Iotusdt

IOTUSD Sell TF H4. TP = 0.1763On the 4-hour chart the trend started on May 30 (linear regression channel).

There is a high probability of profit. A possible take profit level is 0.1763

But do not forget about SL = 0.2256

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested. Thank you!

Good luck!

Regards, WeBelieveInTrading

IOTUSDT |Coin Review| Rebound from local resistance!hello trader Today I prepared a new idea for you. Like and subscribe to the channel there is a lot of useful information✅

Friends, IOT showed a good growth of almost 15%, as some alts showed a good percentage too.

I think that after all, we will push up the channel borders and see a correction approximately in the $0.034 zone

Then you already need to watch how the market will behave, this is an approximate take profit, you don’t need to climb immediately with a large leverage and wait for these values, I gave you a chart, now think with your head and wake up in profit)

IOTA has formed hammerline resistance into rocketship supportHello viewers,

There is a possibility that during the historic action of IOTA something has been cooking. Something that was kept the coin in the closet and pushed down with the hammer and formed to be the impossible father to crack. Fortunately, this father has been overthrown from his crown and is no longer a liability. What we see on the charts is that IOTA has switched tone from the hammerline resistance into rockethsip support.

The lift off can lead us to various places, if the line holds. Risk:Reward seems astonishing. Lets go margin.

Not an investment advice.

IOTA vs 4 years downtrend channelAs of writing, $8 million short positions are still open. Combine that with all the progress IF and the community are delivering, plus the latent realization of severe limitations in blockchain based DLTs (Cardano Smart Contract most recently) there is a good chance IOTA is switching into a steep uptrend channel after 4 years of misery.

IOTUSDT ANALYSISI have 4 positive signals .It is above the support and up trend line also I saw buy3 it means big hope for this coin

You can buy it right now and you can sell at the resistance line ($ 0,5100) or you can watch the EngineeringRobo' s sell signal

Your money your choice . Don't ignore EngineeringRobo just join us and please dm me.

Iota Can Hit The Support Again Before The Next Move UpOn December 3rd 2019 I posted an article and on that post I revealed that the priceline of Iota had formed a big bullish butterfly pattern on weekly char. At that time the price action was just entered in the potential reversal zone of that pattern. And as per Fibonacci sequence of bullish butterfly it was expected that the priceline will take the bullish divergence from the PRZ level atleast up to the Fibonacci projection of A to D leg from 0.382 to 0.786 Fib projection level. And finally in very next month January 2020 the price action took a powerful bullish divergence and produced more than 119% bullish rally and moved down again. This time the Iota has even broken down the potential reversal zone of this bullish butterfly.

Falling wedge and volume profile based move:

We can also observe that on weekly chart the priceline of Iota is moving in a falling wedge and after this recent drop the price action has hit the support of this falling wedge. Even though the bollinger bands was above the support and there was a little bit distance between the lower bands of bollinger bands and the support of the falling wedge but the bearish trend was very strong therefore the the candlesticks has hit even beyond the support of this wedge and retraced back into the bollinger bands. If we place the volume profile on the complete price action moving within this wedge then we can see that the trader’s interest is very low below $0.115 and above $0.42. And the volume profile’s point of control is at $0.28. Therefore there are strong chances that whenever the priceline will be moved down than the area where the traders has low interest of trading then it will move up again at least up to the point of control of the volume profile. This is very positive sign traders don’t have interest upto the support.

Bullish Crab pattern a bullish reversal signal:

Now if we switch to the smaller time period and that is 2 day chart then we can see at the support of falling wedge the priceline of Iota has formed a complete a bullish crab pattern. The priceline has hit the just a spike in the potential reversal zone of this pattern and turned bullish. As per Fibonacci sequence the Crab pattern the price action was suppose to hit at least 0.382 to 0.786 Fib projection of A to D leg. And the candlesticks has already hit this zone. But I am expecting that the priceline will again give us another chance to catch it from the potential reversal zone and it will again turn bullish and start a proper bullish rally that can lead the priceline to hit the resistance of the falling wedge that has been formed on weekly chart.

The potential reversal zone starts from $0.09 goes up to $0.119 but because we have a strong support of falling wedge therefore we can have another spike up to 9 cents or little bit more. But it will be very much difficult for the price action to break down the support and move up to the maximum extent of this potential reversal zone.

100 simple moving average support:

And now if we switch to the more smaller time period chart and that is 4 hour chart then it can be clearly observed that the priceline is moving around the 100 simple moving average at this time. We also examine that the candlesticks are moving above this simple moving average and 100 SMA is holding the price action. Therefore I am expecting if the Iota will break down this 100 simple moving average support then it can again enter in the potential reversal zone or buying zone of the Crab pattern that has been formed on 2 days chart.

Conclusion:

On midterm the priceline can move down to reach that support again and after hitting the support Iota can turn very strong bullish to make another attempt to breakout the resistance on long term.

And If it will be able to breakout from resistance then more powerful bullish rally can be started.

Note: This idea is education purpose only and not intended to be investment advise, please seek a duly licensed professional and do you own research before any investment.

IOTAUSDT formed bullish Butterfly | Upto 66% move expectedPriceline of IOTA / US Dollar cryptocurrency has formed a bullish Butterfly pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 0.2025 to 0.1713

Sell between: 0.2267 to 0.2853

Regards,

Atif Akbar (moon333)

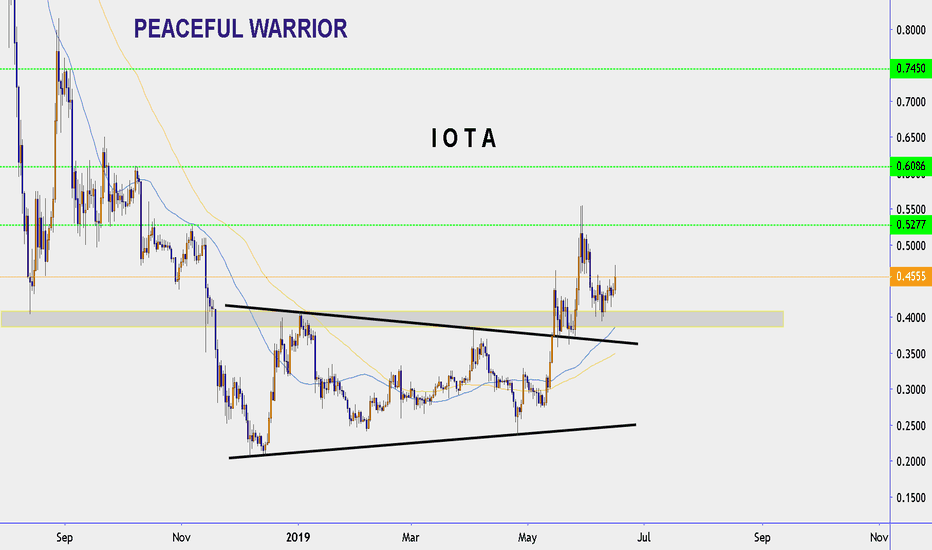

IOTA Mid Term Technical Analysis | IOTA Formed Bullish ButterflyThe triangle and firm support:

Since sep 2018 the 20th ranked leading cryptocurrency is moving within a descending triangle , during this period the price action is hitting second time on the support of triangle and also at the lower bands of Bollinger bands .

One of the main reason that the priceline is not able to breakdown the support sofar is that the volume profile of complete pattern is showing very weak interest of traders at the support of triangle therefore whenever the price action hits the support the selling interest gets weak and the bulls take charge and take the price action up to the resistance of this triangle so this time again we can expect the bounce upto the resistance of triangle very soon.

The ichimoku bear cloud is also getting squeezed.

The oscillators:

The relative strength index ( RSI ) has entered in oversold zone indicating that the sellers will be weak at this area and if we see the moving average convergence divergence then it is still bearish and fast length and slow length MAs are moving sideways but soon they can give bull cross signals, the stochastic RSI is also oversold and it can also give bull cross very soon.

The harmonic move:

If we zoon the corner of the triangle then we can clearly see that the price action has completed the formation of bullish butterfly pattern which can lead to breakout of triangle lets have a look at this pattern.

After initial leg the A to B leg is retraced upto 0.786 Fibonacci then B to C leg is projected between 0.382 to 0.886 Fibonacci projection of A to B leg then final C to D leg is retraced between 1.27 upto 1.618 Fibonacci and here we have all legs driven as required for perfect bullish butterfly .

Now we are in potential reversal zone of this pattern and from there the priceline should move up between 0.382 upto 0.786 Fibonacci projection area of A to D leg so this move has capacity to give upto 66% profit but if the candles sticks will be closed above 0.786 Fibonacci levels then the price action may have breakout from the resistance of this descending triangle’s resistance so we can set our buying and sell targets as below:

Buy between: $0.2025 to $0.1713

Sell between: $0.2267 to $0.2853

Regards,

Atif Akbar (moon333)

IOTUSD Mid Term Technical Analysis | IOTUSD Formed ButterfLyThe descending triangle and firm support:

On bitfinext week chart since Sep 2018 the 20th ranked leading cryptocurrency is moving within a descending triangle , during this period the price action is hitting second time on the support of triangle and also at the lower bands of Bollinger bands .

One of the main reason that the priceline is not able to breakdown the support sofar is that the volume profile of complete pattern is showing very weak interest of traders at the support of triangle therefore whenever the price action hits the support the selling interest gets weak and the bulls take charge and take the price action up to the resistance of this triangle so this time again we can expect the bounce upto the resistance of triangle very soon.

The ichimoku bear cloud is also getting squeezed.

The oscillators and MACD:

The relative strength index ( RSI ) has entered in oversold zone indicating that the sellers will be weak at this area and if we see the moving average convergence divergence then it is still bearish and fast length and slow length MAs are moving sideways but soon they can give bull cross signals, the stochastic RSI is also oversold and it can also give bull cross very soon.

The harmonic move:

If we zoon the corner of the triangle then we can clearly see that the price action has completed the formation of bullish butterfly pattern which can lead to breakout of triangle lets have a look at this pattern.

After initial leg the A to B leg is retraced upto 0.786 Fibonacci then B to C leg is projected between 0.382 to 0.886 Fibonacci projection of A to B leg then final C to D leg is retraced between 1.27 upto 1.618 Fibonacci and here we have all legs driven as required for perfect bullish butterfly .

Now we are in potential reversal zone of this pattern and from there the priceline should move up between 0.382 upto 0.786 Fibonacci projection area of A to D leg so this move has capacity to give upto 66% profit but if the candles sticks will be closed above 0.786 Fibonacci levels then the price action may have breakout from the resistance of this descending triangle’s resistance so we can set our buying and sell targets as below:

Buy between: 0.2025 to 0.1713

Sell between: 0.2267 to 0.2858

Regards,

Atif Akbar (moon333)

IOTAUSD formed bullish Gartley | upto 13% movePriceline of IOTA / US Dollar cryptocurrency has formed a bullish Gartley pattern and entered in potential reversal zone.

This PRZ area should be used as stop loss in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 0.2645 to 0.2548

Sell between: 0.2721 to 0.2904

Regards,

Atif Akbar (moon333)

IOTAUSDT forming bullish Crab | A long opportunity coming aheadPriceline of IOTA / US Dollar cryptocurrency is forming bullish Crab pattern and soon it will be entered in potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this area.

I have used Fibonacci sequence to set the targets:

Buy between: 0.2619 to 0.2558

Sell between: 0.2667 to 0.2782

Regards,

Atif Akbar (moon333)

IOTA - IOTABTC formed a W or double bottom during 2 monthsIOTABTC has probably bottomed out, at least locally. Over the time of 2-3 months it formed a double bottom pattern, which finds support in buy volume depicted by VFI divergence over that time span. So IOTA, even if dependent on BTC price (IOTUSD), has probably ended its downtrend in relation to the rest of the market.

IOTAUSD formed a bullish Shark pattern|Upto 123% potential tradeAfter completion of gartley pattern the priceline of IOTA / US Dollar cryptocurrency has formed a bullish Shark pattern and entered in potential reversal zone to hit the sell targets soon insha Allah.

This PRZ area can be used as stop loss in case a complete candle stick closes below this area

Volume profile of complete pattern is showing less interest of traders at this area.

MACD is turning bullish

Stochastic is oversold but did not give bull cross.

I have used Fibonacci sequence to set the targets:

Buy between: 0.2612 to 0.2052

Sell between: 0.3288 to 0.4595

Enjoy your profits and regards,

Atif Akbar (moon333)

IOTAUSDT formed bullish gartley | a good long oppottunityPriceline of IOTA / US Dollar is forming differing harmonic pattern continuously after forming 2 sharks now it has completed the formation of gartley pattern and entered in potential reversal zone.

I have defined the targets using Fibonacci sequence:

Buy between: 0.2433 to 0.2385

Sell between: 0.2471 to 0.2562

Regards,

Atif Akbar (moon333)

IOTA USD formed bullish BAT | Upto 81% potential trading ideaPriceline of IOTA USD cryptocurrency has formed a bullish BAT and entered in potential reversal zone even giving a spike beyond the PRZ area and touching the lower band of bollinger bands 1st time since after April 2019.

Stochastic entered in oversold 1st time since after Feb 2019.

I am expecting the next candle stick will be closed sideways or within the PRZ area rather than closing below the PRZ so we can wait for next candle stick whether it will breakdown the PRZ support or will move up back into this zone.

I have used Fibonacci sequence for targets definition.

Buy between: 0.3036 to 0.2716

Sell between: 0.3797 to 0.4939

Regards,

Atif Akbar (moon333)