#UPL CMP 632 TGT 740+ Longterm more than 15% - BY RACHIT SETHIAUPL CMP 632

TGT 740 +++

SL 600

TIMEFRAME <6M

RR > 3

Return >15% +++

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

IPL

#IPL #UPL #FACT #PIIND #BESTAGRO #BHARATRAS #DEEPAKFERT #KILPEST#IPL

NSE:IPL

CMP: 263

TP: 300

SL: 245

TF: <6m

RR > ~2.4 times

Return > ~15%

NSE:IPL

UPL FACT PIIND BESTAGRO BHARATRAS DEEPAKFERT SHARDACROP SUMICHEM

KILPEST

Factors: BULLISH WEDGE BREAKOUT Trend Following Rising Volume with rising Prices. Flag pattern breakout. Pennant Pattern Breakout with Bullish Candle. Retest Successful. Higher Highs & Higher Lows. Broken above RESISTANCE levels Trading at SUPPORT levels Earnings are strong. Bullish Wedge Breakout Risk Return Ratio is healthy. And Rising from Double Bottom Pattern to Flag Pattern forming. If you like my work KINDLY LIKE SHARE & FOLLOW this page for free Stock Recommendations. With 💚 from Rachit Sethia

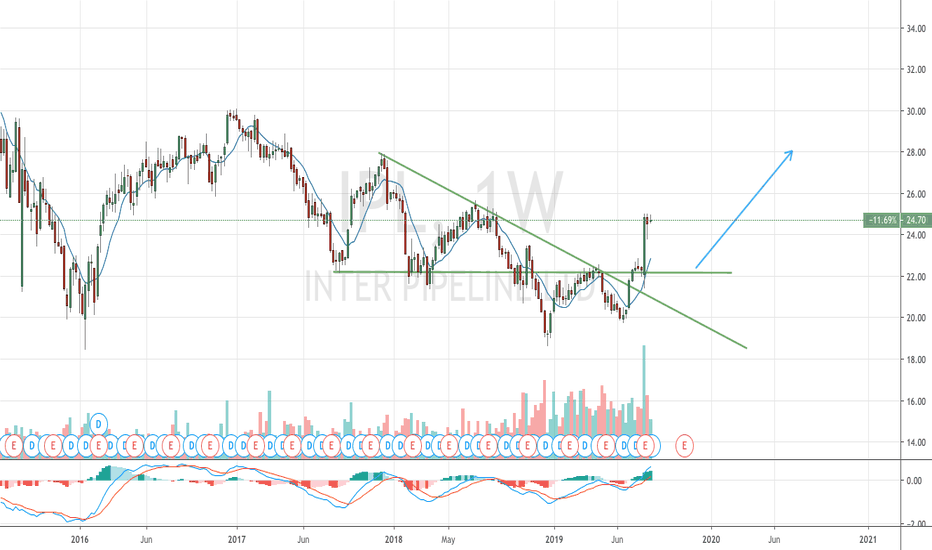

IPL - Has it found Support?IPL has been in a nice uptrend making higher highs and higher lows. It has pulled back at the lower end of the parallel channel and showing signs of supportive price action. We may see a bounce off this support level of $2.20 - $2.35 zone for added confirmation that bulls may be taking over and take it higher. MACD is also about to cross which may be a sign that the selling pressure is coming to an end. Once bullish price action is confirmed, my target would be between $2.50 - $2.60 zone which could be a zone of resistance.

Please note these are my own notes, by no means trading advice. Please do your own research before entering into any trade.

IPL looks to have turned a corner....Those familiar with IPL will already know they produce explosives, fertiliser & industrial chemicals for Mining & the Ag Industries. You would also likely be aware that the price has been channelling sideways since March 2020. Finally, the price appears to be making a break to the upside, so I like how IPL looks right here; for those who a little more cautious you might want wait for a confirmation, but I am happy to buy it today at this level.

IPL Resistance / Support LinesMy position on Inter Pipeline is still neutral on the short term. I personally closed with profit before the trading halt. I'm expecting a fair amount of volatility this week due to the takeover offer. Fib based extension Resistance / Support lines are listed on this chart. I don't see heading past $29 or below $23 on the bounce personally until more definitive news is reached. I still like IPL long term though I & I plan to re-enter at a later time.

$IPL LongWait for a break-out retest at key support.

Great company with monthly dividend/ great oil business.

$IPL swing trade buy set-up ASXHere's my buy set-up $IPL Incitec Pivot Ltd based on a consistent bullish trend, price testing support, higher high candle although somewhat red at the moment. Price is oversold and the chart looks ok overall for a reasonable probability it heads north. As always, this could go against my call, hence stop loss in place to minimize loss. Admittedly there is a bit of red volume so this is a risky trade. Not financial advice.

VERY BEARISH IMPERIALPretty self explanatory but here goes...

Neckline of a massive head and shoulders pattern has been broken. A re-test of the neckline (187.00-190.00) will be the place to enter a short for a very large move down. I repeat...very large...

Target1: R150.00 (conservative)

Target2: R140.00 (aggressive)

Target3: R100.00 (Ultra-aggressive)