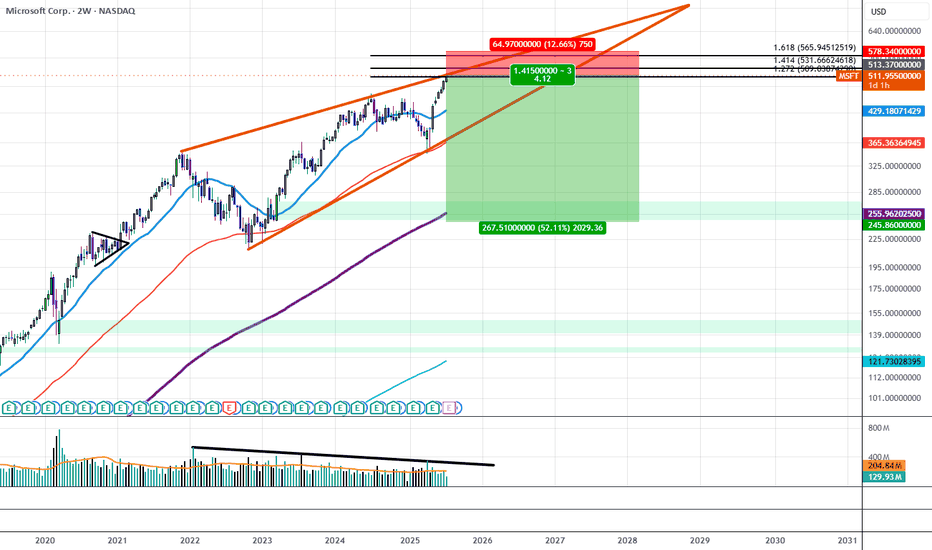

Microsoft Sees Declining Trading Volume Despite All Time HighsSince December of 2021, MSFT traded within a Rising Wedge structure that has gradually resulted in lower and lower highs in volume, at the same time IV on the Options Chain has begun to price down the strikes above $515 while Shorter Term Downside IV has begun to price up all the way out to $240.00. If this trend continues we will likely see the $515 area act as strong resistance as liquid interest above it begins to dry out.

This could be the beginning of a move to break down the wedge and trade down to the lower strikes first targeting the $365 price level and resolving around $240 near the 200 Period SMA.

Iv

SP500 28 April 2022Close candle of 27 April = 4180

Expected opening price for today = 4210(at least based on ES movement and volume)

TOP Side = 4280 - 4300 according to Implied Volatility and ATR

BOT Side = 4120 - 4100 according to Implied Volatility and ATR

Expected movement at 28April 00h between 1.5 - 2.5% movement during the day

In terms of fundamentals that can affect SP500

At 14:30 european time(in 4h) we have the release of :

US GDP

US Jobless claims

Both of the them are expected to lower than previous values -> Bearish Movements

So final decision:

Once SPX is going to get closer to 4280-4300 we can go into a short trade

with SL around 4325-4330 ? and aim for 4250-4200

However all of this can changed based on whats going to happen within the first hour

of SPX opening

The current intraday mood for SPX is fully bearish because of yesterday.

However there a high chance that within the first hour of opening we can get an

Iron condor SIGNAL, with 4280/4125 aproximatively.

Further update will come once the SPx opens

Potential Bearish entry BTC Based on the current market view, we have been in a sidemarket channel for the last week.

We can see that the channel was made from 41.000 as a top and 39000 as a bottom.

By using these values and taking a look at the same time on the ATR and implied volatility, we can with certain degree estimate the next movement of this asset.

This is a 1:2 Risk/reward ratio short entry

Key points :

Stop loss : 41500

Take profit : 39200

Options - GAMMA / DELTA SquaresNot time to reload on the Gamma Slamma, too many Underlying

Equities must be sold, not just yet, but soon.

Monday's are usually a Solid Day to mess with the VIX.

17.40 is the level to watch as the "Operators/EGG Peeps" need

more Protection.

_______________________________________________________

Emotionally Pregnant

TSLA EarningsTSLA has been on a rampage lately, and it is safe to say that this is a highly volatile stock. The ER is today (Wed, Jul 22) and will be announced AH. Given the hinderances imposed on almost all Americans during the Coronavirus pandemic, despite the major run-up TSLA has had, my personal opinion is that EPS will miss expectations. My guess is that the insane bull run by TSLA was purely on earnings anticipation and bandwagoning, and it is due for a huge pullback after the ER. In the coming weeks I believe it is likely that TSLA could fall back into the $1200s area after the ER release and the hype (for the most part) subsides. It may try to test the support trend line before ultimately breaking and gapping down, but after all, it is TSLA, and it has surprised us many times before. If you plan on trading the ER for TSLA, please be aware of the IV on it and do your own research before executing any trades. TSLA is an amazing stock but it will burn you if you are not careful.

CROSSROAD IN THE NEXT EVENT AND MARKETS The chart posted is that of the hourly SP 500 the drop to a perfect low in time spirals and price based on long term FIB 1974 LOW TO PEAK .382 pullback and near perfect 50 2009 to peak FYI NYSE WAS PERFECT. has now rallied back to a three wave rally back to a 50 % and was off the spiral low dates 3/21/23 and 4/ 2 spiral in time . We now have two views .First THE FRACTAL of the drop 2007 to 2009 is one of four long term decline dated back to 1783 . and if the fractal drops from here we would match the 2009 JAN 2009 PEAK and the drop would take out the low 3/23 and would drop to 2034 .Second much more bearish is we rally and go to a high all time record high as we hit top JULY 2007 CRASHED TO JULY 16 2007 RALLIED TO OCT 16 2007 THEN WE WOULD DROP OVER THE NEXT 512 DAYS TO 666 TO 745 IN THE SP . I AM NOW 75 % SHORT AS OF THIS POST INTO MCO 4/8 AND PREMARKET 2766 MY STOP IS 2812 .BEST OF TRADES WAVETIMER

SPY Sell Both Call and Put SellToOpen Apr Call spread 250/260 Limit 5.8;

STO Apt Put 210 market 6.80 credit;

Total credit 12.6;

1. If SPY will stay above 260, I will win 12.6-10=2.6

2. If SPY stay Between 210 - 250, I will win 12.6;

3. Below 198.4, I will lose money;

This is a mush better price than previous plan. I am willing to be assigned.

If SPY price keep going down, there will be more better price than what I got.

Key points in this trade:

1. we are still in a strong downtrend.

2. Next fresh demand is 220.

3. in next two weeks, it might be a downtrend consolidation/lower low side way move.

4. SPY IV is supper high now. try to sell something to catch this special benefit.

WEEK OF 9/25: IV REMAINS IN GOLD, MINING, PETRO SECTORSWhile broad market implied volatility has basically been absent (we had one VIX pop to ~20 on 9/12, after which it has receded dramatically), it has remained in the same place as it has for the past several weeks -- in gold, mining, and oil and gas, with a smattering of high IV in individual biotech issues.

Here are the top high IV stock and ETF options as of Friday close, screened for good liquidity:

NVAX (biotech) (134.9%)

VRX (biotech) (80.0%)

GPRO ("gadgets") (80.0%)

WLL (oil and gas) (79.9%)

CHK (oil and gas) (79.4%)

CLF (mining) (73.1%)

AG (silver miner) (70.8%)

AMD (semicon) (68.9%)

TWTR (66.5%) (M&A rumor)

ESV (oil and gas) (65.2%)

GDX (gold miner ETF) (42.8%)

XME (mining ETF) (37.6%)

XOP (oil and gas ETF) (36.9%)

In comparison, SPY implied volatility currently stands at 13.1%; DIA, 13.2%; QQQ, 14.7%; and IWM, 17.7%.

Unfortunately, this makes selling premium a touch frustrating here (at least for me), since I'm already in NVAX, CHK, WLL, CLF, AG, AMD, and GDX, and there is some correlation between GDX and XME, so I don't necessarily want to pile into more individual miners -- whether they be gold, silver, or otherwise. Additionally, I think my "petro boat" is fairly full here, too.

At least for me, it's probably a bit of hand-sitting (although I could "dabble" with GPRO or VRX) until something pops to the forefront ... . In any event, can't hurt to have dry powder running into these "little elections."

BOJ: JPY V USD, EUR, GBP - WHAT THE OPTION MARKET IS TELLING US50 Delta ATM Volatilities:

USDJPY -

- $Yen has an ATM implied volatility curve of 55.95%mrkt 24.08%1wk 18.31%2wk 14.12%1m

- Obviously we are aggressively steeper in the front end, with BOJ tomorrow and JPY MOF Fiscal Package details coming next week providing heightened vol for the 1day and 1wk vols - naturally we then see the curve tail off as the event vol fades.

GBPJPY -

- £Yen has an ATM implied volatility curve of 58.66%mrkt 25.93%1wk 23.02%2wk 18.30%1m

- The same can be said about sterling yens ATM curve, adding that it is steeper accross the tenors as the recently heightened GBP risk/ BOE event vol is priced into the 1wks and 2wks greater relatively vs $yen, with 1ms also outperforming $Yen as the perceived GBP risk/ vol post-brexit carries higher vs the USD.

EURJPY -

- EUROYEN has an ATM implied volatility curve of 49.42%mrkt 22.82%1wk 18.03%2wk 14.23%1m

- EUROYEN mirrors $yen from 1wk-1m as the term structure is very similar for eur vs usd (no significant event vol expected). Though we see a notable 6-7vol divergence in the current vol which is expected as $Yen expressions are favourable for BOJ out-performance positionings (USD a firmer based/ more widely traded) and £Yen are favourable for BOJ under-performance structures as BOE next week compunds the attractiveness in the downside of the cross (BOE likely to ease) which in turn increases the demand for £Yen expression on a BOJ no-show.

25Delta Risk Reversals (25d call vol minus 25d put vol - examines the relative demand)

USDJPY -

- $Yen RRs are +3 mrkt, +0.62 1wk, -0.67 2wk, -0.81m

- Interestingly we are seeing a moderate $Yen topside coverage in the front end (e.g. current and 1wks) implying the market is hedging/ positioning for a BOJ Out-performance Surprise (call demand > Put). The RRs are quite small at +1 so i wouldnt say there is a huge consensus on BOJ HIT expectations. Nonetheless calls are likely being purchased to hedge underlying spot short positions in the near term as any $yen/ BOJ topside is expected to not last long and be faded aggressively - which explains the switch to negative RRs after the BOJ/ MOF events have passed.

GBPJPY -

- £Yen RRs are -6 mrkt, -3 1wk, -1.3 2wk, -2.2 1m

- Understandably SterlingYen has a different RR structure as BOJ and BOE predispositions are priced into option structures, rather than just BOJ (as is the case for £yen and euroyen) - so we see a strong put bias, particularly in the front end (current and 1wks) as these cover the BOE and BOJ event vol. Unlike $Yen we see there is a clear trend for BOJ miss/ downside speculation as it is the logical chosen proxy, as a BOJ miss is highly likely to then be compounded over the current and 1wk terms as BOE hit expectations are priced in, accelerating the GBPJPY to the downside and RRs towards the LHS (BOJ miss = yen strength, BOE hit = Streling weakness - aggressive downside). Also put gbpjpy, automatically hedges any BOJ hit/topside risk as 1wk later the BOE is likely to ease so any yen downside arising from a BOJ hit will likely be smoothed somewhat by BOE easing induced GBP selling; thus lessening the negative impact or even turning the position back into the money.

SELL EURUSD: TECHNICAL ANALYSIS - 1.09 CLOSE, MA, STANDEV, IV>HVEUR$ Technical analysis - highly bearish:

Key level close:

1. On the daily and weekly we closed below the strongest pivot point of recent times below 1.10 - this is very bearish as historically this is the strongest level (lower than post brexit).

MA:

1. We trade below the 2wk and 4wk MA - this is a bearish indication + we have been below the 3m MA since brexit.

IV/ HV:

1. Realised Vols have also unsurprisingly come off, this would but bullish but brexit has distorted the longer dated HV and they are lagging, plus Implied vols are steepening higher than HV - with 1wk, 2wk and 1m Implied vols trade at 9.55%, 8.87%, 7.96% vs HV 1wk 2wk 1m at 6.7%, 7.09%, 7.24% - so IV is greater than HV across the front end which is bearish.

Deviation Channels/ Support levels:

1. We Trade close to the bottom of the 6m deviation channel at 1.0900 but this is due to brexit so shouldnt be considered bullish but we could see resistance here. Looking at the 3m SD channel, this is more appropriate and shows us trading just below the average 3m price - hence there is definitely more room for downside and we have just crossed the middle regression line implying we are entering some downside deviation now, with the -2SD resistance level at 1.085 which is in line with the price support level at 1.083.

Risk-Reversals

1. 25 delta Risk reversals trade marginally bearish for EUR$, with current at -0.25, 1wks at -0.15 and 2wks at -0.32 and 1m at -0.72 - this suggest the EUR$ has a slight downside bias but is potentially searching for direction in lack of ECB directive rhetoric coming out on Thursday. I also think EUR$ has taken a bit of a back space in the vol space as investors search for better alpha (JPY/ GBP pairs) given EUR$ low volatility at the moment due to lacking CB bias vs other pairs.

- Though 3m risk reversals trade with a clearer downside bias at -1.1 which shows the market expects EUR$ to trade lower in the 3m term, even if this is only a slight bias - likely a result of September ECB easing expectations nonetheless.

*Check the attached posts for indepth fundamentals*

GBP DOWNSIDE BREXIT POSITIONING & VOLATILITY UPDATEMy FX portfolio currently consists of :

- 2Long x USDJPY @ 106.8; 2Short x GBPJPY @ 151.2 (dynamic hedge for long UJ); 2Short x GBPUSD @ 1.4570. I will add to my short GBPUSD holdings if i can get a similar price & I may add to short GBPCHF or EURCHF downside if markets make a turn for the worst as IMO CHF denominations are under-priced relatively (as discussed in the attached article).

ATM Implied Volatility and Historical Volatility:

- GBPUSD ATM IV continues to rally today, despite being in the 2 year 100th percentile, to trade at 19.15% (0.6 up) currently, 1wks 20.5% (up 1.5), 1m 29% (up 0.5) from yesterday, whilst HV continues to trade relatively flat at 10%, with ATR increasing about 10 pips on the week.

- This positive divergence in IV and HV means that GU potentiallly has almost 2x as much more volatility to show in its price action - so I expect the market to get much more rangy in the coming weeks, so anyone day trading i advise to leave GBP crosses alone and i advise a MINIMUM SL of 1 ATR which is 150 pips, as IV implies such moves will become less and less uncommon in the coming weeks.

Therefore I also suggest only play longer term 2/3wk positions so that the 150pip SL can be justified with 300+pips of upside tp.

- GU Risk Reversals on the 1wk increased to -2 (from -1.8) with the 1m trading flat at -8.7, so we can expect further downside in the pair as puts in the nearterm continue to be demanded more so than the calls - which makes sense in this highly volatile and fundamentally short environment.

Vol demand

- GBPJPY and GBPCHF1wk and 1m risk reversals in the long run are becoming negative at a higher rate/ momentum compare to USD e.g. investors are buying GBPJPY and GBPCHF Puts at an increasingly faster rate than GBPUSD puts (the change of the RR values are increasingly negative more than the GU - The GU RRs are almost already fully priced). Hence, from a future value point of view (since the demand for downside is not outpacing that of GU) we can expect, GCHF and GJPY to in the future fall at a faster rate than GU, which makes sense given the room let until the next support levels.

- GJ 1wk and 1m are at -0.9 and -7.4, whilst GCHF are at -1.2 and -5.6 (compared to GU at the above -2 and -8.7), we can see that the put demand for GJ and GCHF still has room to increase until it reaches the levels that GU is trading at hence why I like expressing GJ and GCHF even more so.

- Finally, GJ and GCHF HV trade at 19 and 15 respectively. However GJ vols are begging to trade lower, (perhaps indicating the pair is now becoming oversold) and GBPCHF HV is trending higher (indicating that sell side demand may be picking up now that the GJ expression is reaching its fully priced state, after selling off since sunday).

This supports my view from my last piece about getting short GBPCHF now vs adding shorts to GU or GJ since they are much more overweight to the downside.

APPLE: BULLISH VOL CROSS AND SUPPLY SIDE; BUT DEMAND DEFICIENCYVolume

Apple Volume traded up for the first time in 4 days on thursday, increasing 25% from 20m to 26m, whilst this may be considered bearish - as increased selling, it is important to not 26m is still 35%-40% below the 4wk and 6month average.

Volume cannot fall forever and we have been trading at extremely low volumes all week, so given these facts, a modest rise from 20m-26m is still bullish IMO given that apple traded at 46m last week, so even at 26m now we are still significantly depressed on the supply side - though the demand deficient problem of the recent times remained rife in the stock yesterday, where the stock fails to attract new liquidity, which is all the stock needs to ask the price up given the perfect, low supply environment apple is currently in.

Historical and Implied Vols

We continue to have a bullish view from a vols perspective as implied traded flat yesterday, up only 10bps at 21.02.

Also, a bullish cross pattern emerged between HV and IV, where HV is crossing lower then IV.

The shorter period 5/10 HVs are already trading below IV, but yesterday the 20/30 period HV also made a bid to make a move below IV in the coming days.

As i have highlighted from the last bull cycle on the graph, when the 4 HVs traded bid and started falling (to eventually trade below IV), Apples price was bullish, rising over 10usd, such interactions between HV and IV is historically highly correlated bullish behaviour. In april as you can see it was Earnings uncertainty that caused the relationship to unnaturally break down - in previous bulls, the HV < IV has allowed bull runs to continue for several months before.

Vol correlation with apples price also traded flat remained above the -90% and maintaining my bullish view with the indicator.

Evaluation

Much of same from apple, where we are witnessing a perfect "bull run" environment (low all round vols, low volume, low price) but the demand side remains the issue - likely due to apples poor mirco-econ environment of poor confidence/ fear regarding their future performance and the ever looming July Earnings, which is artificially keeping demand low for apple.

I dont expect any significant upside today from apple, given fridays are normally the worst day for stocks due to the "end of week" sell-off that occurs as some money managers cannot hold open risk on their books over the weekend.

IMO i expect apple to close 99.2, higher if we are lucky.

If we dont have a bull run soon, we may not see one until august, given that i expect apples price to trade low/ down in the 3 weeks before earnings as investors remember Aprils tragic sell-off and try to avoid a similar event (even if it is unlikely).

GILD - Valuation bargain, but technically awful. Future BUY NASDAQ:GILD has been a great investment and I believe it will continue to be a good company to own long term. The valuation using multiple methods is outstanding compared to it's peers. Fundamentally, the question has been regarding future growth. GILD will have to find new ways to generate future sales growth to replace the expected slower growth from it's hep C blockbusters. Investors are concern GILD could be a value trap. Even with the questions about future growth, this stock seems crazy low compared to it's peers.

From a trader's perspective. Price action is awful and it may stay bearish for awhile. I don't see a favorable long swing trade entry at this time, but this sell off will get over done.

I plan on also evaluating my "investment options". One possible option to consider is a buy-write around $80 - 78. Options are currently selling at discount, so ideally I would like to IV go up to sell them a a premium.

GME -- EARNINGS AFTERGLOW PLAYHaving announced earnings about two weeks ago, IVR/IV in GME remains high (70/55).

The standard setup -- the short strangle:

Jan 22 27.5/38.5 short strangle

POP%: 71%

Max Profit: $113/contract

BPE: ~$333/contract

Break Evens: 26.37/39.63

Look to take it off at 50% max profit and move on ... .

WYNN -- NONEARNINGS PREMIUM SELLING PLAYSome stuff hits my high IVR/high IV radar over and over again. WYNN is one of those, with an IVR currently at 100 and an IV at 81.

Some caution is in order, though, since ordinarily I like going 45 days out and WYNN's earnings are due to be announced on 2/2, so I want any setup to expire somewhat before that so I don't get caught in a volatility expansion (that being said, how much more can it expand?).

Here's the setup (which I'll look to take off somewhat in advance of expiry), since it's getting in a bit tight to earnings:

Jan 22nd 45/77 short strangle

POP%: 79% (ridiculous, quite frankly for a play that is nearly worth 2.00 in credit)

Max Profit: $196/contract

BPE: ~$615

BE's: 43.04/78.96

EARNINGS PLAYS THIS COMING WEEK -- FDX, ORCLOnly two earnings plays stick out to me this coming week -- FDX and ORCL, both of which announce earnings on 12/16 (Wednesday) after market close, so look to put on setups before NY close on Wednesday.

Currently, FDX's 52 week IVR is at 54 (IV 34), which isn't stellar, but it's at 92 for the past six months. Moreover, there is pretty good credit to be had whether you go short strangle or iron condor, so I imagine I'll play that one way or another if the IV sticks in there.

ORCL (IVR 75/IV 35) isn't looking all that hot, frankly, because I can't get 1.00 in credit with either a short strangle or iron condor (a Dec 24 34.5/39.5 short strangle will only get you a .61 credit at the mid price right now, which isn't anything to go crazy over; a same expiry iron condor just isn't worth it). Nevertheless, we could see a greater volatility pop toward earnings that makes it a little bit more worthwhile such that I'll play just because there isn't that much else worthwhile to do ... .

(Of course, there is that all FOMC thing next week, too).

HYG -- PREMIUM SELLING PLAYYou know what they say, one's man's junk is another man's treasure ... . With an IVR of 100 and an IV of 18, this may be as good as junk is going to get for premium selling (don't quote me on that; further sell-off could be on the horizon ... ).

HYG Jan 29 74/84 short strangle

POP%: 75%

Max Profit: $109/contract

BPE: ~ (Undefined/After Hours)

BE's: 72.91/85.09

HES -- POST EARNINGS HIGH VOL PLAYWith a dwindling earnings calendar and some buying power to put to good use, I'm looking to go where the IVR/IV takes me. With an IVR of 74 and fairly decent IV of 43, HES popped up toward the top of the Dough "Notable Stocks" grid (sorted by IVR).

Here's my set up:

Dec 24 51/68 Short Strangle

POP%: 75%

Max Profit: $150/contract

BPE: ~$597/contract

BE's: 49.50/69.50

Notes: The underlying isn't the most liquid thing, so you may not get a fill at this particular price and might have to monkey around with it a bit. Me, I'm just going to enter the order and if it fills, it fills. If it doesn't, I'll look at it again next week to still if there's still premium in the play. As always, I'll look to take the trade off at 50% max profit so I can redeploy the capital elsewhere.

Binary Event - Bullish moveCVX is a correlative equity to XOM. These are consist in trend moves comparable to other equities in their sector. You want volatility for the option's play. Right now, CVX is at a crossroads with an IV of 73 and HV 71. With earnings coming up, we're expecting a shift north till the end of this year's first quarter. That's a good play to go deep in options. FEB (22) Call Strike 105 is our target for front month. APR 15 (78) Call Strike is 110 and/or 115. The decrease in IV over the next months in consideration of the options months shows favorable signs of going north. Tomorrow is we'll know.