IOTAIOTUSD / IOTAUSD

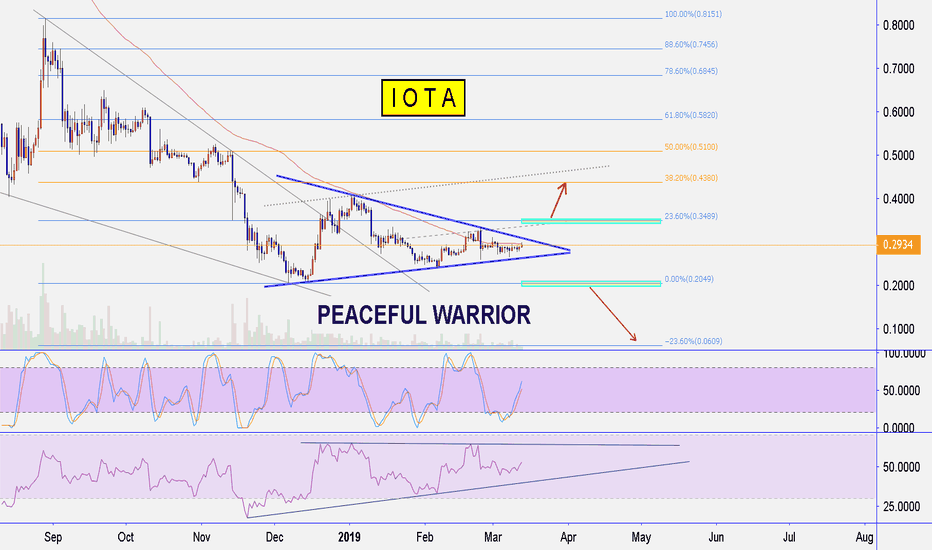

Price is narrowing, the volatility subsides before the storm. The question of which way the blow would be would not have taken a decision in the medium term. There is a chance to pass at least 38-50% Fibo on the chart upwards. You also need to consider that we are in a falling trend and the opportunity to go down below 20 cents is very large. Indicators looks for bulls more.

IOTUSD

There is a trading opportunity to buy in IOTAUSDMidterm forecast:

While the price is above the support 0.2045, beginning of uptrend is expected.

We make sure when the resistance at 0.4015 breaks.

If the support at 0.2045 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

The RSI bounced from the downtrend #1 and it prevented price from more gains.

A trough is formed in daily chart at 0.2667 on 03/09/2019, so more gains to resistance(s) 0.3340 and maximum to Major Resistance (0.4015) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 49.

Trading suggestion:

There is a possibility of temporary retracement to suggested support zone (0.2660 to 0.2045). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.2660)

Ending of entry zone (0.2045)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Take Profits:

TP1= @ 0.3340

TP2= @ 0.4015

TP3= @ 0.4535

TP4= @ 0.5260

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

There is a trading opportunity to buy in IOTAUSDTechnical analysis:

. IOTA/US Dollar is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 45.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (0.2610 to 0.2045). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (0.2610)

Ending of entry zone (0.2045)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 0.3340

TP2= @ 0.4015

TP3= @ 0.4535

TP4= @ 0.5260

TP5= @ 0.6105

TP6= @ 0.7920

TP7= @ 0.9265

TP8= @ 1.1550

TP9= @ 1.4475

TP10= @ 1.7435

TP11= @ 2.2170

TP12= @ 2.6930

TP13= @ 3.3680

TP14= @ 4.2300

TP15= Free

IOTA Price Analysis: Market Outlook for the Rest of 2018The 6 hour time frame is investigated in today’s Iota price analysis. Switching from an arithmetic scale to a logarithmic scale helps to make chart patterns clearer, which is also the case for IOTA.

Over 12 months of price action is captured in this analysis using a bearish price channel. The main bearish channel (upper green line and blue dotted line) even though tentative does provide context also for the price action of IOTA.

An inner bearish channel is also shown (with blue parallel lines), and is acceptable as chart patterns can nest inside one another. Physical measurements and/or projections based on the width of the inner channel are best carried out on an arithmetic scale, making the width useful as the minimum distance expected for price of IOTA to target upon upside or downside breakout from the inner channel.

IOTUSD: 1st target hit. 2nd projected towards the end of JanuaryTP = 0.3200 hit as the 1W Channel Down (RSI = 34.160, MACD = -0.306, Highs/Lows = -0.1732) made a new bearish leg nearly making a new Lower Low at 0.2450. Based on this channel and the Lower Low support (dashed line) we will pursue our final TP = 0.1495, which is projected to be accomplished near the end of January. However due to the highly probable scenario that the crypto market is near a bottom, we are prepared to close that final position (still on profit) if the price jumps above 0.4000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

IOTA opportunities explode with Electronic Gian Bosh partnershipOn the November 12, engineering and electronics manufacturer Bosch, has announced about the partnership with IOTA. Here is the actual tweet: twitter.com

Bosh is a leading enterprise in regards to the research and development of technology designed for Internet Of Things (IoT). Currently Bosh is integrating its new data collection IoT device with the decentralized IOTA Data Marketplace.

IOTA Marketplace is where parties can trade (buy and sell) access to active data streams, through MAM (Masked Authenticated Messaging). MAM is often said to be like a radio, where Only who knows the radio frequency may reach the message. In MAM, only who knows the Channel Key can get access to the data. Also, users can “trust the source and integrity of data even though the identity of the source is masked”.

After Bosh announced about the partnership, IOTA has gained more than 5% over the Bitcoin, hitting 79k satoshis. Nevertheless, the growth has been short-lived and price currently stuck close the 200 Moving Average. The recently low at 76k satoshis could prove to play an important role in the short term price development. Daily close below that price, could send IOT/BTC down to the 72-74k support area, confirmed with Fibonacci retracement levels.

But, as long as daily close will remain above, IOT can be expected to move higher, especially considering the fact that the 78.6% Fibonacci resistance has been broken. The next upside target is seen at 84-85k satoshis area, which is 61.% Fibonacci.

Its worth mentioning that the RSI oscillator broke above the descending channel and found the support at the upper trend line, rejecting it recently. Considering these technical aspects as well as the huge partnership with Bosh, over the medium term price increase should be expected.

Having said that, probability that 74k satoshis support area will be re-tested should not be ignored. And finally, if 70k satoshis physiological support is broken, bullish outlook will become much less likely. In that case the downtrend continuation could be the most expected scenario.

IOTUSD - 25% Cyclical Trade? Last Leg Down?Hey traders!

I'm looking at this short trade as we continue to trade below the EMA50. Some very interesting market structure here, and we can see a potential breakdown of this descending triangle.

***This is not investment advice and is simply an educational analysis of the market and/or pair. By reading this post you acknowledge that you will use the information here at YOUR OWN RISK

Is Bitcoin Dead? Part 2 (=>Part 1 under BTCUSD ticker)Welcome back crypto friends!

In Part 2 I give you specific examples with IOTA & Ripple, which show perfectly how Blockchain technology is getting used right now in the real world, and which is also to reason not to panic right now.

Was there a hype? -Definitely. Is Bitcoin or Cryptot now dead? -No way.

Have fun watching! ;)

Bitcoin: Bottom at 6.000 breaks!Hello dear crypto friends, hope you're doing well!

It's happening: The bearish scenario that we talked about on the weekend is unfolding, as we're breaking the holy half-year bottom 6.000 Dollars with BCH hash-wars & the Tether FUD in the background.

In this video, we'll look at the individual zones, which are gonna be important not just for granpda Bitcoin, but also for the Alt-Majors like BCH, XRP, ETH, EOS, IOTA.

Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up, because the mechanism shows my video to other people then. Make also sure to follow me so you get notified on my Crypto Analyses! I wish you a good trading! :) No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

About myself: Global citizen & early Bitcoin adopter from Germany. I invested in the 2nd rally from 50 to 1.000 Dollars in BTC.

IOTUSD: New Lower Low made. Channel Down intact.IOTA has just priced a Lower Low on the 1D Channel Down (RSI = 34.297, Highs/Lows = -0.0018) and even crossed Augusts 0.4050 low, which was the bottom on the 1W chart (also bearish with STOCHRSI = 28.684). A retrace tp 0.4570 is expected before IOTA finally tests the 0.3200 November 02, 2017 low.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

IOTA sitting Silent slightly above Demand zone.Hey! I am back with another Technical analysis, this time looking at longer timeframe on IOTA.

Informative text.

If you are only curious about forecast, go to " Technicals " or " Conclusion"

IOTA has tested known demand zone in august and saw relatively quick 70% gain . But this still wasnt enough as Bitcoin was going pretty much sideways, and IOTA and every other coin has to obey and follow .

The thing is , if IOTA would breakout and see an 300% gain for example, and be at second ressistance point from above, IOTA would be worth only about 2$ per coin , without Bitcoin showing some green moves.

Buyers need to see an good uptrend certainity on Bitcoin for strong altcoins as Ripple, Ethereum and Iota for example to see parabolic or sharp uptrend moves.

This doesnt neccesary mean that Bitcoin has to break 20k level or higher for IOTA to see price above 6$ once again, but it would help a lot, all I am saying is that Bitcoin has to leave the demand zone of 5800-6000 area and continue gaining value to show alts their way.

If Bitcoin sees another crash to 5800 , alts will follow and very likely to see oversold crash bounce as IOTA seen once.

Technicals.

IOTA is showing once again that she likes this Demand zone .

Unsuccesfu l breakout and downtrend has been formed. After this downtrend is broken I expect to IOTA remain silent for about the same time as Bitcoin or show some sharper moves up when Bitcoin starts to move.

Low volume shows that an uptrend is first most likely to happen and after a while IOTA can see another Breakout .

MACD is showing clear trend , and its currently uptrending with MACD giving first week buy signal , still unclosed but on a good clear way.

RSI shows demand still above 30 even after such sellout, found some support and began uptrending , with ressistance getting close to support, sharp move may be ahead . (15-60% at least).

Conclusion.

Uptrend or an impulsive move most likely to happen. IOTA has good Fundamentals and there is no reason for IOTA price to not grow .

Use the ressistance levels as take profit zones , slightly below ressitance.

Thats al l from me, for now. If you agree with this Technical Analysis , consider leaving that " Agree Button " blue , as it leads me to post more similiar Technical Analysis .

Thanks for your time and good luck trading!

Crypto In The Big Picture: BTC BCH XRP ETH EOS IOTAHello crypto friends, hope you're doing well guys! ;)

In this epsiode, I'm going to show you crypto on the weekly chart right now, and especially what scenarios could bring you the most gains.

Also gonna show you my 2 last plays with XRP & BCH.

The mentioned interview about the ultimate case for Bitcoin: offthechain.libsyn.com

Have fun watching! ;)

If you had some value from my analysis, give it a thumbs-up, because the mechanism shows my video to other people then. Make also sure to follow me so you get notified on my Crypto Analyses! I wish you a good trading! :) No matter what you do, please set your stop loss. Please be aware, that you can lose all your money on the online exchanges.

About myself: Global citizen & early Bitcoin adopter from Germany. I invested in the 2nd rally from 50 to 1.000 Dollars in BTC.