single point of failure.

Conclusion

If the assumptions of the #Classicening prove to not come to pass.

It won’t change the fact that #ETC is still grossly undervalued and thus has outstanding potential to out preform the market.

#EthereumClassic should provide a great investment vehicle both in the short term and longer for investors who see the value in decentralized layer 1 chains and a secure platform for #Dapps .

With many upcoming developments like the upcoming #Atlantis upgrade and chart showing an upside breakout:

There couldn’t be a better time to do your DYOR on #ETC.

It’s relatively scarce and thinly traded so it will take a lot less $ volume to bring it into a New All Time High which will be over 43 USD on most exchanges

8x from its current levels

PS. I wanted to get this write up as quickly as I could, just know my preemptive apology for all the grammar mistakes.

Chart is looking to break it’s MA’s and this is just finishing its retrace from 9+ just a few weeks ago so time is of the essence to DYOR.

=:] My thoughts do your own DD . My opinion might have a rooting bias not an opinion to buy or sell anything

How is that for disclosure =:]

3800 on streamr until april 2020 understand howPlease see related ideas ... long trades to you see my vision.. enjoy

I've been warning about this amazing coin for some time

I was initially able to predict the explosion of iota

bought the .35 and sold it to 5usd

unfortunately i didn't buy iota anymore

the reason?

The tangle net was very slow when tested

but i wanted to invest in iot technology

iot is not just a pyramid, it is something real, tangible.

that's when I met streamr

streamr is iot in real time

an eth based network

very fast and functional

since when i am investing in streamr we have had many updates.

not just hires

real upgrades, we had swash, an add-on that pays for user data

important cross-platform integrations and more.

now it's not just me who sees it

I realized that in binance streamr volume has become one of the top 20

day after day the volume goes up

this happened to iota before the explosion

and now it will happen with streamr

will you go with me?

Looks like the ITC Bottom might be in Vs BTC - IoT ChainAfter ITC finished it's last incredible nearly 4x pump, it fell all the way to new lows vs BTC, however it is still well up vs the USD.

ITC looks primed for another pump.

I wouldn't be surprised if we saw 4200 sat over the next couple of weeks.

If you are going to put a stop loss in I would say at 1380 sat.

If you want to look for a lucky buy in (which you likely won't get) 1650 sat

ITC USDT Still Sitting On Upwards TrendlineFor those that FOMOd in at the top, and have not bothered to zoom out a bit, things might look bleak for ITC, but ITC has not even fallen below the ITC USDT trend-line yet. normally this would be the time to buy.

I see some similarities in the trend-line, and RSI patterns from earlier pumps. During this trendline.

RSI is showing a bullish divergence from the price trendline.

The massive increases in overall volume through this month make me think the trend will continue, at least until it stops, which it has not yet.

Previous shorter term targets have already been met, however I feel we still have a long way to go.

.518

.5737

.6220

.7694

.8631

1.3677

1.9734

3.2443

Previous all time high was $9.57 it is possible it might exceed this long term.

Will The Uptred Continue for another 400% ? It's possible.ITCBTC has pumped near 400% since I said the first pump was coming.

Eventually it seems the FOMO went into overheat and there was a nice bubble formed on the existing trend line which has popped.

I am starting to see signs of this drop slowing down and a return to the trendline.

Medium term target is still at 20 000 satoshi. Beyond that, possibly higher. Time will tell.

If you wanted to put a stop order in I would suggest sub 5500 sat, however I won't be using one, sometimes ITC does fingers down that might trigger them just before a pump.

IOT Chain (ITC): $0.40 | 5280 Satoshiprobably the next DOGECOIN in progress that may just surprise the space againi

ITC BTC - Larger Pump Seems To Be Coming - Bullish Continence ITC has gone up 283% since I first said it was going to pump. You would think this might be over, but I don't think so.

Previous shorter term targets have already been met, however I feel we still have a long way to go.

5600

7500

12595

20724

Previous all time high was 60938 it is possible it might exceed this long term.

Any buy below 5k sat should be good.

If you wish to put a stop loss in 4300 should work. It is unlikely to go below 4400, but there is a lot of volatility in the asset.