AUD/USD & AUD/JPY Analysis / Iron Ore & InflationThe Australian Dollar has weakened in recent weeks due to Iron Ore prices declining as China's zero covid policy has caused investors to fear a slowdown in the world's second-biggest economy.

Australia exports 80% of Iron ore to China, so any slowdown in China will hit demand for Australia's commodity exports and put downward pressure on the currency.

We also have Australian inflation data out tomorrow, which could surprise to the upside and beat economists' forecast, causing a rally higher in the Australian Dollar on rate hike expectations.

In this video I break down what could play out and how to make money from the potential outcomes.

Ironore

Australian Dollar Iron Ore Prices Causing AUD to StrengthenIn this video I break down why the Australian Dollar is bullish because Iron Ore prices are rallying due to the war in Ukraine.

Iron Ore is Australia's key commodity export, therefore higher prices increases the demand for Australian Dollars.

Watch this video to learn how commodities have an impact on certain currencies in the Forex market.

Commodity prices: Iron OreFrom mid-September until the end of October, Iron Ore appeared to have found a safe space above US $100. Now, after a steep decline beginning October 27, 2021, Iron Ore has started to test May 2020 lows, close to US $90 per metric tonne. The commodity is grating against predictions by ANZ Bank (ASX: ANZ) for it to “find a floor around current levels”.

Demand (or lack thereof) from China is what has driven the price of Iron Ore sub-100 dollars. Chinese authorities have ordered its steel manufacturers (large consumers of Iron Ore) to cut production to meet targets to reduce energy consumption and pollution across its provinces. China’s production restrictions are scheduled to last until mid-March 2022.

According to S&P Global, Iron Ore outlook is unfavourable, with “pricing risk is to the downside” as supply tends to increase in the latter half of the year.

FMG / Fortescue holding supportFortescue has been in a steady downtrend since the drop of iron ore prices in August. Since October, however, it was able to hold support at around 14 over and over again. With the recent drop in SGX:FEF1! this especially notable.

I am fundamentally bullish on Fortescue due to its fundamentals (balance sheet, green hydrogen ambitions, autonomous hauling) but it's hard to find a good entry point with iron ore prices plunging this rapidly.

FMGI thought it woudl keep going up, but it's exytended that thin bullflag into a lower cell - so double and and there's snot only neat symmetry with a lower cell and a good waisteband lining up with features to hang them off, but multiple gradients in there .. SO another week or so for FMG, I'd reckon, with a retest of the TL below - see teh RSI30 line coming up to repell/support. If it breaks lower it's a sell.

AUD/CHF Signal - CHF Trade Balance - 20 Sep 2021AUDCHF is plummeting at the market open today prior to the CHF trade balance data, which reveals the balance of imports and exports in Switzerland. Technically the pair is rebounding out of the fibonacci golden pocket resistance, and we are looking for downside into the 0.6650 level.

ASX:FMGThe recent drop in iron ore prices has seen the major mining companies being beaten down, the selling has now reached panic proportions and of all the big miners Fortescue has faired the worst. While I am not saying this is a good time to buy, as iron ore prices still have fundamental head winds to contend with and the prices can certainly move much lower before smaller miners are forced out the market and the supply glut begins to dissipate. However expect some consolidation or a small bounce within the highlighted zone before any moves lower are made. This zone will be the first major test for bulls if the can keep prices around the $15.00 mark and a floor develops in the next few months in iron ore prices this could develop into a good buying opportunity. Don't be surprised though if price consolidates before moving lower to one of the highlighted support zones.

*Not a recommendation to buy or sell, simply for educational purposes*

ASX/200 - NOW IS THE TIME TO BUY AUSTRALIA'S STOCK MARKET INDEX Fundamentals

Now is the best time to buy Australia's stock market index, as Australian companies exporting commodities to the rest of the world during the recent commodity boom, is pushing up the share prices of the biggest mining companies within the country and pushing up the index!!!

Mining companies are seeing their share prices rise due to the booming commodity demand from the re-opening of the global economy as the vaccination rollout is pushed forward, alongside the commodity and precious metals demand for the transition into clean energy.

Commodities

Australia’s commodity export economy is reliant on export demand, especially from China. Therefore with strong global economic growth expectations from fiscal and monetary stimulus, Demand will be strong for Australian exporters, along with Domestic growth, supporting Australian equities.

Key Economic Data To Watch

Chinese & U.S Manufacturing PMI

Correlation - S&P500 & ASX/200 Historically move closely together.

Technicals

A breakout above the recent high 7175 would be another opportunity to enter a long buy position.

Risk Management

ATR Volatility Stop Loss: 13.00%

Risk/Reward Ratio | 3:1

Stop Loss Area: 6188 (925points)

Take Profit: 9301 (2,191points)

Gold Builds Up As Hyperinflation Risk RiseInflation is the term that indicates rising prices for goods and services in an economy, while rapid and out of control rising of prices indicates Hyperinflation .

While following the rapid increase in prices of commodities and metals such as Lumber LBS1! and Iron Ore TIO1! , it is accurate to say that global economy is being driven to Hyperinflation due to mismanagement of economical struggle caused by Covid-19 Pandemic.

Gold offered and offers strong potential for gains in economic struggles and even after economic recovery occurs, given how undervalued at this time relative to high prices of commodities.

Taking all these fundamentals into consideration combining with technical analysis, Gold price does not reflect its value.

You may see my long position strategy below and on the chart,

Entry Point: 1870.00

1st Target : 1950.00

2nd Target: 2075.00

3rd Target: 2180.00

Stop Loss : 1800.00

Thank you and stay tuned for more strategies!

Please leave a like and comment what you think.

Trade safe and have a nice Monday

$VALE - once this breaks out...Commodity markets are 20 to 25-year cycles. When commodities are at their lows relative to the S&P500, it is usually an opportunity of a lifetime. VALE is a great example of a base metals producer that will do incredibly well in the coming years. It also pays 8% dividend. Combine an increasing share price with a high dividend and you've got a stock you can't afford to miss.

AUD/USD - Buy Set UpWe have a long term buy set up for the AUD/USD.

In this video, we look at how Iron Ore is a key export for Australia and the effect the commodity price has on the AUD/USD exchange rate.

With China's economy expected to grow in 2021, an increase in Australia's key export to the world's second-largest economy should support a continuation of the bullish momentum in both Iron Ore prices and the AUD/USD exchange rate.

Iron Ore - where to next?Thanks for viewing. This will just be a short one. My reasons for bearishness are:

- bearish RSI divergence (higher price high shown as a lower high on the RSI - at a minimum indicates reduced momentum but normally precedes changes in price direction),

- MACD histogram is trending downward quite steeply,

- MACD moving averages look like they are starting to head towards a cross-over to the downside,

- Declining volume over the past 18 months (seems to average over 400 in May 2019 and is about 120 now),

- A generalised global industrial slowdown.

I may be wrong, or I may be right but just too early, and there may be residual upside remaining. Medium term I see price heading back to ~$40 level.

Protect those funds.

$ASR Assore Ltd looking technically constructive. (Bullish)Assore Ltd was in a solid downtrend for the best part of the 2nd half of 2019, dropping from a high of just over R400 down to a low of R215. However, towards the end of 2019 we saw the stock break the downtrend line (DTL) and start to trade above the 50 dma (blue line) which was the first clue that the stock was turning the corner. During December, the stock then broke its previous swing high horizontal resistance level at approximately R262 before encountering some closing price resistance at approximately R272. In addition, the last few pullbacks on the stock have been supported by higher swing lows (UTL), which further adds to my conviction that the trend has changed on this counter. Today, the 14th Jan 2020, we are starting to see the stock clear this resistance level, and should the stock convincingly close above R272 by EOD, it looks like we have the all clear for the stock to now trade higher and tag the major resistance level at R310-R314 where we will encounter both the 50% fib retracement of the entire period, as well as the 200 day moving average (green line).

MT Buy Opportunity LoadingCommodities have remained very cheap against the recent rise in Major World Indexes.

This includes iron ore.

And this cheapness can create opportunities in the iron and steel industry.

The price can get even cheaper.

The analysis does not contain a very high quality risk / reward ratio, but I think it is possible to make very profitable trades based on this idea in lower time frames.

Parameters

Risk/Reward Ratio : 1 / 1.68

Stop-Loss : 13.632

Goal : 20.43

Bonus Chart: Iron Ore weaknessIron ore futures is reversing upon a weekly stretched ABCD completion which is confirmed by price action hitting SSR resistance and breaking down below key MA support.

Iron ore prices has been supported largely by supply issues but demand is being tested this trade war. Not sure those highly indebted property developers in China, especially those which have been gouging on USD debt, will be building much in the next year or so.

Bullish signs from Iron Ore Futures 3 scenarios: 2 bull 1 bear.

1. Bullish upper trend-line break from first wave leading diagonal (T1 equal to or greater than $106 and T2 ~$139),

2. ABC correction (blue) following extended correction - we are currently in wave B triangle (T1 $106 for 1:1 wave A),

3. Downward breakout for additional corrective retrace.

At this stage scenario 2 looks the more likely.

Before getting too far ahead; look for a lower trend-line bounce first.

This is a 100% technical analysis and no element of fundamental analysis was considered. I am not a professional trader and my analysis if shared simply to further my own education.

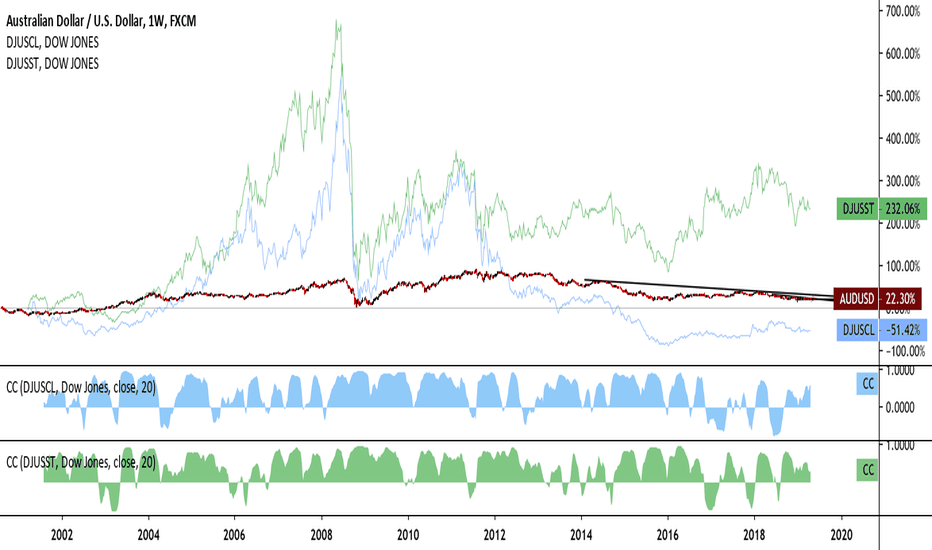

Correlations Between AUDUSD, Coal, and Iron OreI've been taking quite a deep look at the relationship between correlatives of the Australian dollar lately. There's no question that this deep dive would be remiss without looking at correlation coefficients between AUDUSD and that of commodities it exports, primarily iron ore and coal. The chart really speaks for itself. Aussie dollar sees strength when coal and iron prices are up, weakness when its down. Pretty simple. Not much more to say beyond that, but the implications for this relationship are quite fundamental to several questions vis-a-vis the Australian economy such as financial diversification, their reliance upon Chinese imports, not to mention the environmental tolls the Aussies have suffered from global carbon emissions. All issues, public policy or financial, must recognize this important financial relationship before going forward to reassess any changes to the economy that come down on it. At the very least, the implications of these correlations need to be recognized.