#IOTA/USDT T looking good to buy #IOTA

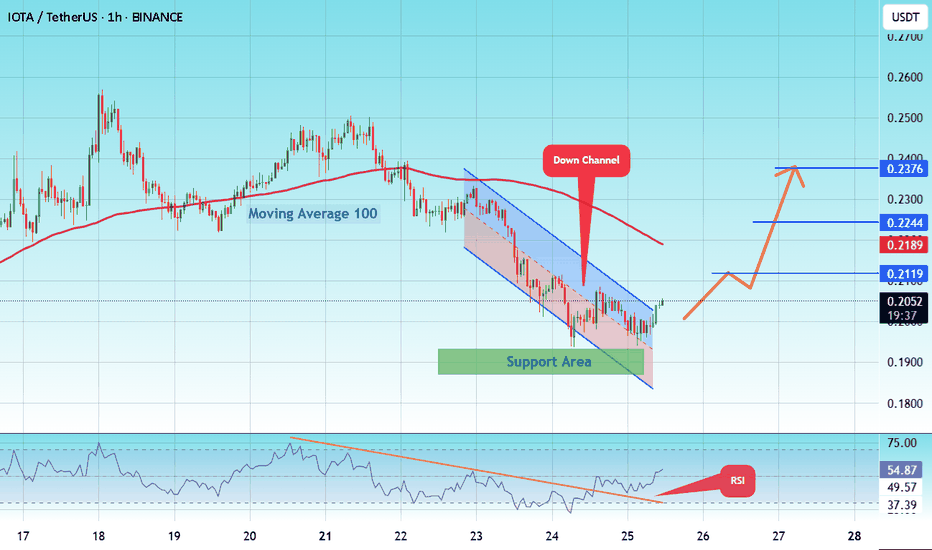

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.1847, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.1880.

Entry price: 0.2054

First target: 0.2119

Second target: 0.2244

Third target: 0.2376

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

Iotaeth

#IOTA/USDT#IOTA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.2125.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2135

First target: 0.2261

Second target: 0.2364

Third target: 0.2483

#IOTA/USDT#IOTA

The price is moving within a descending channel pattern on the 12-hour frame, which is a retracement pattern

We have a bounce from a green support area at 0.2000

We have a tendency to stabilize above the Moving Average 100

We have an upward trend on the RSI indicator that supports the rise and gives greater momentum

Entry price is 0.2100

The first target is 0.2471

The second target is 0.2700

The third goal is 0.2990

#IOTA/USDT /Ready to go up#IOTA

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.1011

We have an upward trend, the RSI indicator is about to break, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.1182

First target 0.1274

Second target 0.1360

Third target 0.1496

IOTAETH - Support, Resistance and TPThe price came out of the area of the dynamic resistance line, which is 4 years old, which may mean a new trend - up.

Chart show's the key points and profit zone.

Profit is huge -1450%.

Enough to make you rich.

It's worth a try.

IOTAUSDT, We are going toward support zone areaHello everybody

According to the chart you can see the the price is in correction-downward trend and we have 2 scenario that can be happen, one of them is we are made AB of elliott correction and now we are ready to making C of the correction ABC or another theory is we finish the ABC correction and we made wave 1 and we are in coorection 2 of the first wave , the 2nd scenario is more valid than the others because its not attractive that the price drop more to prz level and its not good because if the 1st theory want to happen the btc should dump more to 30K and at this time its not happen

According to the chart the both of the support (S) zone area its good to buy in 2 step and reduce average purchase and wait until the target reach.

We will update targets in future

Good Luck

Abtin

#IOTA $IOTA #MIOTA - The Market CycleI'm now looking for the 4th wave to complete on HTF support, which will then lead us into a very violent and explosive 5th wave. Look at Oct 2017 > December 2017 as an example.

The times/dates of price forecast are only for illustration purposes.

I believe this will be the 'minimum' target to chase within this Bull Market Cycle.

I'm long. Average re-entry of 0.65c.

IOTA - TWO SCENARIOSI'm now scalping long up to $2.25 - further price action will be observed in this topic.

Currently locked in medium term bullish pennant, price will most likely re-test both of the resistance/support levels number of times until breaking out.

Two scenarios presented in green and red.

If interested in my point of view, comment and follow the idea.

#IOTASTRONG

Last chance to board #IOTA $IOTA #MIOTA$IOTA #IOTA #MIOTA - Is at the last point of supply, before the inevitable happens, and new millionaires are made.

This is Wyckoff Theory. It's how large money moves a market to their will.

Don't fight large money, just ride their waves.

The next major wave from here is vertically up.

PS—preliminary support, where substantial buying begins to provide pronounced support after a prolonged down-move. Volume increases and price spread widens, signaling that the down-move may be approaching its end.

SC—selling climax, the point at which widening spread and selling pressure usually climaxes and heavy or panicky selling by the public is being absorbed by larger professional interests at or near a bottom. Often price will close well off the low in a SC, reflecting the buying by these large interests.

AR—automatic rally, which occurs because intense selling pressure has greatly diminished. A wave of buying easily pushes prices up; this is further fueled by short covering. The high of this rally will help define the upper boundary of an accumulation TR.

ST—secondary test, in which price revisits the area of the SC to test the supply/demand balance at these levels. If a bottom is to be confirmed, volume and price spread should be significantly diminished as the market approaches support in the area of the SC. It is common to have multiple STs after a SC.

Note: Springs or shakeouts usually occur late within a TR and allow the stock’s dominant players to make a definitive test of available supply before a markup campaign unfolds. A “spring” takes price below the low of the TR and then reverses to close within the TR; this action allows large interests to mislead the public about the future trend direction and to acquire additional shares at bargain prices. A terminal shakeout at the end of an accumulation TR is like a spring on steroids. Shakeouts may also occur once a price advance has started, with rapid downward movement intended to induce retail traders and investors in long positions to sell their shares to large operators. However, springs and terminal shakeouts are not required elements: Accumulation Schematic 1 depicts a spring, while Accumulation Schematic 2 shows a TR without a spring.

Test—Large operators always test the market for supply throughout a TR (e.g., STs and springs) and at key points during a price advance. If considerable supply emerges on a test, the market is often not ready to be marked up. A spring is often followed by one or more tests; a successful test (indicating that further price increases will follow) typically makes a higher low on lesser volume.

SOS—sign of strength, a price advance on increasing spread and relatively higher volume. Often a SOS takes place after a spring, validating the analyst’s interpretation of that prior action.

LPS—last point of support, the low point of a reaction or pullback after a SOS. Backing up to an LPS means a pullback to support that was formerly resistance, on diminished spread and volume. On some charts, there may be more than one LPS, despite the ostensibly singular precision of this term.

BU—“back-up”. This term is short-hand for a colorful metaphor coined by Robert Evans, one of the leading teachers of the Wyckoff method from the 1930s to the 1960s. Evans analogized the SOS to a “jump across the creek” of price resistance, and the “back up to the creek” represented both short-term profit-taking and a test for additional supply around the area of resistance. A back-up is a common structural element preceding a more substantial price mark-up, and can take on a variety of forms, including a simple pullback or a new TR at a higher level.

$IOTAUSDT - Multiyear AccumulationThe study of Wyckoff Theory, along with market cycles, would suggest IOTA is being heavily accumulated within this range.

With a clear demand level of 0.20c and clear supply level of 0.40c. Anything sold above 40c is a win, and anything bought below 20c is a win.

Until we've breached the downwards channel resistance, and weekly range high resistance, we can assume we'll just keep dancing between these levels.

If 0.23c is lost as support, a capitulation event could occur.

If 0.23c holds, we may finally get a rally coming out of this range.

As a tech company at the forefront of technology advancements, once the composite man unleashes this beast, generational wealth will be made for those who accumulated the lows.

IOTA/BTC (Test Major Support?)💎Technical Analysis Summary💎

BINANCE: IOTABTC

-IOTA is trading on a downtrend channel

-It is approaching the key support area at the 2100s sat

-If we see a reversal or channel breakout

-That's a good entry point with proper stop loss location

-The upside potential is up to 2900s sat or higher

``````````````````````````````````````````````

Trading Involves High Risk

Not Financial Advice

Please Exercise Risk Management

``````````````````````````````````````````````

If You Like My Daily Published Ideas

A little Help By Supporting My Channel

Through Leaving A Thumbs Up, Comment & Follow

Happy Trading! --> Thank You! :)

``````````````````````````````````````````````

IOTA/BTC (Strong Bounce @ Golden Fib?)BINANCE: IOTABTC

-Strong bounce at major support area around 2500 sat

-This zone is a confluence of golden Fib level and 200D MA

-If the daily candle closes back above the trendline support

-There is a chance IOTA to test the 3100 sat potential new resistance

-Still very high risk, Bitcoin should stabilize for Altcoins to recover faster

-Please exercise proper risk management in this time of sell-off

**If you like my daily Published Ideas

**Please don't forget to leave a thumbs up & comment

**Thank you! :)

IOTA/BTC (Back at Key Support, Will Start new trend?)IOTA/BTC

-the is price back at the previous resistance zone

-and has the potential to flip new support

-it has also broken the downward trendline

-but there is a minor resistance at 2400s level

-I recommend buying only if we can break/close above 2400

-your target is the recent top at the 2700s or higher

-stop loss is placed under the 2300s