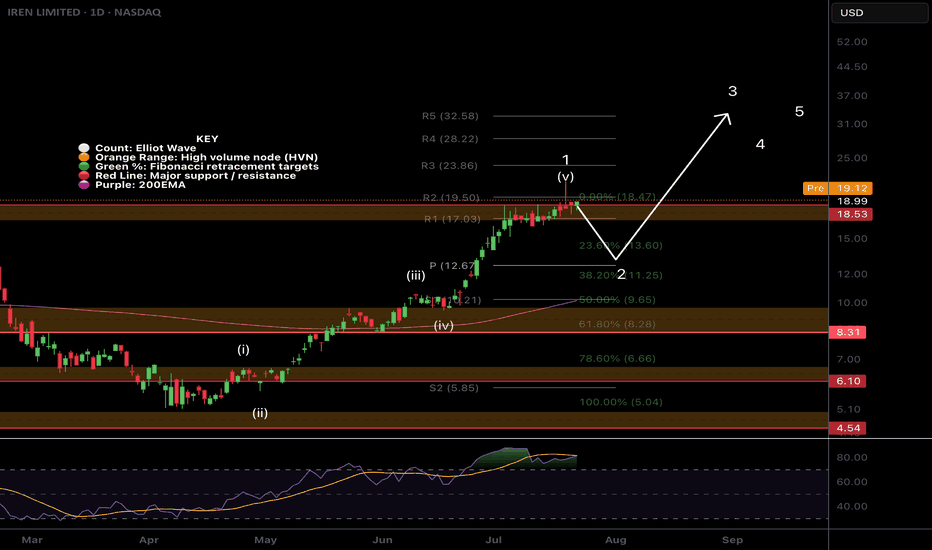

$IREN wave B complete?After its mammoth rally NASDAQ:IREN appears to have completed a wave 1 of 3 with wave 2 underway. The recent push up into the previous all time high resistance appears to be wave b of c in a corrective wave 2.

My initial target for wave 2 is the ascending daily 200EMA and .5 Fibonacci retracement at $10.44. This is also just above the weekly pivot and major High Volume Node support which remains untested.

Weekly RSI has reached oversold, not significantly, but price did have decent retracement the last few times it was reached.

Bitcoin stocks have all had a decent retracement causing me to upgrade my Elliot Wave count to a completed macro wave 1 with wave 2 now underway, suggesting the best returns are still to come over the next months for this category asset class in wave 3!

Analysis is invalidated if we go to new highs above $21.7 or lose $5.08

New long signals are certainly building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very food profits lately in these markets!

Safe trading

IREN

Strong Fundamentals, Stretched ValuationThe Bull Case - Operational Excellence:

IREN delivered another impressive month with record monthly revenue of $86m, record 728 BTC (#1 among Bitcoin miners and surpassed Mara, Cleanspark, Cango, Riot, and BitFuFu) and record hardware profits of $66m in July IREN July 2025 Monthly Update. The company's operational metrics are genuinely strong:

Mining Efficiency: 45.4 EH/s average operating hashrate with best-in-class efficiency (15 J/TH) and healthy 76% hardware profit margin

AI Pivot Execution: Successfully expanding beyond Bitcoin with 2.4k NVIDIA B200/B300 GPUs and 98% hardware profit margin on AI services

Infrastructure Scale: Massive pipeline with 1,400MW Sweetwater 1 and additional 600MW Sweetwater 2 projects

The Valuation Concern:

However, the market appears to have gotten ahead of itself. IREN is trading at $18.32 with a 52-week range of $5.13 to $21.54, representing a ~257% gain from its lows. Current analyst consensus shows mixed signals - while 12 analysts give it a Buy rating with an $17.78 price target, this suggests minimal upside at current levels.

Key Risk Factors:

Bitcoin Dependency: Despite AI diversification, Bitcoin still drives 97% of revenue (~$83.6M vs $2.3M AI)

Execution Risk: Aggressive expansion timeline with April 2026 energization for Sweetwater 1 creates delivery pressure

Capital Intensity: Massive CapEx requirements for 2GW+ of planned capacity in a rising rate environment

IREN is operationally executing exceptionally well, but the stock price already reflects much of this success. The 320%+ rally from 2024 lows has created a situation where even strong execution may not drive meaningful returns from current levels. The company's transformation into a diversified digital infrastructure play is promising, but investors are paying a premium multiple for what remains largely a Bitcoin mining operation.

2025 Is a Big Year for Bitcoin Miners—Who’s Winning the Hash War

Bitcoin’s resurgence in 2025 has reignited the mining race. The halving came and went, hashprice bounced from the abyss, and a fresh wave of capital is pouring into the space. So we figured: time to catch you up on who’s making real moves and pulling ahead — both in market cap and megawatts.

⚡ CleanSpark (CLSK): The Sharpshooter

If Bitcoin mining were a sport, CleanSpark would be the athlete that trains all year, eats clean, and shows up for every match. No drama, just execution.

In 2025, CleanSpark continues to grow fast — but smart. It’s acquiring distressed sites, upgrading facilities with immersion cooling, and pushing its fleet beyond 50 EH/s. Its Tennessee expansion (a deal scooped up for pennies on the dollar) was classic CLSK: low cost, renewable-powered, and ready to scale.

In Q1 2025, CleanSpark posted $162.3 million in revenue, up a blistering +120% YoY, and delivered $246.8 million in net income, or $0.85 per share. It's one of the few miners that’s profitable and expanding — at the same time.

The stock is up 25–30% YTD, trading around $12. While it’s been volatile like the rest of the sector, CLSK remains the benchmark for cost-effective, execution-focused Bitcoin mining. If you’re looking for a fundamentals-backed growth story, this is it.

🏗️ Iris Energy (IREN): The AI-Ready Dark Horse

Iris Energy may have flown under the radar in past cycles, but in 2025 it’s turning heads — not just because of Bitcoin, but because of data infrastructure.

While IREN runs a lean BTC mining operation powered by 100% renewable energy in Australia and Canada, the real story is its pivot toward modular data centers. It’s one of the few miners actively positioning itself for GPU workloads and AI compute as a hedge against mining volatility.

The upside? Flexibility. If BTC mining margins compress again, IREN has the facilities and roadmap to reconfigure its power-hungry machines for AI hosting. The market likes the optionality. The stock’s up ~70% this year and may still be cheap if the data center thesis catches on.

🔥 BitFuFu (FUFU): The Challenger

BitFuFu came in hot after its 2024 IPO — vertically integrated, Bitmain-backed, and global from day one. It’s the largest cloud mining provider in the mining space. It provides cloud mining, sells miners, hosts them, runs its own mining pool (BitFuFuPool), and operates a global fleet clocking over 36 EH/s under management.

While others focused on HPC & AI business, BitFuFu doubled down on mining scale and infrastructure. It aims to own over 1 GW of power capacity and launched its own mining operating system.

The post-halving reality has been rough. Q1 2025 revenue came in at $78 million, down 46% YoY, with self-mining revenue dropping 70.7%. But the company has a track record of being profitable every year since founded, plus its P/S is only 1.6, well below other mining giants such as Mara and Riot.

Watch this one. Especially if BTC pushes above $150K.

🐋 Marathon Digital (MARA): The Goliath, Still Standing

Marathon is the largest public miner by market cap — and has been the face of institutional mining exposure for years. It’s also the most debated name in the game.

On one hand, MARA controls a monster fleet with over 75 EH/s expected by year-end, global mining operations from the U.S. to the UAE, and a budding software business for managing hashrate.

On the other, critics argue it’s bloated, overly reliant on third-party infrastructure, and too slow to pivot in a fast-moving landscape.

Still, when Bitcoin’s hot, Marathon runs. The company holds a large BTC treasury of over 50,000 BTC, is adding immersion-cooled sites, and remains a proxy trade for many traditional investors wanting in on mining without picking niche plays.

Love it or hate it, MARA isn’t going anywhere. And if BTC moons in Q4, it’ll be one of the first tickers to feel the heat.

🧊 Cipher Mining (CIFR): The Quiet Killer

Cipher isn’t flashy. It doesn’t dominate headlines or make bold predictions. What it does do: mine Bitcoin efficiently, at low cost, with minimal dilution and maximum discipline.

Based in Texas, CIFR locked in long-term power contracts at enviably low rates and steadily grew its fleet past 13.5 EH/s. It has some of the best cost-per-BTC metrics in the industry and avoids unnecessary spending or debt.The Texas-based miner produced 602 BTC in Q1, and benefits from low power contracts and disciplined growth.

The market loves it: CIFR is up ~35% YTD, trading at $6.52. It’s becoming a favorite among investors who want hash exposure with less volatility and more transparency. The monthly production updates are clear, consistent, and confidence-building.

👀 Trends to Watch in H2 2025

1. Hashprice Rollercoaster: Hashprice (BTC earned per TH/s per day) has bounced from $39 post-halving lows to nearly $60. If BTC rallies again, miners with fixed-cost power will reap the upside.

2. GPU Hosting Pivot: With AI demand surging, some miners are repurposing infrastructure to host GPUs — think IREN.

3. M&A Season: Expect smaller players with weak cash flow to get scooped up.

4. Regulatory Shifts: Crypto Week laws passed in the U.S. provide more clarity. But ESG pressure and power usage scrutiny will remain part of the narrative.

💭 Final Thought

Bitcoin mining stocks aren’t just about Bitcoin anymore.

They’re about infrastructure. Data. Energy. Efficiency. Optionality. And in 2025, the winners will be those who can balance raw hashpower with strategic foresight.

Whether you’re team CLSK, FUFU, IREN, MARA, or CIFR — the landscape is shifting fast. And with BTC momentum building again, this might just be the beginning.

So — which miner are you backing this cycle?

$IREN More downside after huge rally!NASDAQ:IREN is printing bearish divergence on the daily RSI at all tie high resistance.

An Elliot wave motif wave appears complete and wave looks underway with a shallow target of the daily pivot, 0.382 Fibonacci retracement and ascending daily 200EMA.

The daily red wick after printing a 20% start to the day is reminiscent of a blow off top in this asset trapping newbs with FOMO price discovery pump. Market behaviour in action!

Analysis is invalidated if price returns to all time high.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Killing It. More Upside?NASDAQ:IREN has poked above the true all time high range (Launch price dump excluded) in a high degree Elliot wave 3

Long term target remains the R5 weekly pivot at $40 but may over extend with a bullish Bitcoin and Macro economic tailwind, coupled with AI growth.

Many thought this was a greedy target at $5 but now that price is $16 it doesn't look so bad. You have to know when to let the runners run, that is were the big bucks are trading!

Any retracement of a decent degree should expect to find support at the weekly pivot $9.4 before continuing upwards and may present an excellent buying opportunity! I will be posting the signal levels on Substack.

As always ,all time high range will be the next support if price continues upwards from here.

Safe trading

$IREN Weekly Bb expansion + SMA bullish alignmentNASDAQ:IREN Weekly bollingers have only looked this sharply expansionary a couple times in history.

Weekly SMA total bullish alignment has likewise also happened a couple times in its history.

But this time the bullish cross confluence will happen from much higher levels with a much stronger fundamental position from an execution risk and near term catalyst standpoint.

IRENs Incredible Surge Continue next wWeek?NASDAQ:IREN has been on a rampage since the April surging 175% and nearing all time high! A great couple of trades for us so far!

Price is likely to hit all time high next week with such a strong trend, where resistance and a pullback is a high probability.

The weekly pivot is $9.77, the most likely area for price to find support just above the 0.382 Fibonacci retracement (which will be dragged up to the weekly pivot once a new high is made).

Price discovery terminal target are the R3 & R5 weekly pivot points at $28 and $40.

Safe trading

Iren June PlayHad a good run up close to 10, healthy pullback especially given market conditions. Lots of instutional buyers bought at these prices and under. Classic structure shift into a sweep. Should be over 10 EOD Tuesday.

Extremely bullish crypto over a holiday weekend as well.

Not sure why bears so concerned about a 1-2% dilution. It's not all at once either.

A close below 8.7 would temporarily invalidate this entry.

Im 5k deep in calls since $6.8

Up quite a bit and rolled over to some deeper OTM contracts.

See you all at 15.

$IREN has the lowest all-in cost of mining a single coinNASDAQ:IREN is mining a single bitcoin at $40,000 all-in costs. When bitcoin appreciates to $150-200k, the miners with their rigs, land, infrastructure, balance sheet, hardware etc will be repriced higher. Thats the gain I would like to capture with this entry here at $9 a share.

This phenomenon will be seen throughout the entire sector, all miners will appreciate from here.

IREN a fresh reviewIREN has been moving upwards swiftly due to BTC 100k

Now we take a fresh look at IREN

it formed a double top which is a bearish sign and hence I took profit out of IREN at the double top high that is around 15$ area

So far its respecting the 50 day MA very nicely but there is a also an amazing cup formation which is leading me to think about it long term and therefore I would only now recommend entries after the 16$ barrier is breached.

As of now the latest strong support is 13.60 area . and if it goes further down then get ready for a support at 9$

Technically I wouldn't recommend buying anything which is in a bear tren therefore I would only recommend buying at a breakout of 16$

Entry when a daily candle close above 16$

Stop loss would be 13$

IREN's most important channel to watch!Hello Tradingview community!

As always: If this pattern I'm showcasing doesn't work as predicted..

then please don't come crying to me (ty) -> NFA DYOR

Alright the channel/chart explains itself as you can tell

But here is my short description:

This chart has been respected for 2 years now and still is -

What targets do I have for EOY?

Well anything from bearish 7ish to even bullish 25ish

But my conservative target is 14-15 dollars EOY (NFA)

BOOST and follow for more!

NFA DYOR <<<-----

Ring the Siren, It's time to buy IREN - Targeting $45 Why am I bullish IREN?

AI Cloud Services Growth: Iris Energy's AI Cloud Services division is expected to generate $32 million in annualized profits. This is a new strategic move that leverages their existing infrastructure to diversify revenue streams beyond Bitcoin mining

Increased Bitcoin Mining Output: For September 2024, Iris Energy mined 347 Bitcoin, with an average hashrate of 16.5 EH/s. The company continues to expand its mining capacity, contributing to higher output

Expansion and Partnerships: Iris Energy has been rapidly scaling its operations. They recently purchased NVIDIA H200 GPUs to support their AI cloud business, and they extended a contract with Poolside to upsize their AI Cloud Services, enhancing their overall service portfolio

These factors indicate both short-term revenue boosts and longer-term strategic growth, making IREN an attractive play in both crypto mining and AI infrastructure sectors.

Bitcoin Miner Moon Race - BMMR - CORZQ Leads the way!

The great power of the Bitcoin ecosystem, where is the hash rate coming from? Miners.

And most of these miners have bases in Americas only.

Most of the Eurasia / South America / Central America (El Salvador Volcano) are not publicly traded yet or direct government related but I suspect this trend is occurring globally.

Forget the Moon race, its the Hash Race.

All of this too when we are in early stages of a bull market. Don't hear a peep of Bitcoin miners or the ecosystem on Bloomberg either? BlackRock radio silence. . . but the waves are public.