"EURNZD Bullish Momentum Continues: Next Wave After Retest"EURNZD has followed the predicted bullish momentum, currently trading at 1.89 and aiming for the 1.93 target. The pair remains strong within its uptrend, signaling continued buying pressure. However, a small retesting phase is likely before the next bullish wave, allowing the market to confirm support levels and attract further buyers. This setup aligns with the technical outlook, reinforcing the expectation of further upside movement.

A minor retracement or consolidation at current levels could offer a healthy correction, giving traders an opportunity to re-enter before the next surge. Fundamental factors, including recent economic data from the Eurozone and New Zealand, suggest a favorable scenario for EUR strength. If risk sentiment remains positive and the European economy continues showing resilience, EURNZD could gain further momentum toward the 1.93 target.

Traders should watch for confirmation signals such as increased volume, bullish candlestick formations, or breakouts from key resistance zones. If the pair successfully holds above its retesting level, the next leg of the rally could unfold, offering another profitable move. As always, proper risk management is crucial to navigate potential market fluctuations effectively.

J-DXY

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

The EURUSD pair has recently risen over the past few days, reaching a key resistance zone. At this level, we anticipate a correction before the price resumes its upward movement.

After pulling back to the identified support level, the pair is expected to continue its bullish trend toward the specified targets.

What are your thoughts on EURUSD’s next move? Share your insights below!

Don’t forget to like and share your thoughts in the comments! ❤️

DXY (Dollar Index) Ready to BUY? | Monthly FVG in Focus! 💰 Smart Money Preparing for a Bullish Move on DXY!

The US Dollar Index (DXY) is approaching a key Monthly Fair Value Gap (FVG), which could act as a strong demand zone. If price reaches this level, we will look for confirmation on lower timeframes (H4/M15) before entering buys.

🔍 Why is this Important?

✅ Monthly FVG as a High-Probability Buy Zone

✅ Institutional Order Flow Aligning for a Bullish Reversal

✅ Strong Demand Expected at FVG

✅ DXY Strength = Bearish Pressure on Gold & Majors

📊 Key Market Levels:

🔹 Monthly FVG Buy Zone:

🔹 First Target:

🔹 Breakout Confirmation Above:

🔹 Invalidation Below:

⚡ Trading Plan:

📌 Wait for price to reach the Monthly FVG

📌 Look for Bullish Confirmation on H4/M15 (BOS, CHoCH, Liquidity Grab)

📌 Enter Buys Once Institutional Reversal is Confirmed

📌 Manage Risk – Watch CPI & FOMC Events

💥 Stronger DXY = Weak Gold & Bearish Pressure on Majors!

💬 Are you buying DXY at the Monthly FVG? Drop your thoughts below! 👇

#DXY #DollarIndex #Forex #SmartMoney #ICT #SMC #Liquidity #TradingView #OrderFlow

GBP/USD 15-Minute Chart: Bearish Reversal at Harmonic CompletionThe chart showcases a well-defined harmonic pattern, the Shark, with the price reaching the terminal zone at 1.2670 , marked by a red downward triangle. This suggests a potential reversal zone where selling pressure may emerge.

Key observations:

The price has reacted strongly at the completion point, aligning with Fibonacci extensions.

Overbought conditions are evident in the RSI and other momentum indicators, indicating potential exhaustion of the bullish trend.

Target levels:

T1: 1.26241

T2: 1.25741

Suggests a possible downside move if the reversal confirms.

Traders should watch for bearish confirmation before entering short positions, while bulls may seek a break above 1.2670 for further upside.

DXY (Dollar Index) and Pamp/Dump BTC. Markets Cycles.USA Dollar Index + Bitcoin Pamp/Dump Cycles. Logarithm. Time frame 1 week. Minima and maxima of bitcoin secondary trends are shown. Everything is detailed and shown, including what everyone always wants to know. Cyclicality. Accuracy.

This is what it looks like on a line chart to illustrate simple things.

DXY Will Go UP! Buy!

Hello,Traders!

DXY keeps falling down

But the index will soon

Hit a horizontal support

Level of 103.610 and

After the retest a local

Bullish correction

Will be expected

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold XAUUSD Move 03-07 March 2025Technical Analysis & Trade Signal

Market Overview:

Current Price: Around 2,858.140 USD

Trend Analysis:

The price was in an uptrend but recently broke down, indicating a possible bearish reversal.

A key support level was broken, which is now acting as resistance.

Key Levels:

Resistance Zones:

Minor Resistance: 2,900 - 2,920 USD

Strong Resistance: 2,960 USD

Support Zone: 2,780 - 2,800 USD

Trade Signal:

📉 Sell Signal: If the price retests the 2,900 - 2,920 USD resistance zone and rejects downward, enter a short trade targeting 2,800 USD.

📈 Buy Signal: If the price holds support around 2,780 - 2,800 USD and starts moving up, consider a long trade targeting 2,900 USD.

👉 Confirmation: Use additional indicators like RSI, MACD, and volume to confirm the trade setup before executing.

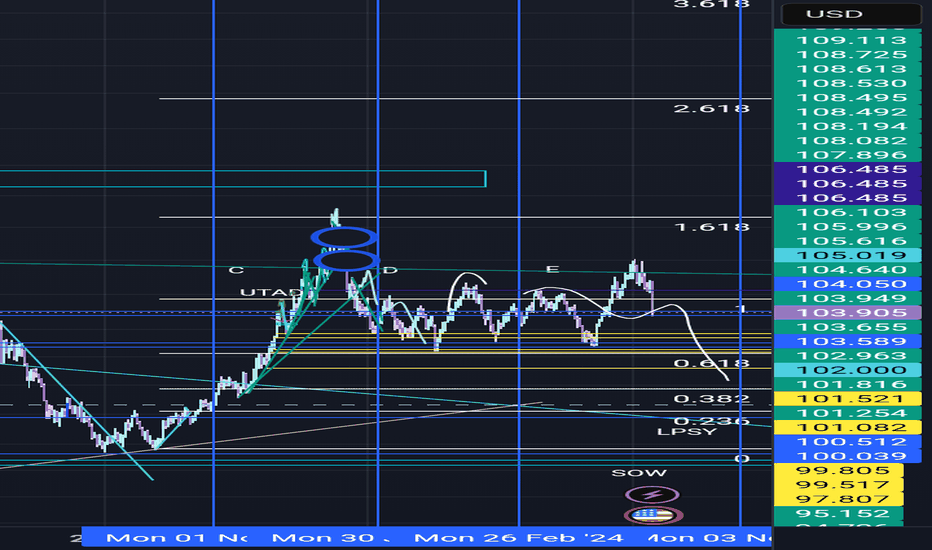

USD | USD INDEX Weekly FOREX Forecast: March 10 - 14thIn this video, we will analyze the USD through the USD INDEX (DXY). We'll determine the bias for the upcoming week, and look for the best setups to take.

The USD is bearish, and there is plenty of economic news coming up this week. Should be plenty of opportunities from Tues through Friday.

Short term bullishness, in the form of a pullback, is potentially there. But longer term bearishness is likely to continue.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

DOLLAR GAINS BUYER AMID NFP BAD DATA??Dollar seems on hold in it's 2.618 fibonacci support after NFP data released. Will it go higher next week?

I see dollar still waiting next data release. I mention JOLTS Job Opening & CPI which both of them crucial in current context of US macro-economy. Strong job opening & CPI means investor and retail trader must be no worries about US macro-economic despite concern about trade war. Otherwise, weak job opening & CPI means labor market and inflation continue cooling down. It will push THE FED to give clear path about their plan for future Interest Rate.

So, dollar could make sideways movement (or even gain buyer) but overall still in bearish momentum. Dollar still driven by concern of trade war and if job opening comes weaker than expected, it could gives more power to seller.

Dollar idex is ready to drop next week are you ready ?This week, the market was slow with little movement. However, starting next week, keep an eye on the dollar. The order flow is showing a strong sell, and the daily chart reveals an FVG that indicates a sell from this level. Additionally, the current low aligns with the monthly FVG level. Trading next week should be exciting!

Gold Bullish to $1,963- 1H TF (UPDATE)Gold Wave 5 (Major Wave Y) moving perfectly as I called for previously! We're seeing a nice push up towards our ATH target of $2,963 which could possibly hit next week.

Because this is the last 'impulse wave' to the upside (Wave 5), price has been moving slow. But that's the way the Elliott Wave Theory works. Last wave moves slow, in order to trap late buyers & sellers.

Digesting the US & Canada job numbers The numbers are out and, so far, the market is reacting logically. Let's dig in!

NASDAQ:AMD

NASDAQ:AVGO

NASDAQ:NVDA

MARKETSCOM:GOLD

MARKETSCOM:EURUSD

MARKETSCOM:DOLLARINDEX

MARKETSCOM:USDCAD

Let us know what you think in the comments below.

Thank you.

74.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

The Dollar's Demise May Not Be Over Just YetThe US dollar index is on track for its worst week in nearly two and a half years. It is also nearly 6% off from the January high, which is similar in depth to the two previous selloffs seen in 2023 and 2024. Yet I do not think we've seen the low just yet, even if there is evidence of a potential bounce on the daily chart.

Matt Simpson, Market Analyst at City Index and Forex.com

Falling towards overlap support?US Dollar Index (DXY) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 103.53

1st Support: 102.36

1st Resistance: 105.62

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

The US Dollar Index is Decreasing - Positive for Cryptocurrency#DXY #Analysis

Description

---------------------------------------------------------------

+ The Dollar Index has breached its support level and is now trading below it, moving toward the next support zone around $100.

+ This development is positive for Bitcoin and the broader cryptocurrency market, as the US Dollar Index typically declines during a bull run.

+ In the long term, I anticipate further declines, potentially reaching the $90 range.

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

3.7 Gold short-term non-agricultural comingFundamental analysis

Tariff policy shows signs of easing, but risks have not been completely eliminated

Recently, the United States has postponed the implementation of the auto import tariff plan for Canada and Mexico, which has eased the economic and trade tensions in North America to a certain extent. However, this postponement is not indefinite. More importantly, import tariffs in other countries and regions are still in the process of being prepared or implemented, and potential uncertainties may still erupt again at any time. Driven by a series of previous tariff policy news, gold prices have repeatedly received safe-haven support. Although there is a slight correction at present, it is still near the historical relative high.

Technical analyst interpretation:

Currently, gold is fluctuating around $2,900/ounce. Overall, bullish confidence remains solid, but it also faces a large technical barrier in the short term. The following are several key observation points:

Key levels and support and resistance

Intraday key level: $2,914/ounce

If this position can be effectively broken through, it may attract more bulls to enter the market and pave the way for further impact of $2,934/ounce (R1).

R1 resistance during the day: $2934/oz

If the gold price breaks through this level, the next target will be $2950/oz (R2), and approach the historical high of $2956/oz on February 24. Once it approaches this high again, the market may experience a new round of violent fluctuations.

S1 support below: $2899/oz, coinciding with the $2900/oz mark

This area is a short-term long-short watershed. Once the shorts successfully suppress the price below $2900/oz, the bullish sentiment is vulnerable, and the risk of a short-term correction will also increase significantly. If it effectively falls below $2899/oz, the gold price may continue to fall to $2879/oz (S2), which is another possible long defensive position.

High consolidation and correction risk

From the overall market situation, the gold price has been strong since the end of last year, constantly refreshing the interim highs. However, as the market digests the Fed's expectations of rate cuts, bullish sentiment may be blunted at the current position. In addition, if the ECB or the United States' policy expectations change again, causing funds to reassess the prospects of global economic recovery and monetary policy, gold may also face certain pressure to fall from highs.

Pay attention to the operation of gold prices in the range of $2,900-2,934/ounce: If the bulls continue to fail to break upward, it is advisable to be alert to the potential correction caused by high-level profit-taking; and once the positive news is released, the possibility of gold prices quickly breaking through $2,934/ounce and heading straight to the $2,950-2,956/ounce area cannot be ignored.