Who likes Apple Crumble....WWDC Event FlopSome Key Areas:

Unified Design: Liquid Glass

- Apple unveiled a new design language called Liquid Glass, inspired by visionOS. This aesthetic introduces rounded, translucent elements across iOS 26, iPadOS 26, macOS 26 ("Tahoe"), watchOS 26, tvOS 26, and visionOS 26, aiming for a cohesive and modern look across all devices

Apple Intelligence & AI Enhancements

- Apple expanded its AI capabilities under the Apple Intelligence umbrella:

On-Device AI Models: Developers can now access Apple's on-device large language models to integrate AI features into their apps, ensuring privacy and efficiency.

- Genmoji: A new feature allowing users to create personalized emojis by merging existing ones.

- ChatGPT Integration: Siri can now delegate complex queries to ChatGPT, powered by GPT-4o, with user consent.

- Live Translation: Real-time translation is now available in Messages, FaceTime, and Phone apps, enhancing multilingual communication.

iOS 26 & iPadOS 26: Enhanced User Experience

- Redesigned Apps: Updated Camera, Safari, and Phone apps featuring the new Liquid Glass design.

iPadOS 26 brings

- Advanced Multitasking: Enhanced window management and a Mac-like Preview app.

macOS 26 ("Tahoe"): Productivity Focus

- Personalized Spotlight: Improved search functionality with AI-driven suggestions.

WatchOS 26 & AirPods Enhancements

- AI-Powered "Workout Buddy": Provides real-time insights and encouragement during fitness activities.

Gaming & Developer Tools

- Apple Gaming Hub: A new app aggregating games and challenges, enhancing the gaming experience across devices.

Apple is at a technical inflection point. It needs to hold the wedge or it runs the risk to going lower to the previous lower boundary range.

Ipad

APPLE Next stop 200 after a pull-backLast time we bought APPLE (AAPL) on the short-term was on June 05 (see chart below), after a technical pull-back, and easily hit our 190 target:

The stock has maintained the Channel Up since late March with the 1D MA50 (blue trend-line) in Support since January 25. Based on the 1D RSI, which has been within a Rectangle pattern while the stock is on the Channel Up, we are about to see a technical pull-back towards the Higher Lows (bottom) trend-line and then rebound for a Higher High. That is a short-term opportunity for buyers to target $200.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Apple - Will next earnings reinforce the selling pressure?After the 242% run-up from its lows during the 2020 crash to its high in January 2022, Apple gave up almost 20% in regard to the current value. In addition to that, the introduction of the new iPhone 14 has not created much hype among consumers and market participants. Since the release of the new product, the price has continued to be choppy and seemingly returning to its 2022 lows.

Because of that, we will continue to monitor the Apple stock in the coming weeks and provide a more detailed update on the price and its potential future direction. However, at the moment, we abstain from setting a price target for this stock title.

Illustration 1.01

Illustration 1.01 displays the daily chart of Apple stock and two moving averages, 20-day SMA and 50-day SMA. In addition to that, two yellow arrows point to natural retracements toward the price's moving averages, acting as a correction of the downward move. If the price fails to break above the 20-day SMA and then subsequently above the 50-day SMA, then it will add to a bearish consensus.

Illustration 1.02

The picture above shows the weekly chart of Apple stock and two simple moving averages; now, 20-week SMA and 50-week SMA. The yellow arrow pinpoints the similar retracement toward (and even above) these SMAs; in this particular example, the retracement represents a strong correction of the downtrend.

Please feel free to express your ideas and thoughts in the comment section.

DISCLAIMER: This analysis is not intended to encourage any buying or selling of any particular securities. Furthermore, it should not be a basis for taking any trade action by an individual investor. Therefore, your own due diligence is highly advised before entering a trade.

Man Who Tied Woman Up and Stole $3B in BTCUSD ArrestedA man who took $3 billion in bitcoin during a savage burglary has been captured — 7,000 miles from where the supposed wrongdoing occurred.

The man is blamed for breaking into a home in California, binds up a lady with conduit tape, and moving millions from her record.

The 31-year-old supposedly wore ski goggles, a hood and gloves during the bold assault. Investigators say he took steps to torment the casualty with a blade — and utilized an iPad staying nearby his neck to give guidelines.

The man in this way escaped to Taiwan after the robbery in March, with American specialists finding him and making a trip there to keep him.

At the hour of his capture, he was found with $18,000 in real money — close by a tablet, PC, crypto wallets and extra proof of his wrongdoings.

He is currently back in San Francisco where he has to deal with penalties of first-degree private robbery, seizing for payment and criminal dangers — and stayed quiet when stood up to by correspondents at the air terminal.

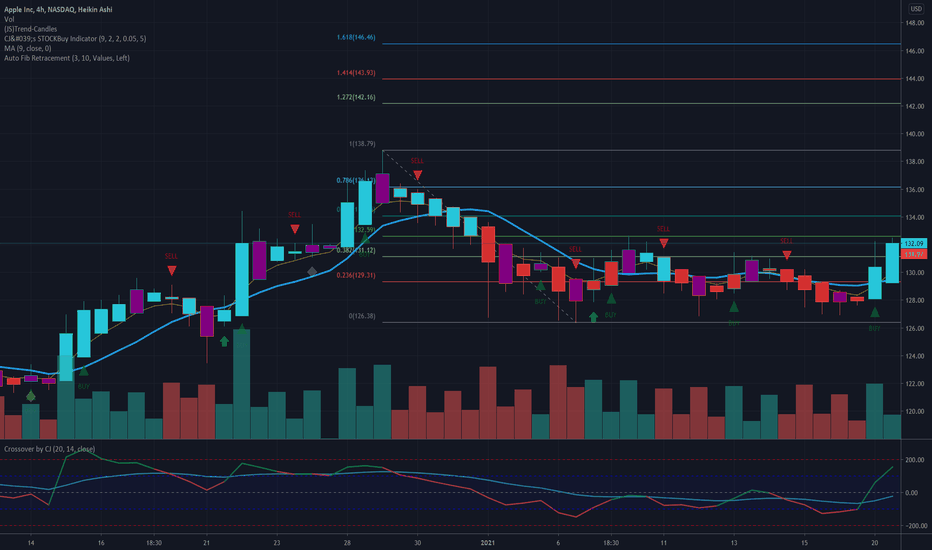

Apple is finally flashing BUY signal, 7 confirmsSome unknown company called by a fruit.

- everybody is jumping on the Apple cart.

- get on the bus towards earnings.

Happy Trading, from CJ -- aka the greatest FURU.

To find out more about The Ultimate Stock Indicator on Tradingview, please check my public profile.

RECAP on $AAPL So as predicted again. WE got the consolidation under resistance on the daily and finished the day choppy and without a decision on where AAPL wants to go. That is represented in the Spinning Top Candle on the daily where buyers and sellers tried but no one won. We didnt get the usual AAPL pump but with so much overhead on the chart it couldn't be done without conviction. The probability of AAPL seeing downside relies heavily on the movements of SPY, but if we get a market wide pullback we could see outselfs at support quick. A break here would have us under the EMAs and my HULL indicator. We will see if anything yields from the bullish spinning top, Any upwards movments from SPY could send us over the daily resistance and up on a bullish trend! Happy trading!

Adobe to spike on Adobe Max Conference, 2018I believe the risk / reward ratio on Adobe is a good swing trade at the moment. The Adobe Max Conference is coming up in a few days, and historically Adobe stock has benefited from this. There is speculation about a possible Photoshop for iPad release as well, which could give investors a lot of hype.

Apple: Stable Volatility + Accumulate to $193 PT SpreadDespite the volatility experienced in 2018 so far, Apple has maintained a healthy path along its overall trend lines. Opportunities to accumulate this year have been great and ranges within Fibonacci channels have held strong. Earnings season, WWDC, OLED adoption and other catalysts can help propel stock back up and into a "money zone" that should hold and allow for the stock to be traded by those looking for technical gains. The $180 resistance level has been hit and crossed and should bounce nicely if hit again during a period of market stability/momentum. Price target of $193 falls in line with historical spread of $33. Long AAPL with sustained fundamentals and technicals.

AN INTERSTING CURIOSITY ON AAPL!When someone talk about a smartphone, what is the device that your mind start to thinking?!

In june 2007 the first Iphone was released and it becames immediatly the most loved mobile of all time, in fact when a new one is coming people are ready to literally camping in front of Apple store.

The chart confirm this Trend, the popularity have started to rise since that moment and now this stock is maybe the most well known of NASDAQ and so on!

What is better of a little phone?, a biggest one: it was born the Apple tablet!

It was on jenuary 2010 and here the stock jumped on an airplane and go away from the bottom to the top!

What do you think about guys?! Will it continue to rise or maybe start to go down?!

APPLE OR APPLTRIANGLE PLAYING OUT. break may happen either side. GO SHORT WHEN RED LINE TOUCHES WITH STOP LOSS. Buy when price touches Green line (one lesser degree from 2004 support line), so plan to dump when needed. Go deep short if it fails to break the ultimate red line from the 2015 top. Using options strategy carefully.

Buy the rumor & sell the news.Apple trend reversal signals are extremely strong now after the "buy the rumor & sell the news" today.

It might very well close below EMA 50 today, and that includes rejection of the all time high made back in 2012 fall.

If that does confirm, we are looking at correction down to 59~79 area which is a 40% correction (max).

Next week's movement is critical here, and given Apple's market cap it'll affect S&P500 a lot from this downtrend!

This also comes at a time when gold is at a make it or break it moment (20% uptrend within next few months or a big correction downwards)

With the toppish & bubblish market, anything can burst it even if its a bullish news.

P.S: (sorry for the party popper, & enjoy your new iPhone :) )