AAL - Airlines recovery, BUY opportunityWe can see a nice wedge breakouts on rising volume in airlines.

Fundamentally, we should take into a consideration deffered demand on trips due to COVID restrictions. Combined with Technical Analysis it means that airlines have space to growth.

I am publishing this idea a bit later then I should, but still it is a great buy opportunity.

Keep in mind your possible risks. Probably AAL will give a chance to take a large position on retest (level 22.30). Stop Loss 21.00

JETS

JETS ETF Bullish inclined naked Puts - 16 Apr ExpiryThis Month I will only be entering a primary trade.

As the Primary trade, this is aligned to the larger market direction and is deemed less risky. I'm bullish inclined for JETS as it is considered one of the COVID19 recovery sectors. The strike is also at a resistance point of the range. Entering at 0.3 would have been my preference but I was too late to get that price as I was wrapped in the previous JETS trade.

I need another JETS as I'm over-reliant on this for the past 1 year.

Sold 365 Puts @ 0.23 Strike 24

BP Block: 94K

Max Gain: Est $8,395

Touch Probability: 29%

% Distance to Strike: 14%

Wish me luck!

Educational Trend Analysis@mmsoccer $jets and $vde have a high correlation, i would just pick one for a position

mmsoccer

but with flights picking up

wouldn't they go up?

and what about the triangle with a more bullish entry?

dilille010

@mmsoccer youre talking about fundamentals, i rarely use fundamentals to trade, im in $blok to have exposure to crypto, thats about as close to fundamental trading as i get

mmsoccer

okay

dilille010

$jets looks like its rollingover for a support check at 25.5

mmsoccer

jets is all airlines though, and vde is an energy etf?

dilille010

@mmsoccer wrote:

jets is all airlines though, and vde is an energy etf?

check a correlation calculator

hold on ill look im not doing anything

mmsoccer

correlation could be random?

dilille010

@mmsoccer its got a .77 correlation, for my trading diversification, i dont hold two postions with higher than .5 correlation on a rolling 5 year basis

mmsoccer

they do look correlated

but they are at a strong support

definitely different though

dilille010

if nopthign changes, trend says this will test 25.82 by April 23 @mmsoccer

its riding the high side of it, if you turn the trend horizontal in your head, is this a bullish buy right now?

no, its on the high side of its downtrend

thats trend trading

mmsoccer

your chart makes sense

dilille010

it could go bullisj quickly because it is riding the downtrend, but what if it keeps going down and you trade against thew trend

if you trade it now, its better to go with trend

then be ready to go bull when it makes a new uptrend

mmsoccer

holy caca

the 1h looks so different

one sec

dilille010

each trader chooses their timeframe, based on their risk appetite and trading profile

mmsoccer

i love the 1h as you can tell lol

dilille010

the 1 hour is mixed for me. its breaking both up and down trends and its in a downward consolidation, downward consolidations are usuaally bearish @mmsoccer

mmsoccer

dilille010

i dont use candles for trend trading anymore

mmsoccer

im looking more short term for the 1h, triangles imo can go either way

dilille010

candles are emotional for me and tell me nothign about trend, i rely on closing prices

mmsoccer

but going doesn't require margin or anything so that seem less risk

in forex i trade short and long, because currency values fluctuate normally

dilille010

@mmsoccer you are arguing a bull position for a stock in a bearish trend on 1 day and 1 hour, in a downward consolidation, in a stock that is making lower lows and lower highs, you see your argument

technical analysis says this is going lower

mmsoccer

on the 1h i see it as neutral

and the daily

dilille010

then make your bull position, just have stop losses built in or be ready to cost average down

mmsoccer

with confirmation it could go either way

dilille010

im giving you pearls and you are just saying, "but yeah, no, i think im right"

mmsoccer

ya thank you!

im gona go have confirmation code for the bullish entry

and code my takeprofit and stop loss

with my coding platform i cant short stocks

UAL - Bullish Inverse head and shoulders patternUAL - United airlines has a bullish Inverse head and shoulders pattern on daily chart. Options flow - Over 27,000 June $50 calls traded friday. 6000 $45 April calls traded vs 8 in open interest. More flights starting as more vaccines get to people , you could call this a "re-opening" trade. I own march calls in JETS etf. Cheers!

JETS ETF Bullish inclined naked Puts - 19 Mar expiryAs the Primary trade, this is aligned to the larger market direction and is deemed less risky. I'm bullish inclined for JETS as it is considered one of the COVID19 recovery sectors. The strike is also at a resistance point of the range

Overall the market seems to be bullish especially after the US inauguration.

Sold 200 Puts @ 0. 36 Strike 21

BP block: 48k

Max gain - est $7057.54 (Minus comms)

Once my Feb JETS options expire, I will add on to this position

Time to take flight? #stocksThe one sector that has continue to lag is the airlines but that may be starting to change. We have consolidated near the high end of the range (rectangle)for over a month and it appears the sector wants to breakout. If we can clear the downtrend line and hold the 21.40 recent lows then the sector could get back some of the enormous Covid losses. Vaccines and broader reopening's should only be a tailwind.

JETS ETF Bullish inclined naked Puts - 19 Feb expiryAs the Primary Trade is this aligned to the larger market direction and is deemed less risky. I'm bullish inclined for JETS as it is considered one of the COVID19 recovery sectors.

More vaccine news and it's potential positive speculation could start increasing it's frequency, resulting in traders trying to capitalize on it by entering sectors previously hit hard by COVID19

Sold 140 Puts @ 0.40, Strike 19

BP block: 27k

Max gain - est $5600

JETS ETF Bullish inclined naked Puts - 18 Dec expiryDecember's Primary Trade

As the Primary Trade is this aligned to the larger market direction and is deemed less risky. I'm bullish inclined for JETS as it is considered one of the COVID19 recovery sectors. The 9 Nov vaccine and US election news cause a significant gap upwards.

Vaccine news as we near 2021 could start increasing it's frequency, resulting in traders trying to capitalize on it by entering sectors previously hit hard by COVID19

Sold 140 Puts @ 0.17, Strike 17

BP block: 25k

Max gain - est $2380

JETS ETF Bullish inclined naked Puts - 22 Jan expiryAs the Primary Trade is this aligned to the larger market direction and is deemed less risky. I'm bullish inclined for JETS as it is considered one of the COVID19 recovery sectors.

More vaccine news and it's potential positive speculation could start increasing it's frequency, resulting in traders trying to capitalize on it by entering sectors previously hit hard by COVID19

Sold 120 Puts @ 0.30, Strike 19.5

BP block: 28k

Max gain - est $3600

Jets with good risk reward ratioThis is one of the industries mostly beaten down by pandemic. As we have now positive news about vaccination I think this industry due upside. Another bullish sign as per technical 20MA cross above 50MA and 50M above 200MA. Most of the airline stock ticker has a similar chart pattern. As per chat setup, this has a good risk-reward ratio. Play strategy

- Buy around 22.06 which is the nearest support. Stop-loss 20.56.

- Potential target 29.25 where the gap

- P:L = 32:6

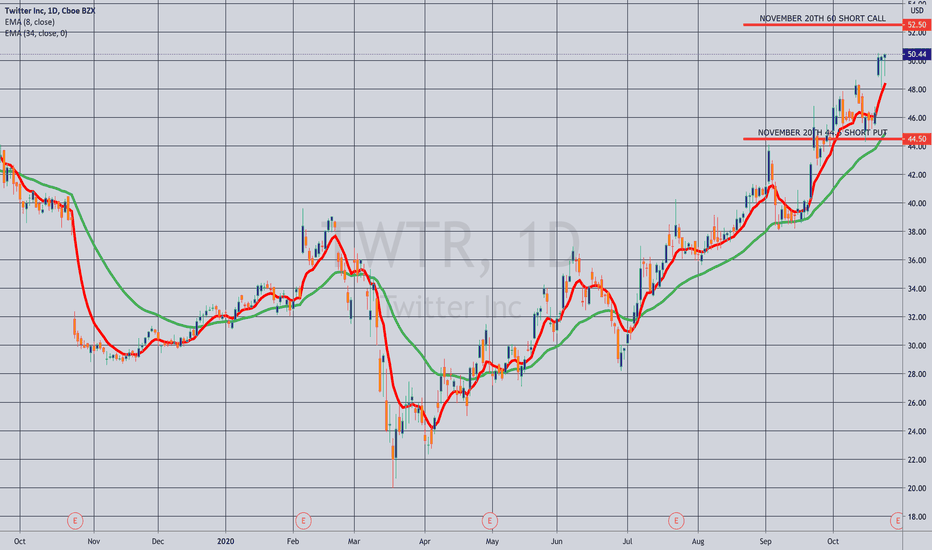

THE WEEK AHEAD: TWTR, MGM, AMD EARNINGS; JETS, XOP, GDXJEARNINGS:

If you like to play earnings for volatility contraction, there are a ton this coming week. Here are the ones that made my cut for volatility contraction plays based on options liquidity and bang for your buck as a function of stock price:

TWTR (49/73/15.9%),* announcing Thursday after market close.

MGM (16/69/15.2%), announcing Thursday before market open.

JBLU (22/73/14.6%), announcing Tuesday before market open.

TECK (20/64/14.1%), announcing Tuesday before market open.

AMD (30/62/14.0%), announcing Tuesday after market close.

BA (19/59/12.4%), announcing Wednesday after market close.

FB (47/52/11.1%), announcing Thursday after market closes.

Honorable Mentions:

AMZN (63/51/11.2%), announces Thursday after market close. (Option illiquid).

AAPL (36/47/9.8%), announces Thursday after market close. (November 20th short straddle paying less than 10% of stock price).

GOOG/GOOGL (40/40/8.6%), announce Thursday after market close. (Options illiquid).

MSFT (32/40/8.2%), announces Tuesday after market close. (November 20th short straddle paying less than 10% of stock price).

Pictured here is a TWTR short strangle in the November 20th expiry (26 days) with the short options camped out at the 22 delta. Paying 2.72 at the mid price as of Friday close, it has -.55/10.56 delta/theta metrics and break evens wide of 2 times the expected move on the call side, between the expected and 2x on the put.

For those of a defined risk bent, the uneven winged** November 20th 40/44.5/60/65 iron condor pays 1.50, has delta/theta metrics of 2.53/3.43, and has a 2x expected move break even on the call side and an expected move break even on the put.

MGM: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

JBLU: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

TECK: Short straddle or iron fly with risk one to make one metrics; 25% of credit received take profit.

AMD: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

BA: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

FB: Short strangle with 2 x expected move metrics; iron condor paying one-third the width of the wings; 50% of credit received take profit.

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK AND SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

JETS (12/50/16.1%)

XOP (15/56/16.0%)

GDXJ (17/49/15.1%)

SLV (36/48/13.9%)

EWZ (17/43/13.3%)

XLE (26/44/12.6%)

GDX (16/40/12.6%)

XBI (30/41/11.6%)

SMH (21/35/10.3%)

EWW (23/35/10.0%)

I threw JETS in here due to continued high implied volatility in airlines which is sticking in there even for names that have already announced "earnings" (or lack thereof) (e.g., DAL (63.5%), UAL (80.7%), AAL (106.6%)).

BROAD MARKET:

QQQ (30/34.9.7%)

IWM (29/33/9.0%)

SPY (23/27/7.6%)

EFA (23/24/6.3%)

IRA DIVIDEND-PAYERS SCREENED FOR THE DECEMBER AT-THE-MONEY SHORT STRADDLE PAYING >10% OF STOCK PRICE:

KRE (25/45/13.3%)

XLE (26/44/12.6%)

EWZ (17/43/13.3%)

* -- The first metric is the implied volatility rank (where 30-day implied volatility is relative to where it's been over the past 52 weeks); the second, implied volatility in expiry nearest 30 days until expiry; and the third -- for earnings: what the November at-the=money short straddle is paying as a function of stock price; for exchange-traded funds, broad market, and IRA dividend-payers, what the December at-the-money short straddle is paying as a function of stock price. For lack of a better term, I've dubbed this last metric as the "bang for your buck".

** -- Only 5-wides are available on the call side.

JETS ETF bearish inclined naked calls - 13 Nov expiryOnce again I'm re-entering a JETS options trade given the low volatility . The industry is still weak and I don't think we will see much upwards movement in the next month especially with the US elections heating up and the focus still on CN, Tech and Healthcare.

For this trade, I sold calls close to a key price resistance point. I did not cover this options trade as I realised my covered options did not protect when volatility increased and the strike got closer.

For now I am leveraging S/R lines to determine strike price selection. I wonder if a potential hedge is a OTM VXX options position at a cheap low price point (When VXX is down, it means the market is up)

Sold 80 Calls @ 0.30, Strike 21

BP block: 15k

Max gain - est $2400