ITB

$NOA is leading the international small capsNorth American Construction Group provides mining, heavy construction services to customers in the resource development, industrial construction in the US, Canada and Australia.

I tried trading this stock back in 2021 and got stopped out.

If it wasn't for that I would have had dead money for more than a year! Thank God for stops.

Now, NYSE:NOA is ready to make all time highs and it could be a good trade again. Already broke out relative to its peers ( AMEX:GWX ).

Other stocks in its industry/sector like NYSE:GVA , NYSE:MTZ , NYSE:EME & NYSE:OII are also in strong uptrends.

The Invesco Dynamic Building & Construction ETF AMEX:PKB is also making new highs. I'm looking for stocks in this sectors.

Not everything is tech stocks!

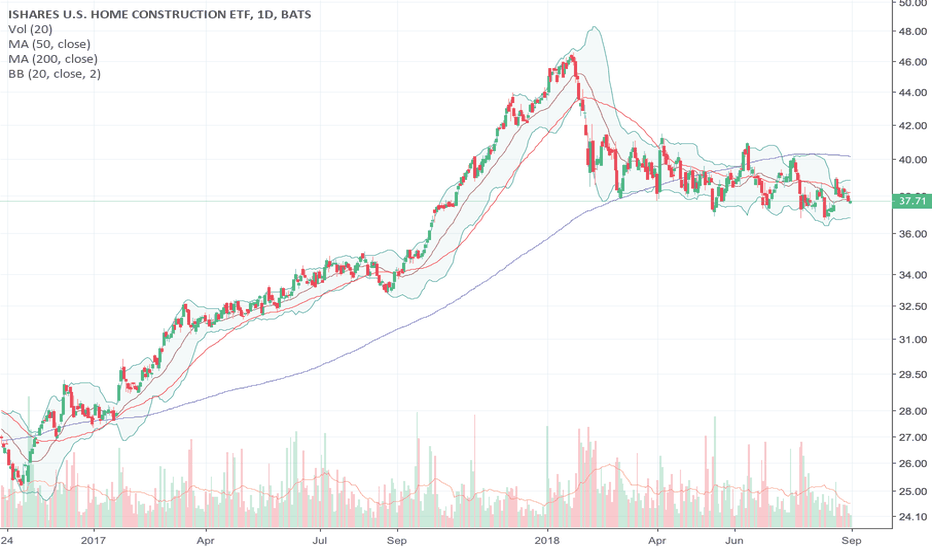

Trade school: Parabolic moveThe ETF for home builders went parabolic last week, mostly because of an earnings blow-out from DR Horton (DHI). This chart is one to watch to see how dangerous parabolic moves can be. ITB faded intraday after stretching well above its upper Bollinger Band (BB). The BBs define an expected price range. So when price goes well above the upper-BB, the stock, ITB in this case, is "stretched" and due for a cooling period if not an outright pullback. I am watching this one closely as I am a perma-bull on housing.

6/5/22 ITBiShares U.S. Home Construction ETF ( AMEX:ITB )

Sector: Miscellaneous (Investment Trusts/Mutual Funds)

Market Capitalization: $--

Current Price: $60.52

Breakout price: $61.00

Buy Zone (Top/Bottom Range): $59.80-$54.00

Price Target: $67.40-$68.80

Estimated Duration to Target: 138-145d

Contract of Interest: $ITB 10/21/22 60c

Trade price as of publish date: $5.80/contract

$SPX $AAPL $TSLA $ITB Chart breakdownClosing the week red again. Bears seem to be in total control, charts breaking down across the board (less VIX/ Bear Funds of course)

SPX less than 3850 (-20%) funds go officially "Bear Market"

3700 Capitulation levels

Less than 3500 massive de leverage , margin-calls , and breakdown

We need one of those "bear market rallies" I keep hearing about ...

7 red weeks in a row, very historical price action, caught a lot of people off guard, including me : )

Normalization Places Fresh Pressures on the Spring Selling Seaso{repost from my blog which includes screenshots and charts}

Housing Market Intro and Summary

The Spring selling season looked like it started strong for new home sales. The data for April reveal a story evolving differently. Absolute inventories rose for both existing and new homes and yet sales declined. Housing starts also suffered a setback. Median prices of homes soared, especially for new homes, as sales skewed more toward the higher end of markets. Home builders face increasing cost pressures and buyers lament affordability challenges. The stocks of home builders also felt the pressure in May during a sharp 2-day pullback. Yet, with mortgage rates still near record lows, sentiment remaining high among home builders, and the tailwinds of strong housing demand still blowing, the current “cooling” resembles an overdue normalization of the housing market. Important trends continue to point upward for now.

Housing Stocks

The iShares Dow Jones US Home Construction Index Fund (ITB) fell 1.8% in May for a rare down month. I finally brought my seasonal trade on home builders to an end given the sharp pullback in May and the softening housing data. ITB remains in a strong uptrend given support at its 50-day moving average (DMA) (the red line below) remains intact. However, I concluded the risk/reward no longer favors the seasonal trade with normalization placing fresh pressures on the Spring selling season. I made one last trade in ITB June call options during the May dip. Per the seasonal trade, I now look toward October/November to get aggressive on trades in housing-related plays.

The iShares Dow Jones US Home Construction Index Fund (ITB) lost 1.4% as it continues to pivot around its 50-day moving average in an extended trading range.

{The iShares Dow Jones US Home Construction Index Fund (ITB) survived its sharp May pullback with a successful test of 50DMA support.}

Toll Brothers (TOL) joined the ranks of stronger home builders with a solid 3.8% post-earnings bounce. TOL looks poised to challenge its all-time high set in early May.

{Toll Brothers (TOL) only closed below 50DMA support once during the May pullback. The overall uprtend looks well intact.}

Century Communities, Inc. (CCS) held onto its post-earnings momentum through the May pullback. CCS even ended the month hitting a new all-time high.

{Century Communities Inc (CCS) maintained a firm hold of its uptrend as defined by the 20DMA (the dotted line above).}

Lennar Corp. (LEN) is one of the home builder stocks that suffered most from the May pullback. LEN lost 7.1% on the day it sliced through 50DMA support. The stock traded down to a 2-month low before bottoming. The stock now faces overhead resistance converged at its 50DMA and downtrending 20DMA. While a fresh 50DMA breakout would suggest new light for the home builder trade, I will stay neutral even at that point.

{Lennar Corp. (LEN) is still trying to recover from the May pullback which plunged the stock into a 50DMA breakdown.}

Housing Data

New Residential Construction (Single-Family Housing Starts) – April, 2021

The February data showed softening for single-family housing starts. Starts normalized and returned to the year ago levels and the existing uptrend. March starts bounced smartly off the uptrend, but April starts dropped right back to February levels. While the monthly drop seems alarming, I continue to interpret the data as part of a process of normalization. Starts soared well above trend last year and are now returning to trend.

Single-family home sales dropped to 1,087,000 which was 13.4% below March’s 1,255,000 starts (revised slightly upward from 1,238,000). Starts were 58.7% above last year’s pandemic impacted starts. The rate of year-over-year change has remained positive for ten straight months.

{Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures , first retrieved from FRED, Federal Reserve Bank of St. Louis, May 30, 2021.}

The Northeast led all regions with year-over-year gains. Housing starts in the Northeast, Midwest, South, and West each changed +247.8%, +44.7%, +43.6%, +81.5% respectively year-over-year.

Existing Home Sales – April, 2021

The report on existing home sales included the classic signs of a housing slowdown: an increase in inventory accompanied by a decline in sales. So far, I have yet to read a satisfactory explanation for this divergence (for example, did California’s jump in inventory and sales skew the numbers?).

Existing home sales dropped to levels last seen July, 2020 and have yet to respond to the start of the Spring selling season. The seasonally adjusted annualized sales in April of 5.85M decreased 2.7% month-over-month from the downwardly revised 6.01M in existing sales for March. For the second month in a row, the National Association of Realtors (NAR) blamed the monthly drop in sales on insufficient inventory despite an increase in absolute inventory. The NAR looks forward to more inventory with “the falling number of homeowners in mortgage forbearance”; a looming an unwelcome event for many households. Year-over-year sales increased 33.9% over last year’s lockdown-impacted sales.

Normalization for existing home sales includes a topping pattern.

{Source: National Association of Home Builders (the NAHB’s record of the NAR existing homes data)}

The absolute inventory level of 1.16M homes increased by 0.09M from March. Inventory dropped 20.5% year-over-year (compare to March’s 28.2%, February’s 29.5%, January’s 25.7%, December’s 23%, November’s 22%, October’s 19.8%, September’s 19.2%, August’s 18.6%, July’s 21.1%, June’s 18.2% year-over-year declines, unrevised). The inventory situation is finally improving ever so slightly even though the NAR did not recognize it as such. “Unsold inventory sits at a 2.4-month supply at the current sales pace, slightly up from March’s 2.1-month supply and down from the 4.0-month supply recorded in April 2020. These numbers continue to represent near-record lows.”

Given the slow start to the Spring selling season, I now fully doubt that the NAR’s optimistic forecast for an 8.2% year-over-year increase in single-family existing home sales will bear fruit. The tough comps coming later this year will wipe out the strong year-to-date, year-over-year gain of 20%. Affordability problems present more and more challenges to buyers. Yet, the NAR remains steadfastly optimistic that coming inventory will cool down price appreciation: “The additional supply projected for the market should cool down the torrid pace of price appreciation later in the year.”

The average 17 days it took to sell a home set a new all-time record low that slipped by the record of 18 set in March (once again, the NAR did not acknowledge the new record). The on-going year-over-year decline in inventory is on a 23-month streak.

The median price of an existing home soared to $341,600 and set a fresh record high. Prices have increased year-over-year for 110 straight months, and April’s was a 19.1% year-over-year gain. The percentage gain was also a new all-time record surpassing the 17.2% record from the previous month. The median price increased from March by 4.7%.

Soaring prices are still not slowing down first-time home buyers as a share of all buyers. First-time home buyers took a 31% share of sales in April down just slightly from March’s 32%. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, and 31% for 2020. Investors picked up the slack with 17% share of sales, up from March’s 15%, up from 10% a year ago.

The West towered above all other regions for existing home sales. The regional year-over-year changes were: Northeast +16.9%, Midwest +0.8%, South +15.9%, West +15.5%.

All regions registered strong year-over-year price gains. For April: Northeast +22.0%, Midwest +13.5%, South +15.8%, West +19.9%.

Single-family home sales decreased 3.2% from March and increased on a yearly basis by 28.9%. The median price of $347,400 was up 20.3% year-over-year.

California Existing Home Sales – April, 2021

Unlike the country overall, existing home sales in California are responding to the Spring selling season. An expanding set of records are staving normalization. These sales increased for the third month in a row (after revisions). A monthly 7.4% increase in inventory helped support red hot demand in the state. For April, the California Association of Realtors (C.AR.) reported 458,170 in existing single-family home sales for California. Sales increased 2.6% from March and increased 65.1% year-over-year. At $813,980 the median price jumped 7.2% month-over-month and 34.2% year-over-year.

California set yet more records for existing sales in April.

$813,980 median price (broke March’s record)

$383 per square foot

65.1% year-over-year price increase (from pandemic-impacted levels)

The share of homes sold above asking price

The sales-to-list price ratio

7 median number of days to sell a single-family home (down from 13 days a year ago and down from 8 in March).

The increasing price pressures prompted C.A.R. Vice President and Chief Economist Jordan Levine to doubt the durability of California’s housing market: “Not only do skyrocketing home prices threaten already-low homeownership levels and make it harder for those who don’t already have a home to purchase one, it also brings to question the sustainability of this market cycle.” In other words, the Californian housing market is overdue for normalization.

Inventory dropped to 1.6 months of sales in April from 1.7 in March (revised upward). Active listings dropped over 50% year-over-year for the fourth month in a row. San Francisco sat alone as California’s only county that increased listings (22.7%). Still, the county recorded a healthy 165.7% year-over-year increase in sales with the 2nd smallest increase in median price in California at 5.9%. Clearly, buyers are finding relative “bargains” in San Francisco. The sales activity now flies directly counter to the exodus narrative.

San Mateo became the first Californian county to crack the $2M median price mark. California experienced a stark skew in sales toward higher-priced markets:

“The million-dollar segment increased in demand by more than 200 percent year-over-year, with sales of homes priced $2 million and higher surging over 300 percent from a year ago. Sales of properties priced below $300k, on the other hand, continued to fall precipitously, with the year-over-year growth rate dropping 34 percent in April. Tight housing supply continues to be the primary constraining factor for sales in the lower price segment.”

New Residential Sales (Single-Family) – April, 2021

The path to normalization for new single-family home sales includes a peak that stretches out from July, 2020 to January, 2021. New home sales in February dropped to the lowest point since June, 2020. After what looked like a strong start to the Spring selling season for new home sales, April undermined the narrative with a monthly decline of 5.9%. April sales increased 48.3% year-over-year from the pandemic trough. March sales were revised significantly down from 1,021,000 to 917,000.

{Source: US. Bureau of the Census, New One Family Houses Sold: United States , first retrieved from FRED, Federal Reserve Bank of St. Louis, May 30, 2021.}

Median home prices ended a two month decline and rebounded sharply just short of the all-time high. The 11.4% increase was the second highest since on record (since 1963). Last Fall’s breakout to all-time highs now looks sustainable. April featured a strong skew to higher-end home sales, likely driven by California’s strong performance. The 19% of sales in the $500,000 to $749,999 price range could be a major high (I reviewed the reports as far back as 2014). The share of sales above that price range nudged up from 6% to 7%. The share of sales in the $200,000

to $299,999 price range plunged from 35% to 25%.

The monthly inventory of new homes for sale rebounded from March’s 3.6 months of sales to 4.4 months. The absolute inventory level of 316,000 was an increase from March’s 306,000. So, just as with existing home sales, my red flag went up seeing sales decline despite the increase in inventory.

The West lagged all regions for a second month in a row for year-over-year sales changes despite being the only region with a month-over-month gain. The Northeast soared triple digits again, this time 100.0%. The Midwest increased 46.7%. The South increased 61.2%. The West increased 11.6%. New home sales in the West remain well off their pandemic highs and are marginally off the pandemic lows. If not for California’s strong performance, the West may well be right back to pandemic lows.

{U.S. Census Bureau and U.S. Department of Housing and Urban Development, New One Family Houses Sold: United States , retrieved from FRED, Federal Reserve Bank of St. Louis, May 30, 2021}

Home Builder Confidence: The Housing Market Index – May, 2021

The National Association of Home Builders (NAHB) reported no change in the NAHB/Wells Fargo Housing Market Index (HMI) from April’s 83 level. In April, the NAHB pointed to strong demand as a driver boosting confidence despite supply chain issues. May’s report focused on soaring construction costs: “Policymakers must take note and find ways to increase production of domestic building materials, including lumber and steel, and suspend tariffs on imports of construction materials. In recent months, aggregate residential construction material costs were up 12 percent year-over-year, and our surveys suggest those costs are rising further. Some builders are slowing sales to manage their own supply-chains, which means growing affordability challenges for a market in critical need of more inventory.” Accordingly, the NAHB projects more price increases ahead for new homes.

The components of the Housing Market Index (HMI) barely budged from April to May while consumer sentiment suffered a large setback.

{Source for data: NAHB}

While the aggregate HMI remained flat, regional HMI’s moved all over the place. The Northeast plunged from 84 to 77. The Midwest pulled back from 75 to hit 72, a new low for 2021 and the lowest point since August, 2020. The South nudged upward from 84 to 86 for a new high for the year. The West remained at its lofty level of 91. These high levels stand in stark and surprising contrast to the relatively low levels of new home sales. For more consistency, I want to see the West’s new home sales move much higher from the pandemic lows.

Home closing thoughts

Housing On A Sugar High?

Demand and prices in the housing market are both strong. Yet, the Federal Reserve continues its furious pace of purchasing Mortgage Backed Securities (MBS). The traders on CNBC’s Fast Money cannot explain why. As a result, they mused over whether the housing market is feeding off a “sugar high”, a high that inevitably comes crashing down. Is it possible the MBS market remains broken? Insufficient buyers? Whatever the reason, the support for MBS’s is helping to support a high velocity of housing activity.

My favorite investment in the MBS recovery remains AGNC Investment Corp (AGNC). I made the case for buying AGNC in the immediate wake of the collapse of the MBS market.

{The remarkably consistent uptrend for AGNC Investment Corp (AGNC) looks like a direct beneficiary of support from the Federal Reserve.}

Lumber Watch

Lumber prices finally cooled off in May. Futures for lumber are still in a strong uptrend as demonstrated by the 50DMA. While this pullback brings some relief to the industry, the accompanying drop in housing sales and starts make me wonder whether cooling lumber prices signal a cooler housing market ahead. This decline could at minimum represent a reluctant slide into normalization.

Lumber futures cooled off in May.

Earlier in the month, the NAHB posted alarming info on soaring material costs for home builders. Building materials prices are setting new records in aggregate. Chart after chart in this article show soaring prices for steel mill products, softwood lumber, gypsum products, and on-going price increases in ready-mix concrete.

Be careful out there!

Full disclosure: long ITB call options

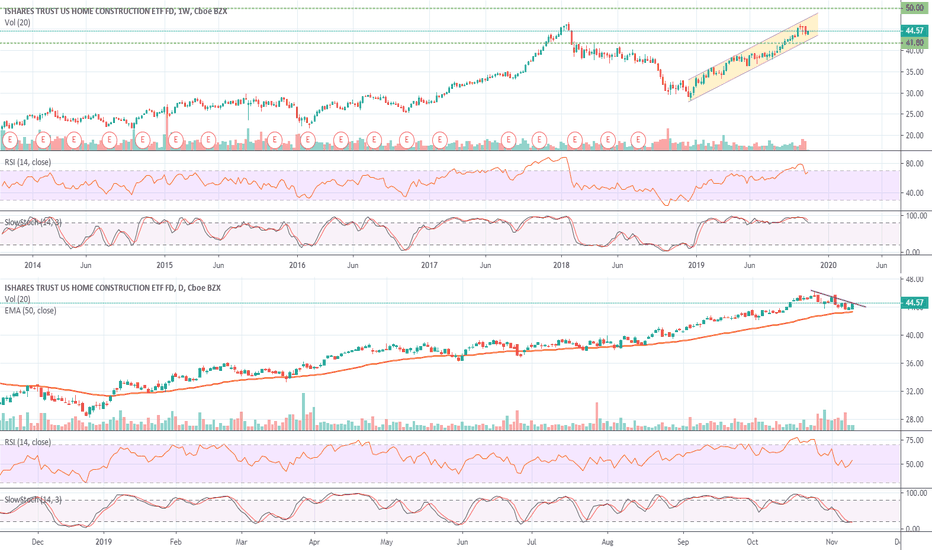

ITB - Home Construction StrengthHere is a dual chart showing the weekly chart on top along with the daily chart below.

On the weekly chart, you can see how the price has remained within an ascending channel since the Christmas Eve low. The price recently hit and broke through the 61.8% Fibonacci Extension level in early September. The recent pullback has the price sitting right in-between the 61.8% & the 100% price levels.

Looking down at the daily chart, it seems like the price is getting ready to break out of a short pullback with the price finding support on the 50-day EMA line. The price is also exiting an oversold condition with the RSI still holding above 50. ITB looks to be getting ready for its next bullish swing higher.

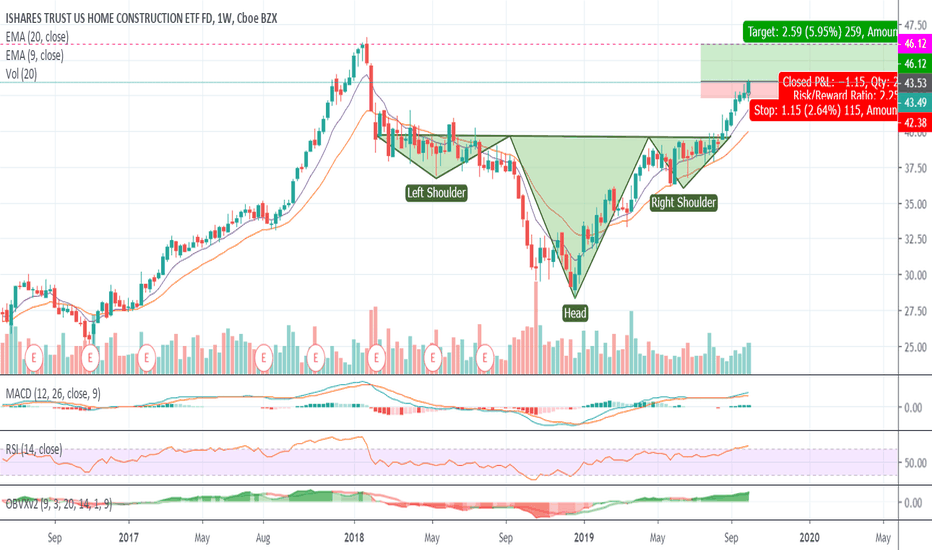

ITB Homebuilders, weekly chart has more room to runITB Homebuilders 3x ETF, weekly chart has more room to run. Daily chart is ready for break out. Inverse H and S . LEN , KBH and DHI all had great earnings reports recently. Above $46.35 would be all time highs. The FED should be cutting rates again with the Oct 4th economic data, so more bullishness for homebuilders. Good luck!

An Extended Oversold Period Ends with Important FootnotesAbove the 40 (November 1, 2018) – An Extended Oversold Period Ends with Important Footnotes

November 1, 2018 by Dr. Duru

AT40 = 21.4% of stocks are trading above their respective 40-day moving averages (DMAs) – ends an 11-day oversold period that followed a 4-day oversold period

AT200 = 32.0% of stocks are trading above their respective 200DMAs

VIX = 19.3

Short-term Trading Call: bullish

Commentary

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), closed at X%. The move ended a very extended 11-day oversold period that followed a one day respite from a 4-day oversold period. Today was the kind of day I wanted for a punch out of oversold conditions; it even quickly invalidated a small bearish divergence. The rally in the S&P 500 (SPY), the NASDAQ, and the Invesco QQQ Trust (QQQ) were all strong enough to close at their intraday highs and surpass the previous day’s intraday highs. The volatility index, the VIX, even cooperated by falling below 20 and presumably starts the end of wild swings in the market.

{The S&P 500 (SPY) gained 1.1% in a move that confirmed the breakout from the lower Bollinger Band (BB) downtrend channel.}

{The NASDAQ gained 1.8% in a move that confirmed the breakout from the lower Bollinger Band (BB) downtrend channel. It closed right at downtrending 20DMA resistance.}

{The Invesco QQQ Trust (QQQ) gained 1.3% as it closed right at converged resistance from the 20 and 200DMAs.}

{The volatility index, the VIX, looks like it confirmed a double top. I earlier expected one final surge in volatility before the next implosion.}

I thought my footnote on the action would be the wildcard of Friday’s jobs report. However, a poorly received earnings report from Apple (AAPL) in the after hours has the potential for sending the market right back into oversold territory. Whatever happens Friday, attention should quickly turn to the midterm elections on Tuesday. No matter the results, I am anticipating a volatility implosion as the market settles into incrementally lower uncertainty. If volatility remains high, then I will have to re-evaluate my expectations for a relatively benign end to the year.

Perhaps an even more important footnote is the relative performance of AT40 versus AT200 (T2107), the percentage of stocks trading above their respective 200DMAs. AT40 ended the oversold period at a slightly higher level than it ended the prior oversold period. However, AT200 ended this oversold period significantly lower: 32.0% versus 39.6%. This disparity flags longer-term technical damage in the stock market; the rebound out of oversold conditions left behind a small group of stocks. These laggards will hurt breadth as the rally proceeds and could provide the seed for the next market topping action. As usual, I will take this process one step at a time.

This was another day to mainly focus discipline on holding my long positions and looking for more buying opportunities from the shopping list. I snuck into ProShares Ultra S&P500 (SSO) on the small pullback from the open. I am in accumulation mode for SSO shares. I added to my Walmart (WMT) call options. I launched another short Rio Tinto (RIO) versus long BHP Billiton (BHP) pairs trade this time with a bullish bias. I even purchased a call spread on Red Hat (RHT) to play the post IBM deal discount. However, I missed out on getting back into Baidu (BIDU); I blinked and the call options I targeted increased by almost 4x as the stock gained a whopping 6.0% by the close. President Trump’s claim that he would get a “great deal” with China helped ignite the fire.

Confidence and A Conditional Reprieve Amid Oversold LowsAT40 = 11.7% of stocks are trading above their respective 40-day moving averages (DMAs) (hit an intraday low of 9.4%, oversold day #3)

AT200 = 32.3% of stocks are trading above their respective 200DMAs (intraday low of 30.0%)

VIX = 21.3 (a decrease of 14.7%)

Short-term Trading Call: bullish

Commentary

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), fell as low as 9.4% on Friday. AT40 dropped as low as 8.6% intraday during the February swoon (February 9, 2018 to be exact). Since 1986, AT40 has closed below 9.4% only 92 trading days, and AT40 last closed below this level on January 21, 2016 at 8.3%. The day before that, AT40 closed at 7.4% and traded as low as 3.8%. AT40 obviously cannot trade much lower than these levels.

AT200, the percentage of stocks trading above their respective 200DMAs, is very important now as an oversold gauge. AT200 closed the week at 32.3%. In January, 2016, AT200 managed to get as low as 9.0%, a level last seen around the historic March, 2009 bottom. In other words, while AT40 suggests the market is set up for a sustained bounce, AT200 reminds me that these oversold extremes can get yet more extreme if panic gets a fresh heaping of fuel.

Trading action around important technical levels also remind me that the market could go lower. The S&P 500 (SPY) is essentially back to flat for the year but is still 7.2% above this year’s double bottom. A retest will be in play if the index fails to win what is perhaps the stock market’s most important battle: a test of 200DMA support. During the February swoon, the S&P 500 only ONCE closed below its 200DMA. The index closed below its 200DMA on Thursday and set up Friday’s drama. The index gapped up just above its 200DMA in an effort to clear out bearish sentiment. Sellers quickly closed the gap and then failed to take the index lower. Buyers fought off a test of the intraday low and managed to churn the index toward the day’s open for a 1.4% gain on the day. It was a messy way to demonstrate the importance of the 200DMA! If buyers can follow through early this coming week, the technical pattern will look like a (short-term) washout of the market’s most motivated and panicked sellers. I call this a conditional reprieve in the middle of oversold conditions because of the criticality of this 200DMA pivot.

{The S&P 500 (SPY) closed right on top of its 200DMA support after sellers almost ruined an opening gap up.}

The NASDAQ had a battle similar to the S&P 500’s; the main difference came with an intraday pullback that did not create a complete reversal of the gap up. The Invesco QQQ Trust (QQQ) did not fully reverse its gap above the 200DMA. Its 2.8% gain on the day has the look of a successful, and bullish, reversal of a 200DMA breakdown.

{The NASDAQ gained 2.3% with a gap up and then close just below its 200DMA.}

{The Invesco QQQ Trust (QQQ) made a convincing leap with the reversal of the opening gap up only touching 200DMA support. QQQ ended the day with a 2.8% gain.}

While the big indices fared well at the end of the day, other indices did not. Their poor performance underlined Friday’s conditional reprieve. Some of these sectors need to wake up to help the stock market mount a credible and sustainable bounce out of oversold conditions.

The faders managed to keep these indices plastered with bearish sentiment. The iShares Russell 2000 ETF (IWM) closed flat after sellers completely reversed the opening gap up. The Financial Select Sector SPDR ETF (XLF) suffered a similar fate. This disappointment was even more critical given the wake of bank earnings from the likes of JP Morgan Chase (JPM). The iShares US Home Construction ETF (ITB) held no pretense of recovery as its fade resulted in a 1.0% loss and fresh 17-month low. ITB has dropped 17 of the last 18 trading days in a sign of a near complete market retreat from home builders.

{The iShares Russell 2000 ETF (IWM) ended the day flat as it clings to the starting point of the big May breakout.}

{Bank earnings failed to save Financial Select Sector SPDR ETF (XLF). Sellers faded the opening gap up to a flat close on the day. At least buyers were able to bounce back from a fresh 2018 intraday low.}

{The iShares US Home Construction ETF (ITB) continued its epic slide with an 18th straight down day. The 1.0% loss closed ITB at a 17-month low.}

As suggested by the breadth indicators, the sell-off is causing broad damage. The Health Care Select Sector SPDR ETF (XLV) had a solid uptrend coming out of the February swoon. XLV even broke out to a new all-time high in late August. Last week, XLV broke down solidly below its 50DMA support and nearly reversed all its gains from the breakout.

{The Health Care Select Sector SPDR ETF (XLV) gained 1.5% in a return to the lower Bollinger Band. A 50DMA breakdown is not confirmed.}

The volatility index, the VIX, dropped 14.7% to 21.3. The intraday high failed to top Thursday’s intraday high: a small positive for volatility faders. Still, the VIX is still considered elevated given its perch above 20.

{The volatility index, the VIX, remains elevated despite a 14.7% pullback.}

The VIX typically serves as a gauge of fear on the high side and complacency on the low side. If we had an equivalent for government economic policies, say a “GIX”, the GIX might be at record lows. Confidence is of course half the battle of economic performance and confidence is tangibly oozing from D.C. (from one side anyway!). With consumer confidence at record levels, unemployment down to historic levels, and economic growth impressively strong, the rhetoric accompanying policymakers represents a euphoria perhaps only matched by the complacency of the “Great Moderation” when the Federal Reserve (mostly under Chair Alan Greenspan) was heralded for ushering in a time of lasting economic prosperity…just ahead of the Great Recession. If you knew nothing about economics, you might conclude this time around that the U.S. really has figured out how to repeal the laws of economic cycles.

In particular, Larry Kudlow, the leader of President Trump’s National Economic Council, is beating a steady drum of unapologetic and triumphant confidence. In a CNBC interview, Kudlow issued a sound bite that *I* am confident will one day in the not-so-distant future sound cringeworthy to those of us who follow economics. Kudlow declared: “We are in a hot economic boom. There’s no end in sight.”

Other key points from this interview…

Not worried about the Fed killing the economy. It has staying power. {Me: This message is consistent with Treasury Secretary Mnuchin’s reassurances about monetary policy. Contrast these claims with President Trump’s worries over rate hikes.}

Biggest blue collar employment boom since the 1980s.

In 2018, U.S. entered an economic boom that no one thought was possible.

Loves the skepticism. Proved the skeptics quite wrong. Don’t think that’s going to change.

I fully understand why Kudlow is blowing the trumpets and beating the drums. For example, the display is an “eye-for-an-eye” response to the shrill skeptics who denounced the policies that helped kicked the economy into a higher gear. However, as an investor and particularly as a trader, I cannot help but think about the contrary implications of important government officials claiming that the economic good times will continue as far as the eye can see. Such claims defy experience and the laws of economic/business cycles. Such claims help form a foundation of hubris which can lead to policy errors. My unavoidable wariness feels even more poignant when in parallel I stare at charts showing a stock market violently and sharply falling off its all-time highs. I am not worried about over-optimism today or this quarter, but it is something that makes me stand up and take notice. (At the end of the chart review, I include a link to a Bloomberg Politics video for more context on Kudlow’s economic triumphalism).

For now, I am keenly focused on my strategy for trading oversold market conditions. The stock market is on day #3 of oversold conditions. The average oversold period lasts about 5 days and the median is around 2 (50% below 2 and 50% above 2). At the current oversold depths, it could easily take another 2 or 3 days to climb out of trouble. The longer an overperiod lasts, the more bearish the implications. Similarly, the more frequently the market returns to oversold conditions, the more bearish the implications. The drama at the 200DMAs is extremely important context for these bearish implications. A stubbornly oversold market with an S&P 500 and NASDAQ below 200DMAs is a recipe for fading rallies.

{Mean and Median Duration Below Given T2108 Threshold}

The drama at the 200DMAs made me a little less aggressive. I sold my S&P 500 call options immediately after the open. I added to my Caterpillar (CAT) put options. I took profits in other bullish positions. I selected two small fades with a short on Roku (ROKU) which was up as much as 10% at one point, and I bought shares in Direxion Daily Russia Bear 3X ETF (RUSS). On the bullish side, I doubled down on put options on the ProShares Ultra VIX Short-Term Futures (UVXY) and opened a calendar call spread on Nvidia (NVDA). I become an aggressive buyer of SPY and QQQ call options on a combination of indices trading well below their lower Bollinger Bands (BB), volatility surging, and AT40/AT200 reaching toward historic oversold lows. Again, with earnings season coming up, I am leery of taking on a lot stock-specific risk as part of the oversold trading strategy.

Housing Market Review: Data Weigh Heavy On A Breakdown BuildersI saw a flicker of hope for home builders in the May Housing Market Review. Traders decided to snuff that flicker out very quickly afterward. When I wrote June’s housing market review and described a “struggling flicker,” the iShares US Home Construction ETF (ITB) was once again bouncing off the bottom of 2018’s trading range. Almost like a cycle, a month later the July Housing Market Review came just as ITB tested the bottom of the range once again. By the time of the September Housing Market Review, ITB was still holding to its trading range, but weakening housing data made for a precarious outlook. In September, ITB finally broke down and hit a 13-month low.

{The iShares US Home Construction ETF (ITB) broke down from its trading range and now sits at a 22.3% year-to-date loss.}

Last week, Lennar (LEN) reported earnings. As has been the pattern for home builders, traders and investors quickly faded any initially optimistic interpretation of the results. LEN traded as high as 2.1% before succumbing to the selling. Sellers followed through the next day.

{Lennar (LEN) hit a 20-month low as sellers continued to press the stock lower post-earnings.}

LEN now sits at a 29.0% year-to-date loss and a 1.1 price/book ratio, a 0.9 price/sales ratio, a forward P/E of 6.6, and a trailing P/E of 11.9. This valuation is extremely low!

New Residential Construction (Single-Family Housing Starts) – August, 2018

While housing starts surged in May and left no doubt that home builders were confident as ever, the subsequent plunge in housing starts in June appeared to temper that enthusiastic interpretation. Small increases in July and August seem to have stabilized things for now.

Single-family housing starts for July were revised slightly downward for a second month from 862,000 to 860,000. August starts increased month-over-month by 1.9% to 862,000, still barely off the lowest level of the year. On an annual basis, single-family housing starts decreased by 0.2%. Even though this decline is ever so slight, it is now the second month of the last three delivering a year-over-year decline. June’s year-over-year decline was the first for housing starts since August, 2016. I am now worrying even more that something important is indeed fundamentally changing in the housing market. These data look like a breakdown in slow motion.

{Housing starts are still trying to stabilize at the lower boundary of the current uptrend from the post-recession trough.}

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures , retrieved from FRED, Federal Reserve Bank of St. Louis, September 24, 2018.

Over the 8 months prior to May, regional year-over-year changes in starts exhibited wide dispersion. For May, housing starts were very strong across the board. For June, the Midwest stood out as a large loser. For July, the wide dispersion returned, and it continued in August. The Northeast, Midwest, South, and West each changed -11.8%, 0.0%, -1.7%, and +6.6% respectively. The bump up in July housing starts was less impressive than it appeared given it was mainly driven by the Midwest. For August, only a second month of gains for the West prevented housing starts from looking worse. Housing starts are almost certain to show a notable decline for September given damages from Hurricane Florence from Virginia to South Carolina.

Existing Home Sales – August, 2018

Existing home sales narrowly avoided a fifth straight month-over-month decline, but sales continued their year-over-year decline into a sixth straight month. The NAR chose to celebrate headlines about a stabilization of sales and the end of the decline, but I fail to see any confirmation of such optimism.

The February existing sales numbers ended a 2-month sales decline and softened a bit my alarm bells. In March, monthly sales continued to increase, but the year-over-year change was a decrease. For April, both monthly and year-over-year changes were declines. May recorded similar declines and put existing home sales right back in “yellow” cautionary territory. The June and July double whammies of monthly and annual declines put existing home sales in “red” territory. August’s continuation of year-over-year declines is enough to keep my mental indicator in red territory.

The seasonally adjusted annualized sales in August of 5.34M were flat month-over-month from the unrevised 5.34M in sales for July. Year-over-year sales decreased 1.5%, the same as July’s decline, and once again stayed consistent with the trend of decelerating existing home sales. Sales are down 1.2% year-over-year for the first 8 months of the year.

{Existing home sales over the last year have taken on a toppy pattern.}

(As of the March, 2018 data, the NAR further reduced historical data to just 13 months. For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here)

Source for chart: National Association of Realtors, Existing Home Sales© , retrieved from FRED, Federal Reserve Bank of St. Louis, October 4, 2018.

The routine description for existing sales is usually sales decline because of a shortage of inventory and sales increase in spite of inventory shortages. Sales have not increased for months, so the National Association of Realtors (NAR) has bounced around various themes attempting to put the declines in context. For August’s data, the NAR chose to emphasize a stabilization in sales after a few months of “drip drip” down (from the press conference). I cannot join this optimism until I see sales turn upward again. I duly noted that the NAR did not include any discussions this time about particular markets which provide points of optimism.

The “cross-over” in June when inventory increased year-over-year for the first time since June, 2015 is no longer a one-time event. The 1.92M existing homes for sale is flat with July and is up 2.7% year-over-year. Despite the NAR’s celebration of the inventory increase as a sign buyers are ready to return to the market, the supply crisis continues to run deep at 4.3 months of supply at the current sales rate. This inventory level is the same as the 4.3 from the prior two months although up slightly from the 4.1 from a year ago.

The share of sales going to first-time buyers decreased from 32% last month to 31% this month. This share was 31% in June and May, 33% in April, 30% in March, 29% in February and November was 33%. So the share percentage continues to just bounce around. September, 2017 was the first time in two years where the share dropped below 30%.

The average share for first-time homebuyers for 2016 was 35%. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017. Investors purchased 13% of homes in August, the same as the last two months. Investor sales averaged a share of 15% in 2017 and 14% in 2016.

Existing home sales decreased across three of four regions. The NAR’s focus on the month-over-month numbers did not tell the real story of continued decline – the West’s second consecutive substantial drop is particularly concerning: Northeast -2.7%, Midwest -0.8%, South 1.8%, West -7.4% year-over-year. As usual, regional sale fluctuations had no relationship to the on-going price run-ups. May’s price decline in the Northeast was a true outlier. The year-over-year price changes for August were again relatively robust: Northeast 2.6%, Midwest 3.4%, South 3.2%, West 4.8%. If not for the relatively steady first-time homebuyer numbers and recent sales declines in the West, I would have assumed that higher-end homes are increasingly dominating existing home sales.

August’s 4.6% year-over-year increase in the overall median price of an existing home delivered the 78th consecutive month with a year-over-year increase. The median price of $264,800 is lower than July’s $269,600 and the second consecutive month-over-month decline. June’s $276,900 was an all-time high, so I think the NAR’s optimism over four straight months of annual price gains below 5% is premature.

Single-family sales were flat on a monthly basis and decreased on a yearly basis by 1.0%. The median price of $267,300 was up 4.9% year-over-year (and yet one more reason not to join the NAR’s optimism about “slowing” price gains).

New Residential Sales (Single-Family) – August, 2018

In February, new home sales barely crept forward. New home sales were resurgent in March. April sales did not keep pace on a monthly basis but delivered a strong year-over-year performance. In an increasingly (and surprisingly!) stark contrast to existing home sales, new home sales from May to August have increased in each month on a year-over-year basis (after revisions, June just barely eked out an annual gain of 0.3%). The good news on new home sales failed to stem the on-going selling in home builders as interest rate fears continued to dominate the investment thesis. Moreover, new home sales are still well off a substantial peak in November, 2017. That peak was special because prior peaks in the post-recession recovery period occurred around the Spring selling season. November continues to look like an absolute and not just seasonal or cyclical peak until proven otherwise.

The Census Bureau revised July sales of new single-family homes downward from 638,000 to 608,000; four of the last five months have delivered sizable downward revisions. New home sales for August increased 3.5% month-over-month and surged 12.7% year-over-year to 629,000. Year-over-year gains regularly hit double digits since 2012; last November’s 26.6% jump was the highest since February, 2015 when new home sales soared 29.8% year-over-year. Accounting for revisions, August delivered 2018’s first double-digit annual gain. November and December’s double digit gains still stick out like a sore thumb.

{New home sales are still struggling to hold onto the post-trough uptrend.}

Source: US. Bureau of the Census, New One Family Houses Sold: United States , retrieved from FRED, Federal Reserve Bank of St. Louis, October 7, 2018.

In December, the inventory of new homes dropped to 5.2 months of supply. A market for homes is in balance at 6 months of supply. February’s inventory stood at 5.9 months. It proceeded to decline as low as 5.2 in May. For June, inventory jumped back up to 5.7 days of sales, and in July inventory effectively returned to balance at 5.9. August’s inventory stood at 6.1 months of supply. I will be interested to see whether new homes move too far to an over-supply condition as the inventory of existing homes slowly increases. An over-supply of new homes would detract from any optimism over higher supplies of existing homes.

May’s median price of $316,700 (revised) was an actual year-over-year decline. June delivered a second straight decline. July’s prices bounced back: the median price increased 1.6% (revised). August’s median price of $320,200 was a year-over-year increase of 1.9%. The average price increased 5.2%.

The Northeast was a notable laggard for the second straight month with a year-over-year sales decline of 2.9%. The other three regions all increased substantially again: Midwest 13.2%, South 11.5%, West 19.1%. The Northeast has been extremely volatile for many months now. While the Midwest and the South continued streaks of multi-month growth, the West’s gains come as a welcome bounceback from a 15.0% year-over-year drop in June (and another stark contrast to existing home sales where the West has suffered two straight months of notable annual declines).

Home Builder Confidence: The Housing Market Index – September, 2018

In the April housing market review, I explained why I would not have thought much of March’s slight decline in the Housing Market Index (HMI). At 70, the HMI was still higher than it was for most of 2017. For July, the HMI stayed at 68 for the second straight month. However, the HMI dropped another point in August and stayed at 67 for September. For the second straight month, the NAHB cleverly called 67 a “solid reading.” I remain circumspect about this reading given it is the low for 2018. The components of HMI are still languishing. Two factors exist that may allay alarm over 2018’s HMIs: 1) in 2017 the HMI was also slipping to a low around this time (September, 2017 was the nadir for last year at 64), 2) the 69.3 average HMI for 2018 is still higher than 2017’s average of 67.8.

The statement from the NAHB in May was very positive with a big caveat for rising prices. For June, the NAHB made an even bigger issue of lumber prices by shining a spotlight on trade actions that drove those prices higher. For August, the NAHB singled out the drivers of poor affordability. The latest statement was one of the stranger ones I have seen from the NAHB. The NAHB finally acknowledged the decline in lumber prices but seemed eager to increase the spotlight on other drivers of poor affordability: “…builders still need to manage construction costs to keep homes competitively priced. Wages and subcontractor payments continue to rise as the labor market for residential construction sector remains tight.” The NAHB later went on to suggest that trade problems are still driving material costs higher: “housing affordability is becoming a challenge, as builders face overly burdensome regulations and rising material costs exacerbated by an escalating trade skirmish.”

In between, the NAHB strained to be positive by noting strong housing demand from first-time home buyers including millennials. Finally, Hurricane Florence is apparently going to have a material impact on housing starts in Virginia and the Carolinas which together account for about 12% of the country’s home building.

{Consumer confidence surged ahead of home builder confidence. The components of the HMI are still revealing languishing confidence for home builders.}

Source: NAHB

As a whole, the regional HMIs confirm the languishing nature of recent HMIs. The NAHB also made significant revisions to August’s regional readings. The Northeast soared 15 points off August’s significantly downward revised reading of 46. The revision means that the Northeast hit a 14-month low in August. The Midwest dropped for a fourth straight month. The 56 reading was the region’s lowest since a 53 in August, 2016. The South dropped back to its low of the year at 69. The West stayed flat at its low of the year of 73. The Northeast is now the only region above its low of the year.

Needless to say, home builder sentiment will be a key tell in the coming months. If the HMI does not begin a recovery in October, I will expect a poor start to the seasonally strong period for home builder stocks (November through March/April). Until then, home builder sentiment looks like a breakdown in slow motion.

Parting thoughts

With iShares US Home Construction ETF (ITB) sitting at a 13-month low, I am very tempted to bottom-fish. Home builders are incredibly cheap and priced for a recession in a macro environment with no other concrete signs of an imminent recession. I have watched various analysts on CNBC’s Fast Money try to pick bottoms to no avail. The latest attempt at a bottom may be the closest to success given the seasonally strong period for home builders begins in November.

For the second time in about a month or so, Carter Worth examined the technicals for home builders under the theme it is so bad it is good. Last time it was LEN; this time was ITB. Worth likes the full reversal of the big 2017 breakout as a key tell. He also likes how some major home builders, like Lennar, managed to eke out gains on Friday despite the market sell-off. Michael Khouw proposed an options configuration for playing Worth’s technical analysis. He decided to keep it simple going long January (2019) $34 call options.

I like this as an initial play. However, the seasonal trade can extend as far as March and April, so I also like a calendar call spread selling November $34s and going long April $34s. As of Friday, the cost is roughly the same as Khouw’s play, but the calendar spread might allow staying in the trade for a longer duration. I particularly prefer the calendar spread because I see little short-term upside for ITB. If I am correct, the short side of the calendar spread could deteriorate fast enough to deliver profits for the calendar spread whereas the January calls would sit at a loss in a sideways scenario.

Be careful out there!

Full disclosure: long ITB calls

Find and follow Dr. Duru on his blog, StockTwits, Twitter, or SeekingAlpha!

Extremes Prime Prospects for Market Bounce, Oversold LoomsAT40 = 33.8% of stocks are trading above their respective 40-day moving averages (DMAs) (was as low 31.9%)

AT200 = 47.8% of stocks are trading above their respective 200DMAs

VIX = 14.0 (was as high as 15.8)

Short-term Trading Call: neutral

Commentary

The S&P 500 is only 1.0% off its all-time high, yet extremes and critical tests of support abound.

AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs), dropped to a fresh 6-month low and closed at 33.8%. AT40 has warned of underlying weakness in the stock market since it sliced through 40% and broke the lower bound of a multi-month range. At the time, I was more focused on the potential bullish implications of the S&P 500’s ability to hold 20DMA support at the same time AT40 slipped…

“So on a relative basis, the S&P 500 (SPY) is not likely to go much lower from here without a specific and very bearish catalyst. The S&P 500’s ability to levitate above its uptrending 20DMA adds to the impression that support will hold.”

The S&P 500 is only a mere 0.4% lower from that point BUT 20DMA support gave way. It was a rare down day on which the S&P 500 lost more than 1% at one point. Buyers stepped in at the lows and closed the index with a 0.8% loss. The S&P 500 even came close to recovering its 20DMA support.

The Invesco QQQ Trust (QQQ) DID break through 50DMA support but buyers managed to close the index right on top of it.

The S&P 500 managed to bounce away from 50DMA support, and the Invesco QQQ Trust (QQQ) held 50DMA support, yet the NASDAQ was not so fortunate.

These major indices effectively created a cascade toward critical 50DMA support. Along the way, small caps continue to roll over with 50DMA resistance fading away in the rear view mirror. The iShares Russell 2000 ETF (IWM) lost another 1.4% and closed at a 3+ month low. A test of 200DMA support seems imminent.

Together, this selling looks like a recipe for a larger sell-off with small caps and now the NASDAQ leading the way lower. However, AT40 closed at 33.8% and was as low as 31.8%. For the last two years in particular, these levels have represented “close enough” to oversold with two important exceptions from the February swoon and the election related sell-off in 2016 (see longer-term chart at the bottom of this post).

The volatility index, the VIX, added to the case for an imminent bounce. The VIX soared as much as an extreme 36.4% before volatility faders stepped in to push the fear gauge to a 20.7% close underneath the 15.35 pivot. If recent patterns hold, this move suggests the latest surge in fear has already exhausted itself. In deference to the volatility faders, I quickly took profits on my latest tranche of call options on ProShares Ultra VIX Short-Term Futures (UVXY). I also did not want to make a bet on the jobs report delivering news strong enough to sustain higher volatility.

Noted VIX expert Bill Luby also thought the market hit extremes and called for a bottom. I agree with Luby that a bottom here is very likely, but I do not think it will be a sustainable bottom.

Soaring interest rates have made me more circumspect. I think financial markets need to adjust to an environment where the 10-year U.S. Treasury stays above 3% and continues higher. That is, more fear needs to appear. As long as the market leaders are able to keep the S&P 500 levitating above 50DMA support, I am doubtful such fear can get exorcised.

Thursday’s spike in rates cut iShares 20+ Year Treasury Bond ETF (TLT) by 0.7% and sent it to a 4-year low. The weekly chart below shows the speed of recent losses.

This move seemed quite extreme, so I decided to triple down on my TLT call options in anticipation of a potential snap back bounce. Friday’s jobs report should play an important role in determining whether rate fears take a break or not. Any strength pointing toward higher inflation will grease more skids across the market.

If the jobs report stays out of the way, then the technicals have the market set up for a bounce. The market just needs an excuse. Beaten down stocks are likely to benefit greatly from a bounce whereas the S&P 500 could be tightly capped by its recent all-time high. In other words, I suspect that a rally from here will be short-lived and the ultimate destination for the market is a true oversold reading (AT40 below 20%). I left the short-term trading call at neutral to reflect my expectation for a small bounce. Assuming AT40 rebounds sharply enough to at least 50%, I will likely look for fades at or near the S&P 500’s all-time high and downgrade the short-term trading call accordingly.

KB Home: Yet Another Post-Earnings Fade for A Home Builder“KB Home shares jump on third quarter earnings” – such is the kind of quick trigger post earnings headline that consistently fails for home builders. KB Home (KBH) opened higher by 5.7% but was all downhill from there. At the close, KBH lost 3.1% on the day in a major reversal. This close was a vast improvement on a loss which reached 6.4% at the intraday low. Bottom-fishers were not able to push the stock back over its declining 50-day moving average (DMA).

In her reporting, Diana Olick, CNBC’s housing market reporter, pointed to a red flag in a 26% cancellation rare; most home builders are “in the teens.” KBH did not address this high cancellation rate and analysts did not ask about it either (Seeking Alpha Transcript). However, this rate was only up by one percentage point year-over-year; KBH simply tends to have a high cancellation rate.

As usual, KBH reported generally strong results. From the earnings slide presentation and the earnings release (percentage changes on a year-over-year basis):

Housing Revenues: +7%

Net income: +74%

Earnings per diluted share: +71%

Operating income: +38%

Adjusted housing gross profit margin: +140 basis points

Deliveries: +8%

Average Selling Price: -1%

Net Order Value: -5%

Net Orders: +3%

Backlog Value: -4%

Ending Community Count: -3%

Average Community Count: -7%

Absorption (net orders per community, per month): 11%

During the conference call, KBH summarized its guidance in strong terms:

“…a solid outlook for the fourth quarter, we expect a meaningful improvement in our book value by the end of this year. We are poised to finish 2018 with growth in revenues and a significantly higher year-over-year operating margin fueled primarily by the expansion of our gross margin, a key goal for us. As we look ahead to 2019, the combination of community count growth beginning in the fourth quarter of this year, a substantial increase in communities slated to open in 2019, and maintaining our solid absorption pace gives us confidence in achieving our targets next year.”

Still, investors likely found reasons to nitpick and sell in the details. KBH lowered metrics on average selling price and revenue (emphasis mine):

“Our $2 billion backlog provides visibility on deliveries for the remainder of this year, supporting our 2018 expectations including housing revenues that are at the low end of our previous guidance range. Although we are pleased with our year-over-year absorption pace increase in the third quarter, we now recognize in retrospect that our full year revenue guidance from last quarter was too aggressive based on the timing of getting our communities open and establishing our targeted pace to support projected fourth-quarter deliveries.

In addition, with our backlog currently weighted outside of California, we’re lowering our ASP expectations from our previous guidance, reflecting our third quarter backlog ASP that is down 4% year-over-year, which will also impact our revenues. Managing the business for the balance of 2018, we made the decision to maintain our pace price discipline and achieve a higher gross margin for this year as opposed to running our communities at a faster pace to preserve delivery volumes.

As a result, we’re now expecting a gross margin of approximately 18% for this year at the high end of our previous guidance range.”

Net-net, it was yet another fade for post-earnings action for a major home builder. The impact rippled throughout the sector. Toll Brothers (TOL) finished reversing all its post-earnings gains with a 2.5% loss on the day. Lennar (LEN) lost 2.0% with a 19-month closing low. The iShares US Home Construction ETF (ITB) lost 1.4% to close exactly at a 52-week low.

This month’s round of housing data have not improved the outlook for the housing market. I will cover this and more in my next Housing Market Review. It looks like time is running out on a good start for the seasonally strong period for home builders!

Be careful out there!

Full disclosure: long ITB call options