Israelishekel

Go Down, Moses.. To Let My Shekel Go... 😕Shekel drops to 4 against the dollar, in first since 2015.

Currency’s weakness comes as conflict rages, even after Bank of Israel announced plan to intervene in the foreign exchange market to try and contain sharp shekel FOREXCOM:USDILS moves.

The exchange rate of the New Israeli Shekel on Monday crossed the threshold of NIS 4 per dollar, the local currency’s weakest level since 2015, with Israel in its 10th day of conflict with the Hamas terror group.

Since the devastating massacre launched by Hamas on October 7 in Israel’s southern communities, in which more than 1,300 were killed, more than 4,000 injured, and some 200 kidnapped by terrorists, the shekel has dropped by about four percent against the US dollar.

Investor uncertainty over the duration and scope of the conflict has been growing in recent days, with the Israel Defense Forces gearing up for a ground operation to smash the terrorist organization in the Gaza Strip.

The currency’s weakness comes even as the Bank of Israel last week announced a plan to intervene in the foreign exchange market to try and moderate shekel volatility after the country formally declared a state of war. As part of the program, the central bank can sell up to $30 billion in foreign exchange to protect the shekel from collapse.

It was also introduced to “provide necessary liquidity for the continued proper functioning of the markets,” the Bank of Israel said.

Israel’s consumer price index (CPI), a measure of inflation that tracks the average cost of household goods, unexpectedly decelerated 0.1% in September, before Hamas’s unprecedented attack, figures by the statistics bureau.

Following the lower-than-expected September print, economists and market participants have started to price in an interest rate cut by the Bank of Israel as early as at its next monetary policy meeting on October 23, or even earlier, should it be necessary.

The September CPI index points to the fact that the economy was slowing even before the conflict broke out.

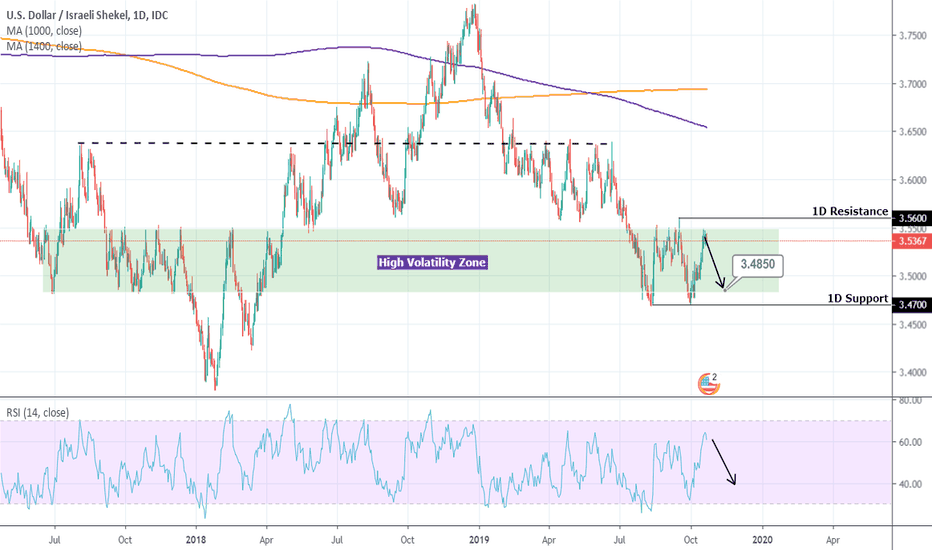

Meanwhile technical graph for FOREXCOM:USDILS says, U.S. dollar is about to break out major multi year resistance against shekel, where 4 shekels is a key to watch at the end of Q4'23.

🏛ISRAELI SHEKEL WILL FALL FROM BEARISH WEDGE↘️SHORT🔥

☑️USD_ILS is trading in a textbook like bearish wedge

And while a move Up inside the wedge is still possible

I am expecting a bearish breakout and consequent move down

Until the pair finds support

SHORT↘️

✅Like and subscribe to never miss a new idea!✅

BEZEQ bu opportunity , BEZQ Stock signal buy

after the red candles of the downtrend we have a green candle that means the end of the downtrend and the start of the uptrend, and also the candle with the wick above the body our confirms the start of the market rise, so we are going to buy and collect our profits in the take profit.

signal buy , buy opportunity

ridethepig | ILS Market Commentary 2020.04.29The first 3.50 test triggered development from the Bank of Israel, it shows how quickly the zone can be protected and the tables are turned. Intervention is clear, smelling it a mile off here and makes the short-term opportunity towards the highs an attractive option. When the CB like Israels comes out to say that the currency has gone too far and they wont hesitate to step in... you know the swing that follows from that will illustrate the use of fundamentals in particularly striking fashion.

The attack on EM FX raises the stakes; because we have the second iteration of the virus to come in the Southern Hemisphere and another leg lower to track in Global Equities. We can keep an ear to the ground on local Israeli politics, without any surprises a leg back towards the top in the range looks imminent. Will look to dial back below 3.50.

Thanks as usual for keeping the likes, comments, charts, questions and etc coming!

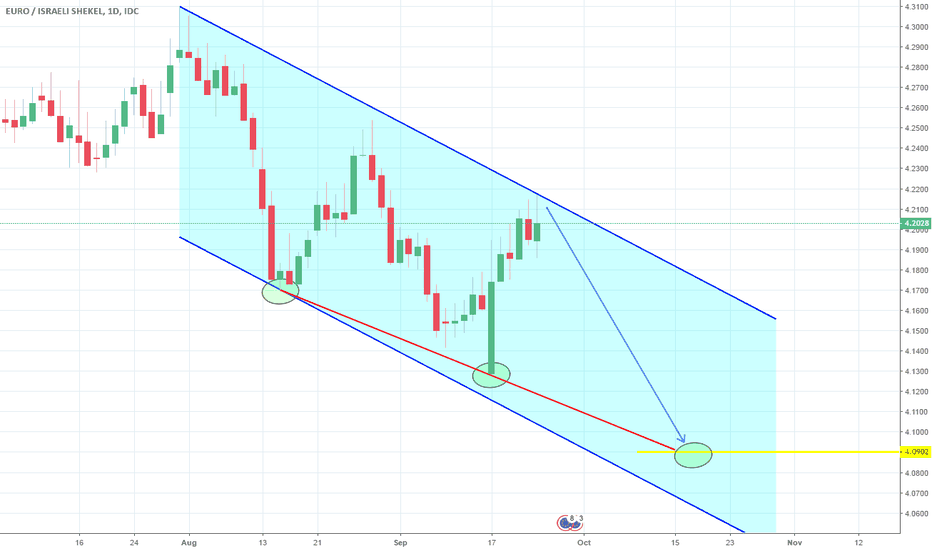

EURILS: Sell entries.EURILS has been trading within a long term Channel Down since December 2018 (RSI = 38.590, MACD = -0.085, ADX = 31.136, Highs/Lows = -0.0915). At the moment it is trading around the 1D MA50 and on the Lower High trend line. We expect the price to be rejected back to the 3.7790 Support. If not, then the June - December 2018 fractal may be played out: rise towards 3.9500 and then rejection.

Previous call within the Channel Down:

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURILS: Further downside expected.The pair is on a strong 1M Channel Down (RSI = 37.575, MACD = 0.082, Highs/Lows = -0.1355) since the beginning of the year. We are expecting another test of the 3.7870 1D Support. Based on the RSI (despite being a bullish divergence) we are expecting a symmetric low outside the Channel. That should be the 3.7870 contact.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDILS: Rising Wedge within a Channel Up. Buy opportunity.The pair is trading on a Rising Wedge within a wider 1D Channel Up (RSI = 59.015, MACD = 0.014) and the neutral Highs/Lows (0.0000) indicate that it is close to pricing a Higher Low. The long's obvious TP is the Wedge's Resistance at 3.7900 but if it breaks we will extend the buying to 3.8200.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.