#IOTA/USDT T looking good to buy #IOTA

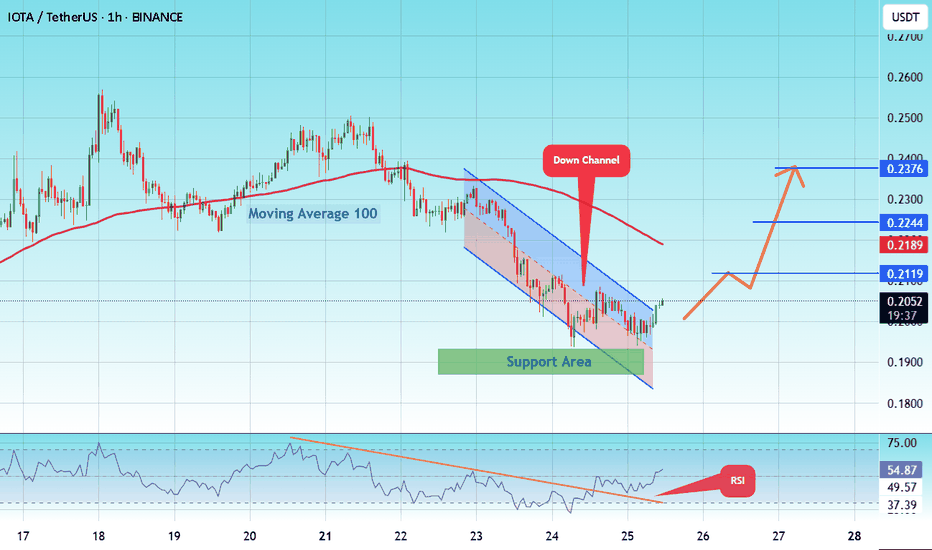

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.1847, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.1880.

Entry price: 0.2054

First target: 0.2119

Second target: 0.2244

Third target: 0.2376

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

IOTA

IOTA/USDT Weekly Analysis – Critical Support Retest

📊 Pattern & Price Structure:

The chart indicates that IOTA is currently retesting a major historical demand zone in the range of $0.110 – $0.160, which has served as a strong support since 2020. The price has bounced off this area multiple times in the past, reinforcing it as a solid accumulation zone.

There is also a potential formation of a double bottom or accumulation range around this level, which often acts as the foundation for a major reversal if accompanied by volume and momentum.

🟢 Bullish Scenario:

If this support holds and buyers show strength:

1. The price could rebound and test key resistance levels:

$0.2454 (initial resistance)

$0.3496

$0.4000

$0.4751

2. A breakout beyond those levels may trigger further upside targets at:

$0.8982 (weekly key resistance)

$1.4913

$2.000

$2.390 and potentially even $2.677

3. Bullish catalysts such as positive fundamental news, rising market sentiment, or visible accumulation volume could spark an explosive move.

🔴 Bearish Scenario:

If the price fails to hold the $0.110 – $0.160 support zone:

1. A breakdown could lead to a decline toward previous extreme lows around:

$0.0700 – $0.0534

2. This would signal a loss of long-term buyer interest and open the door to deeper bearish continuation.

⚠️ Technical Conclusion:

The yellow zone is a make-or-break level — bulls must defend this to maintain any bullish structure.

As long as IOTA stays above $0.110, the risk-reward favors a bullish reversal.

A confirmed bullish weekly candle and volume spike would strengthen the bullish outlook.

📌 Key Levels:

Major Support Zone: $0.110 – $0.160

Resistance Levels to Watch:

$0.2454 → $0.3496 → $0.4000 → $0.4751 → $0.8982 → $1.4913 → $2.000 → $2.390 → $2.677

#IOTA #IOTAUSDT #CryptoAnalysis #AltcoinBreakout #TechnicalAnalysis #BullishReversal #CryptoSetup #SupportAndResistance

IOTA Is Showing a Dangerous Pattern! Don't Ignore This SignalYello, Paradisers! Are you watching what’s forming beneath the surface of #IOTA’s slow drift? While the market sleeps on this coin, a dangerous structure is developing, and if this key support breaks, we could see a fast and painful selloff few are prepared for.

💎After months of low momentum, IOTA is now beginning to show signs of a head and shoulders pattern, a classic bearish reversal formation. This is a structure which cant be ignored, especially not at this stage of the market.

💎#IOTAUSDT neckline support lies between $0.1600 and $0.1500, a range that bulls have barely managed to defend over the past several weeks. If this zone breaks, the confirmation will be triggered and sellers will likely dominate, pushing price lower in a decisive move.

💎The first downside target sits at $0.1350, where moderate support exists. However, this level may not be strong enough to absorb selling pressure if the market sentiment remains weak.

💎If sellers manage to breach $0.1350, expect an accelerated move toward $0.1130–$0.1030. This deeper zone represents major structural support, where a stronger bullish reaction could finally take place.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

IOTAUSD Channel Up eyes +45% bullish leg.IOTAUSD is trading inside a Channel Up, which is the bullish pattern that took it above its 5 month Falling Resistance, essentially the trade war correction.

The 1day MA50 is providing support and the 1day MA200 is already broken, which signals bullish extension.

The Channel's previous bullish leg recorded +45%, so go long and target 0.31000.

Follow us, like the idea and leave a comment below!!

TradeCityPro | IOTA: Testing Key Resistance in RWA-DePIN Rally👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the IOTA coin for you. This project is one of the RWA and DePIN-based initiatives and is among the older projects in this category.

✔️ The coin has a market cap of $822 million and ranks 85th on CoinMarketCap.

📅 Daily Timeframe

As you can see on the daily timeframe, after finding support at 0.1547, the price initiated a bullish leg and moved up to the resistance zone I’ve marked.

💥 This area is a very significant resistance zone, and in this bullish leg, the price has reached it for the first time and got rejected.

🔍 In my view, as long as the price hasn’t confirmed a breakout above 0.1960, the chance of starting a downtrend is higher than continuing the current uptrend. If this resistance zone is broken, we can consider it strong confirmation of buyer strength.

📈 For a long position, we can enter on the breakout of this same zone. For spot buying, this trigger can also be used, but the main long-term triggers are 0.3774 and 0.4918.

⚡️ On the RSI oscillator, there's an important zone at the 50 level. If this level is broken, the probability of breaking 0.1960 increases. If that happens, the next support zone will be 0.1547.

📊 Make sure to pay close attention to volume. If any of our triggers are activated without volume confirmation, the likelihood of a fake breakout increases.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

IOTA Could Be On The Way Back To December 2024 HighsIOTA with ticker IOTUSD made sharp and impulsive rally at the end of 2024, which we see it as a first leg (A)(1) of a bigger recovery in minimum three waves (A)(1)-(B)(2)-(C)(3). Since the beginning of 2025, Crypto market slowed down and IOTA made a deep retracement, but in three legs ABC with an ending diagonal/wedge pattern into wave C, which indicates for a correction in wave (B)(2).

Well, it nicely bounced recently, making a clean five-wave impulse away from projected 78,6% Fibonacci support and back above channel resistance line, so it can be wave 1 of a new five-wave bullish cycle within higher degree wave (C) or (3). That said, after current pullback in wave 2, be aware of more gains for wave 3 of a five-wave bullish cycle that can send the price back to December 2024 highs this year.

#IOTA/USDT#IOTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2125.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2135

First target: 0.2261

Second target: 0.2364

Third target: 0.2483

IOTA Analysis (1D)IOTA has a bullish structure on the higher timeframes. It is currently approaching a support zone through a time-based correction.

We are looking for buy/long positions around the POI (Point of Interest) zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

IOTA: Your Altcoin Choice (S3.5)IOTAUSDT was producing lower lows until November 2024, then it went bullish and the correction of this bullish wave ended as a strong higher low. This is the 7-April low three weeks ago. Now IOTAUSDT is full green on the third week. Growing non-stop since the bottom was hit.

So the charts are great. We can see the bear market, a consolidation period and then a recovery phase. Now comes the next stage of the cycle and this is a new bull market. See the action in 2021 for reference. Massive growth ahead.

Some targets can be seen on the chart. These are not potential ATH projections but rather conservative targets. Total growth in 2025 can be much more and it seems possible that the bull market will extend into 2026 because time is needed for massive growth.

The next cycle top can happen in November 2025 just as it can happen in February or March 2026, too early to know.

If we take November 2024 as the market bottom and count 1 year and 1 month for the totality of the bullish phase, this would put a new cycle top around December 2025, give or take a few days.

That's just the map. This can give you an idea of what to expect.

Plan and ahead and prepare.

I am wishing you great profits, ease in your personal growth journey and financial success.

May your life be blessed with abundance.

Thanks a lot for your continued support.

Namaste.

Can #IOTA Gain Bullish Momentum Again or Not? Key Levels Yello, Paradisers! Is #IOTA about to break out or is another rejection going to send it even lower? Let’s break down the latest #IOTAUSDT setup:

💎#IOTA is forming a bullish flag on the 1D timeframe, a classic continuation pattern that often leads to a strong upward move. After a parabolic run in late 2023, price action has been consolidating within a descending channel, respecting both support and resistance levels. But the real battle is about to begin.

💎The key breakout zone sits around $0.31—this is the descending resistance that IOTA must break to confirm a bullish reversal. A clean breakout with volume could send prices surging toward the $0.61–$0.63 resistance zone, where sellers may step in.

💎On the downside, the support zones between $0.17 and $0.10 remain crucial. Bulls need to defend this area to maintain the bullish structure. The buyers have already tested these levels, and they held. You can watch for strong volume and the 50-EMA to confirm growing demand at these levels.

💎If buyers fail and a daily candle closes below $0.10, it would invalidate the bullish scenario, potentially leading to a deeper correction toward lower levels.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

TradeCityPro | IOTAUSDT Identifying a Re-Entry Point for Buying👋 Welcome to TradeCityPro Channel!

Let’s analyze one of the oldest coins in the market that has recently experienced a bullish move. Together, we’ll find our entry and exit points.

🌐 Overview Bitcoin

As always, before analyzing IOTA, we’ll take a quick look at Bitcoin on the 1-hour timeframe. Bitcoin is currently undecided, consolidating below its resistance and ATH while undergoing a correction. The positive aspect of this is that the volume is decreasing during the correction phase.

If you missed the previous entry, you can open a long position at the 106996 resistance with a wide stop-loss at 99851. This level can also act as your spot trading trigger, but only if you don’t hold Bitcoin. Personally, I would wait for Bitcoin’s dominance to drop and then switch my focus to altcoins.

📊 Weekly Timeframe

On the weekly chart, IOTA has been within a falling wedge pattern, which is inherently bullish and capable of reversing the primary trend. After breaking the 0.1423 trigger, the bullish move was activated.

Before the breakout, the weekly candle engulfed the three previous candles, signaling that bearish momentum had ended and giving an early signal to add this coin to the watchlist.

If you entered at 0.1423 or 0.2022, it would have been logical to secure your initial investment and continue holding the remaining coins. For now, there aren’t any clear weekly triggers for a new entry.

📈 Daily Timeframe

On the daily timeframe, IOTA has been performing better than most altcoins. While many altcoins have retraced to their daily boxes, IOTA remains above the 0.382 Fibonacci level, which is a strong bullish signal.

Momentum entered the coin after breaking the 0.1888 resistance—the top of the daily box—with a strong candle and good volume. At that point, it was possible to enter with a risky stop-loss at 0.1485 or a safer stop-loss at 0.1081. Afterward, the price moved up to 0.4999, showing signs of weakening momentum with smaller candles indicating a potential pullback.

If you’ve already entered during the breakout, hold your position for now.

You can exit if the price stabilizes below the 0.28 support, but I personally wouldn’t, as the chart still shows a bullish posture.

If you’re looking to re-enter or add more, wait for a breakout above 0.4018, which could initiate a new primary bullish trend.

The 0.1081 fake breakout triggered a significant reversal, marking the start of a new bullish move. This behavior highlights the importance of recognizing fake breakouts as trading opportunities.

If 0.28 is broken, the next support levels to watch are 0.2365 and 0.1888, though it’s unlikely for the price to drop below these levels at this stage.

As long as the price stays above 0.28, IOTA remains bullish , Wait for a breakout above 0.4018 to confirm a new bullish trend , Support levels are 0.28, 0.2365, and 0.1888 , IOTA continues to show strength, making it an interesting candidate for long-term holding or strategic trading.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

iota long midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

IOTA can increase!BINANCE:IOTAUSDT

IOTA is forming a bullish rounded bottom which means the price can increase after the break out happens!

the expected bullish movement is as much as the depth of the rounded bottom!

also we can see a bullish divergence on MACD!

⚠️ Disclaimer:

This is not financial advice. Always manage your risks and trade responsibly.

👉 Follow me for daily updates,

💬 Comment and like to share your thoughts,

📌 And check the link in my bio for even more resources!

Let’s navigate the markets together—join the journey today! 💹✨

IOTA at $0.28 Support: Breakout or Breakdown Ahead?IOTA/USDT is trading within a descending triangle pattern, indicating consolidation with lower highs and steady support.

The initial support is at the $0.28 level, providing a key area to watch for potential breakdowns.

A breakout above the descending resistance trendline could trigger a bullish move, with targets in the $0.36-$0.38 zone.

DYOR, NFA