Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

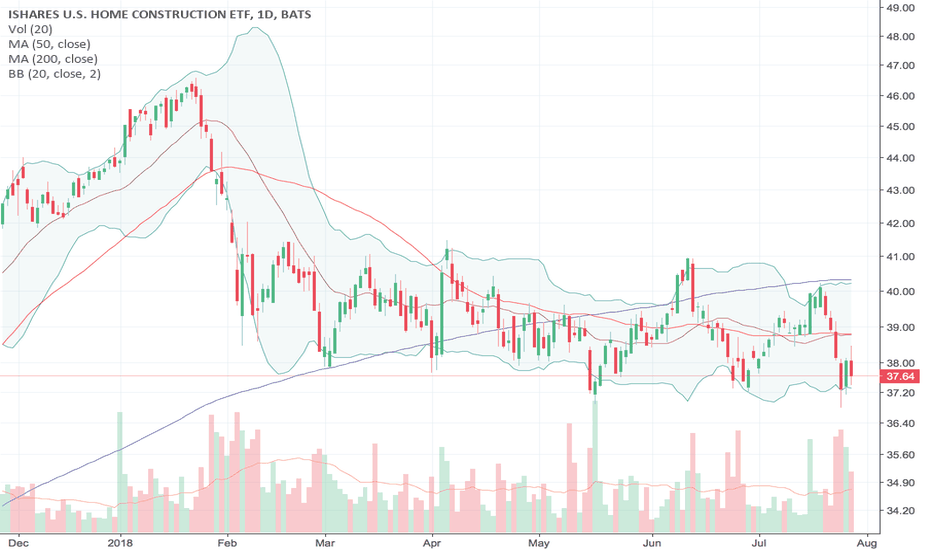

ITB

ITB bearish trade in home builders'So with the FED hiking rates another .25 bps in June (96% odds as of right now) I am making a bearish trade in the home builder ETF. I have never traded through a rising rate environment so.......take it with a grain of salt. I am buying the 40 put in October and selling the 36 put in October for $1.12 This is a defined risk trade for a debit (not really the Tasty Trade way) With an Implied Volatility Rank of 14% I am going to allow this for my smaller account since the risk/reward ratio is more inline with growing a small account (risk 1.12 to make 3.80) I would have defaulted to a 3 wide spread but the 36 strike had considerable more open interest for 20 cents more. This trade may work because the overall market tanks or the market could continue rallying and make it price in even more hikes.....I am not really sure what will happen but I have come to really hate those long sideways horizontal channels that can tend to plunge. I have 130 days for this trade to play out and no way of adjusting without adding risk other than rolling out for time (which usually only works if it goes against you) I can not see home sales continuing at this pace if interest rates continue going up and something has to give.

Housing Market Review (May, 2018) - A Fresh Flicker of LifeHousing Market Review (May, 2018) - A Fresh Flicker of Life As Sentiment Turns Without A Change in Data. The housing data continue to plod along but the market for home builder stocks is suddenly warming up all over again.

drduru.com $ITB $CCS $DHI $PHM $LEN $FPH $LGIH $MTH $XHB

Dissonance: Decelerating Housing Data, Diverging Builder StocksHome builder stocks are starting to diverge as housing data decelerates. Investors are showing interesting preferences even as all builders continue to tell similar stories. For more....

Housing Market Review (April, 2018) - Dissonance: Decelerating Housing Data and Diverging Home Builder Stocks drduru.com $ITB $PHM $LEN $KBH #housingwatch #stockmarket

Lumber is Sinking – Is Housing Next?Earlier this month, the idea of lumber being a signal for economic data was brought to the table (here). Lumber is not necessarily a trader’s first go-to for evaluating economic forecasts, but there is a striking resemblance in trend for lumber and the ISM manufacturing PMI data. As lumber prices dive, manufacturing data tends to do the same (and vice versa). Lumber, reasonably so, is also correlated to housing; and the US cannot have a recovery without housing participating.

The housing data over the last few years has been lackluster, and today’s data is no exception. Housing starts contracted a whopping 17 percent. That’s 14.5 percent lower than general forecasts. Weather was cold, and it is always to blame.

However, analysts were already discounting the weather issue. Wall Street’s best and brightest were looking for a drop of only 2.5 percent, so clearly it is not just the weather. According to the US Department of Housing and Urban Development, privately-owned housing starts were seasonally-adjusted at an annual rate of 897,000, or 17 percent below the revised January estimate. Single-family housing starts in February were at a seasonally-adjusted annual rate of 697,000, or 14.9 percent below the revised January estimate. Not good.

Housing completions of privately-owned housing fell came in at a seasonally-adjusted annual rate of 850,000, or 13.8 percent below the revised January estimate of 986,000.

The “recovery” bulls will harp on the permits data which was three percent higher than the general consensus. But, let’s be objective. Permits do not particularly matter much because builders cannot sell permits. Building permits are also cyclical. They tend to rise to elevated levels on optimistic outlooks but then completely collapse right be for the next recession. Permits could continue to rise, but it is not indicative of a healthy housing sector, or economy for that matter.

umber has closed well-below the massive ascending channel created when prices bottomed in 2009. Currently trading at $270.90, lumber prices are down almost 14 percent since first bring more attention to lumber a month ago. The basic assumption is that low prices are great for builders and the housing sector in general, and they are at the margin. However, a trend shift in prices indicate that homebuilders are not purchasing lumber. Homebuilder confidence fell for a third consecutive month in March.

Prices saw a bit of support at $265 but could easily hit $245 on trend continuation. To illustrate the correlation of lumber to housing, check out lumber prices relative to the iShares DJ Home Construction ETF (ITB) and the SPDR S&P Homebuilders ETF (XHB). It’s not a perfect match, but it grasps the overall trend quite well. Notice the prices of lumber, ITB, XHB leading into the housing crisis – they collapsed. This time should be no different.

The two popular ETFs now trade at a premium to lumber prices, but the upward trajectory is stalling; and this is far likely contributed to Fed-induced buying (similar to the XLE and future prices). It is only a matter of time before housing ETFs begin to rollover, too.

Please check out bullion.directory for up-to-date news and analysis on precious metals, market sentiment, economics and central bank folly.

False breakout...Housing SUCKS. This is the SLOW season coming up, to make it worse. New housing apps down to lowest level in forever, everything about housing SUCKS. GREAT SHORT HERE.

Update 11/21: I was a little early on this short! I was happy to buy a few cheap $33.5 weekly puts for next week. I typically don't like to buy options at the end of the week to carry into the next, but, this was one hell of a candlestick up, that hardly seems sustainable. But then again, I never thought the XHB would make it this far. This whole thing is being propped up with HFT/ALGO BS because the whole market s rigged. Look at all the mess: FOREX Scandel, Libor scandal, now the latest commodity scandel, Madoff, JP Morgan and all these banker deaths that seem all too conspicuous. ALL these unusual banker suicides 48 of them in the past year and a half, and now on last night who slit his own throat and wrists? Who does that to themselves? Ridiculous. Many of them at JP Morgan, some who knew each other, some in IT Programming. Probably knew too much. Did you know these institutions carry insurance policies on their employees that are classified? They have a motive to see them killed if they get in the way. THEY COLLECT. I'm not conspiratorial, it's just the way this screwed up place we call planet earth has become. Pretty sickening how greedy and selfish we can be at times. Anyway, this wasn't meant to be a diatribe. There are so many banking scandals it's sick. And none of them go to jail. They to big to fail, and to big to jail.

Update: Wow, who would have thought the ECB would finally juice the market, and China drops rates. Next up... does the FED juice the market to keep up? I am finally short XHB at 33.50. I hope there are no more surprises!