AUD/USD tests uptrend as Trump targets Powell at Fed siteThe US dollar is trading mixed after President Trump made a rare appearance at the Federal Reserve’s renovation site, in an attempt to distract from you know what.

While the visit had no formal policy announcements, Trump did try to further undermine Chair Jerome Powell by erroneously claiming the renovation cost had blown out to 3.1 billion by adding the cost of a building finished 5 years ago.

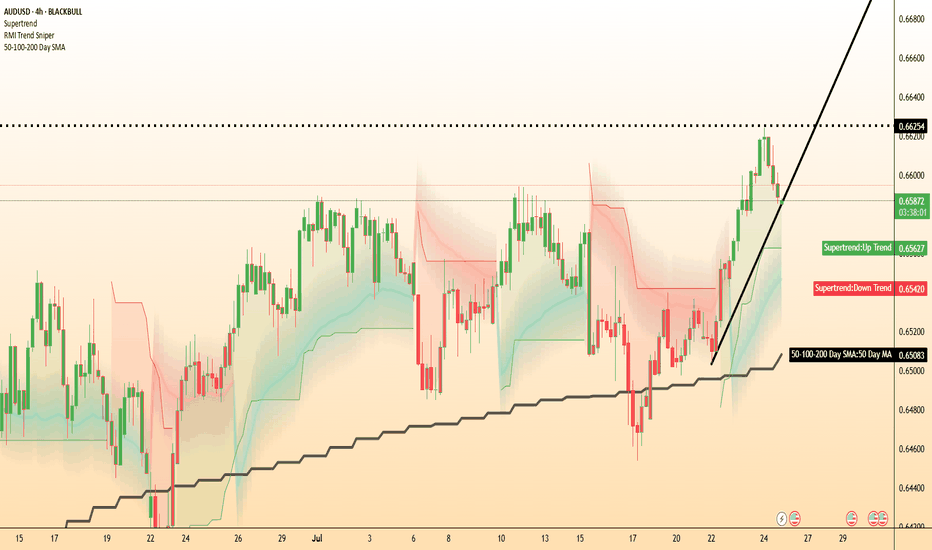

Meanwhile, AUD/USD could be of the most interest. Traders might like to watch to see if it can hold its uptrend after its downside breakout from yesterday. AUD/USD remains potentially supported above its 50-DMA, with momentum pointing to potential further upside beyond 0.6625.

Jerome

DXY GAME ON!! SPIKE COMING FOR THE DOLLAR?Last week's surprising jobs report sticky inflation, and persistent and frothy financial conditions may force the Federal Reserve members into a more hawkish position, forcing them to keep the heat on interest rates and the money supply.

Many market participants were looking for a pause in rate hikes as soon as next month and possibly a pivot to lowering rates shortly after. This new data is going against what the Fed was trying to accomplish in this rate hike cycle, which is

to keep inflation within mandated guidelines, and to tame loose financial conditions, dashing the hopes for a pivot in policy anytime soon and pushing that pivot out for far longer than some were expecting. This will put upward pressure on bond yields and a dollar so heavily shorted causing the pivot crowd to close out some of their short positions as the Fed puts the screws to the money supply and inflation. This classic cup and handle setup illustrates the effect the Fed Policy may have on the dollar.

Nasdaq - Which Scenario will Jerome Powell pick?Jerome Powell speaking today, market have setup perfectly to react to what he has to say

Current inflation has nothing to do with the FedWith the most anticipated FOMC announcement in a long time coming tomorrow I'm throwing out my prediction: the Fed will be surprisingly patient with their tapering. This chart shows a few reasons why:

1. M2 growth does not have anywhere close to the same effect as it did on inflation in 1970.

From the 3 decades 1970-2000 the CPI Growth/M2 growth was in the range of 0.65-0.75. Something happened in the next decade that broke this ratio down where it has been declining ever since - QE. Quantitative easing allowed the Fed to flood bank reserves into the system to protect from a liquidity crisis. This is what people refer to as "printing money" but in reality it that money is not being injected into the real economy. Banks reserves need to get loaned out and circulated in the economy to have an effect on inflation and this appetite for loans is not something their QE controls. Lower rates may have a limited affect but the majority comes from aggregate demand factors that are difficult to control.

The second chart shows the first derivate of CPI/M2 over a 12 month period. Comparing the levels in the 1970s to our current period should make it clear we are not seeing even close to the same effects on CPI that we did then. We are still in an era more similar to 2010-2020 than 1970-1980 and the Fed doesn't even need to stop purchases to see the growth rate slow.

2. The dollar has not has barely been effected and already looks to have bottomed.

The last chart shows how drastically the dollar index plunged in the two CPI spikes of the 1970s. This preluded the actual CPI numbers which is intuitive - the dollar plunging takes time to actually reach the consumer. This current cycle we haven't seen anything close to that. The dollar has held steady and is relatively unchanged since 2014. The dollar is not seeing a massive decline relative to other currencies like we did in the 1970s.

3. Supply issues have clearly had an effect on CPI

It's not a surprise that Covid severely damaged the worlds supply chains. Pretty much every earnings call from a company that is exposed to the global supply chain mentions this. The New York Fed has a gauge here if you want to see for yourself. Luckily, it seems to be peaking but we are not sure of that yet.

In summary, the inflation numbers we've seen are likely not being caused by monetary policy and the Fed knows this. Supply pressures look like they are starting to ease but we are not out of the woods. A drastic measure by the Fed may not even work to stop the inflation if my my assumptions are correct and it would induce a much more damaging stagflation. I predict the Fed is extremely cautious with their moves and we will not see anything drastic in tomorrows statement.

Is this the last dump? A simple fractal analysisThe stock market reacted positively to the latest info from the FED today, this lines up well this current rounded bottom formation.

This rounded bottom looks strikingly familiar to the previous step-down pattern, using a fractal we can see a possible dump lower which would bring us into a high-demand zone (36k-37k) and give a possibility of squeezing these shorts out for a final wave. This pattern would indicate a larger rally coming tomorrow before rejection.

One way or another, leverage must be reduced to move up or down and I believe that like the last large correction we must move lower for a stronger bounce if we want to have a meaningful year of profits.

Long Entry: 40 750

SL: 40 000

Target: 45 300

NFA, my personal trade opinion

Negative Rate Cut? Powell Wants a Correction $SPYThe markets are at a crucial spot and Powell is due for a decision soon... The chance of negative rates is low but definitely not out of the picture and if that happens, TLT will pump and HYG/IWM will dump (yes SPY too). Timing will be hard but the pressure is certainly building and is confirmed on the technical side of things.

$TLT tested a crucial level at $148.9 this last week which could signal weakness in the equity/bond market as well as the Dollar. Either A) things will spin out of control regarding Delta variant and TLT will breakout or we could see this melt-up continue for roughly 4-5 more months before seeing IWM and the rest of the market make its correction. If TLT were to fall the market could also very likely follow to the downside, this environment is choppy.

On the other hand, we watch IWM as it typically can signal weakness in the market via smaller cap companies. If the markets do correct, puts on IWM/HYG will pay beautifully. I'll give this 6 - 8 month then pop, otherwise my short position will get stopped and we could just continue to melt up until the next election. Also whether Crypto has it's one or two top cycle will play a part in all this as money will either transfer away or to the Crypto market (& possibly away from other markets).

It should go as followed If markets do correct to the downside:

1) TLT will breakout and possibly melt quickly as done in 2020 or flash crash. SPY/ETFs could see a gap down then trend up to retest as resistance

2) SPY will begin its bleed, IWM HYG leads the way to the downside.

3) Metals and Cryptos seem like they could move in sync. Cryptos might even lead the way. The one question I ask is if people sell out of both Cryptos and Stocks, where does their money go? Will this create the largest spending era or send us into a depression? Share your thoughts below

DCJ | Melt-Up or Short

DXY: The following Story On this one, I will leave the time to tell if my analysis and drawings are accurate or not. DXY is going to retest the resistance then go a little bit down, then will eventually break the upper non-horizontal resistance to test the 92-round number and very strong resistance. Will the DXY break it ? I have a huge doubt as I'm not positive on USD since the Biden Administration is using a bad monetary policy. Will J. Powell be able to stabilize it ? I doubt since the inflation is coming no matter what will happen. 92 so is our final upper level before the bearish movement where we will look for sell setups. Trade safe !