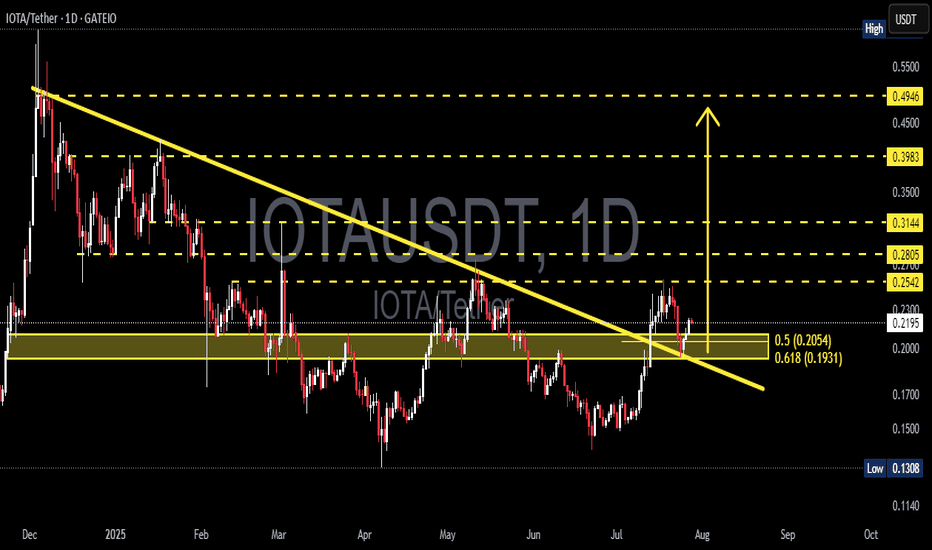

IOTA/USDT – Major Breakout from Long-Term Downtrend!📊 Chart Overview

After spending several months under pressure within a long-term descending trendline since December 2024, IOTA has finally shown a highly promising technical signal. The recent breakout didn’t just pierce the trendline — it was confirmed by a successful retest of the golden Fibonacci zone, a classic reversal trigger in technical analysis.

> This is a classic early sign of a potential trend reversal, often followed by strong momentum plays.

---

🧠 Structure & Pattern: Signs of a Macro Reversal

✅ Descending Trendline Breakout

Price has broken through a major downtrend line that had held for over 7 months, signaling a shift in market dynamics from sellers to buyers.

✅ Fibonacci Golden Pocket Retest (0.5–0.618)

The pullback landed perfectly at the golden pocket (0.2054–0.1931), a highly watched confluence area for reversals. Price bounced right from this support, showing buy-side strength.

✅ Demand Zone Activation

The yellow box highlights a previous accumulation zone that now acts as strong demand, reinforcing the potential for an upward continuation.

---

🟢 Bullish Scenario (Structured Upside Potential)

If the price holds above 0.2054:

Short-Term Targets:

📈 0.2542 → Minor resistance & previous breakout area

📈 0.2805 → Key psychological zone and past rejection area

Mid–Long-Term Targets:

💰 0.3144 → Historical resistance

💰 0.3983 → Fibonacci extension zone

💰 0.4946 → Final major resistance before the previous macro downtrend

Confirmation:

A daily candle close above 0.2542 with increasing volume would strongly validate the bullish continuation.

---

🔴 Bearish Scenario (Potential Fakeout Risk)

If the price fails to hold above the 0.1931 zone:

⚠️ It may turn into a fake breakout, indicating that buyers weren’t strong enough to sustain the breakout.

Downside targets to watch:

🧱 0.1700 → Minor psychological support

🧱 0.1308 → Previous macro low and critical support

---

🎯 Conclusion & Trading Strategy

IOTA is currently at a critical decision point, balancing between a confirmed macro reversal and a possible fakeout. However, the technical breakout above a long-standing trendline — combined with a retest of the golden pocket zone — puts bulls in a favorable position for a potential rally.

🔍 What to watch next:

Price action above 0.2200–0.2540

Volume confirmation on breakout levels

This setup is ideal for early trend traders, swing traders, or position traders looking to ride a larger bullish wave with well-defined risk.

#IOTAUSDT #CryptoBreakout #MacroReversal #FibonacciSupport #BullishSetup #AltcoinAnalysis #CryptoTechnicalAnalysis #TrendlineBreak #BuyTheDip

Iotausdtrade

IOTA/USDT Weekly Analysis – Critical Support Retest

📊 Pattern & Price Structure:

The chart indicates that IOTA is currently retesting a major historical demand zone in the range of $0.110 – $0.160, which has served as a strong support since 2020. The price has bounced off this area multiple times in the past, reinforcing it as a solid accumulation zone.

There is also a potential formation of a double bottom or accumulation range around this level, which often acts as the foundation for a major reversal if accompanied by volume and momentum.

🟢 Bullish Scenario:

If this support holds and buyers show strength:

1. The price could rebound and test key resistance levels:

$0.2454 (initial resistance)

$0.3496

$0.4000

$0.4751

2. A breakout beyond those levels may trigger further upside targets at:

$0.8982 (weekly key resistance)

$1.4913

$2.000

$2.390 and potentially even $2.677

3. Bullish catalysts such as positive fundamental news, rising market sentiment, or visible accumulation volume could spark an explosive move.

🔴 Bearish Scenario:

If the price fails to hold the $0.110 – $0.160 support zone:

1. A breakdown could lead to a decline toward previous extreme lows around:

$0.0700 – $0.0534

2. This would signal a loss of long-term buyer interest and open the door to deeper bearish continuation.

⚠️ Technical Conclusion:

The yellow zone is a make-or-break level — bulls must defend this to maintain any bullish structure.

As long as IOTA stays above $0.110, the risk-reward favors a bullish reversal.

A confirmed bullish weekly candle and volume spike would strengthen the bullish outlook.

📌 Key Levels:

Major Support Zone: $0.110 – $0.160

Resistance Levels to Watch:

$0.2454 → $0.3496 → $0.4000 → $0.4751 → $0.8982 → $1.4913 → $2.000 → $2.390 → $2.677

#IOTA #IOTAUSDT #CryptoAnalysis #AltcoinBreakout #TechnicalAnalysis #BullishReversal #CryptoSetup #SupportAndResistance

Iota/Usdt On The Verge Of BreakoutIota/USDT appears to be exhibiting strength in the short term. All that is required now is to wait for a breakout of this pattern. In the event of a successful breakout, a 15-30% bullish move can be anticipated. It is important to note that this is not financial advice; please conduct your own research (DYOR).

IOTA/USDT BREAKOUT! READY FOR A PUMP🚀In the 4-hour time frame, IOST has broken out of this falling wedge pattern and is currently bouncing after retesting this pattern. If we look at it on a higher time frame like daily, we can see bullish divergences in the RSI. This seems like a solid choice. Its strong tokenomics and competent team make it a promising asset. The chart indicates the potential for significant growth in the next few weeks.

Entry: Current Market Price (CMP) and add more up to $0.22

Target: According to the pattern, we can expect up to a 50% to 70% bounce in the price.

Remember to do your own research.

NFA

#Crypto FWB:IOTA

IOTA prediction, Price target ---> 0.57$?BINANCE:IOTAUSDT

Hello dear traders.

As you can see, the price has jumped higher after attracting support in the indicated area, contrary to the bearish scenario predicted by some traders.

The price is now in an upward rally and there is no specific price resistance up to the $0.57 level.

If USDT.D continues its neutral or bearish trend, Bitcoin and other altcoins can rise further.

✌💥If you are satisfied with my analytical content, please share my ideas💥✌

✍🐱👤Otherwise, make sure you leave comments and let me know what you think.🐱👤✍

🍾Thank you for your support. I hope you will gain profit by following my analyses.🍾

IOTA and the 1150 Risk To rewards potential Opportunity Hi Everyone;

today we have one of the best risk to reward Investment opportunity

it is more than 1150 times the risk and the chart is look very promising.

I expect breaking the previous bear market key point will clear the way to the final target

IOTAUSD MIOTA Sell TF H4 TP = 0.1565On the 4-hour chart the trend started on June 27 (linear regression channel).

There is a high probability of profit. A possible take profit level is 0.1565

But do not forget about SL = 0.1970

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested. Thank you!

Good luck!

Regards, WeBelieveInTrading

IOTA Long Setup 1 HR TFBINANCE:IOTAUSDT.P Long Setup: The price has now retested the previous level. This is a bullish sign, as it suggests that the price is ready to continue its uptrend. This suggests that the bulls are still in control and that the price is ready to continue its uptrend.

Entry Price and SL mentioned.

Iotausdt Most Probably IOAUSDT

has recently confirmed the trendline resistance breakout and retest, and a symmetrical bullish pattern has emerged on the 8-hour timeframe. This pattern indicates a potential bullish move to the upside if a successful breakout occurs.

It is recommended to wait for confirmation of the breakout before taking any positions. Proper risk management is important to avoid losses in case of a false breakout or a sudden market reversal. If the breakout is successful, the price is likely to move 30-50% higher from the breakout level. Traders should keep a close eye on the price action and adjust their positions accordingly.

If You Are Satisfied With Our Work Join us