BTC - D1 - BEARISH STRUCTURE STILL IN PLACE !Looking at the Daily picture, we can see a clear downtrend channel; the 61.8% Fibonacci retracement @ 31'665 has been reached this morning and the BTC is currently trading below both the Kijun-Sen (Base line) @ 32'611 and the Tenkan-Sen (Conversion line) @ 33'344. A Daily closing below those levels would add further selling pressure over the coming session (s).

Recent and current price action should still be seen as a corrective move only in a BROAD BEAR TREND !!!

30'300 AHEAD OF THE VERY IMPORTANT PSYCHOLOGICAL LEVEL OF 30'000 SHOULD BE SEEN SOON...

Watch carefully price action on shorter time frames to get clues and catch intermediate (s) signal (s) for tactical reversal which will be triggered mainly by short term bullish divergence (s) !

Only a sustainable move above the downtrend channel resistance line would force to a view reassessment of the expected strategic bearish scenario calling for lower levels !!!

Do not forget to protect any long postions with a tight trailing stop loss as it is better to cash in a small profit than a big loss :-) and last but not least watch the clouds on different time frames :-)

Have a nice trading day, all the best, take care and have fun.

Ironman8848

Ironman8848

BTC - D1 - RISING WEDGE AND DOWNTREND CHANNEL IN PROGRESS...Looking at the Daily time frame we can see 2 formations in progress, the first one (in blue) is a rising wedge and the second one is a downtrend channel (in red) After having reached a low of 32'101, some corrective recovery took place (pullback towards the rising wedge breakout): failure to reenter in this pattern triggered a renewal selling pressure in building this new downtrend channel.

No change in my view; as long as BTC does not recover and hold above the trigger level (KS) @ 34'970, any recovery should still be seen as a corrective move only.

Intermediates resistances are at 33'900 (MBB) ahead of 34'030 (TS) a move above those areas would temporary neutralise the downside risk,

On the downside, first intraday support on H1 is around 33'200/33'000(clouds support zone) ahead of former low @ 32'101 and then 31'665 (61.8% Fib ret)

Watch intraday time frames to get clues for validation or invalidation

Have a nice sunny Sunday.

Here in Cap Ferret, we have all the ingredients :-) for a pleasant Sunday ...

all the best and take care

Ironman8848

BTC - D1 - EN ROUTE FOR 30'300...Failure t o breakout the important resistance level of 34'970 mentioned yesterday triggered a new selling pressure which pushed down the BTC, filling on its way the 50 % Fib retracement.

Next support level is @ 31'665 (61.8% Fib ret) ahead of the triangle technical target of 30'300 which is also the 78.6 % Fib retracement and which is expected to hold !

Indeed, close to the psychological level of 30'000, it is highly expected to see some buyers again...

As already mentioned several times, watch shorter time frames very closely to detect early reversal signals which may be triggered mainly by bullish divergences on intraday time frames.

Have fun, take care and all the best my friends :-)

Ironman8848

US 10 YEARS - THE TREND IS YOUR FRIEND...Looking at the weekly chart we can see that current levelis below both, MBB (@ 1.5630%) and Kijun Sen (@ 1.3851%).

Wait for weekly closing for confirmation !

In the meantime, the expected target of 1.2890 % (38.2% Fib ret) has nearly been reached with a low so far @ 1.30 % !

Pressure remains to the downside , next significant supports levels being respectively @ 1.14 % and 0.99%.

Watch D1 , H4 and shorter time frames to get clues and intermediate signal (s) for validation or invalidation of the expected bearish (yield) scenario.

Ironman8848

BTC - D1 - WATCH CAREFULLY @ 34'970 !Looking at the Daily chart (D1), there is really one important level to watch at on the upside and this level is @ 34'970 !

Why ?

34'970 is the level of Kijun Sen & 50 % Fib retracement of the 41'341-28'600 downside move.

In addition, within the rising wedge formation, yesterday's mentioned in my previous analysis, there is also a triangle formation in progress with breakout being respectively @ 323'230 on the downside and 35'380; a breakout confirmed on a daily closing would be the first warning for a potential move of 2'923 points, targeting respectively roughly 30'300 on the downside and 38'300 on the upside.

Watch shorter time frames to get intermediate clues for validation or invalidation of those formations in progress (rising wedge and triangle !)

Have a nice afternoon.

I enjoy holiday at Cap Ferret (France) :-)

All the best and take care.

Ironman8848

BTC - D1 - RISING WEDGE IN PROGRESS ! WARNING !Looking at the D1 time frame there is a potential rising wedge formation in progress !

Below KS (34'970) and MBB (34'570) and currently around TS (34'320).

Watch carefully at today's price action as a failure to recover above KS on a daily closing basis would add further

pressure to the downside,

A move below 32'500 on the downside would be the first warning signal about the rising wedge formation above mentioned an a breakout confirmation of this important support level would open the door for a big drop of roughly 6'700 points, towards a technical target of 25'800 !!!

WATCH CAREFULLY AT SHORTER TIME FRAMES H4 TO M15 TO GET MORE CLUES AND INTERMEDIATE SIGNALS OF VALIDATION OR INVALIDATION ON^F THIS POTENTIAL RISING WEDGE IN PROGRESS.

Have a nice trading week

I am on holiday and I only will give you time to time updates :-)

Have fun and all the best

Take care

Ironman8848

BTC - H1 - DOUBLE BOTTOM IN PROGRESS - TRIGGER @ 32524 !Looking at the H1 time frame, a RSI bullish divergence triggered a short term recovery, in building

on its way a potential double bottom, currently in progress. Trigger level @ 32'524 !

A H1 closing level above the trigger level would be the first signal for further upside towards the double

bottom target which is @ 33777 which coincides with the bottom resistance of H1 clouds and slightly higher

there is the 61.8 % Fib ret (33895) also in the clouds area.

So watch carefully price action over the coming period (s) which will validate or invalidate this short term double bottom formation.

Once again, any recovery should still be seen as a tactical corrective move only, providing some very short term buying opportunity which

should be managed with discipline in adopting an appropriate RR approach (trailing stop loss !)

A failure to confirm this very short term reversal pattern and a breakout on the downside of the former low (31'271 would directly put the focus

on the psychological 30'000 support level ahead of former low of 28'600.

My first significant strategic support level remains @ 27'169 (61.8% Fib ret 3850-64895)

Have a great weekend.

All the best

Take care

Ironman8848

BTC - D1 - CORRECTIVE MOVE ONLY - SELL ON RALLY !No change in my view which still express some tactical buying opportunity in a broad strategic bear trend !

Indeed, despite an intraday high of 35289 reached yesterday's, BTC failed to firstly close above Kijun (34970), and secondly is currently still below Mid Bollinger Band.

Recent and current price action is confirming what has been said before and any recovery or exaggeration 35'500-36'000 should be used as a good strategic selling opportunity.

Watch shorter time frames to get clues and validation or invalidation on my bearish expected scenario.

Have a nice trading day.

All the best.

Ironman8848

BTC - H4 - TWO SUCCESSIVE DOJIS ! = UNCERTAINTY & INDECISIONLooking at the H4 time frame, we can see 2 successive dojis which took place over the last 2 H4 periods; it could

mean some uncertainty and indecision about further direction.

For the time being, the BTC hold above the former downtrend resistance line which also coincides currently with the level

of the Mid Bollinger Band around the 33'400 area.

So, next H4 closing level should give more clues about upcoming price action and I would strongly suggest to monitor accordingly

price action on shorter time frame which will allow you to detect potential reversal signal (s), such as bearish divergences, breakout

of clouds support zone, etc,

Looking at my previous H1 analysis, the rising wedge breakout occured a couple of hours ago, but clouds support zone, for the time being

rejected the downside breakout attempt and triggered, for the time being a sideways price action, confirming the uncertainty above mentioned.

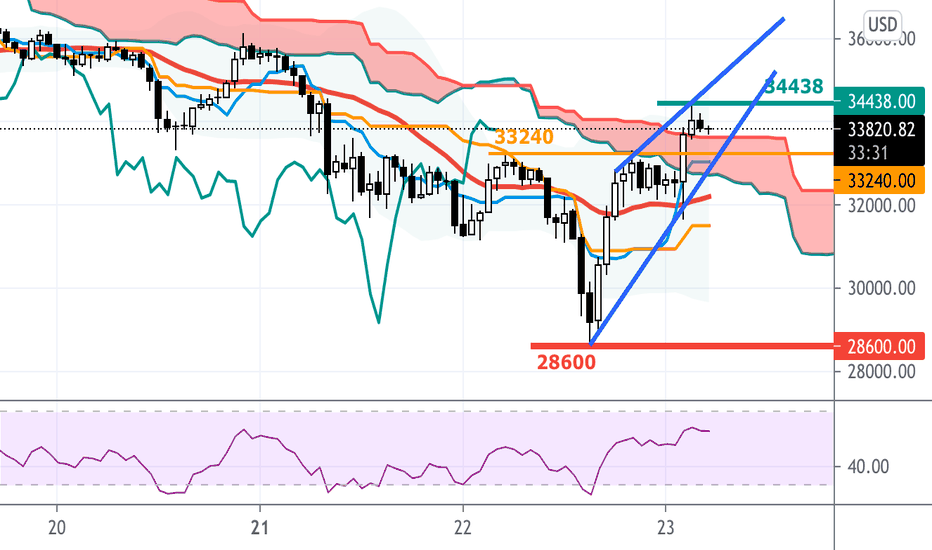

BTC - H1 - RISING WEDGE IN PROGRESSUnfortunately, my first significant technical target @ 27'169 has not been reached.. . Indeed, following

the low of 28'600, reached yesterday afternoon, BTC managed a very nice recovery, in breaking up, very quickly, several

resistance level on H1, beginning with TS, KS ahead of Mid Bollinger Band; interesting to note that MBB hold the pullback

attempt in rejecting the downside breakout.

Currently on H1, a "RISING WEDGE" pattern in on progress with its bottom support around the clouds area.

So, a failure to move above the former high (@ 34'438) and also to hold above the clouds support area would confirm a top in place

calling for renewing selling pressure and putting the focus on the level of MBB (32'213) as first significant support on this H1 time frame; a

confirmation will be given by a breakout of the KS, currently @ 31518.

CONCLUSION :

Watch carefully a the price action on shorter time frames which will either validate or invalidate this potential rising wedge formation, which if confirmed

would trigger a downside move of roughly 4'250 pts from the downside breakout, targeting in this case, a retest of former low @ 28'600

A sustainable move above 34'438 would put the focus on the 35'000 area (34'970 being the 50% Fib ret of the 41'341-28'600 downside move)

Watch also H4 price action, which for the time being is attempting to upside breakout the downtrend line resistance (MBB currently @ 33632 should also be

seen as a good barometer for further development as a failure to hold above this level on H4 closing should also be seen as a warning signal of a reversal.

Have a nice trading day

All the best and take care

Ironman8848

BTC - H1 - CORRECTIVE MOVE ONLY ! SELL ON RALLY .After having reached a low of 31'163 nearly (very close of my first target of 31'025 ), a bullish divergence

detected on H1 triggered a corrective upside move towards a high so far of 33'240.

As you can see on this hourly chart the Kijun-Sen worked perfectly well as resistance level to break !

In order to neutralise this ongoing selling pressure, BTC needs first to clearly move and hold above KS (currently @ 32'864) which should

be, of course confirmed by a breakout of the clouds resistance area in this H1 time frame, which coincides also to the downtrend line resistance (in red).

CONCLUSION :

No change in my view which is still calling for a move towards the psychological support level of 30'000 ahead of lower levels with the first significant support

level @ 27'169 (61.8% Fib ret 3850-64895)

STRATEGICALLY SPEAKING :BTC REMAINS A SELL ON RALLY AND NOT A BUY ON DIPS YET !

TACTICALLY SPEAKING : IT IS ANOTHER STORY AND A LOT OF VERY SHORT TERM BUYING OPPORTUNITY WILL OCCUR IN DUE COURSE TRIGGERED BY BULLISH DIVERGENCE (S)

ON SHORT TERM TIME FRAMES.

AS ALREADY MENTIONED, I STRONGLY SUGGEST TO PROTECT ANY TACTICAL LONG EXPOSURE TAKE IN USING A DISCIPLINATED RISK MANAGEMENT (TRAILING STOP LOSS !)

Have a great trading day and all the best

Take care

Ironman8848

BTC - W1 - BEARISH ENGULFING! EN ROUTE FOR 30'000...THEN LOWER !Last week price action (black candle) triggered, on a closing basis, a BEARISH ENGULFING pattern !

Ongoing bearish price action will continue to weigh on the BTC in opening the door for a retest of former lows

of 31'025, 30'066, psychological 30'000 support level, for the next significant target of 27'169, being the 61.8% Fibonacci

retracement of the 3'850-64895 rally.

Interesting to note that this target coincides also with the weekly clouds support area(27150-22925) and which should be seen as a very

strong support zone in this time frame.

Watch shorter time frame for validation or invalidation of this expected scenario.

BTC is currently far away of KS or pivot level @ 45'363 !

In order to neutralise this ongoing selling pressure, BTC should at least, recover above the primary downtrend line resistance ahead of KS, previously

mentioned.

Some tactical trading opportunities will, in due course, of course occur; offering countertrend buying opportunities which should be seen as

a corrective move only on a broad bear trend !

PLEASE KEEP IN MIND TO PROTECT YOUR COUNTERTREND EXPOSURE WITH TIGHT TRAILING STOP LOSS !!

Have a nice trading week.

All the best and take care

If you find my analysis as an added value for you, please do not forget to like it and for those who did not follow me yet, please add Ironman8848 in your following list.

Ironman8848

BTC - ONGOING DOWNTREND STILL INTACT !M1 : Recovery attempt failed...!

W1 : Bearish engulfing pattern in progress (wait W1 closing for validation or invalidation)

D1 : Below the clouds and for the time being below the cluster of TS, MBB and KS

In order to neutralise the ongoing downtrend, BTC should at least, quickly recover above

MBB (@ 37'040) ahead of TS, currently @ 38'000). A failure to do it would probably increased this

ongoing selling pressure, in opening the door for lower levels towards 33'500/33'000 first ahead of

31'000/30'000.

H4 : 61.8% Fib ret @ 34'965 filled, with an intraday low of 34'718. Below the clouds. In this time frame,

first significant resistance level is @ 36'460 (TS) ahead of the 38'000 area, level already mentioned in D1.

H1 : The low @ 34'718, triggered a bullish divergence which pushed, slightly up the BTC, facing currently MBB

as first resistance level ahead of KS slighly higher @ 36'345

M30 : Bullish divergence also clearly confirmed. Watch clouds resistance area which also coincides with H1 KS !

M15 : Currently facing clouds resistance zone

M5 : Currently attempting to upside breakout a triangle pattern (Warning the breakout is to close of the Apex, which means

this kind of triangle should be seen cautiously !!)

CONCLUSION :

No change in my bearish view, already expressed long time ago, any recovery should be seen as a tactical move only and not as a strategic

trend reversal yet. ONLY A MOVE ABOVE 43'380 ON A WEEKLY BASIS WOULD FORCE TO A VIEW REASSESSMENT OF MY EXPECTED BEARISH SCENARIO.

Have a nice weekend and have fun.

All the best and take care

Ironman8848

BTC - GLOBAL OVERVIEWM1 : Currently holding above the Kijun Support level (34'372)

W1 : Below the KEY PIVOT LEVEL @ 43'380

D 1 : Yesterday's failure to manage a recovery, on a daily closing basis, above the former support trend

line, triggered a new selling wave pressure

H4 : First target @ 37'400 reached with a low so far @ 37'224

H1 : Short term level to watch at are :

38'207 on the upside

37'224 on the downside

Interesting to note that the Mid Bollinger Band is currently @ 38'204 !

A clear breakout of this resistance area would put the focus again towards the 39'000 area which is also, by the

way the bottom of the clouds resistance zone in this H1 time frame

On the other side , a failure to hold above the former low of 37'224 would directly put the focus on 36'183 (50% Fib ret and

also roughly the bottom of the clouds support zone in H4)

M30 : Sideways price action

M15: Same than M30

M5 : Above the clouds and also, currently in a sideways price action.

CONCLUSION :

LOOKING AT THE H4 TIME FRAME, ONLY A CLEAR SUSTAINABLE MOVE ABOVE 39'500/39640 (FORMER HIGH) WOULD TEMPORARILY NEUTRALISE

THE ONGOING BEARISH MOOD !

Have a nice trading day

All the best and take care

Ironman8848

BTC - H4 - LEVELS TO WATCH : 38'000 AND 39640 !M1 : Recovery attempt in progress, confirmation will be given on M1 closing at the end of June.

W1 : KEY PIVOT LEVEL @ 43'380 (Kijun) as long as BTC is not able to sustainably hold above that

important level, the expected bearish scenario remains alive !

D1 : Currenty attempting to recover above the former uptrend line support which became now the

new resistance area to break. Wait closing for a breakout validation or invalidation

H4 : Kijun (38'062) worked perfectly well as support level, in rejecting the downside breakout attempt

which reached a low of 38'095 ! Currently trying to recover above Tenkan-Sen and MBB and a sustainable

move above 39'640 would, for the time being, neutralized the ongoing downside risk

H1 : Below the clouds and, currently between MBB (support) and KS (resistance)

M30 . Bullish divergence triggered the recovery. Facing the bottom of the clouds resistance zone

M15 : Above the clouds

M5 : Recent price action is showing a pullback towards the clouds which hold in rejecting the dowside breakout

CONCLUSION :

In H4, 2 levels to watch for further development :

On the upside : 39'640

On the downside : 38'000

IMPLICATIONS :

A clear breakout of one of those levels would imply a move towards, respectively :

Former high around 41'341, being also D+ bottom clouds resistance area

37'400 ahead of 36'183 and 34'965 being respectively 38.2%, 50% and 61.8% Fib ret and also broadly the clouds support zone in this H4 time frame.

Have a nice trading day and have fun.

All the best, take care

Ironman8848

BTC - KEY PIVOT LEVEL @ 43'380 (ON W1 CLOSING !)M1 : Recovery attempt in progress

W1 : KEY PIVOT LEVEL @ 43'380 (Kijun). Pullback in progress towards the former uptrend support line !

D1 : Attempting to breakout the 40'000 without great success for the time being, still below the clouds !

H4 : Recent pullback towards a high of 41'341, has been rejected from the former support trend line (in green): as a result, BTC is now

below Tenkan-Sen and has already tested the former top level around 39'500 ! A failure to hold sustainably above

39'500 would be the first warning of a confirmation of a top in place, calling for lower levels towards the MBB, currently

@ 38917 which should be seen as a good barometer for further development. Below next significant support is @ 38'062 (50% Fib ret

and Kijun). A breakout of the former high @ 41'341 would open the door for the W1, key pivot level @ 43'380

H1 : Watch the clouds support area on the downside and former high on the upside

M30 : Watch the clouds for direction

M15 : Sideways price action

M5 : Triangle breakout on the upside in progress. Watch upcoming period for validation or invalidation of this pattern

Have a nice trading day

All the best and take care

Ironman8848

US GOV BONDS 10 YR YIELD - THE TREND IS YOUR FRIEND...M1 : Ongoing bearish (yield) price action, currently below KS.

W1 : Ongoing breakout progress of the MBB important support level (1.5160)

D1 : Currently below the clouds and testing the bottom line support of the ongoing

downtrend channel

H4 : Far below the clouds area and below all indicators, (KS, MBB and TS)

H1 : Failure to recover above the clouds (1.5320) triggered a renewal selling pressure

As for H4 below the clouds ad below the cluster

M30 : Currently trying to recover above both TS and MBB (RSI bullish divergence !)

M15 : RSI bullish divergence. Recovery above MBB in progress

M5 : Currently attempting to confirm a clouds breakout

CONCLUSION :

ONGOING BROAD BEAR (Yield) TREND; SHORT TERM TIME FRAMES ARE PROVIDING

TACTICAL CORRECTIVE MOVE WHICH ARE EXPECTED TO BE PRETTY LIMITED.

LOOKING FORWARD AND IN ORDER TO NEUTRALISE THIS ONGOING DOWNSIDE RISK CALLING

FOR FURTHER DOWNSIDE TOWARDS, AT LEAST THE 1.30 AREA (1.3280 being the KS and 1.2890 being the 38.2% Fib ret

of the 0.5040-1.7740 rally), the 10 Years should first recover above the ongoing downtrend line resistance in place on M1,W1 and D1,

which is currently around 1.65/1.70: ONLY A SUSTAINABLE MOVE ABOVE THAT AREA WOULD FORCE TO A VIEW REASSESSMENT OF THE EXPECTED

BEARISH (yield) SCENARIO.

Next important support level being @ 1.1390 (top of the W1 clouds support area and also the 50 % Fib ret of the rally above

mentioned.

Have a nice trading day

All the best, take care and have fun

Ironman8848

BTC - H4 - TESTING THE CLOUDS SUPPORT ZONE ! WHAT NEXT ?H4 : Yesterday's failure to first confirm upside clouds breakout and secondly

to breakout the former uptrend support line (also cluster of respectively

2 former trend line) triggered a renewal selling pressure.

BTC is currently trading around an important level which is the clouds area

which as you can see is very thin, meaning very fragile too and also below the

recent uptrend line support, which started @ 31'025 !!!

So what next ?

1) On the upside :

In order to neutralise the ongoing downside risk, BTC should quickly recover above

the former high (@ 38'556) which also coincides roughly with the cluster above mentioned

of the two former support and resistance trend lines.

Such kind of price action would open the door for the 39'500 area (former congestion top),

then 40'000 (psychological level) ahead of the 41'000/41'500 area.

ONLY A SUSTAINABLE MOVE ABOVE THE LATTER ZONE WOULD FORCE TO A VIEW REASSESSMENT

OF THE EXPECTED BEARISH SCENARIO CALLING FOR AT LEAST A RETEST OF FORMER LOW 31'000/30'000

2) On the downside :

First significant support is @ 35'600 ahead of 34'735 (50 % Fibo ret & KS)

Below 33'850.

Interesting to note that the supports above mentioned coincides with the clouds projection...

CONCLUSION :

Watch shorter time frame to get clues for validation or invalidation of the clouds support area.

Recent price action is clearly showing a great uncertainty about further development (successive dojis !!)

Have a nice trading day and may your long goes up and your short goes down.

All the best, take care and have fun :-)

Ironman8848

BTC - H4 - 78.6 % FIB RE FILLED @ 37'678 ! What next ?H4 : Nice "corrective" rally seen from the low of 31'025 towards

a high so far of 37'682.

The 78.6 % Fibonacci retracement of the 39'490-31025 downside move

has been filled (37'678).

So, what next ?

We can see that the upside breakout attempt of the clouds failed,confirmed

by the inability to the "chiku" to also confirm clouds breakout.

In addition, despite this strong rally, BTC is still below the former uptrend support

line, which is currently around the 38'500 area.

I would strongly suggest to look at the clouds area as the PIVOT ZONE for further development

in this time frame.

Indeed, a failure to clearly breakout the top of the clouds and to stay sustainably above it would

trigger again new selling pressure, calling for lower levels !

First support being around 36'110 ahead of 35'140 (current level of the ongoing support trend line)

Below watch at the Mid Bollinger Band (34'825) which for me remains one of the good leading indicator.

A breakout of this level would put the focus on former lows !

Watch shorter time frames to get clues and to get intermediate signal (s) for validation or invalidation.

Have a nice day

Take care and all the best

Ironman8848 :-)

BTC - H1 - RISING WEDGE IN PROGRESS - 61.8 % FIB RET FILLED !H1 : Nice recovery seen from the low of 31'025 (bullish divergence and hammer !)

towards a high so far of 34'740 reached one hour ago.

A rising wedge pattern is in progress and BTC is currently attempting to upside

breakout the top of the clouds.

Therefore, price action over the upcoming period (s) will be very important to look at.

Indeed, a failure to clearly breakout the clouds would confirm the top of the recent recovery

and trigger a new downside move.

Looking ahead and above, as you can see on this H1 chart the 34'600-35'500/36'000 area looks very

fragile and in a case of a clouds breakout we should assist to an upside acceleration towards

this new resistance area which has been a former congestion area, seen a couple of days ago.

CONCLUSION :

Watch carefully ongoing price action on shorter time frame which will validate or invalidate further upside.

On the downside, watch the former clouds resistance which becomes now new support zone ahead of the cluster

of TS, (wedge base line !), MBB and finally KS.

Have a nice afternoon

Ironman8848

Nasdaq 100 E-mini-Futures - W1 - MAJOR DOUBLE TOP IN PROGRESS !M1 : Ongoing uptrend channel .. but already below the middle level of the channel !

W1 : Under the influence of a major double top in progress

D1 : Full Fibonacci retracements, including the 78.6 % (13'816) have been filled with a high so far @ 13'865.

Therefore, something is cooking and a trend reversal is in progress

H4 : RSI Bearish divergence triggered a first downside move; watch TS as the first support. A failure to hold above

13'780 would be the first warning signal, calling for further downside towards the clouds support area (13'650-13'500)

13'502 being the 38.2 % Fibonacci retracement of the last 12'915-13'865 rally

H1 : Bearish divergence confirmed by a bearish engulfing pattern at the top

M30 : Already below TS and MBB

M15 : Below the cluster of KS, MBB and TS

M5 : Below the clouds and the cluster

CONCLUSION :

SOMETHING IS COOKING !!!

WATCH CAREFULLY PRICE ACTION ON INTRADAY BASIS IN SHORT TERM TIME FRAMES AND ALSO TODAY'S CLOSING LEVEL

ON D1 BASIS. A TOP IN PLACE WOULD BE CONFIRM BY A FAILURE TO HOLD ABOVE MBB CURRENTLY @ 13'500 AND KS @ 13'431

Have a nice day and have fun

Take care

Ironman8848

VIX - AT A GLANCEM1 : In an ongoing downtrend channel

W1 : Same than M1, below the cluster of MBB, TS and KS and last but not least

below the clouds

D1 : Also below the clouds and the cluster; potential double & triple bottom in progress

below the 16.00 area

H4 : For the time being, each attempt to recover above the ongoing downtrend line resistance

failed. In order to neutralise this ongoing selling pressure, the VIX should quickly recover above

TS first, then above the downtrend line resistance and finally above MBB and KS.

A sustainable move above 17.50 would be the first signal of a potential trend reversal in this time frame

H1 : Below the clouds and currently still below the cluster too

M30 : Same than H1; watch clouds resistance area and especially the 17.50 area

M15 : Currently still below the clouds

M5 : Below the clouds too; RSI bullish divergence in progress

CONCLUSION :

AS MENTIONED ON D1, A POTENTIAL DOUBLE & TRIPLE TOP FORMATION IS IN PROGRESS, WATCH CAREFULLY

PRICE ACTION ON INTRADAY TIME FRAMES FIRST AND ALSO THE CLOSING LEVEL ON THE UPCOMING DAYS

Ironman8848

BTC - D1 - TRIANGLE BREAKOUT - WARNING !!!M1 : Persisting ongoing bearish price action in progress !

W1 : Same than M1, as long as BTC remains below KS

D1 : Triangle breakout in progress, first confirmation would

be given by a closing level, on a daily basis below the base of the triangle !

Watch closely today's price action

H4 : Last couple of candles are showing successive black candles pattern with

a low so far @ 32'418 as expected (see related idea below )

H1 : Below the clouds and below the cluster too

M30 : Same than M30

M15 : Same than M15; RSI bullish divergence triggered a recovery attempt which, for the

time being has not been very successfull as selling pressure remains

M5 : Below the clouds. Watch former congestion bottom @ 33320 as first very short term resistance

area which also coïncides with clouds resistance zone.

CONCLUSION:

REMAINS THE SAME ! RECENT AND CURRENT PRICE ACTION SHOULD STILL BE SEEN AS A CORRECTIVE TACTICAL MOVE ONLY IN A BROAD STRATEGIC BEAR TREND.

AS ALREADY MENTIONED SEVERAL TIMES, ONLY A SUSTAINABLE MOVE ABOVE THE 40'000 AREA AHEAD OF 41'230 WEEKLY PIVOT LEVEL WOULD FORCE

TO A VIEW REASSESSMENT OF THE EXPECTED BEARISH SCENARIO CALLING FOR A RETEST OF THE FORMER LOWS @ 32'418 , 31'100 AHEAD OF

THE PSYCHOLOGICAL LEVEL OF 30'000 AND POTENTIALLY LOWER TOWARDS 27'169 (61.8 % Fibonacci retracement of the 3'850-64'895 rally !) AND TOWARDS

THE TECHNICAL TRIANGLE TARGET (IF CONFIRMED) @ 21'270

Have a nice day, have fun and take care.

If you find my analysis valuable for you, please do not forget to like it and for those who did not follow me yet, please add Ironman8848 in your following list.

Many thanks in advance

Ironman8848