#IOTA/USDT T looking good to buy #IOTA

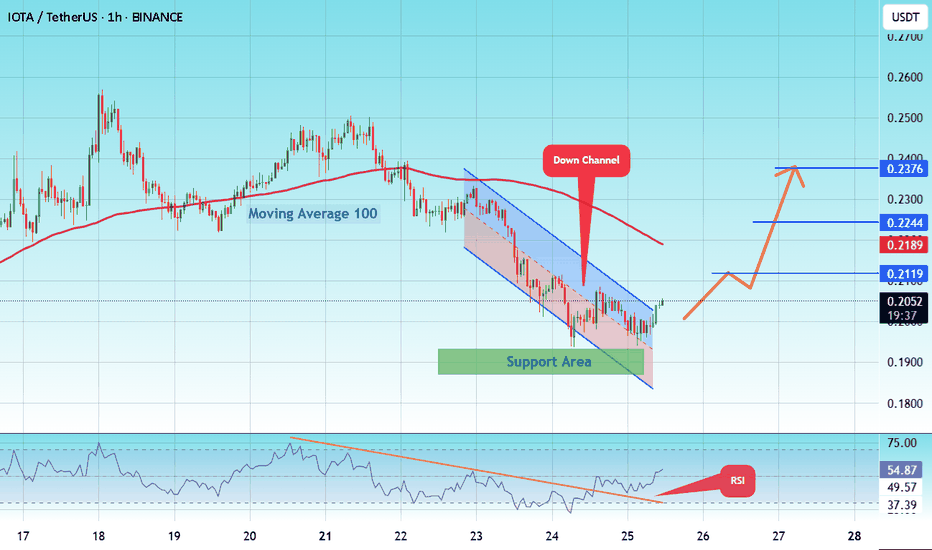

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.1847, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.1880.

Entry price: 0.2054

First target: 0.2119

Second target: 0.2244

Third target: 0.2376

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Iotabtc

#IOTA/USDT#IOTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2125.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2135

First target: 0.2261

Second target: 0.2364

Third target: 0.2483

IOTA Analysis (1D)IOTA has a bullish structure on the higher timeframes. It is currently approaching a support zone through a time-based correction.

We are looking for buy/long positions around the POI (Point of Interest) zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

#IO/USDT#IO

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.6800.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.7905

First target: 0.8560

Second target: 0.9420

Third target: 1.03

#IOTA/USDT#IOTA

The price is moving within a descending channel pattern on the 12-hour frame, which is a retracement pattern

We have a bounce from a green support area at 0.2000

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum

Entry price is 0.2100

The first target is 0.2471

The second target is 0.2700

The third goal is 0.2990

#IOTA/USDT /Ready to go up#IOTA

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.1011

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1182

First target 0.1274

Second target 0.1360

Third target 0.1496

#IO/USDT#IO

The price is moving in a descending channel on the 1-hour frame and is sticking to it well

We have a bounce from the lower limit of the descending channel and we are now touching this support at a price of 1.45

We have a downtrend and the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.48

First target 1.57

Second target 1.70

Third target 1.83

IOTA is bullishFrom where we put the red arrow on the chart, it seems that the correction of IOTA has started.

This correction seems to be a double (zigzag + triangle) that is now over and the trigger line is broken.

By maintaining the green range, it can move towards the targets.

Closing a daily candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

IOTA LOOKS BULLISHFrom where we have written "START" on the chart, a new pattern has started, the waves A and B of this pattern have ended and we have entered the bullish wave C.

By maintaining the green range, it can go to the targets.

We have a high liquidity pool, and the first target is to sweep this pool.

Closing a candle below the invalidation level will violate the analysis

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

#IOTA/USDT#IOTA

The price has been moving in a bear flag since July 2023

The downtrend has been broken

The moving average100 was also broken above

We also have oversold conditions on the MACD

Current price 0.2850

A rebound to 0.2270 is expected

Target 0.3640

Which represents 150% of the current price

You should pay attention to the retracement areas as shown on the analysis

WHAT AFTER THE VOLUME INCREASE IOTAThank you for reading this update.

Depending on our study we see that IOTA has a good chance of volume increase.

This updates depending on day trade, And the market should confirm with time the right market way.

Since the last increase its important to see IOTA having a new confirmation.

If there is new trend ww follow with new update.

#Nottradingadvice

IOTA / IOTAUSDTGOOD LUCK>>>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

The 0.1765-0.1968 section is the first diverging sectionHello?

Traders, welcome.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a good day.

-------------------------------------

(IOTAUSDT chart)

(1D chart)

Could the current be the last low point of this time?

This can only be known in the past.

Therefore, rather than worrying about such things, it is necessary to focus on determining the timing of short-term buying by checking whether there is support or resistance at any point or section.

In that sense, the 0.1765 point is an important support and resistance point.

Therefore, the key is whether the price can sustain the price increase above the 0.1765-0.1968 range.

To do so, it is important to be able to hold the price up until it rises above 0.1592 and the MS-Signal indicator turns into a bullish sign.

When this happens, it's time to start short-term trading.

Depending on whether this short-term trade rises above the 0.1765-0.1968 range or not, you need to decide whether to get a cash profit or leave the number of coins (tokens) corresponding to the profit to have the power to continue trading.

It takes a lot of time to turn into a full-fledged uptrend, so it's tedious and exhausting to keep increasing your holdings until then.

However, if you increase the number of coins (tokens) you have for profit, you will eventually be able to get a big profit.

Whether it's worth taking IOTA into mid- to long-term trading that way is up to you.

FYI, the current coin market is still far from the real world.

Therefore, the real world, that is, whether or not there is business value, should not be used to determine the value of a coin.

Whether or not the current coin is worth investing in is based on the number of users, that is, whether or not there is community power.

-----------------------------------------------

(IOTAKRW chart)

(1D chart)

It needs to rise above 329 to turn into an uptrend.

To do so, it needs to show a rise above 217 to hold the price.

Based on the current trend, whether it can rise above the 217-283 zone will determine whether a trend reversal will begin or whether the cascade will continue.

Therefore, in order to start trading IOTA, when it shows support around 217, I think it's when the MS-Signal indicator turns into a rising sign and shows support and rising.

-------------------------------------------------- -------------------------------------------

** All descriptions are for reference only and do not guarantee profit or loss in investment.

** The trading volume indicator is displayed as a candle body based on 10EMA.

Display method (in order of boldest)

More than 3x 10EMA trading volume > 2.5x > 2.0x > 1.25x > trading volume below 10EMA

** Even if you know other people's know-how, it takes a considerable period of time to make it your own.

** This is a chart created with my know-how.

---------------------------------

IOTA ANALYSIS (1D)Hi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the IOTA symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

IOTA formed bullish BAT for upto 26% pumpHi dear friends, hope you are well, and welcome to the new update on IOTA (MIOTA) coin with USD pair.

Previously I shared a long-term trade setup of IOTA, which is still in play:

Now On daily time frame, IOTA has formed a bullish BAT move for another bullish reversal move.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

IOTAUSD still early (170% gains to be made)We believe that IOTA bottomed out and it's ready to start/continue the uptrend.

If you're patient, you can make even 170 % gains , however it will probably take many months. Take profit levels are shown on the chart.

Buying now for a mid-term or long-term trade/investment may be a good idea.

IOTA is still cheap and we believe that it's very undervalued.

Good luck