AUD/USD tests uptrend as Trump targets Powell at Fed siteThe US dollar is trading mixed after President Trump made a rare appearance at the Federal Reserve’s renovation site, in an attempt to distract from you know what.

While the visit had no formal policy announcements, Trump did try to further undermine Chair Jerome Powell by erroneously claiming the renovation cost had blown out to 3.1 billion by adding the cost of a building finished 5 years ago.

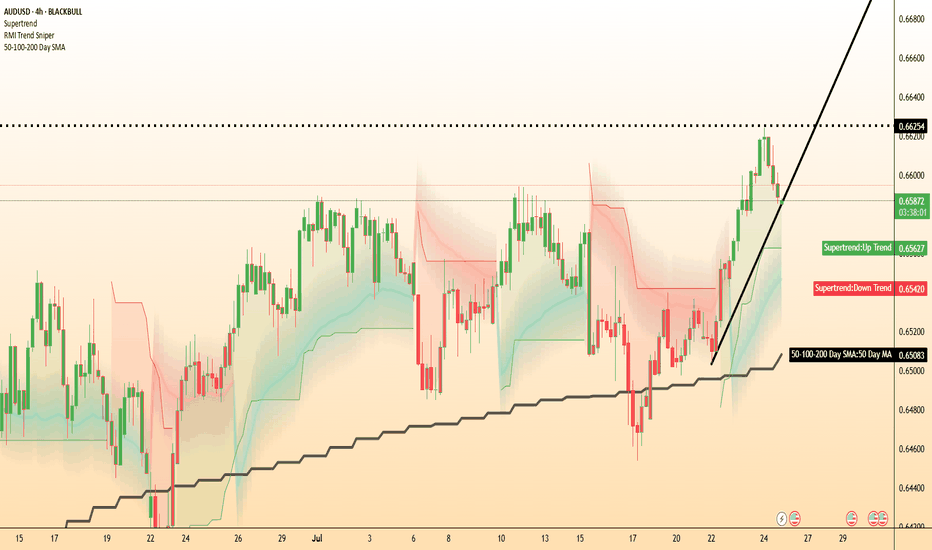

Meanwhile, AUD/USD could be of the most interest. Traders might like to watch to see if it can hold its uptrend after its downside breakout from yesterday. AUD/USD remains potentially supported above its 50-DMA, with momentum pointing to potential further upside beyond 0.6625.

Jeromepowell

What Happens the Day Jerome Powell Is Fired or Quits?A sudden exit by Fed Chair Jerome Powell would create both a political and monetary shock.

While the Chair is technically protected from arbitrary removal. Recent reports confirm that President Trump and his allies are scrutinising the Fed’s $2.5 billion renovation project—potentially laying the groundwork for a “for cause” dismissal.

A surprise departure would undermine confidence in the Fed’s independence. The U.S. dollar could fall sharply across major pairs.

USD/JPY could fall toward ¥145, with safe-haven demand favouring the yen. However, the reaction may be less severe than in pairs like Swiss franc which we have noted in the past is the potentially preferred safe haven. A panic selloff could extend to 142.20—a prior consolidation floor.

GBP/USD could surge as traders anticipate a more dovish Fed stance under the new Trump-stooge Fed Chair. From a technical perspective, GBP/USD is maybe already oversold and potentially poised for a potential rebound anyway—Powell’s resignation or firing could potentially exacerbate this. The first level to watch being a return to 1.3700, assuming the likely expectation of Fed rate cuts rise.

Mr. LATE drop the RATE!!"Jerome Powell aspires to be remembered as a heroic Federal Reserve chair, akin to Tall Paul #VOLKER.

However, Volker was largely unpopular during much of his tenure.

The primary function of the Federal Reserve is to finance the federal #government and ensure liquidity in US capital markets.

Controlling price inflation should not rely on costly credit.

Instead, it should be achieved by stimulating growth and productivity through innovation and by rewarding companies that wisely allocate capital, ultimately leading to robust cash flows... innovation thrives on affordable capital.

While innovation can lead to misallocations and speculative errors, this is a normal aspect of the process.

(BUT it is crucial that deposits and savings are always insured and kept separate from investment capital.)

By maintaining higher interest rates for longer than necessary, J POW is negatively impacting innovators, capital allocators, small businesses that need cheap capital to function effectively, job creators, and the overall growth environment.

Addressing price inflation is a far more favorable situation than allowing unemployment to soar to intolerable levels.

"Losing my job feels like a depression".

But if I have to pay more for eggs, I can always opt for oats.

BIG BIG weekI think 7 FED speakers,

A lot of tension in the markets, tops mean polarisation, considering reflexivity theory extreme volatility will ensue.

A lot of people might think the -0.786 ATH we got before the holidays is the top. I think they are mistaken as seen in the analysis below.

There is still legroom for higher, this is a big bet on my part.

I have a few contracts on the mag7 (GOOGL, TSLA and META) focusing on GOOGL since they seem to be in the same headwind as S&P

Let's see how this plays out

EURUSD SHORTNFP came in lower than expected but unemployment rate declined. The next event coming up is US CPI, which is expected to go up. I am still maintaining a sell position because any higher than expected CPI will force the FED to continue holding. Also with the Trump's tariff threats I still anticipate the EURO to remain under pressure. Those with no entries watch for 1.03500 and go short.

Bitcoin Hits $100K: What Does It Mean for Gold?Bitcoin’s historic surge past $100K has reignited debates about its role in the financial world. Fed Chair Jerome Powell weighed in, calling Bitcoin a "speculative asset," likening it to virtual gold rather than a competitor to the dollar:

"It's highly volatile, not a store of value or form of payment. It's really a competitor for gold."

With Bitcoin soaring, many are asking: Could this mark the beginning of a stronger correlation between Bitcoin and gold, or are they destined to move on separate paths?

Gold Faces Its Own Test

While Bitcoin grabs the headlines, gold prices slipped below $2,630 per ounce, pressured by firming U.S. Treasury yields. Benchmark 10-year yields rose 0.6%, as markets anticipate today’s U.S. Non-Farm Payrolls (NFP) report, expected to show 200,000 new jobs. A weaker report could lift gold, especially as traders assign a 74% chance of a 25-basis-point Fed rate cut in December.

Fed Chair Jerome Powell has emphasized caution, acknowledged the economy’s resilience but signaling a careful approach to rate cuts. Gold, often a winner in low-rate environments, now finds itself at a critical juncture.

Our Trading Plan for Gold

Key levels to watch as we await the NFP report:

$2,630: Monitor for price reactions to this recent support.

$2,537–$2,530: Look for potential opportunities at this deeper support range.

The Bigger Picture

As Bitcoin claims new highs and challenges gold’s status as a store of value, gold continues to be swayed by macroeconomic forces. Will gold bounce back, or is it preparing for further dips as Bitcoin surges?

Let us know your thoughts—will Bitcoin and gold align as Powell suggests, or will their paths diverge further?

For more in-depth gold analysis and updates, stay tuned. And as always, happy trading!

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto RalliesMarket Update - September 20th, 2024

Takeaways

The Federal Reserve cuts rates: The Federal Reserve announced Wednesday it will cut the federal benchmark interest rate by a half-percentage point (50 basis points), lowering the range to between 4.75% and 5%. Crypto markets responded well to the move, with the price of bitcoin pushing past $63,000.

US crypto legislation still possible this year: US senator Cynthia Lummis (R-WY) said in an interview Tuesday she thinks crypto legislation could be passed during the lame-duck session of Congress.

US spot bitcoin ETFs pull in $187 million in inflows: US spot bitcoin ETFs drew $187 million in inflows Tuesday, marking the fourth consecutive day of inflows after a significant drawdown.

Republicans ask for clarity on crypto airdrops: US representative Patrick McHenry (R-NC) and other top Republican lawmakers sent a letter to SEC chair Gary Gensler asking for clarity on crypto airdrops.

Federal Reserve Cuts Interest Rates by 50 BPS, Crypto Rallies

The Federal Reserve announced Wednesday it is lowering the benchmark federal funds rate by a half-percentage point (50 basis points) to between 4.75% and 5%. It marked the first interest rate cut in more than four years and signaled the Federal Reserve is ready to ease up on its fight against inflation.

The move marked the first time since 2008 the Federal Reserve had cut interest rates by 50 basis points at one meeting. Many analysts had expected a quarter-point percentage cut, but cooling inflation and a soft labor market allowed Federal Reserve chair Jerome Powell to be more aggressive. In August, the Consumer Price Index (CPI), a key inflation metric, dropped to 2.5% year-over-year, roughly hitting Powell’s 2% inflation target.

The long-anticipated move sparked the broader markets. And crypto prices also rallied, with bitcoin pushing to roughly $63,500 and ether increasing to roughly $2,350 respectively.

A low interest-rate environment is widely viewed as a greenshoot for risk assets including crypto, but it remains to be seen if a rate-cutting campaign will ultimately shoot bitcoin and other cryptocurrencies to all-time highs.

🌐 Topic of the week: Global Stablecoin Ecosystem

🫱 Read more here

SPY500 $SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024SPY AMEX:SPY | RALLY AFTER FED RATE CUT - Sep. 19th, 2024

BUY/LONG ZONE (GREEN): $552.50 - $575.00

WEAKER BULLISH ZONE (PALE GREEN): $552.50 - $540.50

Weekly: Bullish

Daily: Bullish

4H: Bullish

This was my analysis for the end of the day yesterday, forgot to post it. Price has already rallied fairly well today. The Fed cut rates yesterday 50bps, down from 5.50 to 5.00. Here is what I was looking at as the market became volatile when reacting to the news. Despite the market already quickly moving in favor of the bullish zone, I still think we will reach the top of that zone before any form of reversal or significant pullback.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technicalindicators, supportandresistance, rangebreakout, rangebreakdown, rangetrading, chartpatterntrading, chartpatterns, spy, sp500, s&p, AMEX:SPY , fed, federalreserve, fedrate, fedratecut, interestrate, jeromepowell, fedchair, 50bps, volatile, volatility,

What to Expect at Jackson Hole Next Week? Traders will next hear from Federal Reserve Chair Jerome Powell during his highly anticipated address at the Jackson Hole Economic Symposium. The key question hanging over the market: Will Powell use this speech to pave the way for a potential interest rate cut in September?

Scott Helfstein, head of investment strategy at Global X, argues that Powell should take this opportunity to celebrate the Fed's achievements and steer the market toward a 25-basis-point cut next month.

Powell is expected to continue the tradition of Fed chairs delivering opening remarks at the Jackson Hole conference, scheduled for Friday morning next week. Market participants are currently divided on whether the Fed will opt for a 25- or 50-basis-point reduction.

However, the true size of the cut could be influenced by the August jobs report, set to be released just a week after the Jackson Hole summit.

July Economic Calendar - IMPORTANT EventsIt’s going to be a busy month for the Chair of the Fed (Jerome Powell), who delivers a speech today and then will testify later this month in front of Congress to provide updates on monetary policy decisions. Will we gain clarity on the timing of potential rate cuts this year, and if they are even being considered?

Crypto in June - How BTC responds

June saw significant volatility across the crypto market. Bitcoin fluctuated between price highs above $70,000 and lows of around $60,000, with substantial movement around 4 June when Bitcoin peaked above $71,000, before declining on 6 June and continuing a downward trend and falling to levels last seen in May. ETH and altcoins followed along, with Ethereum down approximately 11% in June . Pulling it back to the US markets, some analysts argue that the fluctuations was largely driven by uncertainty surrounding inflation data. The drop to $60k could likely be due to the reducing likelihood of multiple interest rate cuts by the Federal Reserve Bank this year, contrary to earlier investor anticipations (causing hesitation and a cautious approach).

Upcoming Events that could Affect Markets:

❗ Tuesday, 2 July 📢 Jerome Powell speech

Federal Reserve Chair Jerome Powell will provide an economic overview today, outlining current monetary policies. He will answers questions and the outcome of this speech can significantly impact financial markets and investor sentiment.

❗Wednesday, 3 July 📢 Federal Open Market Committee (FOMC)

The upcoming FOMC minutes are expected to provide more details on the Federal Reserve's decision to keep interest rates unchanged, and its revised economic projections. Key points could include the reasons behind the more hawkish stance on rate cuts, and the implications of updated forecasts for unemployment and inflation.

❗Friday, 5 July📢 US Unemployment Rate

The US unemployment rate is a key indicator of economic health, influencing consumer spending, corporate profits and the social sentiment. During May the US jobs sector added 272,000 jobs, further casting doubt on the rate cuts in the US this year.

❗Tuesday, 9 July 📢 Fed Chair Powell testimony

Jerome Powell is set to discuss the state of the economy, monetary policy decisions, and also outline future policy intentions in his twice-a-year testimony in front of Congress.

❗Thursday, 11 July 📢 US Inflation Figures

The year-on-year and month-on-month inflation numbers provide crucial insights into purchasing power trends, influencing market expectations for interest rates and the overall economic outlook. The Consumer Price Index (CPI) climbed 0.2% in May, the smallest advance in core CPI since October 2023.

Take extra caution when over the next few weeks as volatility will be likely depending on the outcome of these events.

_______________________

ECONOMICS:USINTR FRED:UNRATE ECONOMICS:USIRYY

DXY ( US DOLLAR Index ) Analysis 19/05/24Scenario 01 : if the Federal Reserve raise interest rates : Probability of this to happend is lower in my opinion but could happend somehow

1. *Dixie (USD Index):* Typically, when interest rates rise, the value of the dollar strengthens. This is because higher interest rates attract foreign investment, increasing demand for the dollar. So, the Dixie would likely see an increase in value.

2. *U.S. Dollar Index:* If interest rates rise, the U.S. Dollar Index, which measures the value of the dollar against a basket of other major currencies, would likely see an uptick as well. Again, this is due to increased demand for the dollar from foreign investors seeking higher returns.

Scenario 02 : if the Federal Reserve keeps interest rates the same:

1. *Dixie (USD Index):* If interest rates remain unchanged, the dollar's value might stay relatively stable. Without a change in interest rates to attract or deter investment, the Dixie may not experience significant fluctuations.

2. *U.S. Dollar Index:* Similarly, the U.S. Dollar Index could remain steady if interest rates are unchanged. It might experience some minor movements based on other economic factors, but overall, it's likely to maintain its current level.

Scenario 03 : if the Federal Reserve Cut / Lower interest rates: (Probability is High because of the inflation is high and Jerome Mentioned he might Cut rates in the next meeting)

1. *Dixie (USD Index):* Lowering interest rates usually leads to a decrease in the value of the dollar. This is because lower rates make it less attractive for foreign investors to hold onto dollars, as they can find higher returns elsewhere. So, the Dixie might depreciate.

2. *U.S. Dollar Index:* A cut in interest rates could lead to a decline in the U.S. Dollar Index as well. Lower rates could weaken the dollar's value relative to other currencies, causing the index to decrease.

In summary, changes in interest rates by the Federal Reserve can have significant impacts on both the Dixie and the U.S. Dollar Index, influencing their values in the foreign exchange market.

Market is Sensitive to what Jerome Powell is SayingAt the latest FOMC meeting on January 31st, Jerome Powell stated, 'The Fed is not ready to start cutting,' which immediately caused the yield to pivot higher. During an recent interview on Sunday, February 4th, he reiterated that the US central bank is not yet prepared to cut interest rates, resulting in another increase in the yield.

Today, we will discuss the direction of the yield or interest rates in the coming months, as well as why the Fed is carefully considering its decision to cut rates this time.

My name is Kon How, my work in this channel, as always, is to study behavioral science in finance, discover correlations between different markets, and uncover potential opportunities.

Micro 10-Year Yield Futures

Ticker: 10Y

0.001 Index points (1/10th basis point per annum) = $1.00

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Bitcoin Above $42K Again as Fed Holds Interest Rates SteadyBitcoin gained some upward momentum, picking up 0.8% in the past hour, following an announcement from Federal Reserve officials that the central bank would leave interest rates unchanged.

At the time of writing, Bitcoin is trading for$43,119.95, according to CoinGecko. Ethereum also responded positively to the news, having picked up 1% in the past hour. It's currently changing trading for $2,234.

"The seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run," the FOMC said in a statement. "In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5.25% to 5.5%."

Federal Reserve Chairman Jerome Powell said during a press conference that the U.S. economic recovery "has progressed more quickly than generally expected, and forecasts from FOMC participants for economic growth this year have been revised up since our September Summary of Economic Projections."

"Even so," Powell added, "overall economic activity remains well below its level before the pandemic, and the path ahead remains highly uncertain."

Investors were expecting to hear that rates would be maintained. Ahead of the announcement, the CME FedWatch tool showed investors believe there's a 98% chance that the Federal Reserve would leave interest rates unchanged. The tool works by tracking the prices of Fed funds futures contracts, which investors use to speculate on or hedge against changes in rates.

Crypto investors tend to take the FOMC lowering rates or leaving them unchanged to be a bullish sign for markets.

That's because the Bitcoin (BTC) price has historically correlated with risk equities and central bank policy.

The more favorable credit conditions are in the economy, the more likely BTC is to pump. When interest rates are low, investors are more likely to take their dollars and put them into risk assets, such as stocks and crypto. When rates are high, investors flee back to dollars.

Notable Events: Bitcoin rose aggressively to new highs from March 2020 to early 2021 after the Federal Reserve lowered its benchmark interest rate to just 0.25%. And in July, traders breathed a sigh of relief while—despite news that the Fed planned to raise rates—Bitcoin and Ethereum didn't immediate take a dive.

The Fed started aggressively raising rates in 2022 to try and control 40-year high inflation. It hiked them by 75 basis points four times—which negatively impacted the value of stocks, equities and crypto.

'FED Up' for a 'SEC' .... 🤡 They Buy their Own Dips!! 😂🚀What's up Simpsons?

In the first part of yesterday's episode the Federal Reserve became FED-UP of hiking interest rates. This normally is good news for indices and Bitcoin. Especially now that inflation has eased (Link 1)

In the second part of the episode, 🤡Jerome Powell gave the performance of his lifetime: While Springfield was hot and humid this June he said the winter storms will return in July!

He asked citizens to:

🤡wear their jackets

🤡Inflate their snow tubes and wax the sleds

🤡start knitting some woolen bikinis and swim trunks

🤡Get the Christmas lights ready

At the end of his dramatic speech, Jerome touched everybody's hearts with a closing statement:

''Let's show the sun who's boss around here! Who said snowball fights were only for December? Get your gloves on and your aim ready, we be heading for a cold snap in the middle of this summer heatwave but nothing says 'summertime fun' like twinkling icicles in the palm trees!"

Don't miss the next episode: "Bitcoin Laughs All The Way! 😂🚀💰💹"

One Love,

the FXPROFESSOR

ps1: 🤡Jerome? Garry? 🤡

You guys buy your own dips man? It kinda feels like it!!!😂🚀 (Why? Because you both know the power of Bitcoin as a trustless system in a trustless New world. Check Janet Yellen's comments (Link 3)

ps2: If you prefer to stay short maybe make sure your snow boots fit over your flip-flops...

ps3: read the What's up with that Mr Gensler? 🤨post and make sure you also read the post update dated June 8 (look at the support level):

LINKS:

(Link 1): CPI report: US inflation is coming back down to Earth: edition.cnn.com

(Link 2) Fed Chair Powell Dances Between Pause and More Interest Rate Hikes: www.bloomberg.com

Link 3: finance.yahoo.com

Janet Yellen now says Americans should expect a decline in the USD as the world's reserve currency — what’s really going on and how can you prepare?

🤡the clowns already know how to prepare: Buying some Bitcoin🚀

No such thing as a Hawkish pause? USD overrated? Has the market adopted the term “hawkish pause” to bolster USD bids? It could be possible that, in an attempt to drag out USD strength just a little bit longer (euro has weakened –4.20% in past 6 months), the term Hawkish Pause has been thrown around with not-enough criticism.

Not many people have confidence in the US Fed to really make the hard decisions (transitory inflation anyone?), including being able to start up the rate hiking engine again (this year or next) after a few pauses. If they do, will they do it in a timely manner?

Jerome Powell, this morning noted in his public address that the committee hasn’t discussed what it might plan for its December decision but dismissed the idea that it would be difficult to start hiking again (if the conditions in the market require such an action). There are two more inflation readings and two more labor market readings before the last decision of the year.

Maybe investors have shrugged off the hawkish pause rhetoric this morning though. The Australian dollar is pumping, up 0.94% at last look, while the dollar has fallen more than half a percent against the yen. The euro is only up 0.16%.

US10Y: Soaring Bond Yields as Federal Reserve Maintains Hawkish The Fed Hawkish Stance

During Wednesday's address, Federal Reserve Chair Jerome Powell reinforced his stance on tackling inflation with a more cautious approach. He emphasized that the central bank is not yet finished with its efforts to curb inflation and hinted at the possibility of implementing multiple interest rate increases during future monetary policy meetings.

Powell's statement comes as a response to the ongoing challenge of bringing down inflation, which has consistently remained above the central bank's target of 2%. Notably, some Fed officials have emphasized in recent speeches that inflationary pressures persist. They specifically highlight core inflation, which excludes the volatile prices of food and gas, as not decelerating as rapidly as overall inflation.

The aforementioned statement supports the potential scenario of higher Government Bond Yields in the future, as an increase in interest rates typically correlates with elevated yields.

Technical Analsyis

The U.S. government's 10-Year Bond Yield has undergone a retracement, precisely at the 0.5 Fibonacci ratio, establishing a support area. Notably, the yield currently exhibits a bullish trend as it remains above the EMA 200 line, indicating positive market sentiment. Furthermore, the Falling wedge pattern suggests a continuation of the prevailing trend. Complementing this observation, the stochastic line crosses within the neutral area, further bolstering the case for a possible upward movement toward the target area.

It is important to keep in mind that once the target/support area is reached, the roadmap provided may no longer be valid.

If you find this analysis helpful, I encourage you to show your support by clicking the rocket button and sharing your opinions in the comments section below.

"Disclaimer: This analysis is intended solely for educational purposes and should not be considered as a recommendation to take a long or short position on the TVC:US10Y ."

XRP Soars as Court Rejects SEC Appeal The Legal Victory: Ripple's Milestone

The court's decision to reject the SEC's appeal is a significant milestone in Ripple's legal battle.

It affirms that XRP is not a security and can continue to operate without the regulatory cloud that has hung over it.

A Bullish Signal: Market Response

XRP's price has responded with a bullish surge following the court's announcement.

This development underscores the market's confidence in Ripple's long-term prospects.

The Technical Setup: Bullish Triangle Formation

Coincidentally, this legal victory aligns with the formation of a bullish triangle pattern on XRP's chart.

A breakout from this pattern could signify a strong upward move.

Trading Strategy: Navigating XRP's Potential

Traders are closely monitoring XRP for a potential breakout.

Long-term holders see this legal victory as a positive signal for XRP's future.

Conclusion: XRP's Bright Future

Ripple's legal victory against the SEC has provided much-needed clarity and relief for XRP investors. The market's enthusiastic response and the technical setup of a bullish triangle make this an exciting time for XRP.

As the cryptocurrency landscape evolves, staying informed and adapting to new developments remains essential. XRP's recent success story highlights the resilience and potential within the crypto market. 🌐📈🚀

❗See related ideas below❗

Like, share, and leave your thoughts in the comments. 💚🚀💚

Month on Month US Inflation Harmonically Set to Rise to 1.94%This is a followup to this year-on-year inflation chart idea posted back in June 2022:

The YoY US Inflation rate has been on a trend of going down since it tested the 1.414 PCZ of the Bearish Butterfly above, but recently we have seen the MoM rate slow its descent and form a bottoming pattern with MACD Hidden Bullish Divergence at the 200-Month SMA and now we can see that the MACD has crossed positively as the inflation rate has broken out of its recent range. This harmonically puts it into position where we will likely see it at least hit the 0.886 retrace to complete a small bat pattern, but it could go out of control and go as high as the 1.618 Fibonacci Extension area all the way at about 1.94%.

One reason I suspect for the sudden stop of the inflationary decline is due to the Fed not raising rates high enough, fast enough, and then keeping them the same for the last few months. It would also seem that the year-on-year inflation rate is setting up for a similar rise, showing Hidden Bullish Divergence at the Moving Averages and likely one that will result in it going to test higher highs to around its 1.414-1.618 PCZ once area once more before ultimately crashing back down from these highs once the Fed starts to go heavy on rate hikes again. Though the timeframe may be shorter than how it is presented on the chart, I do still suspect we will have action resembling what is projected on the chart below until the Fed starts rising rates aggressively again:

This does not mean I think stocks will go up, that the dominance of the dollar will go down, or even that I think the consumer credit situation will improve. Instead, I think the rise in inflation will be fueled by energy, import, and export costs, and that this will be very bad for: Stocks, Consumers, REITs, and Banks overall, and that the Bond Yields will continue to rise at an accelerated rate.

Gold's Jackson Hole Rally: What's Next? Gold is possibly still within its descending channel, though it has discovered a foothold at $1885 and demonstrated an upward shift this week due to a decline in bond yields. However, the anticipation is for the Fed funds rate to remain higher for longer, so gold’s upside potential might be short-lived.

Butting up against this hypothesis is the very recent surge in gold from $1900 to $1916. This surge can be attributed to a weakened USD, which followed the release of several data points, including a decline in the US Composite PMI to 50.4 in August (below the expected 52.0), and a drop in the Manufacturing PMI to 47.0, reaching a low point for the past two months.

For downside risk, bears may again target the $1880 and $1885 resistance if the price falls back below $1908 level (200 SMA). Immediate upside risk is potentially restricted at $1920 (20 SMA). Jerome Powell is set to take the stage at the Jackson Hole Symposium in the next 48 hours (scheduled for 10:05am ET Friday) and gold’s near-term trajectory will likely be guided by this significant event.

Interestingly, the pound is bucking the trend of a softer US dollar. The GBPUSD weakened to $1.2716, as traders digested the UKs equally weaker-than-expected PMI data. The latest UK Private Sector Output Fell the most in 31 months (about 2 and a half years).

Price Waiting for News Releases | Tech/Fundamental Analysis Traders, today we have those news releases for Wed, 28 Jun 2023..

Buyside liquidity then sellside liquidity..

Use these news as your trigger and most importantly, confirm your entry..

This view is linked to my previous view, please review it..

Price may reprice higher than H2 FVG and into my "sell area" marked in my previous idea..

Those are areas of "possible" reversal points, and entry should be confirmed in the proper time..

I'll keep you updated ✅

🔔 Jingle all the way, oh what fun it is to ride the STX train🚄🔔Merry Xmas to all SEC and Powell bears:

🔔reference:

🔔Dashing through the snow

In a one-horse open sleigh

O'er the fields we go

Laughing all the way

Bells on bobtails ring

Making spirits bright

What fun it is to ride and sing

A sleighing song tonight, oh!🔔

🔔Jingle bells, jingle bells

Jingle all the way

Oh, what fun it is to ride

In a one-horse open sleigh, hey!🔔

🔔🔔🔔MERRY XMAS JEROME, MERRY XMAS SEC!🔔🔔🔔 HAPPY NEW YEAR BEARS!!

The FXPROFESSOR 🎅

OH I FORGOT: STX IS A TRAIN 🚄🚄🚄🚄🚄🚄🚄🚄

SPY S&P 500 ETF Prediction Ahead of FED Rate Hike Decision ! This week's Federal Reserve meeting is highly anticipated, and I`m predicting that the market will go down following the announcement. The primary reason for this prediction is the expectation that the Fed will keep interest rates high for longer, with no rate cuts predicted for this year.

Based on fixed income futures, there is a 70% chance that the Fed will hike rates by 0.25-percentage-points, while only a 30% chance that they will hold rates steady. My prediction is that the Fed will indeed raise interest rates, which could lead to a market downturn as higher interest rates tend to slow down economic growth.

If the Fed's decision leads to higher interest rates that remain in place for an extended period, it could result in lower spending and investment by consumers and businesses, which could further exacerbate the market downturn. Therefore, many investors are closely monitoring any signals regarding future rate hikes or cuts and preparing for a potential dip in the market following the announcement.

According to the technical analysis chart, the SPY appears to be forming a bearish head and shoulders pattern, indicating a potential trend reversal from bullish to bearish. This pattern typically consists of three peaks, with the first and third peaks being of similar size and the middle peak being the highest.

Based on this pattern, my estimated price target for the SPY is 390.

Based on my analysis, I would buy the following PUTS ahead of Fed's decision:

2023-7-21 expiration date

390usd strike price

$5.05 premium

I am interested to hear your thoughts on this strategy.