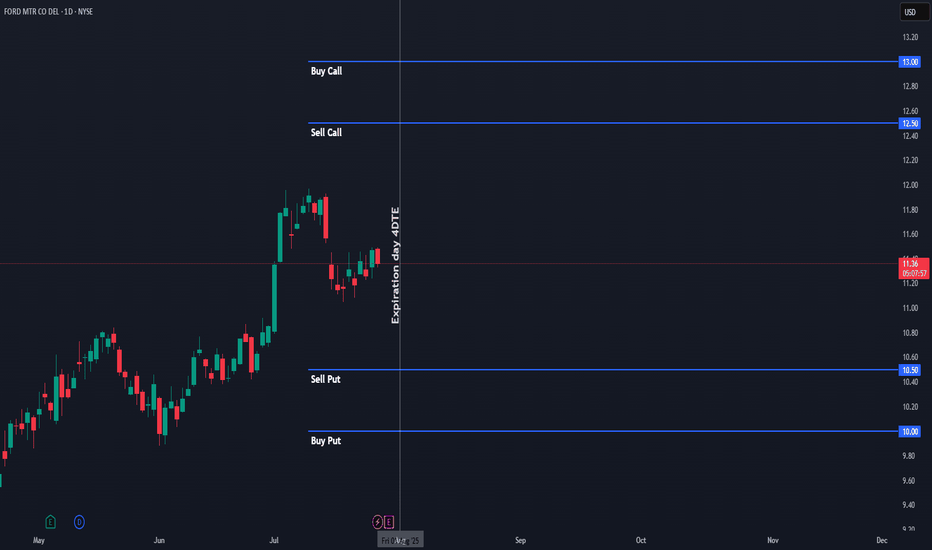

$F Iron Condor – Aug 1st Expiration | $7 Credit | I’m opening an Iron Condor on Ford ($F) with expiration on Friday, August 1st, 2025. The trade is based on the daily chart, using visible support/resistance levels to define the range. I selected strikes with approximately 0.15 delta on each side, giving the setup a high probability of success.

🔹 Total premium collected: $7 per contract

🔹 Stop loss: Defined at 50% of the premium collected (~$3.50)

🔹 Trade logic: We want $F to stay within the range throughout the week to let theta do its job.

🔹 Exit plan: If the price approaches either short strike, I will consider exiting at break-even or take a controlled loss.

This is a non-directional options strategy designed to benefit from time decay and low volatility. The setup is ideal for sideways price action, with no major catalysts expected during the week.

🎯 Target: Full profit if price stays within range until expiration.

❌ Stop: Exit if the price threatens any wing – max loss capped at 50% of the premium received.

This trade combines high probability with well-defined risk and is perfect for consistent weekly income when the market shows indecision or chop.

Ironcondor

DG Trading Setup: Capitalizing on RangeDollar General has experienced a stabilization phase following its Q1 2025 results, with same-store sales increasing 2.4% and revenue growing 5.3% to $10.4 billion. The company has regained traction in the discount retail space, mitigating previous challenges related to shrink and operational inefficiencies.

Institutional Flow & Market Positioning

Recent institutional flow highlights large orders in DG’s 115 call and 110 put, signaling either:

- A range-bound setup, where smart money expects the stock to stay between $110-$115 in the near term.

- Potential volatility, with institutions hedging both directions ahead of an unexpected move.

Considering the ATR (18) and standard deviation (7.353), this aligns with a low-breakout probability, making range-based strategies the optimal play. The absence of earnings between now and July further supports sideways movement expectations.

Options Trade Setup: Iron Condor

To capitalize on premium decay and IV contraction, I’m structuring an iron condor:

- Sell 115 Call / Buy 120 Call

- Sell 110 Put / Buy 105 Put

This strategy ensures limited risk while collecting premium in a high-probability range trade.

DLTR: Range + Flow SetupDLTR – Trading Within Range Amid Strategic Evolution & Flow Anomalies

Dollar Tree (DLTR) continues to show strength post–Q1 FY2025 earnings, breaking higher as it pushes through its multi-price format transition and nears the Family Dollar divestiture. The stock is outperforming key peers (DG, TJX, COST) and trading above both the 50- and 200-day MAs — a signal of growing institutional confidence.

On the fundamentals: Net sales (ex-Family Dollar) jumped 11.3% to $4.64B, comps grew 5.4%, and gross margin expanded to 35.6% despite transitional headwinds. Full-year EPS was guided up to $5.15–$5.65, reflecting management’s conviction in sustained growth. Analysts responded by revising EPS to $6.12 (+13.5% YoY), validating the turnaround thesis.

Valuation-wise, DLTR remains notably underpriced. It’s trading at 16.66x forward earnings — well below the retail average and far cheaper than peers like COST (51.1x), TJX (26.9x), and DG (19.0x). The gap is especially compelling given DLTR’s momentum and shift toward higher-margin discretionary sales via the “3.0” format.

Unusual Activity Insight:

What caught my attention was a cluster of unusual options activity suggesting a short-term strangle strategy centered around the July 18 expiration — likely positioning for the stock to stay range-bound while capturing premium from elevated IV post-earnings. The structure and OI shifts imply smart money is playing both ends of the current price band.

Trading Range and Setup:

DLTR has been respecting a range between $92 and $102, consolidating after its post-earnings move. That behavior, combined with the flow signals, sets the stage perfectly for a defined-risk premium play.

My Approach: Iron Condor (July 18 Expiration)

- Sell 100 Call / Buy 105 Call

- Sell 95 Put / Buy 90 Put

This iron condor aligns with the projected range, offering attractive premium while keeping defined exposure. With theta working in our favor and volatility elevated, it’s a setup that thrives in quiet bullish chop — exactly what we’ve seen since the Q1 breakout

Navigating MSTR’s Price Swings: A Smart Options ApproachOverview

MicroStrategy (MSTR) has continued to capture market attention due to its aggressive Bitcoin strategy and significant stock price volatility. In 2025, MSTR surged 41% in one quarter but also reported a massive $4.22 billion net loss in Q1, raising concerns about long-term financial stability. Analysts remain divided, setting price targets ranging from $200 to $650, largely dependent on Bitcoin’s performance and broader market conditions.

Key Developments Impacting MSTR

✔ Bitcoin Exposure: MSTR maintains a large Bitcoin position, making its stock highly correlated to BTC’s price movements.

✔ AI Integration: The company is investing in AI-driven products, which could provide diversification outside of Bitcoin.

✔ Institutional View: Analysts remain split on MicroStrategy’s valuation due to its uncertain revenue model.

✔ Macro Volatility: Market-wide sentiment, interest rates, and crypto regulations will influence MSTR’s trajectory.

Options Strategy for the Week

🚀 Iron Condor Setup for June 6 Expiration

To capitalize on MSTR’s volatility while managing risk, an Iron Condor strategy is structured within a controlled range:

- Inner Range: Sell Calls at 395 and Puts at 335

- Coverage: Buy Calls at 415 and Puts at 315

✅ Objective: Profiting from sideways price movement while minimizing exposure to extreme volatility.

✅ Risk Management: If MSTR breaks above 415 or below 315, the long positions hedge against excessive losses.

Opening (IRA): SPX May 16th 5000/5030/5785/5815 Iron Condor... for a 10.45 credit.

Comments: High IVR. After having taken small profit on the setup I put on before "Liberation Day," back in with a more symmetric setup in a higher IV environment.

Metrics:

Buying Power Effect: 19.55

Max Profit: 10.45

ROC at Max: 53.45%

50% Max: 5.23

ROC at 50% Max: 26.73%

Will generally look to take profit at 50% max, roll in untested side on side test, manage at 21 DTE.

Opening (IRA): LULU April 17th 300/310/390/400 Iron Condor... for a 3.39 credit.

Comments: Delta neutral earnings announcement IV contraction play.

Metrics:

Buying Power Effect: 6.61

Max Profit: 3.39

ROC at Max: 51.3%

50% Max: 1.70

ROC at 50% Max: 25.6%

Will generally look to take profit at 50% max ... .

Opening (IRA): IWM May 16th 190/195/220/225 Iron Condor... for a 1.70 credit.

Comments: I think I have more than enough long delta on at the moment, so opting to go nondirectional/delta neutral here. Selling the 25's and buying the wings out from there, collecting one-third the width of the wings in credit.

Metrics:

Buying Power Effect: 3.30

Max Profit: 1.70

ROC at Max: 51.5%

50% Max: .85

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, roll in oppositional side on side test.

Opening (IRA): IBIT May 16th 41/44/57/60 Iron Condor... for a 1.02 credit.

Comments: Going neutral assumption here, selling the 25 delta's and buying wings 3 strikes out, collecting one-third the width of the wings.

Metrics:

Buying Power Effect: 1.98

Max Profit: 1.02

ROC at Max: 51.5%

50% Max: .51

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, roll wings in on side test.

Opening (IRA): SPX May 16th 5130/5160/5850/5880 Iron Condor... for a 10.20 credit.

Comments: High IVR/IV >21. Hesitant to add more long delta here, so going delta neutral in SPX and structuring the trade such that I receive one-third the width of the wings (30) in credit.

Metrics:

Buying Power Effect: 19.80

Max Profit: 10.20

ROC at Max: 51.52%

50% Max: 5.10

ROC at 50% Max: 25.8%

Will generally look to take profit at 50% max, rolling down oppositional side on side test, but won't hesitate to take profit quickly if IV crushes in dramatically post "Liberation Day."

Opening (IRA): TSLA March 21st 330/335/465/470 IC*... for a 1.70 credit.

Comments: Post-earnings, IV remains fairly decent here at 57.3. Selling the -20 delta short option legs and buying the wings out from there. Basically, just doing small stuff while I wait for other stuff to play out.

Metrics:

Max Profit: 1.70

Buying Power Effect: 3.30

ROC at Max: 51.2%

50% Max: .85

ROC at 50% Max: 25.8%

Delta/Theta: .95/2.24

Will generally look to take profit at 50% max, consider doing a delta adjustment when the delta/theta ratio skews out to >2.0.

* -- Iron Condor.

Opening (IRA): SMH February 21st 195/220/270/295 Iron Condor... for a 3.91 credit.

Comments: Back into the semiconductor ETF, where I don't have a position on currently. Going comparatively low delta, with the short options camped out at the 17 delta on both sides and the wings about 1/10th the price of the underlying in width.

Metrics:

Max Profit: 3.91

Buying Power Effect: 21.09

ROC at Max: 18.54%

50% Max: 1.96

ROC at 50% Max: 9.27%

Will generally look to take profit at 50% max, roll untested side in toward current price on side test.

Opening (IRA): PLTR Feb 28th 70/75/100/105 Iron Condor... for a 2.11 credit.

Comments: High IVR/IV at 89.1/81.3. Adding to my PLTR position as an earnings announcement volatility contraction play.

Metrics:

Max Profit: 2.11

Buying Power Effect: 2.89

ROC at Max: 73.01%

50% Max: 1.06

ROC at 50% Max: 36.51%

Will generally look to take profit at 50% max, immediately roll out to March if a side is tested.

Opening (IRA): INTC Feb 21st 15/19/20/24 Skinny IC... for a 2.04 credit.

Comments: High IVR/IV (91.4/69.7) earnings announcement volatility contraction play. Going "skinny"/"almost iron fly" here. For purposes of take profit, treating it as an iron fly, where I generally look to take profit at 25% max.

Metrics:

Max Profit: 2.04

Buying Power Effect/Max Loss: 1.96

25% Max: .51

ROC at 25% Max: 25.0%

Opening (IRA): MSTR 2x225/2x240/460/490 Iron Condor... for a 7.00 credit.

Comments: IV remains high here at 112.4%. Going "double double" (put spread half the width of the call spread, but 2 x the number of contracts) to accommodate skew. Earnings are on 2/4, so will probably want to get out before then.

Metrics:

Max Profit: 7.00

Buying Power Effect: 23.00

ROC at Max: 30.43%

50% Max: 3.50

ROC at 50% Max: 15.22%

Will generally look to take profit at 50% max, roll in untested side on side test to about half the delta of the tested side. Given earnings on the horizon, will naturally just money/take/run for less if presented with the opportunity.

Opening (IRA): MSTR 180/210/410/440 Iron Condor... for a 6.03 credit.

Comments: High IV at 95.8%. Here, going delta neutral, 1/10th the price of the underlying for my wing width, and setting up my short option strikes at the 16 delta on both sides.

Metrics:

Max Profit: 6.03

Buying Power Effect: 23.97

ROC at Max: 25.16%

50% Max: 3.02

ROC at 50% Max: 12.58%

Will generally look to take profit at 50% max; roll in untested side on side test.

Opening (IRA): ARKK Feb 21st 45/50/61/66 Iron Condor... for a 1.43 credit.

Comments: An additive delta adjustment trade. With the short call of the setup I put on Friday (See Post Below) at -20 delta and the short put at 29, layering in an iron condor with the short call at the -28 delta and the short put at the 20 delta to flatten out net delta of the entire position. This is skewed slightly short to offset the slightly long delta skew of the setup I put on Friday, so am indicating that it's "short."

Metrics:

Max Profit: 1.43

Buying Power Effect: 3.57

ROC at Max: 40.06%

50% Max: .72

ROC at 50% Max: 20.03%

Since you can't close out an eight-legged setup, will either look to take off each iron condor individually at 50% max or mix and match profitable call side with profitable put side to reduce units/risk running into expiry.

Opening (IRA): SMH February 21st 200/225/270/295 Iron Condor... for a 5.44 credit.

Comments: At 42 DTE, selling premium in the semiconductor exchange-traded fund here with a neutral assumption ... . Using wings that are 1/10th of the price of the underlying in width.

Metrics:

Max Profit: 5.44

Buying Power Effect: 19.56

ROC at Max: 27.8%

50% Max: 2.67

ROC at 50% Max: 13.9%

Will generally look to take profit at 50% max; roll in untested side on side test.