J-DXY

USD/CHF: Bearish Continuation Towards Key SupportUSD/CHF has maintained a strong bearish trend, forming a series of lower highs and lower lows. The chart highlights a **Deep Crab** harmonic pattern, which previously triggered a corrective move before resuming its overall downtrend.

Currently, price action is trading near **0.8767**, approaching a key support zone at **0.8722** (HOP level). The recent rejection from the **H4 supply zone** around **0.8920** further confirms bearish momentum, suggesting sellers remain in control.

**Key Considerations:**

- A breakdown below **0.8722** could accelerate further downside, extending losses towards lower psychological levels.

- A potential pullback may occur if buyers step in at support, but the overall bearish structure remains intact unless a significant reversal signal appears.

**Conclusion:** USD/CHF remains under bearish pressure, with a high probability of further declines. Traders should monitor price action at support for potential continuation or reversal signals before committing to new positions.

GBP/USD Market Analysis: Potential Short Setup at ResistanceThe GBP/USD pair is trading near the **1.3000** psychological level, showing signs of consolidation after a strong bullish move. The chart suggests a potential reversal as price approaches a key resistance zone, with an apparent liquidity grab at the recent high.

The highlighted area around **1.2946 - 1.2921** represents a significant **H4 demand zone**, where price could retrace before continuing its next move. A break below this zone would indicate a deeper correction, with potential downside targets towards **1.2870** (OA level).

**Key Considerations:**

- A sustained break above **1.3000** could invalidate the bearish setup, leading to further upside momentum.

- A rejection at this level, combined with bearish price action, could confirm a short opportunity with a target towards the demand zone and lower support areas.

**Conclusion:** Traders should monitor price action around the resistance level and confirmation of a bearish reversal before committing to short positions. If bullish momentum persists, a breakout could open the door for further gains.

GBP/USD - 1.30 Break I've been monitoring Cable closely, waiting for a clean break above the 1.30 resistance level. Since the start of the month, no solid entry has presented itself, but the bulls seem to be gaining momentum as time progresses.

The chart is shaping up well, with 1.30 acting as a key resistance level. We've already seen multiple rejections this month, with price coming within 10 pips before reversing sharply.

If we get a confirmed breakout above 1.30, I'll be watching for a retest to establish it as support before entering a long position. The target is set at the psychological level of 1.325, aiming for a 3:1 risk-to-reward.

Gold Bullish to $3,030 (4H UPDATE)As per yesterday's video update I gave you all, I said Gold would push higher into $3,030. That target has now been hit!

Gold has pushed up strongly today, up 380 PIPS in less then a day. I'm waiting for bullish momentum to slow down as an indication that market structure will shift to bearish. I'll be keeping an eye on the smaller TF.

3.18 Risk aversion and expectations of rate cuts support gold toIntraday data analysis:

Gold hit a new record high and maintained an upward trend. For the support below, pay attention to the upper rail of the 4-hour Bollinger band at $3010, followed by the integer position of $3000, which is also near the high point of gold prices on Monday; for the pressure above, pay attention to the upper rail of the weekly Bollinger band at $3028, which is also the upper rail position of the current 4-hour Bollinger band. If the gold price continues to break upward, the upper space can pay attention to the upper rail of the monthly Bollinger band at $2950. The 5-day moving average and the MACD indicator cross upward, and the KDJ and RSI indicators cross upward. The short-term technical side is bullish.

Gold intraday reference: Supported by risk aversion expectations and interest rate cut expectations, gold maintains an upward trend and gold prices hit a new record high. In terms of operation, it is recommended to treat it with a volatile mindset. Pay attention to the support below at $3010, followed by $3000. Pay attention to the breakthrough near $3028 for the pressure above. If it stands firm here, you can continue to pay attention to $3050.

We Need a Retrace before the breakout IMO on GoldI want to go long. I am long on gold. but I need to see it pull back and establish a low for he week first before I'm interested in attempting the long. This would make for a much stronger move. Just have to be patient and wait for it all to line up inside of the killzone.

The US Dollar... March has been a fantastic trading month for me so far. I'm out of drawdown and showing a half-decent profit.

This week, there is a lot happening, including interest rate decisions from the Bank of Japan, Fed, Swiss National Bank, and Bank of England.

At the moment, I'm thinking about the dollar with two minds. Based on current positive economic data and the potential of higher US inflation, I'm bullish. On the other hand, I see the potential downside of the dollar based on US uncertainty, possible US recession, and the US losing its spot as a safe-haven and stable investment environment... 🤷♂️ What do you think?

NAS100 - Stock Market Enters Downtrend?!The index is trading below the EMA200 and EMA50 on the four-hour timeframe and is trading in its descending channel. If the index moves down towards the specified demand zone, we can look for further buying opportunities in Nasdaq. A break of the channel ceiling will also continue the short-term upward trend in Nasdaq.

According to EPFR data reported by Bank of America, investors withdrew $2.8 billion from equity funds last week, marking the largest outflow of the year so far. Meanwhile, U.S. government bonds saw an inflow of $6.4 billion, the biggest weekly increase since August.

Scott Basnett, the U.S. Treasury Secretary, stated in an interview that there are no guarantees to prevent an economic recession. He welcomed the decline in stock markets, viewing it as a sign of a healthy market. Analysts believe this shift in tone—unusual for a Treasury Secretary who typically reassures economic strength—suggests an effort to prepare the public for a possible recession.

According to data from the Polymarket betting platform, the probability of a U.S. recession in 2025 is currently estimated at 41%. Reuters reports that American households are increasingly pessimistic about the economic outlook. However, the Federal Reserve may be reluctant to respond aggressively to a weakening economy, given growing concerns that the Trump administration’s trade policies could further fuel inflation.

These concerns were reflected in financial markets on Friday, as the University of Michigan’s consumer sentiment survey showed a decline in consumer confidence for March. Additionally, consumers now expect inflation to reach 3.9% over the next five years, the highest level in more than 30 years.

In an interview with Breitbart, Basnett emphasized the need to remain vigilant against persistent Biden-era inflation and expressed support for deregulation to lower costs. He also stressed that while tackling inflation, the government must also address affordability concerns. Additionally, he backed interest rate cuts to help reduce housing costs and auto loan payments.

This week will be packed with major economic events, creating a high-risk environment for precious metals traders amid ongoing geopolitical developments during Trump’s second term.

Central banks are back in the spotlight, as several key monetary institutions are set to announce their policy decisions in the coming days:

• Tuesday: Bank of Japan

• Wednesday: Federal Reserve

• Thursday: Swiss National Bank & Bank of England

Furthermore, a series of macroeconomic data releases could influence market sentiment, including:

• Monday: Retail sales & Empire State Manufacturing Index

• Tuesday: Housing starts & building permits

• Thursday: Weekly jobless claims, existing home sales & Philadelphia Fed Manufacturing Index

The Federal Reserve is expected to keep interest rates unchanged in its upcoming meeting. Market participants will closely watch the Fed’s updated economic projections and Jerome Powell’s press conference for insights into future monetary policy.

According to a Bloomberg survey, economists anticipate two rate cuts by the Fed this year, likely starting in September. However, despite declining stock indices and rising recession concerns, Powell is expected to maintain a cautious stance, avoiding any rushed rate cuts.

While consumer and business confidence has weakened, the Federal Reserve has limited flexibility to lower rates due to persistently high inflation indicators.

Bitcoin - Will Bitcoin Go Up Again?!Bitcoin is trading below the EMA50 and EMA200 on the four-hour timeframe and is trading in its descending channel. The continuation of Bitcoin’s downward trend and its placement in the demand zone will provide us with the opportunity to buy it again.

As long as Bitcoin is above the drawn trend line, we can think about buying transactions. The continued rise of Bitcoin will also lead to testing of selling transactions from the supply zone. It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and observing capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand range.

In recent days, Bitcoin’s price has experienced a significant decline, reaching its lowest level in several weeks. This price drop coincides with growing concerns about a potential economic recession in the U.S. and the impact of Donald Trump’s recent statements on financial markets. As a result, many investors have shifted towards safer assets.

Analysts believe that Trump’s remarks have intensified market volatility, leading to increased selling pressure across financial markets. Consequently, riskier assets like Bitcoin have also seen a decline in price.

Given the uncertainty in the market and doubts surrounding the future of the U.S. economy, experts predict that Bitcoin’s price fluctuations will persist. While some investors see this drop as a buying opportunity, the lack of clarity on upcoming economic policies has heightened overall risk.

On March 14, Bitcoin broke its long-standing 12-year ascending support trend against gold (XAU). A well-known analyst, NorthStar, has warned that if Bitcoin remains below this level for a week or more, it could signal the end of its 12-year bullish trend.

This breakdown occurred as spot gold prices surged by 12.80% since the beginning of the year, reaching a new record high above $3,000 per ounce. In contrast, Bitcoin—often referred to as “digital gold”—has fallen 11% so far in 2025.

Arthur Hayes, co-founder of BitMEX, who previously predicted that Bitcoin would drop below $80K, now believes its decline will likely bottom out around $70K.

Meanwhile, reports indicate that Russia is increasingly using cryptocurrencies in its oil trade, which is valued at $192 billion. Digital assets are facilitating the conversion of yuan and rupees into rubles, streamlining transactions.

According to sources, Russian oil companies have been utilizing Tether, Bitcoin, and Ethereum in their trades.While digital assets currently represent a small portion of the oil trade, their adoption is growing rapidly.

GOLD H1 Update: Bullish Outlook BUY DIPS by ProjectSyndicate🏆 Gold Market Highlights (March 2025)

📊 Technical Outlook

🔸Bullish OUTLOOK

🔸Broke out and set new ATH

🔸Strong UPTREND: Sequence of Higher Lows

🔸Recommend to BUY DIPS 2925/2950 USD

🔸Price Target BULLS: 3050 USD - 3100 USD

📈 Historic Milestone Achieved

🏅 Gold Futures Surpass $3,000

🔥 Gold prices hit an all-time high, closing above $3,000 ATH

🚀 Major breakout in the precious metals market!

📊 Analyst Perspectives

🔮 Continued Bullish Sentiment

📉 Both Wall Street & Main Street expect further gains beyond $3,000.

💡 Analysts see upside momentum continuing in the coming weeks.

🌍 Market Dynamics

⚡ Factors Driving the Rally

🌎 Global trade tensions & geopolitical risks pushing investors toward gold.

📌 Safe-haven demand surging amid uncertainty.

⏳ Historical Context

📜 Comparisons to the 1980 Bull Run

🔄 Parallels drawn between the current rally and the historic 1980 surge.

❓ Can gold repeat history and extend its gains even further?

🏦 Global Demand Trends

🇨🇳 China’s Record Gold ETF Inflows

📈 Massive inflows into gold ETFs in China, signaling strong demand.

💰 Jewelry demand expected to stabilize as the economy recovers.

🏦 Investor Behavior

🎯 Increased Attention Amid Uncertainty

🏛️ Investors shifting focus to gold as a hedge against economic instability.

💎 Gold’s safe-haven status reaffirmed, attracting more institutional buyers.

📢 Final Takeaway:

🔹 Gold is shining brighter than ever! 🌟

🔹 Expect volatility, but long-term outlook remains bullish. 💹

🔹 Keep an eye on key resistance & support levels. 🔍

GBP/USD MONTHLY TREND UPDATE!

📈 Elliott Wave Perspective: The pair is following a corrective ABC structure, and we might be heading toward Wave (C) completion in the next months!

🔍 Key Insights:

✅ Wave (A) Completed—Now in a corrective Wave (B) 📉

✅ Potential Wave (C) Upside Target: ~1.80 📊🚀

✅ Major Resistance Zone 🟡: Watch for price reaction

💡 Will GBP/USD push higher toward the resistance zone, or is another correction needed first? Share your thoughts below! 👇

#Forex #GBPUSD #ElliottWave #MarketAnalysis #GreenFireForex

DOLLAR TREND REVERSAL?

📉 The DXY has reached a key demand zone—is this the perfect buying opportunity? Liquidity grab & reversal incoming? 📊🔄

🔍 Market Insights:

✅ Support Zone: 102.28 - 102.96 🟡

✅ Bullish Bounce Expected 📈—Targeting 105.42 - 106.13 🎯

✅ Smart Money Accumulation? Watch for a liquidity sweep & strong upside! 🚀

💬 What’s your take? Drop your analysis in the comments! Let’s trade smart together! 🔥📊

#Forex #DXY #USDollar #Trading #MarketAnalysis #GreenFireForex

DXY Will Move Higher! Long!

Here is our detailed technical review for DXY.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is trading around a solid horizontal structure 103.733.

The above observations make me that the market will inevitably achieve 104.118 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURUSD UPDATED Strategic Outlook 2025: 0.9000 PT BEARS 📉 **EUR/USD Weekly Outlook Update**

🔹 **Downtrend Intact**: The **EUR/USD** downtrend has been well-defined since **2009**, and a recent **strong rejection** after a period of distribution confirms bearish momentum.

🔹 **Technical Target 🎯**:

- **Short-term Outlook**: EUR/USD is set to hit **0.95** by **summer 2025**.

- **Year-End Projection**: Expected to end **2025 at 0.9000**.

- **Upside Cap**: Limited to **1.13** at most in 2025.

🔹 **Key Reasons for Further Decline** 📉:

- **Strong USD (DXY Strength) 💪**

- **Firm U.S. Political Leadership 🇺🇸** vs. **Weak EU Leadership 🇪🇺**

- **Fragile Eurozone Economy 🏦**

## 📊 **Why the Eurozone is Set for Further Decline**

🔻 **Slow Economic Growth ⏳**

- The **Eurozone's economy** is growing at a sluggish pace compared to other regions.

- **Weak domestic demand**, **low productivity growth**, and **high export dependency** on slower-growing markets (e.g., China 🇨🇳) weigh on investor confidence and euro demand.

🔻 **Demographic Challenges 👴📉**

- Aging populations in **Germany, Italy, and Spain** reduce the labor force.

- Higher pressure on **social services & pension systems** slows long-term growth potential.

🔻 **High Energy Prices & Inflation 🔥📊**

- The **energy crisis** (exacerbated by the Russia-Ukraine war 🇷🇺🇺🇦) raises business costs.

- **Inflation remains high**, limiting the **ECB’s ability** to stimulate growth without worsening price pressures.

🔻 **Geopolitical Tensions & Economic Risks ⚠️🌍**

- The **Ukraine war & energy disruptions** hit Europe harder than other regions.

- **Reliance on Russian energy** led to severe **supply shocks**, further weakening the eurozone economy.

🔻 **Eurozone Structural Issues 🏗️❌**

- Economic **imbalances between member states** (Germany & France strong, Italy & Greece weak).

- **Common monetary policy** limits individual governments’ ability to react to crises.

- **High debt burdens** in weaker economies drag down overall performance.

🔻 **Tight Fiscal Policies 💰🚫**

- **EU fiscal rules** restrict deficit spending, limiting government stimulus efforts.

- **Lack of fiscal unity** prevents stronger coordinated responses to economic downturns.

📌 **Bottom Line for EUR/USD Traders**

✅ The **downtrend remains dominant** 📉.

✅ **Technical & fundamental** factors favor a **weaker euro**.

✅ Expect further declines **toward 0.95 by summer & 0.90 by year-end**.

✅ Limited upside beyond **1.05** in 2025.

🚀 **Stay updated & trade wisely!** 💹

Weekly Market Analysis - 16th March 2025 (DXY, NZD, ES, BTC)This is weekly market analysis of a few pairs (DXY, NZD, ES, BTC).

I haven't done one of these in a while, but here it is!

I would have done more pairs but the video was already 30 minutes long and I went into more teaching rather than pure analysis.

I hope you found it insightful to your own trading, because what I teach is the truth of the market regardless of whatever specific strategy you use for trading.

Anything can make money in the markets, but of course, risk management and discipline rule all.

- R2F Trading

EUR/USD - Looking for a long entry Hey,

I am looking at a long entry on the EUR/USD. We have recently seen the price break the major 1.05 to the topside once again, thanks to the tariff war which has weakened the DXY.

I am looking at entering long on the two set ups as presented on the chart. The physiological 1.075 level and the intraday 1.0683 level as support.

The price is now showing overbought on the 1D timeframe RSI & MACD, and evidently we are seeing less buying pressure at these current levels.

I will be looking for a strong confirmation at either of these levels before entering long. Preferably a wick below either level with the daily close above.

I expect this to play out before end of March.

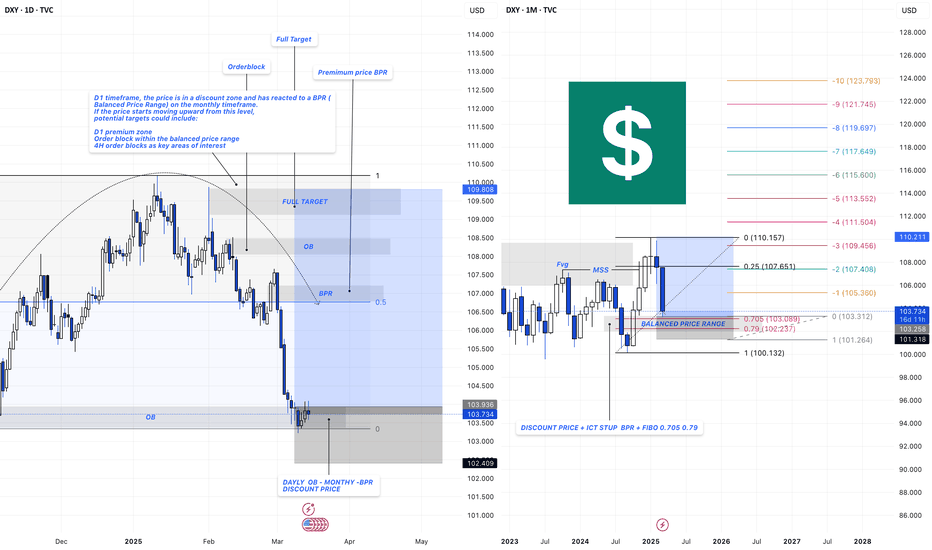

$DXY IdeaFor the DXY, on the monthly chart, we remain in a consolidation bias, as the price is trapped within a range formed by two FVGs. However, when analyzing the yearly candles, we notice a macro bearish bias, since the 2025 candle has swept the 2024 high and is now targeting the annual lows.

Since we trade intraday, it is essential to analyze other timeframes to confirm a trading bias. On the weekly chart, we observe that last week's candle swept the previous week's low and closed within the range, indicating a potential correction. This makes sense, as the DXY has extended significantly in recent weeks and is currently discounted, which may lead the price to a premium zone before resuming its downtrend, in line with our macro bias.

Additionally, based on the economic calendar, there is a possibility that the weekly low will be formed on Monday, which could create an opportunity for a counter-trend trade at the beginning of the week. However, this type of trade carries high risk, requiring caution and confirmation before entry.

For this week, we are looking for bullish opportunities up to equilibrium or until the price shows resistance to continue rising. However, this initial outlook will only be confirmed as price action develops throughout the week.

It is also important to note that this will be a challenging week, due to a lack of significant news events and a Federal Reserve speech on interest rates, which could significantly impact the market and increase volatility.

DXY Analysis – Key Market Structure Levels📌 D1 Timeframe:

- The price is currently in a discount zone and has reacted to a Balanced Price Range (BPR) on the monthly timeframe .

- If bullish momentum builds from this level, potential targets include:

- D1 premium zone

- Order block within the balanced price range

- 4H order blocks as key areas of interest

📌 Monthly Timeframe Confluence:

- The Balanced Price Range (BPR) aligns with ICT Stup , Fibonacci 0.705 - 0.79 retracement levels , and key liquidity areas.

- If price holds above discount levels , we may see a move towards the 110.157 target zone .

🔍 Market Outlook:

Short-term bullish bias as long as discount levels hold. Price action confirmation is needed before considering entries.

⚠ Risk Warning: Trading involves a high level of risk and may not be suitable for all investors. Always do your own research and manage your risk accordingly.

✅ If you find this analysis useful, don’t forget to subscribe and hit the "Boost" button to support the page!