USDJPY Moment of truth for the long-term bullish trend.The USDJPY pair has been trading within a Channel Up since the October 17 2022 High and right now the current 1W candle is very close to its bottom (Higher Lows trend-line). This offers a low risk trading set-up.

Confirmed buy will be if the price breaks and closes a 1W candle above the 1W MA50 (blue trend-line), in which case our Target will be July's Resistance at 161.500 (similar to the 2023 Bullish Leg).

If on the other hand it breaks and closes a 1W candle below the Channel Up, turn short and target the 1W MA200 (orange trend-line) at 139.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Japaneseyen

EURJPY: Top formation, sell opportunity.EURJPY is neutral on its 1D technical outlook (RSI = 53.515, MACD = 0.340, ADX = 26.005) as it ranges between its 1D MA50 and 1D MA200. This is a peak formation on the LH trendline of the 5 month Channel Down identical to January. At least a -6.20% bearish wave is to be expected. Today's spike gives an even better sell entry for a TP = 154.00.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

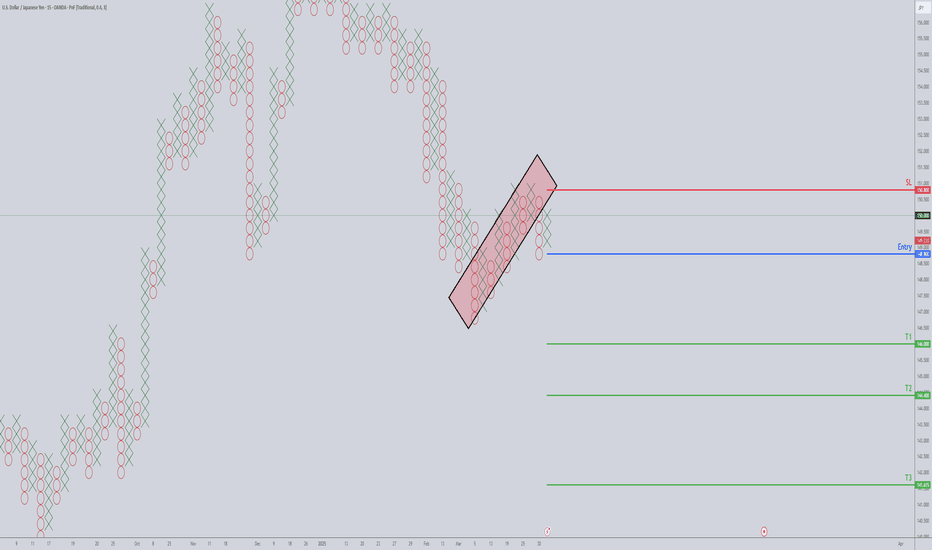

USDJPY Short OpportunityPoint and Figure charting is the OG technical analysis method—no fancy candlesticks or bar charts needed. Unlike other charts, Point and Figure ignores time and focuses purely on price action, offering clarity amid market noise.

If candlestick charts look too chaotic for your taste, Point and Figure usually clears things up. Its simplicity is its best feature: fewer patterns and straightforward trade execution rules, compared to the 150+ patterns of Japanese Candlesticks.

On the USDJPY 40-pip/3-box reversal P&F chart, a bear flag pattern is currently being tested and acting as solid resistance. This creates an aggressive but appealing short entry opportunity at 148.80. Below this entry, there are multiple potential profit targets, with T3 (141.60) marking the maximum realistic expectation.

Now, before you get too excited about a single-column collapse from 148.80 down to 141.60—hold your horses. The odds of USDJPY making such a dramatic drop in one swift move are slim to none. But given the current international trade tensions, stranger things have happened.

Think of the area between 148.80 and 141.60 as a zone where it's easier for USDJPY to drift downward rather than grind upward.

CHFJPY rebound on the 1D MA50 expected.The CHFJPY pair is trading within a long-term Descending Triangle and right now is pulling back to test the 1D MA50. This is almost halfway through the rebound that started on the February 28 2025 Support Zone test.

All previous rallies hit at least the 0.786 Fibonacci retracement level before reversing but since this time we are limited below the Lower Highs trend-line of the Descending Triangle, our Target is 172.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Behind the Curtain: Macro Indicators That Move the Yen1. Introduction

Japanese Yen Futures (6J), traded on the CME, offer traders a window into one of the world’s most strategically important currencies. The yen is not just Japan’s currency—it’s also a barometer for global risk appetite, a funding vehicle for the carry trade, and a defensive asset when markets turn volatile.

But what truly moves Yen Futures?

While many traders fixate on central bank statements and geopolitical news, machine learning tells us that economic indicators quietly—but consistently—steer price action. In this article, we apply a Random Forest Regressor to reveal the top macroeconomic indicators driving 6J Futures across daily, weekly, and monthly timeframes, helping traders of all styles align their strategies with the deeper economic current.

2. Understanding Yen Futures Contracts

Whether you’re trading institutional size or operating with a retail account, CME Group offers flexible exposure to the Japanese yen through two contracts:

o Standard Japanese Yen Futures (6J):

Contract Size: ¥12,500,000

Tick Size: 0.0000005 = $6.25 per tick

Use Case: Institutional hedging, macro speculation, rate differential trading

o Micro JPY/USD Futures (MJY):

Contract Size: ¥1,250,000

Tick Size: 0.000001 = $1.25 per tick

Use Case: Retail-sized access, position scaling, strategy testing

o Margin Requirements:

6J: Approx. $3,300 per contract

MJY: Approx. $330 per contract

Both products offer deep liquidity and near 24-hour access. Traders use them to express views on interest rate divergence, U.S.-Japan trade dynamics, and global macro shifts—all while adjusting risk through contract size.

3. Daily Timeframe: Top Macro Catalysts

Short-term movements in Yen Futures are heavily influenced by U.S. economic data and its impact on yield spreads and capital flow. Machine learning analysis ranks the following three as the most influential for daily returns:

10-Year Treasury Yield: The most sensitive indicator for the yen. Rising U.S. yields widen the U.S.-Japan rate gap, strengthening the dollar and weakening the yen. Drops in yields could create sharp yen rallies.

U.S. Trade Balance: A narrowing trade deficit can support the USD via improved capital flow outlook, pressuring the yen. A wider deficit may signal weakening demand for USD, providing potential support for yen futures.

Durable Goods Orders: A proxy for economic confidence and future investment. Strong orders suggest economic resilience, which tends to benefit the dollar. Weak numbers may point to a slowdown, prompting defensive yen buying.

4. Weekly Timeframe: Intermediate-Term Indicators

Swing traders and macro tacticians often ride trends formed by mid-cycle economic shifts. On a weekly basis, these indicators matter most:

Fed Funds Rate: As the foundation of U.S. interest rates, this policy tool steers the entire FX complex. Hawkish surprises can pressure yen futures; dovish turns could strengthen the yen as yield differentials narrow.

10-Year Treasury Yield (again): While impactful daily, the weekly trend gives traders a clearer view of long-term investor positioning and bond market sentiment. Sustained moves signal deeper macro shifts.

ISM Manufacturing Employment: This labor-market-linked metric reflects production demand. A drop often precedes softening economic growth, which may boost the yen as traders reduce exposure to riskier assets.

5. Monthly Timeframe: Structural Macro Forces

For position traders and macro investors, longer-term flows into the Japanese yen are shaped by broader inflationary trends, liquidity shifts, and housing demand. Machine learning surfaced the following as top monthly influences on Yen Futures:

PPI: Processed Foods and Feeds: A unique upstream inflation gauge. Rising producer prices—especially in essentials like food—can increase expectations for tightening, influencing global yield differentials. For the yen, which thrives when inflation is low, surging PPI may drive USD demand and weaken the yen.

M2 Money Supply: Reflects monetary liquidity. A sharp increase in M2 may spark inflation fears, sending interest rates—and the dollar—higher, pressuring the yen. Conversely, slower M2 growth can support the yen as global liquidity tightens.

Housing Starts: Serves as a growth thermometer. Robust housing data suggests strong domestic demand in the U.S., favoring the dollar over the yen. Weakness in this sector may support yen strength as traders rotate defensively.

6. Trade Style Alignment with Macro Data

Each indicator resonates differently depending on the trading style and timeframe:

Day Traders: React to real-time changes in 10-Year Yields, Durable Goods Orders, and Trade Balance. These traders seek to capitalize on intraday volatility around economic releases that impact yield spreads and risk appetite.

Swing Traders: Position around Fed Funds Rate changes, weekly shifts in Treasury yields, or deteriorating labor signals such as ISM Employment. Weekly data can establish trends that last multiple sessions, making it ideal for this style.

Position Traders: Monitor PPI, M2, and Housing Starts for broader macro shifts. These traders align their exposure with long-term shifts in capital flow and inflation expectations, often holding positions for weeks or more.

Whatever the style, syncing your trading plan with the data release calendar and macro backdrop can improve timing and conviction.

7. Risk Management

The Japanese yen is a globally respected safe-haven currency, and its volatility often spikes during geopolitical stress or liquidity events. Risk must be managed proactively, especially in leveraged futures products.

8. Conclusion

Japanese Yen Futures are a favorite among global macro traders because they reflect interest rate divergence, risk sentiment, and global liquidity flows. While headlines grab attention, data tells the real story.

Stay tuned for the next installment of the "Behind the Curtain" series, where we continue uncovering what really moves the futures markets.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

AUDJPY This Golden Cross is the signal for selling.The AUDJPY pair gave us last time (February 19, see chart below) an excellent sell signal that easily hit our 93.750 Target and bottom of the Bearish Megaphone:

The market is about to complete a 4H Golden Cross and last time it did (January 07 2025), it formed a Top. That was also after a Channel Up that started following an almost -6% decline. Notice how the 1D RSI patterns among the two fractals are similar.

The bearish sequence that followed the previous 4H Golden Cross hit the 1.236 Fibonacci extension. As a result, we expect to see 91.000 by May.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Market Analysis: USD/JPY Eyes Fresh SurgeMarket Analysis: USD/JPY Eyes Fresh Surge

USD/JPY is rising and might gain pace above the 151.00 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 149.55 and 150.00 levels.

- There is a connecting bullish trend line forming with support at 150.30 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 148.20 zone. The US Dollar gained bullish momentum above 148.80 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 149.55. The pair climbed above 150.00 and traded as high as 150.94. It is now consolidating gains and there was a move below the 23.6% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

The current price action above the 150.00 level is positive. Immediate resistance on the USD/JPY chart is near 150.95. The first major resistance is near 151.20. If there is a close above the 151.20 level and the RSI moves above 70, the pair could rise toward 152.50.

The next major resistance is near 153.20, above which the pair could test 155.00 in the coming days. On the downside, the first major support is 150.30 and a bullish trend line, below which the bears could gain strength.

The next major support is visible near the 149.55 level and the 50% Fib retracement level of the upward move from the 148.18 swing low to the 150.94 high.

If there is a close below 149.55, the pair could decline steadily. In the stated case, the pair might drop toward the 148.40 support zone. The next stop for the bears may perhaps be near the 147.50 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

$JPIRYY -Japan's Inflation Rate (February/2025)ECONOMICS:JPIRYY

February/2025

source: Ministry of Internal Affairs & Communications

- The annual inflation rate in Japan fell to 3.7% in February 2025 from a 2-year high of 4.0% in the prior month, amid a sharp slowdown in prices of electricity (9.0% vs 18.0% in January )and gas (3.4% vs 6.8%) following the government's reinstatement of energy subsidies.

Also, food prices rose slightly slower after hitting a 15-month high in January (7.6% vs 7.8%).

Further, inflation eased for healthcare (1.7% vs. 1.8%), recreation (2.1% vs. 2.6%), and miscellaneous items (1.1% vs. 1.4%).

At the same time, education costs continued to fall (-1.1% vs. -1.1%).

In contrast, inflation remained steady for housing (at 0.8%) and clothing (at 2.8%), while accelerating for transport (2.4% vs. 2.0%) and furniture and household items (4.0% vs. 3.4%), and bouncing back for communications (0.1% vs. -0.3%).

The core inflation rate dropped to 3.0% from January's 19-month top of 3.2%, above forecasts of 2.9%.

Monthly, the CPI dropped 0.1%, the first fall since September, after a 0.5% gain in January.

USDJPY DAILY ANALYSISHello traders here is my setup for USDJPY for the week as you can see the price has been on a down trend, and now you can see that the price have done a retracement and it is now on the level of structure that was recently broken and it is likely to act as resistance now I have to wait for confirmations like bearish engulfment then I would look to short the USDJPY.

NP: This is not a financial advice its just my prediction, what do you think?

GBPJPY 1D MA200 rejection. Channel Down sell signal.The GBPJPY pair has been trading within a Channel Down pattern and the recent Bullish Leg got rejected yesterday on the 1D MA200 (orange trend-line). If the 1D RSI closes below its MA trend-line, we will have the ideal sell confirmation signal.

Our Target is the top of the 4-month Support Zone at 188.550.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/JPY Analysis: Dollar Weakens After Fed DecisionUSD/JPY Analysis: Dollar Weakens After Fed Decision

Yesterday, the Federal Reserve announced its interest rate decision, which, as expected, remained unchanged. Fed Chair Jerome Powell emphasised that there is no rush to cut rates amid uncertainty surrounding US inflation and the tariff policies implemented by the Trump administration.

This key announcement triggered volatility in financial markets, notably:

→ US stock indices rose;

→ the US dollar weakened, which was evident in currency (and cryptocurrency) charts involving USD pairs.

The most significant movement occurred in the USD/JPY chart, as the Bank of Japan was also active yesterday. While it also left interest rates unchanged, it acknowledged growing uncertainty around Japan’s economy and added a new reference to the "changing trade environment."

Technical Analysis of USD/JPY

As we noted on 21 February when analysing the Japanese yen’s exchange rate against the US dollar:

→ Price fluctuations are forming a downward channel (marked in red).

→ The former support at the lower boundary of the blue channel may now act as resistance.

Since then, the price has:

→ Tested the breakout level (indicated by an arrow) before continuing to decline within the channel, confirming its relevance.

→ Reached the lower boundary of the channel and rebounded upwards from the 147 yen per dollar level.

Given that the price is closely interacting with the channel lines and is currently around its median, it suggests that supply and demand are relatively balanced under these conditions. This is further supported by the fact that neither the Fed nor the Bank of Japan introduced surprises, leaving interest rates unchanged.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUD_JPY RISKY LONG|

✅AUD_JPY made a retest

Of the horizontal support

Of 94.600 after a breakout

Earlier so we are bullish

Biased and we will be expecting

A further move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY Channel Down to make an important decision.The USDJPY pair has been trading within a Channel Down pattern since the January 10 High. During that time it technically got rejection upon every 4H MA100 (green trend-line) contact or close contact into a new Bearish Leg.

Three out of those four Bearish Legs have been -3.16% so even if a rejection does happen at the top (Lower Highs trend-line) of the Channel Down, you can still be expecting 145.350 as a Target.

If however the 4H RSI Bullish Divergence on Higher Lows prevails and causes the price to break above the Channel Down, we will accept the small loss on the short and go long instead, targeting the 2.0 Fibonacci extension at 156.000. A lower Target in that scenario can also be Resistance 2 (154.800).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JP225/NIKKEI "JAPAN 225" Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the JP225/NIKKEI "JAPAN 225" Indices CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (38300) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 34000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Read the Fundamental, Macro, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook before start the plan.

The JP225 (Nikkei 225 Index) is trending downwards due to a combination of economic, market, and geopolitical factors that are creating a bearish environment for Japanese equities. Below is a detailed explanation of the key reasons behind this downward movement.

⭐⚡🌟Weak Corporate Earnings

Many companies within the Nikkei 225, such as major players in the technology and automotive sectors (e.g., Toyota and Sony), have reported disappointing earnings. Growth has slowed to just 2% year-over-year, far below the expected 5%. This weakness in corporate performance is reducing investor confidence and dragging the index lower.

⭐⚡🌟Rising Inflation and Slowing GDP Growth

Japan’s inflation rate has climbed to 2.5%, surpassing the Bank of Japan’s (BoJ) 2% target. This higher inflation is eroding consumer purchasing power, which hurts domestic spending and, in turn, corporate profits. At the same time, Japan’s GDP growth has decelerated to just 0.8% in the latest quarter, signaling a sluggish economy. A slowing economy is a strong bearish signal for the stock market.

⭐⚡🌟Stronger Yen Hurting Exporters

The yen has strengthened to 142.00 against the U.S. dollar. Since the Nikkei 225 is heavily weighted toward export-driven companies, a stronger yen makes Japanese goods more expensive abroad, reducing competitiveness and cutting into profits. This currency movement is a significant factor pushing the index down.

⭐⚡🌟Global Economic Pressures

U.S. Monetary Policy: The U.S. Federal Reserve’s hawkish stance, with interest rates steady at 3.5%, has strengthened the U.S. dollar. This makes Japanese exports less attractive and reduces the yen-denominated earnings of multinational firms in the Nikkei 225.

China’s Slowdown: China, a key trading partner for Japan, is experiencing economic contraction, with its PMI at 49.2. Weak demand from China is hurting Japanese exporters, adding further downward pressure on the index.

⭐⚡🌟Technical Weakness

The Nikkei 225 is trading below its 50-day simple moving average (36,800) and nearing its 200-day simple moving average (35,500). It’s also struggling to hold support at 36,500. These technical indicators suggest a bearish trend, with the potential for further declines if key support levels break.

⭐⚡🌟Negative Market Sentiment

Speculative Traders: Data shows speculative traders have cut their net long positions to 10,000 contracts from 20,000, signaling reduced bullishness. Meanwhile, commercial hedgers have increased net short positions to 30,000 contracts, indicating expectations of lower prices.

Retail Investors and Analysts: Retail investor bullishness has dropped to 40% from 60%, and major analysts (e.g., Nomura) have lowered their year-end targets for the Nikkei 225 to 36,000 from 38,000. This shift reflects growing pessimism.

⭐⚡🌟Geopolitical and Policy Risks

Regional Tensions: Recent missile tests by North Korea (March 5, 2025) have raised security concerns in the region, dampening investor sentiment in Japan.

Bank of Japan Policy: The BoJ has hinted at potential rate hikes in late 2025. Tighter monetary policy could increase borrowing costs and weigh on stock valuations, contributing to the bearish outlook.

⭐⚡🌟Global Risk-Off Sentiment

The S&P 500 has fallen to 5,800, reflecting a broader global shift away from risky assets. At the same time, gold prices have risen to $3,000, signaling increased demand for safe-haven assets. This risk-off mood is spilling over into the Japanese market, pushing the Nikkei 225 lower.

⭐⚡🌟Commitments of Traders (COT) Data

COT data provides insights into futures market positioning for the Nikkei 225.

Speculative Traders:

Net long positions stand at approximately 20,000 contracts, up from 15,000 the previous month. This increase in bullish bets reflects growing confidence among speculators—a strong bullish indicator.

Commercial Hedgers:

Net short positions are at around 25,000 contracts, consistent with typical hedging activity. This stability suggests hedgers see current levels as sustainable—neutral.

Open Interest:

Total contracts reach approximately 50,000, an 8% increase month-over-month. Rising participation indicates growing market momentum—bullish.

Summary: COT data strongly supports a bullish outlook. Speculative long positions and rising open interest signal upward momentum, while hedgers’ steady shorts indicate no imminent sell-off pressure.

⭐⚡🌟Future Trend Prediction

Price projections for the Nikkei 225 across different timeframes.

Short-Term:

Range: 36,800 - 37,500

A breakout above 37,000 toward 37,500 is plausible if trade talk momentum persists. A pullback to 36,800 could occur on profit-taking.

Medium-Term:

Range: 36,500 - 38,000

Breaking resistance at 37,500 could propel the index to 38,000, driven by BOJ policy and trade developments. A drop below 36,500 might test 36,000 if global risks escalate.

Long-Term:

Bullish Target: 39,000 - 40,000

Achievable if the BOJ maintains easing, the yen weakens further, and global growth accelerates—60% probability.

Bearish Target: 34,000 - 35,000

Possible if the BOJ tightens policy, the yen strengthens, or a global recession emerges—40% probability.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

JP225/NIKKEI "JAPAN 225" Indices CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the JP225/NIKKEI "JAPAN 225" Indices CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (37800) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

Stop Loss 🛑: Thief SL placed at 38500 (swing Trade Basis) Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 36500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

JP225/NIKKEI "JAPAN 225" Indices CFD Market is currently experiencing a Neutral trend., driven by several key factors.

➜Fundamental Analysis

1. Economic Indicators: Japan's economy is expected to grow at a moderate pace, driven by domestic demand and exports.

2. Monetary Policy: The Bank of Japan (BOJ) has maintained an accommodative monetary policy stance, with negative interest rates and quantitative easing.

3. Corporate Earnings: Japanese corporate earnings have been improving, driven by strong export growth and domestic demand.

➜➜Macroeconomic Factors

1. Inflation: Japan's inflation rate remains low, at around 0.5%.

2. Interest Rates: The BOJ's negative interest rate policy has helped to keep borrowing costs low.

3. GDP Growth: Japan's GDP growth is expected to be around 1.5% in 2023.

➜➜COT Data

1. Non-Commercial Traders: These traders hold a net long position in JP225 futures, with 52.3% of open interest.

2. Commercial Traders: Commercial traders hold a net short position in JP225 futures, with 47.7% of open interest.

➜➜Market Sentiment Analysis

1. Bullish Sentiment: 53.2% of investors are bullish on JP225.

2. Bearish Sentiment: 46.8% of investors are bearish on JP225.

➜➜Positioning Analysis

1. Long Positions: 56.1% of investors are holding long positions in JP225.

2. Short Positions: 43.9% of investors are holding short positions in JP225.

➜➜Quantitative Analysis

1. Moving Averages: The 50-day moving average is above the 200-day moving average, indicating a bullish trend.

2. Relative Strength Index (RSI): The RSI is at 55.6, indicating a neutral market sentiment.

➜➜Intermarket Analysis

1. Correlation with Other Markets: JP225 has a positive correlation with other Asian markets, such as the Hang Seng and the Shanghai Composite.

2. Commodity Prices: JP225 has a positive correlation with commodity prices, such as copper and oil.

➜➜News and Events Analysis

1. BOJ Meetings: The BOJ's monetary policy decisions can impact JP225.

2. Japanese Elections: Japanese elections can impact JP225, depending on the outcome.

➜➜Next Trend Move

Based on the analysis, the next trend move for JP225 is likely to be bullish, with a potential target of 40,500.

➜➜Future Prediction

Based on the analysis, the future prediction for JP225 is bullish, with a potential target of 42,500 in the upcoming months.

➜➜Overall Summary Outlook

JP225 is expected to remain in a bullish trend, driven by improving corporate earnings, a moderate economic growth outlook, and accommodative monetary policy. However, investors should remain cautious of potential market volatility and economic uncertainties.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

EURJPY Strong oversold buy opportunity.The EURJPY pair broke again below the 0.786 Fibonacci retracement level of its Rectangle pattern and is consolidating. Every time this break-out occurred, the price was a buy opportunity.

This time, the 1D RSI is on Higher Lows, i.e. a Bullish Divergence, which makes the opportunity even stronger. We are expecting a 1D MA200 (orange trend-line) test below the Lower Highs trend-line at 162.250.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDJPY - 4H Short Opportunities Amid DowntrendFollowing the sharp fall in FX:USDJPY after PPI and CPI news, we expect further downside, potentially reaching the middle or bottom of the channel. 📉

Each push-up could be a short entry opportunity. Even a strong rise below 158 might be a dead cat bounce and a better short entry point. Stay cautious and strategic! 🔻

AUDJPY Sell signal below the 4H MA50.The AUDJPY pair has been trading within a Bearish Megaphone and is currently going sideways within the 4H MA200 (orange trend-line) and 4H MA50 (blue trend-line). Every time the latter broke to the downside, the pattern started its new Bearish Leg.

Assuming it hits at least the 1.236 Fibonacci extension like the first Bearish Leg, we are looking at a short-term Target of 93.750, if the 4H MA50 breaks.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURJPY testing its 1D MA50. Buy opportunity even if rejected.The EURJPY pair is about to test its 1D MA50 (blue trend-line) today for the first time since January 31. We are on the 4th day of a strong rebound within a Rectangle pattern.

As you can see, every time the 0.785 Fibonacci retracement level of this Rectangle gets hit, the price reverses shortly after, targeting at least the 0.236 Fib. The bottom is also marked by a 1D RSI test of the 30.00 oversold level.

The rebound that follows, tends to pull-back after a 1D MA50 test, which is the 2nd opportunity to buy for those that missed the bottom. This time it is possible not to hit the 0.236 Fib as the 1D MA200 (orange trend-line) is involved and is the level that caused the January 24 2025, January 07 2025, December 30 2024 and November 15 2024 rejections.

As a result, a fair target would be just below it at 163.250.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇