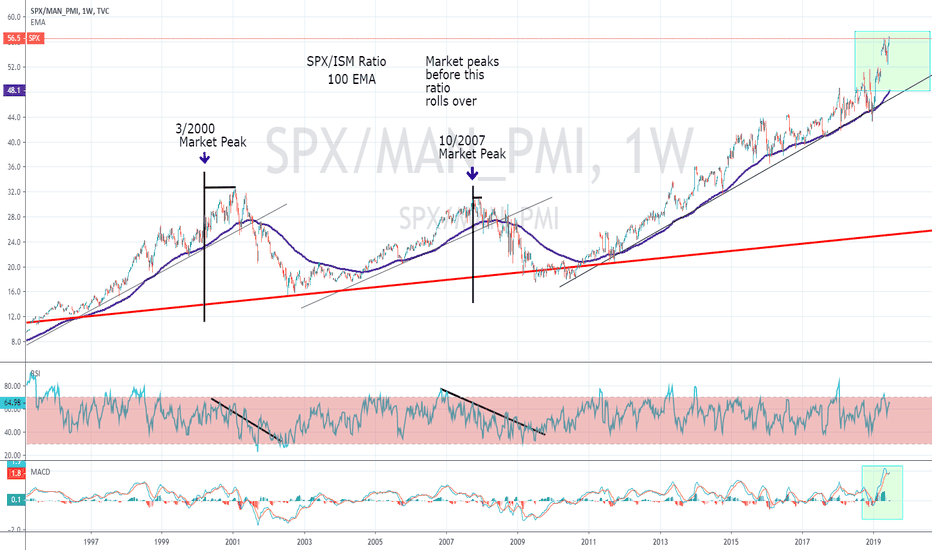

Does SPX vs PMI divergence signal upcoming recession? No, not really. Only 3 of 7 divergences signaled recessions in the last 50 years. Besides, some recessions did not have any divergence.

So data doesn't support the recession is coming thesis.

Red flag -> Divergence with recession following

Green flag -> Divergence w/o recession

? -> No divergence signal before recession

(This post is in response to some comments I received)

ISM

Will currency wars replace commodity wars?In general, Monday began quite peacefully. China has been non-aggressive in its response to Trump who has signed into law a bill that supports pro-democracy protesters in Hong Kong. And it seemed that we were waiting for another boring day.

However, Trump once again showed why we prefer the sale of the dollar for a quite long time. He began the day by accusing Argentina and Brazil of understating their national currencies value to gain a competitive advantage for their products in the US market. In response, the President of the United States raised tariffs on the import of steel and aluminium from these countries.

Well, he continued with the Fed’s traditional accusations of overvaluation of the dollar and called on the Central Bank to weaken monetary policy and the dollar.

Markets took it as signals for sales of the American currency. Moreover, the buyers on the dollar were not happy with the data on the ISM Index in the US manufacturing sector: 48.1 pips with a forecast of 49.2 pips. Recall that an index value below 50 signals a deterioration in business activity in the US manufacturing sector.

Well, returning to Trump and his actions on Monday, in the light of such events, it’s premature to talk about the end of the trade wars. Rather, on the contrary, there is a reason to talk about the transition of trade wars to currency wars with the consequences that maybe even more devastating for the global economy. In general, the future looks rather bleak. In this regard, our recommendations to buy safe-haven assets remain relevant.

Our basic positions for today are: finding points for sales of the dollar, purchases of gold and the Japanese yen, sales of oil and the Russian ruble. We also note that while the period of low volatility continues on the foreign exchange market, it is worthwhile to continue aggressive trading on the intraday basis without obvious preferences, for which you can use watch oscillators.

Data helps the dollar, optimism in financial marketsIn our previous review, we noted that the publication of the ISM index of business activity in the US services sector will be the main event. The ISM index of business activity in the services sector reached 54.7 in October (analysts expected 53.5, before 52.6).

As a result, the USD strengthened. “I think it’s a good time though to pause...and that’s what I am looking to do,” Barkin (non voter)told reporters following a speech to an economic outlook conference in Baltimore was another impulse. It seems that the majority of the Fed feels that way. According to the Chicago Mercantile Exchange, markets also expect a pause until September 2019, the probability that the rate will remain at the level of 1.50% -1.75% exceeds 50%.

As for the USD, Tuesday turned out to be rich in bullish signals. Despite this and yesterday’s growth, we do believe that the potential for its further strengthening is limited. Therefore, we will continue to look for points for its sales across the entire spectrum of the foreign exchange market, both on the intraday basis and the medium term.

China deal is likely to be signed in November so markets are optimistic about that. The confidence that by the end of this month we will see the first signed agreement is getting stronger, so safe-haven assets weaken and commodity markets grow.

Take oil, for example. OPEC sees its oil market share shrinking, Forecasts are generally negative for oil prices - the Cartel expects a significant decrease in oil demand growth in the foreseeable future. However, oil strengthened yesterday at the end of the day - expectations of progress in trade negotiations overcame fears of a surplus in the oil market. So our recommendation to buy oil on the intraday basis remains relevant.

As for the safe-haven assets, the downward pressure is increasing, and they are close to hitting the critical points, after that the further reduction in the price of gold and the Japanese yen is quite possible. On the other hand, their current prices look ideal for purchases. So today we will buy gold and the Japanese yen with small stops.

Today, in terms of macroeconomic statistics, we are waiting for statistics from the Eurozone (a lot of business activity indices, as well as retail sales data) to come out.

Last week outcome and current market statement ISM Manufacturing Index report announced on Tuesday was the main event last week. Recall, the Index fell to its lowest level since June 2009 - 47.8 points (below 50 means decrease inactivity). As a result, the dollar has undergone the most massive one-day sales over the last month.

However, the sale did not receive further development. The markets were waiting for the statistics on the NFP (unemployment fell to 3.5%, which is a record low for the past few decades. NFP figures are close enough to the forecasts and market expectations. Nevertheless, the dynamics can be traced more clearly (downward trend). So after Friday’s data to come out, the Fed has untied its hands to reduce rates in October (currently the markets estimate the probability at 76%). We also note that lower wage growth is also another enable signal to lower the interest rate.

So, our position as for the dollar has not changed, but rather strengthened. We will continue to look for points for its sales across the entire spectrum of the foreign exchange market. Moreover, the US has not only economic but also political problems. The beginning of the impeachment procedure, regardless of its outcomes, is a negative signal for the US dollar.

As for the upcoming week, it will be relatively calm on Wednesday, the markets will look through the minutes of the last FOMC meeting, on Thursday data on the UK economy (GDP, industrial production), as well as inflation in the USA, on Friday, attention will be focused on statistics on the Canadian labour market, as well as consumer sentiment in the USA.

Of our other preferences, we note the purchase of gold, as well as the Japanese yen. According to analysts at JPMorgan Chase, the 4th quarter in the last 10 years is the most unfortunate period for the Japanese yen. So do not forget about the stops and control the volume of entry.

In the oil market last week, everything was following our forecasts. Goal 51.20 has been achieved. After that, the bears recorded profits on Friday. It is still difficult to say whether this fixation will turn into a full-fledged correction. So we will spend the beginning of the week neutral regarding oil - we will observe how events will develop and we will monitor the news background.

Getting ready for a volatile day: pound and dollar have the bullLabor Day in the US and Canada led to a relatively calm day on the financial market. But today everything can change radically.

On the one hand, Hurricane Dorian threatens to become the most powerful in history. This means that the potential damage could also become the most significant. Yesterday we promised to show the way how to make money on this kind of natural force majeure.

Here are a couple of facts. Irma was the first Category 5 hurricane (like Dorian) provoked a sharp decrease in the number of new jobs created out of a farm sector in the United States (NFP indicator) in September 2017. With an average 200K number, its September figures were (the peak activity of Irma in the month of August) -33K (!). In 2018, hurricanes were less destructive, but the September NFPs came out below forecasts 30% (!)and much lower than the average.

Thus, if the hurricane turns out to be quite destructive, we can expect weak figures for the US labor market for September-October. Accordingly, it will be possible to prepare in advance for the failed data and make money on it.

But the consequences of Dorian are not clear yet and will manifest after some time, but in the UK everything can be much more dynamic. Today, the UK Parliament is returning from recess with the understanding that they have less than 10 days to stop Johnson, because on September 12 his activities will be suspended until mid-October (the UK will leave the EU on October 31).

That is, today all sorts of sensational news are possible to happen. There are a lot of development options of events, starting from the law prohibiting exit without a deal, ending with the resignation of the Government or early elections.Thus, the dynamics of the pound so far seems completely unpredictable - it will be entirely determined by the results of the parliamentarians activities.

Let's try to give an approximate plan for working with the pound, depending on certain results. We sell the pound if the Parliament can accept nothing, as this is likely to mean a "hard" Brexit. We buy the pound if a law is passed to ban the exit without a deal or if a vote of no confidence is put forward to the Government. We regard early elections as a neutral option with positive for the pound since it will at least delay the “hard” Brexit.

Also, today it is worth paying attention to the ISM index of business activity in the USA, Michel Lagarde speech, as well as the index of business activity in the UK.

Speaking of our other trading preferences for today, we note that we will continue to sell the euro, buy gold and the Japanese yen, sell oil and the Russian ruble.

This POWERFUL Indicator Predicted The Last Seven Recessions!This simple but elegant indicator is nothing but the ISM Manufacturing Index represented with a baseline of 45. Once the ISM line breaches the baseline it indicates a recession is guaranteed if not already under way.

This indicator has perfectly predicted the last seven recessions and is currently trending down towards the baseline as we speak. Like, share and save this indicator so you can check in on it regularly as it could cross below the baseline within a matter of months or even weeks from now.

This is just one indicator that sits along side the multitude of other recession indicators I have posted recently that all point towards a recession beginning late this year, check them out!

Not Financial Advice

Will the USD/JPY test 105.00 this week?Going hand in hand with the sharp drop in US Treasury yields, which now price in a more than 95% chance of the US central bank FED cutting interest rates at least once by December 2019, the USDJPY followed and dropped below the crucial support region around 108.70.

The drop lower continued into the start of the week with the ISM Manufacturing following the US Services sector's collapse (and Canada and China's plunge), printing at a disappointing 52.1 (53.0 expected) and being its weakest since October 2016 (despite a rise in new export orders and employment).

Three of five ISM components declined, including production, inventories and supplier deliveries, and stagflation looms as prices paid rose.

In addition, the headline PMI fell to its lowest level since September 2009 as output growth eased (with output expectations crashing to the joint-lowest since records began) and new orders fell for the first time since August 2009.

What's especially noteworthy: the lowest ISM index reading during Trump's presidency was already on shakier ground even before the latest escalation of tariffs between the US and China, which definitely have the potential to pinch margins.

While the USD/JPY didn't aggressively accelerate on the downside (which indicates that most of the disappointing print was already priced in), the overall mode stays bearish.

If today's ISM Non-Manufacturing data set disappoints (in our opinion any reading below 55) too, recession fears loom again and USDJPY drops below 107.50, a stint towards 105.00, the flash crash lows from January, could be seen already in the second half of the week.

But even if we get to see a solid print, the current device seems to be 'Sell the bounce', especially if a bounce towards 109.00/20 occurs.

The mode stays bearish on a daily time-frame as long as we trade below 110.70.

Ready to start trading the live markets? Then open a free account with Admiral Markets - 8,000+ instruments to choose from, some of the market's tightest typical spreads, and the world's #1 multi-asset trading platform. admiralmarkets.com/start-trading/

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ISM Play With Massive Alpha And Lots More To ComeSo this play is a complex spread that pits a strong machinery company and a strong retail / cons. disc. company against two weak chemical makers. While the play may initially not make much sense, the alpha here is generated from the comments that companies in these sectors made in the last ISM and NMI reports. Expected weakness in chemicals as input prices increase, and expected strength in consumer spending and capital investment by manufacturing and non-manufacturing firms alike. This spread is pitted perfectly for the current environment and is efficient as I could make it. I was in this morning @ 11.97, and plan to hold for an expected 30% upside from here. My stop on this one remains around 11. I may write some OTM calls on my longs here to even further increase the value here. DO NOT FORGET TO BETA-HEDGE.

Cheers,

Andrew

The USD Rallies Against CAD on Good US Data and NAFTAUSDCAD has been extremely bullish lately, on extremely strong manufacturing data today. It has retraced all of its losses which were caused by CAD strength due to hopes for successful NAFTA negotiations. Currently, Trump has made numerous hints that Canada may not even be a part of NAFTA anymore, and the Canadian Prime Minister, Justin Trudeau has fired back saying that he’d rather not be a part of NAFTA than have a deal that didn’t benefit Canada.

The current price of USDCAD is 1.3178, which is dangerously close to the upper bound of the Kovach Reversals indicator at 1.3186. We should definitely see some resistance at this level.

Technical analysis for USDCAD is as follows. Volatility is lower than usual, but not to an extreme. The RSI indicates that we are in a bull trend, but not overbought yet. The MACD is above the signal line, but not to an extreme. This suggests we may have more room to appreciate. USDCAD is under the 50 period SMA, which is currently at 1.31, indicating bearishness. The ADX does not indicate a trend, i.e. we are ranging.

Bull Score: 2 Bear Score: 1 Ranging Score: 2

The technical analysis for USDCAD intraday is very strong. We see many indications of a strong bull trend. It would be wise to buy on a dip.

The technicals for USDCAD intraday are as follows. Volatility is slightly higher than usual, but not to an extreme. The RSI indicates that we are in a bull trend, but not overbought yet. The MACD suggests that we are in a bullish phase but not overbought yet. USDCAD intraday is above the 50 period SMA by quite a bit, suggesting that we are overbought. Also, USDCAD intraday is above the 100 period SMA by quite a bit, suggesting that we are overbought. Finally, the 50 period SMA is even with the 100 period SMA, indicating longer term ranging. The ADX indicator is at 64, which suggests a strong bull trend for USDCAD intraday.

Intraday, the Kovach OBV and the Kovach Chande are quite strong, necessitating that one wait for a pullback before entering a trade in this product.

ISM Index IndicatorThe manufacturing index still looks like it will have a steady positive correlation and increase over time. The potential for pro-longed growth is especially true given that we live in the age of additive and automated manufacturing. Even when it was negative correlated a year ago, it still ended up recouping any negatives. The index as an indicator of the economy and manufacturing jobs overall seems to be preforming well in its stats. I expect potentially 20% growth many years from now as well as an eventual 70 point target.

Is Lumber Signalling Bad News for US Manufacturing?Lumber is highly correlated to the ISM manufacturing index (or vice versa?). Nevertheless, the weakness in lumber prices is corresponding with the softening manufacturing data, although manufacturing data from Markit suggest manufacturing is weaker than ISM reports. New orders index collapsed from Nov/Dec 66 to 57. Prices have noticeably declined, too.

Anyways, price action is nestled so snugly on price action support at $310.XX, while support was found on the uptrend channel support. This also aligned with a small asymmetrical triangle.

A close below these levels, prices are likely to sell-off to $278, while $268 remains a possibility on weakening economic data.

However, a rally from these levels could push prices to $326.