EURUSD - 1.1300 taken out, sell rallies the way to goUSD strength, along with the Italy-EU jitters, has forced the EurUsd through 1.1300 which was the main support zone in the near-term.

We not have considerable downside opportunity. Keep an eye on Italy's budget issues into tomorrow, but make no mistake: the trend is now

pushing down with force.

ITALY

Italy Has A ProblemLast week saw the break of a bear flag. We are now resting on downtrend support. The chart looks heavy at this point.

Italian banks have major exposure to Turkey. Also, Italy threatens to drag the EU under. The Italians are not as docile as the Greeks - they do not care for whatever rules Brussels attempts to impose on them.

Thus, my next target for capital flight is Italy. My first target is the 2016 lows. Should a bounce materialize, I will be confident in shorting it. For now, I'm short from within the flag.

FTSEMIB - Pressure still to the downsideWith the EU still poised to reject the Italian budget, there's still room for downside movement

in the FTSEMIB, which will also take it's cue from equity markets in Asia and the current risk

off sentiment.

1.43 is possibleThe main bullish trend has been broked the last few days and, since Oct 17, EURUSD headed towards 1.43 with 50 and 200 EMA that are close to crossing in the 1h chart.

A crossing of the two would suggest a continuation of the already marked bear channel that could take the price to around 1.43.

Such a target price could be supported by nowadays Eurozone issues (mostly the italian situation) that are undermining the stability of Euro.

***As usual, not a trading advice of any sort. Merely my idea for informational and educational purposes only***

BTPs - Lower on the Anticipation of a Clash with BrusslesThe Italian Government sent the aggressive budget proposal to Brussels, with Finance Minister Tria suggesting he can "explain" things to EU counterparties and receive acceptance. Market participants know it's a long shot, and BTPs should come under more pressure.

FTSEMIB - Negative Bias Continues Our bias on the Italian stock market continues to be short. The deadline for presenting an acceaptable budget to the EU is Oct. 15th, and no progress has been made. Italy still remains on an opposing foot and thus the markets are maintaining the pressure on Italian stocks.

FTSEMIB - Biased Down on Budget IssuesItalian stocks are taking the hardest hit in Europe, on recent budget issues.

Symmetrical Triangle Formed. ITALY BUDGET NEWS in spotlight.EURAUD seems to be consolidating and not just this pair. Most EU Cross pairs seem to do the same too.

This means Bulls and Bears are fighting at this point.

Who might edged out a win?

Watch my previous Post on my previous days analysis.

Seems like most EUR traders are waiting for the ITALY BUDGET NEWS later on today at 16:00 G.M.T (12AM SGD TIME) before most EUR pairs could find a direction. Unless there are leaks somewhere during the London session :)

I have previously locked in a few shorts and I'm still shorting. However if most EUR pairs remained bullish after the ITALY BUDGET Report is out, I may exit my positions as SOON AS POSSIBLE . IF NOT EUR MAY TANK ACROSS THE BOARD

Keep a watch on this one fellas!

Trade safe.

BTPs - Showing more signs of stressClash between EU and Italy becoming more evident as Italy Rating Outlook Cut by Fitch on Possible Fiscal Loosening but "Italians come before ratings agencies" deputy PM says - “We have to put the financing in the budget so that at least 5 million impoverished Italians can get back to work.”

EUR/USD: Driven by risk & 10-yr German/US yield spread but...Pay attention to the short/long-dated German vs US yield spreads, the risk environment, and the Italian vs German premium as the key drivers to gauge the next capital flows. For now, risk and the narrowing of the 10y spread rules price action, but a source of concern is Italy and 2-yr yield spreads, exhibiting a major divergence with the direction of EUR/USD. The recent acceleration of EUR gains may be partly explained by the change in market dynamics after a reignition of risk appetite, resulting in large numbers of market participants caught wrong-sided, judging by the overly bearish commitment by large specs based on recent CoT reports.

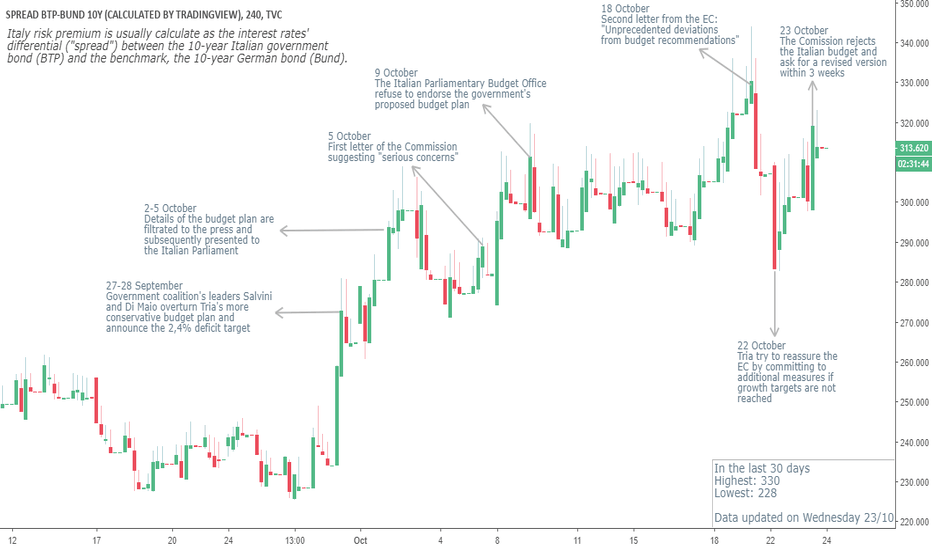

The Spread widens This shows us how critical the situation is , and it is also among one of the contributing factors towards the weakening Euro(BTW the strong DXY isn't helping).

This is a spread chart and shows us the divergence in yield between the two states. It gives us an idea as to how investors are pricing risk relative to a "risk-less counterpart" which in this case , it would be the German bund.

STATE OF EUROPE!A chain is only as strong as its weakest link. Right now Italy doesn't look so good with capital flights and a weakening economy.

On the technical side of things, price had a nice reaction with the lows which happens to be the all time lows in the Italian bonds.

This is a place I'd look for longs but first , I'd need proof that buyers are still here.

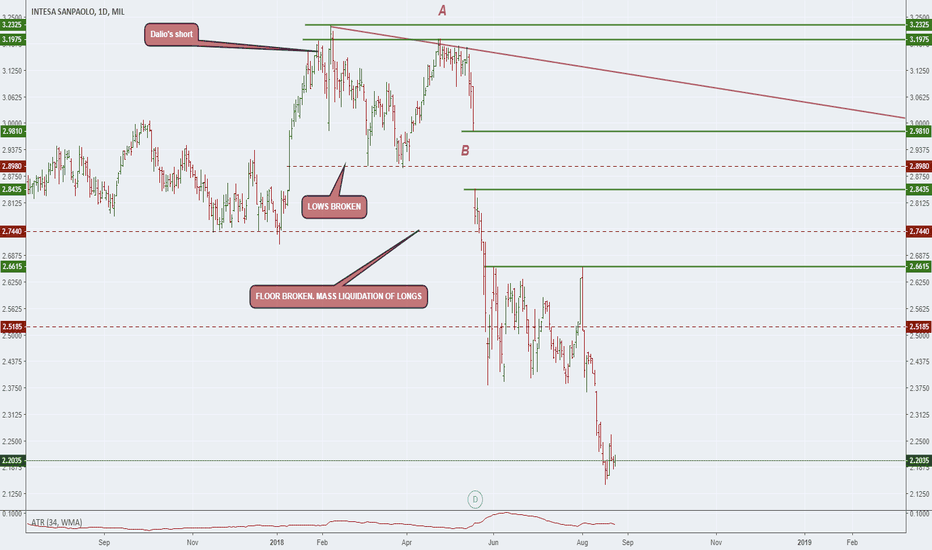

WHALE TRACKS !! A CASE STUDY. ISP is an Italian bank that has really taken a beating this year. Under all metrics it is a really weak institution.

What I wish to demonstrate today is how whales operate and hopefully how to take advantage of it.

Before I continue I'd Like to state two Axioms I take with me anytime I chart

1) A body in motion stays in motion unless an external force acts on it

2) Don't trade or look for the bottom , always wait for it and act on the weaker price action

Ray Dalio put a huge net short position on this bank , before the Italian fixed crisis and the Turkish mayhem that had a bleed over on the whole of the EU.

It is the actions of institutions that guide us , not our hypotheses. With that said are you willing to go long , short or wait? What are the positions in the market , who are in control of the market . Where and how does that change.

Those are the questions that I ask price , and I use its answer to give me a position.

HAPPY WEEKEND.

BTP, calm before the storm, trigger the interest ratehello guys here's a new idea on italy BTP. First of all, we saw recently that the market wants to speculate (again) on BTP, this means that interest rate until September will go down, then will rise due to rating agencies decision and what is called 'DEF', the document of economics and finance by the Government. In this document there'll be the outline of fiscal policy, I expect a higher deficit and maybe a cut in taxes.

This will trigger a sell in the bond market of BTP, driving interest rate up and consequently price down.

Here I post a couple of interest readings on Italy, which can give us some idea of what to expect.

www.zerohedge.com

www.zerohedge.com

au revoir,

docCDS

BTP - Italian bonds still under scrutinyItaly's Deputy PM DiMaio confirms markets' fears: this morning he said

that respecting fiscal rules is not the priority in the next budget.

Until 94.00 is broken to the upside, pressure still remains.

Better picture if we hold here below 93.00 and push towards 90.00 again.