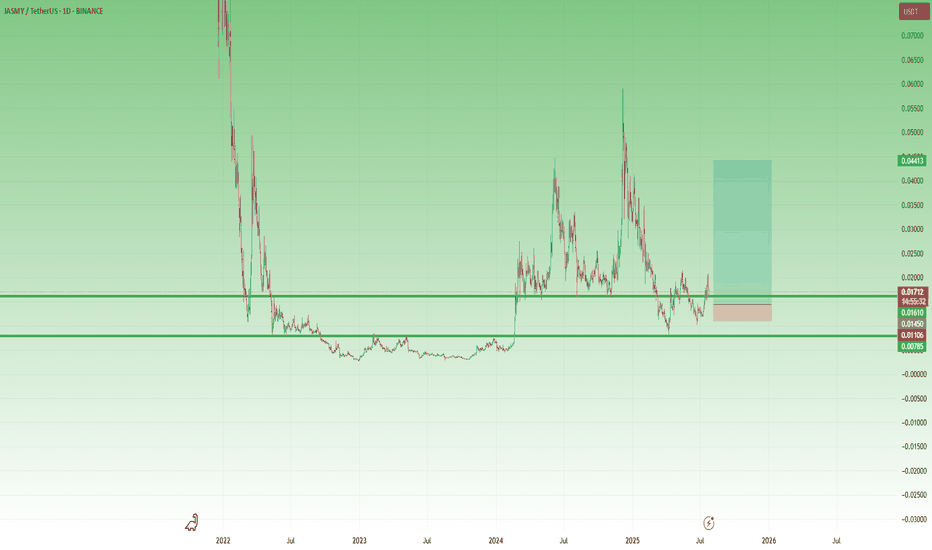

JASMY – A Volatile Setup with x3 Potential 🔸 After bottoming out at 0.003 and spending over a year in accumulation, JASMY finally broke above the key 0.008 resistance zone in February 2024. That breakout triggered a series of explosive moves – but just as violent were the drops that followed.

🔸 What stands out:

• The first post-breakout spike found a new support at 0.015.

• Then came a second vertical move toward 0.06, followed (of course) by a brutal drop.

• But… 0.008 held, and by late June, the chart printed a higher low, showing that buyers became interested.

📍 Right now, the price has reclaimed the 0.015 zone and is trying to stabilize above it. If this level holds, it could become the new base for the next wave.

💡 My plan?

This is very speculative, but I like the setup.

I’m looking to buy around 0.015–0.016, with clear negation below 0.010.

Target? Around 0.045, for a potential x3 move and a tasty 1:8 risk/reward.

⚠️ I’m not the guy who repeats the cliché “ only trade what you can afford to lose, ”

but seriously – this one is for clubbing money, not summer vacation money.

Let the volatility work in our favor. 🚀

Jasmycoin

Live trade hello friends👋

Considering the fall that we had, you can see that the buyers supported the price at the support point and caused it to grow. Now with the return of the price and the construction of an upward pattern, you can see that we can enter into the transaction with capital and risk management and move to the specified goals with it.💰

🔥Join us for more signals🔥

*Trade safely with us*

#JASMY/USDT GOOD TIME TO BUY JASMY I MARK THE TARGETS#JASMY

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.01213, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price upward at 0.01178.

Entry price: 0.01264.

First target: 0.01308.

Second target: 0.01367.

Third target: 0.01441.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#JASMY/USDT#JASMY

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.01480.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are in a trend of consolidation above the 100 moving average.

Entry price: 0.01530

First target: 0.01593

Second target: 0.01650

Third target: 0.01720

Will #JASMY Retest Trigger a Rebound or a Breakdown? Key LevelsYello Paradisers! Have you prepared yourself for what’s about to unfold with #JASMYUSDT? The #JasmyCoin setup is showing signs of a major move:

💎#JASMYUSD has just completed an impulsive move from the Major Demand Zone around 0.01509 and is currently retesting the ascending support after breaking down from the short-term channel. This is the critical moment where disciplined traders prepare their next move, not after the bounce, but before it.

💎What we’re seeing now is a textbook retest of the ascending support, after an aggressive move from the major demand zone. The price is currently hovering just above the 0.01742 support level, a critical area that aligns with the high-volume node from the visible range volume Profile (VRVP), making this a high-probability reaction zone.

💎If the #JASMY price holds here, and we start seeing buyer strength reclaim the broken ascending channel, this could trigger a sharp bounce targeting the mid-term resistance at 0.02221. Above that, the next magnet will be the major resistance sitting around 0.02512, a level likely to attract profit-taking or even large-scale short entries from smart money.

💎However, failure to hold this support and a confirmed breakdown below the 0.01509 zone would invalidate the bullish structure entirely. In that case, we would be looking for a possible bearish continuation, driving the price toward 0.01400 and possibly lower, where more liquidity pockets remain untapped. That move would also trap late long entries and clean out weak hands — the exact kind of shakeout we warn about.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

Is JASMY Ready for a Massive Comeback? Key Levels to Watch!Yello, Paradisers! After months of relentless selling, could #JASMY finally be staging a comeback? Let's dive into its key technicals:

💎After an extended and painful downtrend, JASMY has finally broken out of its multi-month descending trendline resistance. This significant technical breakout marks the first step toward a potential broader recovery. Moreover, the price action is shaping a potential cup and handle formation—a powerful bullish continuation pattern—which strongly suggests that the recovery momentum still has further room to run.

💎At the moment, #JASMYUSDT is battling a crucial resistance zone between $0.01750 and $0.01850. This area serves as the neckline resistance of the developing bullish structure. A clean and convincing breakout above this zone would trigger a major shift in momentum, potentially setting up JASMY for a back-to-back bullish breakout.

💎Should bulls succeed in pushing above this resistance, the next immediate target lies at $0.02500 to $0.02750—a heavy supply zone that coincides perfectly with the 50% Fibonacci retracement. This level is expected to attract some strong profit-taking.

💎However, if bullish strength continues to hold firm even after that, JASMY could extend its rally toward the 61.8% Fibonacci retracement zone, located around $0.03650 to $0.04000. This region is historically known to be a "golden pocket" for reversals and thus demands maximum caution. If signs of exhaustion emerge near this zone, it could potentially mark a medium-term top.

💎JASMY’s first primary support now sits at $0.01500. Below that, a firmer, more critical support base exists between $0.01150 and $0.01100—a zone that has already proven capable of withstanding strong selling pressure in the past.

Paradisers, strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

JASMY at a Breaking PointYello, Paradisers! Have you been watching JASMY closely? If not, you might be about to miss one of the most explosive opportunities we've seen in recent days. A major breakout or breakdown is brewing, and the market is preparing for a decisive move!

💎Right now, #JASMYUSDT is sitting above a critical Demand Zone after successfully flipping a strong historical resistance into support. Price action is following an ascending structure, respecting both the Ascending Support and the broader Ascending Channel pattern. As long as the price continues to hold this support region and maintain the bullish market structure, there is a high probability of a breakout towards the Moderate Resistance level around 0.01994. A clean break above this area could fuel a sharp rally straight towards the Major Resistance zone at 0.02337.

💎However, caution is absolutely necessary here. If JASMY fails to hold the current Demand Zone and we see a confirmed close below the support at 0.01540 level, it would invalidate the bullish setup. In that case, a rapid sell-off is likely, with downside targets opening towards the 0.01397 region and possibly even lower levels. This would create a high-risk environment where inexperienced traders could get trapped very quickly.

Stay focused, Paradisers. Be the hunter, not the hunted.

MyCryptoParadise

iFeel the success🌴

JASMY aiming at $0.10 after this break out!JasmyCoin / JASMYUSD is posting a massive green 1week candle, the strongest one since the December 2nd 2024 that formed the high of this Cycle so far.

This is also the bottom of the Channel Up and a crossing over the 1day MA50 (white line) will be the buy trigger.

Additional indicator to look for is the 1week RSI, giving a buy confirmation over its MA.

Target 0.1000 (+1400%).

Follow us, like the idea and leave a comment below!!

JASMY/USDT: Bullish Breakout and Long OpportunityHello fellow traders,

I've spotted a promising long opportunity on JASMY/USDT that I wanted to share with you.

Here's the setup:

Breakout Confirmation: JASMY has successfully broken out of a descending channel, indicating a potential shift in momentum.

Retracement and Readiness: Following the breakout, the price has retraced, suggesting it's now poised for an upward move.

Target: My target for this trade is the $0.01250 level, which conveniently aligns with the 200-period moving average on the 4-hour timeframe.

Here's my proposed trade plan:

Entry: I'm looking to enter the trade once the price moves above $0.01060.

Stop Loss: To manage risk, I've set my stop loss around $0.00970.

Remember, this is just my analysis, and trading always carries risk. Please do your own due diligence before making any trading decisions.

Wishing you all profitable trades!

#JASMY/USDT#JASMY

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel, this support at 0.1233.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.01279

First target: 0.01300

Second target: 0.01327

Third target: 0.01360

(JASMY) jasmycoinDGT pattern indicator featuring elliott waves. Green diamond is major oversold, green triangles is minor oversold, same for peaks only circles and so on. I'm seeing a lot of oversold signals in cryptocurrency using this indicator, including Ethereum, the blockchain Jasmy is run on as a layer 2 token IoT company.

(JASMY) JASMY "that sux"Jasmy losing like there is no tomorrow. The Elliott Wave prospects of Jasmy seem to have fallen through. The December price was what I wanted to believe was a peak of Elliott Wave patterns with two more to follow only slightly lower but this prolonged down angle on the chart is a bummer.

Are you watching closely?Don't listen to all those dramatic fools screaming and shouting at the top of their lungs so that you give up here. Would you dare to give up here?

Benjamin Cowen keeps crying stating he would prefer not to have a 2nd wave of inflation like it happened in the 70s because his children would suffer. Come now, while he's telling people he wishes for altcoins to die, technicals suggest otherwise.

This is the part where almost everyone gives up, will you give up?

I most certainly won't.

Jasmy short profitJasmy fly. Possible target 0.13 usd, long. Diamond hands. I like Jasmy.

JasmyCoin (JASMY) is a cryptocurrency project of a Tokyo-based Internet of Things (IoT) provider Jasmy Corporation. As a system, the Internet of Things includes mechanical and digital elements endowed with an identifier and the ability to transmit data. The IoT company Jasmy specializes in buying/selling data, and the Jasmy platform connects two categories: service providers and data users.

Max. supply: 50B JASMY

Circulating supply: 49.44B JASMY

Jasmy short 0.027 usdt, or more.

We continue downwards, but Jasmy long-term upward target 0.13 usdt.

2030 ai predict price 0.90 usdt.

This is only my idea guys.

This is not financial advice !

Please do your analysis and consider investing !! Thanks for supp.

#JASMY/USDT#JASMY

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.02046

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02280

First target 0.02438

Second target 0.02718

Third target 0.02962

#JASMY/USDT Ready to go up#JASMY

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.02380

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.02470

First target 0.02670

Second target 0.02955

Third target 0.03210

Others has completely bottomed out to December 2016 levelsIgnore the noise, what's happening is unprecedented.

You wanted an explosive altseason and Bitcoin to hit 1 million dollars?

Well, be careful what you wish for, this is not an alt season. It's the beginning of the end for the United States Dollar. It's escape velocity before a gigantic financial great reset around 2030.

Things are about to get extremely crazy for all financial assets against the dollar.

Why you may ask?

Donald Trump is performing a brexit 2.0.

He's nationalizing the US & this could collapse the dollar as a global reserve. So imagine witnessing a 1923 Weimar Republic scenario in the U.S.A as everything appreciates roaringly sky high & balloons against the dollar to trillions and trillions of dollars.

Some may call it an industrial revolution, others may call it hyperinflation.

We are probably underestimating how severe the whole tariffs war situation, the Bitcoin arms race, the AI arms race and a myriad of countries shifting from globalization to radical protectionism. What makes this scenario different is that back in 2017, the tariffs war was new. Now Trump is being radical and other countries won't follow his lead, they'll turn their backs on him as more and more countries become protectionist.

Ray Dalio has talked about this,

Kenichi Ohmae, Mike Maloney and many others too.

The dollar has peaked and everything is about to moon.

Welcome to the Roaring 20s

JASMYUSD testing the 1D MA50 for a break-out. $0.068 on sight.JasmyCoin (JASMYUSD) has been trading within a 15-month Channel Up and the price made this week a direct contact with its bottom. This is technically a Higher Low for the pattern and naturally it immediately reacted with a rebound.

The price is currently testing its 1D MA50 (blue trend-line), which happens to be at the top of the Bearish Leg (blue Channel) of the previous High. This is a Bull Flag pattern, which has always produced a rally eventually, with the lowest % rise being +194.50%.

With the 1D MACD just completing a Bullish Cross below the 0.0 mark, we expect Jasmy to break-out and go for at least another +194.50% rise from its bottom. Target 0.06800.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Jasmy to 1$? More than realGATEIO:JASMYUSDT

Always should analyse coin on exchanges with history! Big difference between chart Jasmy on Binance and GateIO.

When we check weekly tf we can find out more than 400 days Jasmy in accumulation and disbelief zone around -0.618 FIB

Depends of unlock and adding coins in circulation supply, now only 10% coins on market! But also only 48 Mil Market Cap.

So we can find out next sells zone is around 0.25 cents on weekly timeframe (not now) and next big sales will be at psychological target around 1$.

Whales who accumulate coin over than 400 days know what they do!

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

* Look at my ideas about interesting altcoins in the related section down below ↓

* For more ideas please hit "Like" and "Follow"!

JASMY , the coin that will melt faces this bull runHello everyone as always I wish u all a very good day, Today we look at JASMY , along with the huge community JASMY has it also has a lot of potential to be an easy 20-30 billion market cap coin. As we can see on the chart we are on a huge cup and handle, we also formed a huge inverse head and shoulders pattern that took ages to form! Measuring from the neckline and the cup and handle target we can see that a 50 cent target is achievable. My personal opinion? JASMY has the potential to go even higher! Definitely keep a bag of this coin within your portfolio.

Jasmy Cup and Handle FormationJapan is a heavily regulated country in terms of the cryptocurrency market. Jasmy is a cryptocurrency that is seen as Japan's Bitcoin.

A very clear cup and handle formation is seen in the weekly time frame. Jasmy, which rose after the handle breakout, still appears at the beginning of its rise.

I think Jasmy needs to stay above the HP filter ($0.025) for this rise to continue. As long as it stays above the HP filter, I think Jasmy will come back to the IPO price.

JASMYUSDT Ready to Explode? JASMYUSDT Technical analysis update

BINANCE:JASMYUSDT is moving towards the cup and handle neckline resistance, preparing for a breakout. The price has been forming the cup and handle pattern for the last 1,000 days. Once the price breaks above the neckline on the weekly chart, we can expect a significant bullish move, potentially 200% to 600% move possible in JASMY. This breakout could mark the beginning of a strong upward trend.