Iotausd

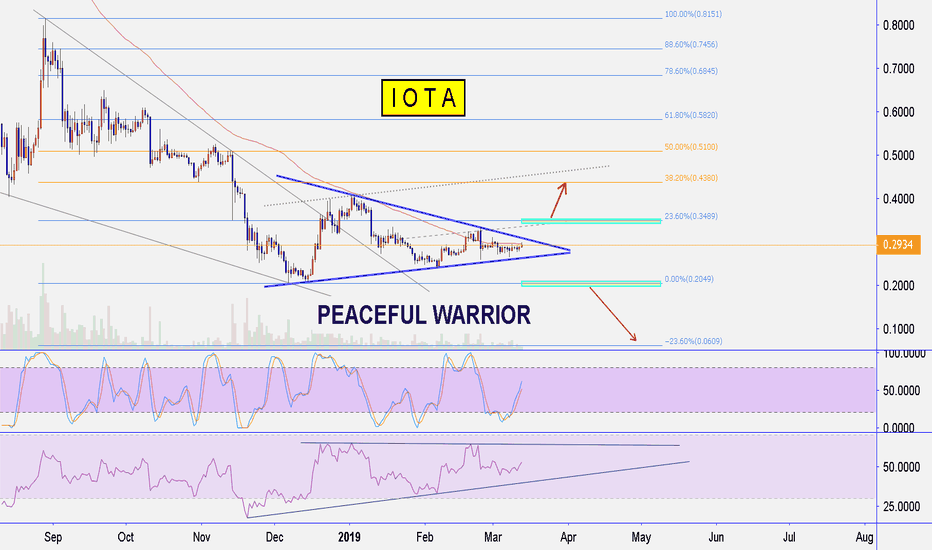

IOTA IS LIKE A BOMB READY TO EXPLODEFOR 16 MONTHS, IOTA IS IN A DOWN TREND IN TRIANGLE PATTERN.

THIS RESISTANCE TREND IS VERY STRONG AND IMPORTANT.

LOOK AT THE MA200 , THIS INDICATOR BULLISH TREND .

IF THE PRICE CROSS UP THE MA200 AND THE TRIANGLE PATTERN WITH VOLUME,

THEN IOTA WILL BE IN HUGE BULLUSH RUN.

6X PROFIT MIGHT COME WITH IOTA.

IOTA - Hopium, Hopium, and Hopium...IOTA is looking slightly bullish on the daily timeframe as it is about to break out of the triangle. Not to mention, bulls did an amazing job defending the daily MACD cross right at the zero mark.

On the weekly timeframe, we can see the RSI making a potential inverse head and shoulders pattern. Similar to every inverse head and shoulders pattern, we must wait for the break of neckline resistance as confirmation.

Using a variety of synthetic currency pairs, we can compare the strength/weakness between IOTA and other cryptocurrencies. In this example, we will use synthetic pair IOTUSD/NEOUSD which simplifies into IOT/NEO.

There's a very visible bearish divergence in MACD, RSI, and Stochastic. There's a possibility that money from algo traders that are trading synthetic currency pairs may go into IOTA due to its temporary weakness against other cryptocurrencies. But keep in mind, this is simply a method to compare the strength/weakness between two highly correlated asset. USD value of IOTA does not necessarily have to go up in order for IOT/NEO to go down.

Using IOT/ETH pairing, we could see that we're approaching a long term support trendline with a double bottom starting to form. This further supports my point in IOT/NEO: IOTA should theoretically gain strength compared to other cryptocurrencies in the coming days or weeks.

Just like every single double bottom, a retest of the neckline is necessary. The neckline support must hold or else it would indicate that IOTA is still too weak.

Feel free to share your long-term bearish ideas, it's always good to know both sides.

IOTAIOTUSD / IOTAUSD

Price is narrowing, the volatility subsides before the storm. The question of which way the blow would be would not have taken a decision in the medium term. There is a chance to pass at least 38-50% Fibo on the chart upwards. You also need to consider that we are in a falling trend and the opportunity to go down below 20 cents is very large. Indicators looks for bulls more.

There is a trading opportunity to buy in IOTAUSDMidterm forecast:

While the price is above the support 0.2045, beginning of uptrend is expected.

We make sure when the resistance at 0.4015 breaks.

If the support at 0.2045 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

The RSI bounced from the downtrend #1 and it prevented price from more gains.

A trough is formed in daily chart at 0.2667 on 03/09/2019, so more gains to resistance(s) 0.3340 and maximum to Major Resistance (0.4015) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 49.

Trading suggestion:

There is a possibility of temporary retracement to suggested support zone (0.2660 to 0.2045). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.2660)

Ending of entry zone (0.2045)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.3340

TP2= @ 0.4015

TP3= @ 0.4535

TP4= @ 0.5260

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

IOTAUSD updateIOTA reach support ascending triangle.

I mark previous drawdown with false break down happen at previous touch.

Rightnow, we still wait for same drawdown with maximum target at 0.27687556 or maybe lower than that before we have bullish run.

I will update more quick analysis if we have a perfect buy low (depend on price action)

Make sure you hit "LIKE" to get quick update notification.

click to see previous analysis

IOTA - Miota can't fly moment IOTA- Miota forecast

Frame: 1D/ 4H minor uptrend after the news of Apple play and Samsung play accept payment by IOTA

Short time: minor upward but there a corrective, refer zone BUY and SELL

IOTA/USDT Binance

OMG/BTC Binance

BUY zone:

0.285 ~ 0.295

SELL Target:

0.3266

0.3439

0.3621

0.3778

STOP LOSS: under 0.275

***

IOTA (IOTA) basis Information:

IOTA (IOTA) is a distributed ledger for the Internet of Things that uses a directed acyclic graph (DAG) instead of a conventional blockchain.

Its quantum-proof protocol, Tangle, reportedly brings benefits like 'zero fees, infinite scalability, fast transactions, and secure data transfer'.

The IOTA Tangle is a Directed Acyclic Graph which has no fees on transactions and no fixed limit on how many transactions can be confirmed per second in the network; instead, the throughput grows in conjunction with activity in the network; i.e., the more activity, the faster the network.

@TrungVuz #TrungVuz Trading

IOTA/USD RANGING IN WEDGEIOTA has broken out of the longterm downtrend and retested the trend line and is now ranging in a symmetrical wedge. Looking for either one more bounce off the bottom of the wedge before buying in with PA or a breakout and retest.

Indicators: Lower timeframes looking bearish for a pull back, higher time frames are looking bullish.

There is a trading opportunity to buy in IOTAUSDMidterm forecast:

While the price is above the support 0.2045, beginning of uptrend is expected.

We make sure when the resistance at 0.4015 breaks.

If the support at 0.2045 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

Price is below WEMA21, if price rises more, this line can act as dynamic resistance against more gains.

Relative strength index (RSI) is 45.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.2660 to 0.2045). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.2660)

Ending of entry zone (0.2045)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.3340

TP2= @ 0.4015

TP3= @ 0.4535

TP4= @ 0.5260

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

There is a trading opportunity to buy in IOTAUSDTechnical analysis:

. IOTA/US Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 45.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.2610 to 0.2045). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.2610)

Ending of entry zone (0.2045)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.3340

TP2= @ 0.4015

TP3= @ 0.4535

TP4= @ 0.5260

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

IOTA (MIOTA) Price Prediction - Overview and Long-Term ForecastIOTA is an open source distributed ledger designed to execute transactions between machines connected to the Internet-of-Things. According to its founders: “We envision IOTA to be a public, permission less backbone for the Internet of Things that enable true interoperability between all devices”. Sounds a little scary to me though, could be the start of “Skynet” and we all know how that turned out.

It was launched in July 2017 and uses a Decentralized Acyclic Graph (DAG) instead of a blockchain. Its native digital asset is called MIOTA which enables micro-transactions between connected devices. The use of the DAG removes the dependency on miners for transaction validation: each new transaction must approve two previous transactions, thus eliminating the need for consensus in IOTA’s network.

IOTA (MIOTA) Technical Analysis – The Big Picture

MIOTA has been trading at $0.29 with a total circulating supply valued at $810,668,236. This puts it in the number 14 spot by market cap rankings.

Similar to most other cryptocurrencies, IOTA reached its all-time high in late December 2017 and has been sliding lower ever since. The last few weeks have been flat, with low volume and almost no volatility which means we may see a strong move to either side very soon. However, this next strong move may be short-lived, and the price could reverse rather quickly so I urge caution.

In the longer term, we can expect to see some type of bullish-movement develop due to the fact the downtrend is exhausted, there is established support in the $0.24 area and bearish advances have stalled.

From a Daily chart perspective, the pair is trapped inside a horizontal channel created by 0.2415 support and 0.4000 resistance. The bears have attempted to break said channel but failed so we can consider it to be firm support for the time being.

This presents us with two scenarios that could develop over the next 3 to 6 months. A break of 0.4000 could generate a climb to the previous significant high of 0.8200 while a break of 0.2415 will likely trigger an extended drop to the all-time low. A bullish break of the 100 days Exponential Moving Average (red line on daily chart above) would increase the chances of a move above 0.4000, thus opening the door for a move into 0.80 area over the coming months.

Daily Chart Support: $0.2415 ($0.2400)

Weekly Chart Support: $0.2400 followed by the all-time low at $0.14

Daily Chart Resistance: 100 days Exponential Moving Average and $0.4000

Weekly Chart Resistance: $0.4000 and $0.8200

Most likely scenario: a break of the horizontal channel will likely generate an extended move towards either $0.8000 or $0.1400; beware that the initial break may be a false one

Alternate scenario: price action remains flat for the coming months, with no interest for the coin from either bulls or bears

IOTA - CALL FOR BOTTOM RISINGIOTA is one of my favorite coins. Let' start in short.

IOTA has been consolidating in the triangle for some time. There is still not enough volume to push it up.

But upon reaching the point E this volume can increase with demand and I expect we could get some nice positive momentum.

After confirmation of the wave E, it is going to be the right time to pick your spot.

Target zone marked.

IOTANow IOTA moving in accumulation zone this is good zone for buy before IOTA fly. According to my observations, I noticed that the iota team has market makers who know and have experience how to make a rocket for the price of iota. that's why my recommendation is to add this coin to portfolio for the medium term. Swing trading

IOTA ($IOTA) - up to 460% PPT! Long term trade.$IOTA is showing bullish divergence on daily chart.

Price reached buy zone and had been moving there for a while.

$IOTA is one of the top project in crypto space with great idea and community support.

Green - buy. Red - sell.

I do not recommend using this chart for margin trading.

It's not a financial advice.

Trade carefully and good luck!