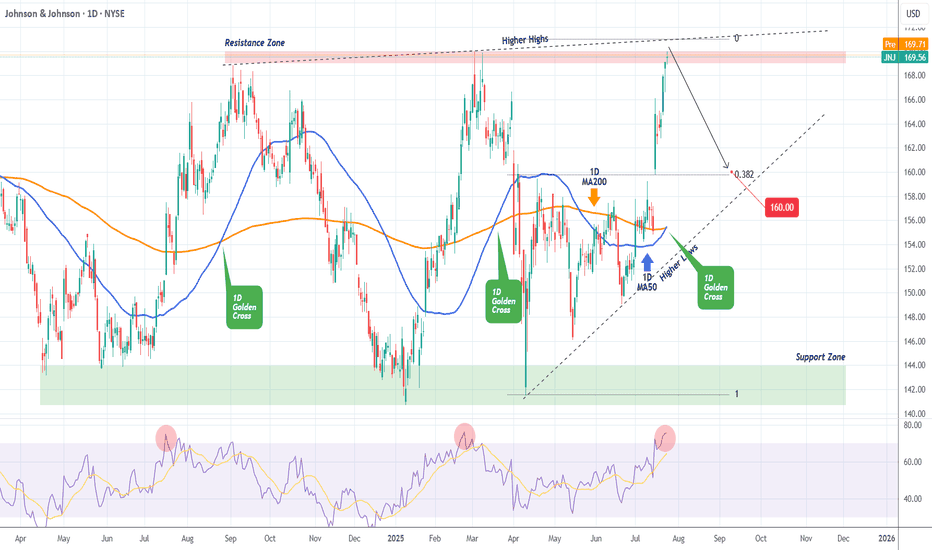

JOHNSON & JOHNSON Sell opportunity on a Double Resistance.It's been 9 months (October 11 2024, see chart below) since our last Johnson & Johnson (JNJ) analysis, where we gave a very timely sell signal that surgically hit our $141.00 Target:

The Channel Down has since broke to the upside and a new Higher Lows structure has emerged but with a clear Resistance Zone for the time being. At the same time, the price is also just below the Higher Highs trend-line that started on the September 04 2024 High.

With the 1D RSI overbought (same as on February 25 2025), we don't give the upside much room to go, so we turn bearish here, targeting the 0.382 Fibonacci extension and Higher Lows trend-line at $160.00.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JNJ

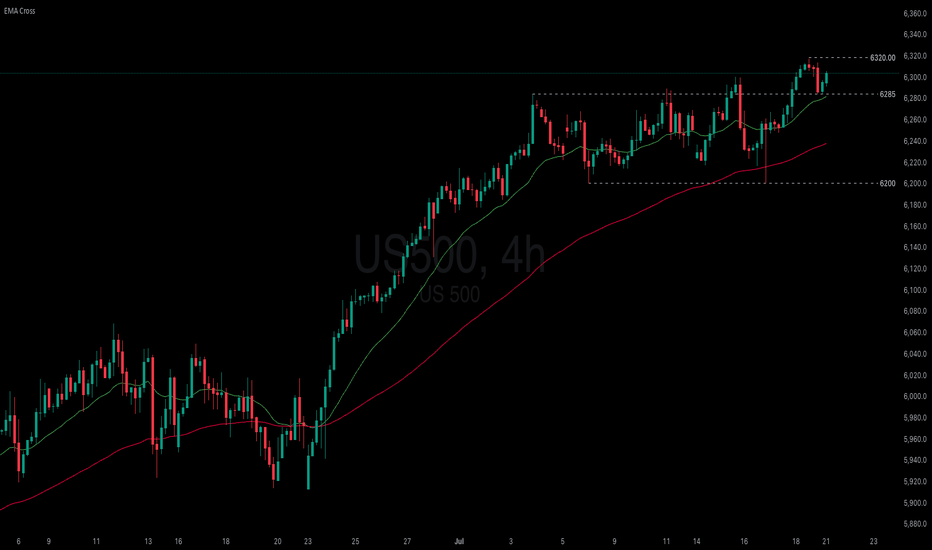

US stocks hold near record highs on strong 2Q earnings

Despite elevated valuation pressures, US equities remain near all-time highs. While tariff concerns persist, resilient US economic data continues to support the market's upward momentum.

United Airlines reported a 1.7% YoY increase in 2Q revenue, citing easing geopolitical and macroeconomic uncertainties and a double-digit rebound in corporate demand. Meanwhile, earnings and share performance among mega-cap stocks have also been strong.

Netflix (NFLX) beat market expectations with 2Q revenue of $11.08 billion and EPS of $7.19. At the same time, Nvidia (NVDA) reached a fresh all-time high on renewed optimism over a potential resumption of exports to China.

After testing the support at 6285, US500 rebounded and approached its previous high again. The index holds above EMA21, suggesting the continuation of bullish momentum. If US500 remains above both EMA21 and the support at 6285, the index could breach the 6320 high. Conversely, if the US500 breaks below the support at 6285, the index could retreat further toward 6200.

JNJ - Macro View 🌐Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 JNJ has exhibited an overall bullish trend, trading within the ascending wedge pattern outlined in blue. It is presently nearing the lower boundary/blue trendline.

At present, JNJ is undergoing a correction phase and is trading within the descending red channel. It is currently approaching the lower limit and a highlighted demand zone in green.

🏹 Thus, the highlighted purple circle is a strong area to look for buy setups as it is the intersection of the green demand and lower blue and red trendlines acting as a non-horizontal support.

📚 As per my trading style:

As JNJ approaches the lower purple circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

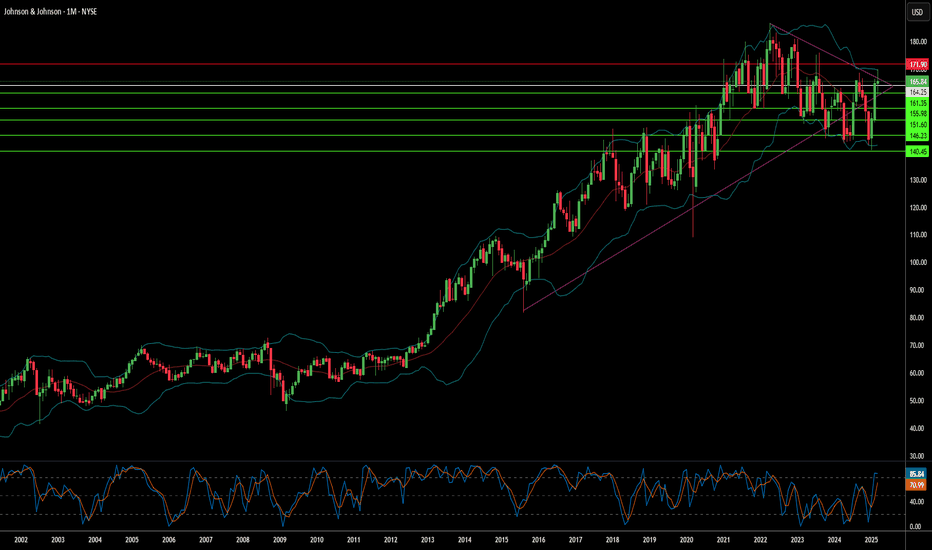

JOHNSON AND JOHNSON: Re-accumulation is targeting $175.JNJ is neutral on its 1D technical outlook (RSI = 49.991, MACD = -1.040, ADX = 18.184) as it's only trading around its 1W MA50 but having made an impressive rebound 4 weeks ago inside the Demand Zone. This is the 4th time this Demand Zone provided a rally and the last one even crossed over the 3 year LH trendline that kept the stock on a downtrend since 2022. The breakout confirmed the emergence of a HH trendline which is taking the stock on a new multiyear bullish path. We expect at least one more high on the HH before the end of the year (TP = 175.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Johnson & Johnson Beats Q1 Estimates, Premarket Not Doing WellJohnson & Johnson (NYSE: NYSE:JNJ ) on Tuesday reported better-than-expected Q1 results and lifted its sales forecast for the full year.

Johnson & Johnson (NYSE: NYSE:JNJ ), together with its subsidiaries, engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide, operating in two segments, Innovative Medicine and MedTech. Posted adjusted earnings per share (EPS) of $2.77 on revenue of $21.89 billion.

However, analysts had expected $2.56 and $21.56 billion, respectively, according to estimates compiled by Visible Alpha.

Price Action

Shares of Johnson & Johnson (NYSE: NYSE:JNJ ) were up about 1% immediately following the report, but the uptick was shortlived as the stock is down -0.54% in premarket trading. They entered the day up about 7% since the start of the year.

The company lifted its projected sales range to $91.0 billion to $91.8 billion, up from $89.2 billion to $90.0 billion previously. It also held its adjusted EPS forecast steady at $10.50 to $10.70, "including tariff costs, dilution from the Intra-Cellular Therapies acquisition, and updated foreign exchange."

Since reporting a disappointing 2025 sales outlook in January, the company closed its nearly $15 billion acquisition of Intra-Cellular Therapies and announced plans to lift its U.S. investment to more than $55 billion over the next four years.23

Technical Outlook

Shares of NYSE:JNJ closed Monday's session up 1.73% and despite the Q1 Earnings beat, the premarket session tells a different story as the asset is down 0.54% in Tuesday's session.

The asset is trading within an enclosed rectangular formation with a perfectly formed support and resistant zones as indicated in the chart. A break above the the key moving averages could cement a bullish breakout that may resort to a break above the $169 resistant point.

With the RSI at 45.35, NYSE:JNJ is well positioned for a bullish campaign once traders digest the earnings news.

Johnson & Johnson (JNJ) Shares Drop Over 7%Johnson & Johnson (JNJ) Shares Drop Over 7%

As the chart shows, Johnson & Johnson (JNJ) shares declined by approximately 7.6%, reaching their lowest level since late February. This marked one of the worst performances in the stock market yesterday.

Why Did JNJ Shares Fall?

Two major bearish factors contributed to the decline:

A Texas judge rejected Johnson & Johnson's third attempt to settle lawsuits related to allegations that its baby powder and other talc-based products harmed consumers.

On Tuesday, Johnson & Johnson announced that its upcoming acquisition of Intra-Cellular Therapies is expected to dilute adjusted earnings per share by approximately $0.25 for the full year 2025. Investors appear to have reacted negatively to this outlook, despite the company’s expectation that the deal will generate around $700 million in additional sales.

Technical Analysis of JNJ Stock Chart

Price movements in 2025 have formed an ascending channel (marked in blue), with indicators highlighting how:

→ The channel’s boundaries have acted as support and resistance levels.

→ The channel’s median line has served as a “magnet” for price action, reflecting the balance between supply and demand.

As JNJ's share price approaches the lower boundary (circled), just above the psychological support level at $150—previously a key level in February—traders have reasons to anticipate that the decline may slow down or even lead to a significant rebound from this support area.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With tens of thousands of lawsuits alleging links to cancer, the company's strategy to manage this liability via bankruptcy has been repeatedly struck down by courts, most recently rejecting a $10 billion settlement proposal. This forces J&J to potentially face over 60,000 individual claims in court, introducing immense financial uncertainty and the prospect of staggering legal costs and damages.

Compounding these concerns is mounting scrutiny over the company's historical and recent marketing practices. A federal judge recently imposed a $1.64 billion penalty against J&J's pharmaceutical arm for misleading marketing of HIV medications, citing a "deliberate and calculated scheme." This follows earlier multi-million dollar settlements related to alleged improper financial inducements paid to surgeons for orthopaedic implants by its DePuy subsidiary, and tax disputes in India over questionable "professional sponsorship" expenses tied to similar activities. These incidents depict recurring legal and ethical entanglements with significant financial penalties and reputational harm.

Taken together, the unresolved talc litigation, substantial financial penalties from marketing violations, and persistent questions regarding ethical conduct create considerable headwinds for Johnson & Johnson. The cumulative impact of ongoing legal battles, potential future liabilities, and damage to its corporate image threatens to drain resources, divert management focus from core operations, and erode investor confidence. These converging factors present tangible risks that could exert significant downward pressure on the company's stock price moving forward.

Johnson&Johnson: Rejected AgainJohnson&Johnson has now been rejected at the $168.75 resistance level for the second time, pulling back more noticeably in response. However, in our primary scenario, we still expect an imminent breakout above this level, which should allow the turquoise wave X to establish its high well above it. Afterward, the turquoise wave Y should drive the stock sharply lower again, as we anticipate the low of the larger green wave in the corresponding long Target Zone between $138.78 and $125.75. That said, reaching this Zone is not a certainty. There remains a 35% chance that the low of the green wave alt. is already settled. Under this alternative scenario, the stock would break through $168.75 without resistance and continue its impulsive move higher.

The Next Big Healthcare Stock?The chart for VERV shows a prolonged downtrend since mid-2021, with multiple resistance trendlines capping price action. However, the stock is now testing a potential breakout above these trendlines and the 50-week EMA (green line), which has acted as dynamic resistance. The RSI is rising above 60, signaling increasing bullish momentum, and the latest weekly candle, up 11.28%, suggests growing buying interest. If VERV successfully holds above this breakout zone, it could push toward the $10-$15 resistance range, confirming a trend shift. However, failure to sustain above the 50EMA could result in another rejection, reinforcing the downtrend. Volume is picking up, adding weight to the bullish case, but confirmation above key levels remains crucial for a sustained move higher.

Disclaimer:

This analysis is for educational purposes only and should not be considered financial advice. Trading and investing involve risk, and independent research or consultation with a professional is recommended before making any financial decisions.

Johnson & Johnson | JNJ | Long at $146.00Johnson & Johnson NYSE:JNJ is strong (but highly controversial) company with anticipated earnings growth on the horizon. With a P/E of 23x, steady dividend growth record, low debt, and expected increased cashflow, the future is optimistic for NYSE:JNJ if they can stay out of the shady spotlight...

While the historical simple moving average I've selected suggests the stock is entering a downtrend on the daily chart, I'm going to go against this given the current price/position it is in. If the price can hold in $140's and then move up, there could be an early cup formation here. However, if the price drops below $140, that idea is out, and the near-term downtrend may be on. But the company, overall, is a personal buy-and-hold for the long-term ups and downs (unless new news points the company in a different direction). Thus, at $146.00, NYSE:JNJ is in a personal buy-zone.

Target #1 = $157.00

Target #2 = $165.00

Target #3 = $170.00+

Johnson & Johnson (JNJ) Posted Q4 Earnings BeatJohnson & Johnson (JNJ) recently reported its fourth-quarter earnings, showcasing a performance that beat analyst expectations with an EPS of $2.04 against a forecast of $1.99 and sales of $22.52 billion, in line with the anticipated $22.45 billion. Despite this positive financial news, J&J's stock took a tumble, closing down 1.9% at $145.27 after issuing guidance for 2025 that fell short of Wall Street's expectations. The company projected sales between $89.2 billion and $90 billion, below the Street's estimate of $91.04 billion, and an adjusted profit per share from $10.50 to $10.70, bracketing the consensus of $10.55.

A Mixed Bag

Innovative Medicines Shine: J&J's innovative medicines segment saw a 4.4% growth, contributing significantly to the quarter's performance. Standout performers included Spravato, which grew by 44% year-over-year, and cancer drugs like Darzalex and Erleada, alongside blood thinners which increased by nearly 30%. However, the looming patent expiration for Stelara, a major immunology drug, casts a shadow over future earnings from this segment.

MedTech Segment Under Pressure: On the downside, medical device sales underperformed, coming in at $8.19 billion against expectations of $8.22 billion. This segment faces challenges, particularly in China, but there's optimism with new investments and product launches like the Ottava surgical robot, which could challenge Intuitive Surgical's market dominance in the future.

External Headwinds: J&J is dealing with several external pressures including foreign exchange issues, which have impacted their sales guidance for 2025. Additionally, potential generic competition and ongoing litigation related to talc products continue to be significant headwinds.

Technical Analysis

Premarket Recovery: Despite the post-earnings drop, NYSE:JNJ shares showed a 0.60% uptick in premarket trading on Thursday, suggesting some investor confidence returning.

RSI and Patterns: The Relative Strength Index (RSI) at 50.48 indicates a moderate condition, neither overbought nor oversold, providing a balanced outlook.

The stock's monthly chart shows a falling wedge pattern, typically a bullish indicator if broken upwards. A breakout above this pattern could signal a bullish campaign for $JNJ. However, there's a risk of further decline if the support at $145 breaks, potentially leading to a dip towards the one-month low of $140.

Moving Averages: NYSE:JNJ currently trades below its 50-day moving average, suggesting short-term bearish sentiment, but a recovery above this average could signal the beginning of a recovery trend.

Forward-Looking Perspective

Despite the immediate challenges, analysts like Edward Jones' John Boylan see J&J's guidance as conservative but achievable, particularly with the company's strategic focus on new product development and pipeline expansion in both pharmaceuticals and medical technology. The emphasis on cancer drugs, robotics, and cardiovascular products is seen as a pathway to long-term growth and margin expansion.

Conclusion

Johnson & Johnson, while grappling with short-term headwinds, holds a portfolio of products with strong growth potential. The technical setup suggests that if JNJ can maintain or surpass current support levels, there's room for optimism. Investors might see this as an opportunity to buy into a dip, given the company's history of innovation and resilience. However, caution is advised due to the external factors and regulatory challenges ahead. The broader narrative for J&J seems to hinge on its ability to innovate and adapt in a rapidly changing healthcare market environment.

Johnson & Johnson (JNJ): 2024 Challenges, 2025 OpportunitiesJohnson & Johnson could become one of the standout plays for 2025 if key levels are respected.

A Brief Recap of NYSE:JNJ in 2024

Johnson & Johnson experienced a challenging year. The company finalized the spin-off of its Consumer Health division, sharpening its focus on Pharmaceuticals and MedTech. In April, J&J completed the acquisition of Shockwave Medical for $12.5 billion, strengthening its cardiovascular MedTech portfolio. Financially, the company performed well, surpassing Q3 expectations with $22.5 billion in revenue (+5.2% YoY) and an EPS of $2.42.

Despite the positives, the stock faced significant headwinds, peaking at $170 in August before dropping to $140 by December—a 15% decline over the quarter.

While we briefly considered a potential outperformance in 2024, we refrained from entering a long position, which proved to be the right decision. Looking ahead, 2025 may offer renewed opportunities. For NYSE:JNJ to regain bullish momentum, it must respect the lower edge of the long-standing trend channel established in October 2021. Ideally, we would like to see a fake-out below this channel to trigger a bearish shakeout, followed by a reversal that targets higher levels.

For the longer term, our outlook includes the potential to test the $116–$100 range. However, if our 2025 thesis aligns with technical developments, we will consider adding exposure to $JNJ.

Looking for a leap play on JNJ. 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

$JNJ Call verticalNYSE:JNJ has been declining for some time. Currently the bullish divergence is everywhere. The price is also outside the BB band. I think there is a very good change for the price to move up in the coming days.

I bought Jan. 2025 $150/$155 call vertical for $2.33

I will double my money if the stock price is above $155 by expiration.

JOHNSON & JOHNSON Excellent confirmed sell signalJohnson & Johnson (JNJ) gave us the most optimal buy entry on our last call (April 17, see chart below) and easily hit our 157.50 Target:

Having been rejected early in September exactly at the top (Lower Highs trend-line) of the 2-year Channel Down and now establishing price action below its 1D MA50 (blue trend-line), this is a confirmed sell signal and the start of the Channel's 5th Bearish Leg. The RSI Lower Highs are common on all previous Channel tops.

Our Target is 141.00, which is on the Internal Lower Lows trend-line (formed by the last 2 Lower Lows) and still above the 1.236 Fibonacci extension.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JNJ completing correction wave C

NYSE:JNJ

JNJ is in multi decade uptrend peaked at 187 – presumably end of major wave 5 and turned into Elliott ABC correction, where major wave (A) length is about 37. Per fibo relation major wave (C) should most probably end at 139.5, while intermediate wave ‘c’ – a unit of the major wave (C) might break the pattern bringing the end of correction to 133 and beyond until possible exhaustion of the major correction at higher fibo multiples.

At the same time the stock is trading in a downward channel with a lower bound standing now at 141, as well as built-in triangle pattern identifies target as of 137.5 (not very reliable)

Week chart: EMA 50 & 200 confirming death cross – it’s late coz in JNJ case SMA 50/200 confirmed it earlier at around 160 – i.e. the stock is already about to be bottomed. RSI in week chart is not yet oversold, while in day chart RSI is heavily oversold.

I would consider weekly and daily RSI to align getting both in oversold territory and open long at somewhere 139-141 with a price target being upper boundary of the current downward channel

How To Pick Top Pharma Stocks like a ProAnalyzing the pharmaceutical industry, whose products play a key role in improving the quality of life of people around the world, is quite challenging sometimes also it requires deep knowledge and a careful approach, as I believe that investors should consider many factors, starting with evaluating the efficacy of the analyzed company's medications, including in relation to its competitors and the "gold standards," and ending with an analysis of its financial indicators

In this article you will learn how to pick Top Pharma stocks like a pro trader and which factors you should consider, so buckle up

1/ Recognizing the risks

At the very beginning, an investor you must recognize that the pharmaceutical industry is highly competitive, where a company's investment attractiveness depends not only on the rate of expansion of its portfolio of product candidates, revenue growth, margins, the amount of total debt and cash on the balance sheet but is also heavily influenced by the expiration of patents on medications and vaccines.

Moreover, in recent months, the healthcare sector has increasingly felt the impact of the upcoming 2024 US presidential elections, as some politicians are aiming to further tighten regulation of drug prices despite the existing Inflation Reduction Act.

2/ Leveraging data to your advantage

The second step use data wisely, you should check all kinda data including stock screener, transcripts of earnings calls, financial results for the last quarters, analyst expectations, options data... The goal is to filter companies in poor financial condition, as well as those that trade at a significant premium to the sector and/or competitors

I would also like to point out that in the current market environment, with Fed interest rates remaining at multi year highs, I do not recommend investing in companies with market caps below $500 million, as they typically have limited cash reserves and weaker institutional backing

Also, I'd recommend investors read 10-Ks and 10-Qs, especially the section related to debt and sources of financing of the company's operations, to reduce the likelihood of an "unexpected" drop in the share price. A striking example is Invitae Corporation aka NVTAQ which declared bankruptcy in mid February 2024!

Was there a prerequisite for this? The answer is yes since the company continued to generate negative cash flow and also had convertible senior notes maturing in 2028.

Convertible notes can involve significant financial risks if the company cannot effectively use the cash to grow the business and break even. In this case, management will not be able to pay off the bonds with cash reserves and will have to resort to significant dilution of investors. In my opinion, Pacific Biosciences of California, Inc. NASDAQ:PACB may face this problem because it has convertible senior notes maturing in 2028 and 2030.

Factors that concern me include the company's declining revenue and total cash and short-term investments in recent quarters, while its operating expenses remain extremely high at around $80 million per quarter.

Let's return to the second step in my approach to selecting the most promising assets in the healthcare sector.

When selecting companies with market caps between $4 billion and $40 billion, I use more parameters since most of them already have FDA approved drugs and/or vaccines.

As a result, it is also necessary to consider the rate of growth of operating income, net debt/EBITDA ratio, and how management copes with increased marketing and production costs.

Finally, let's move on to the last basket, which contains pharmaceutical companies with market capitalizations exceeding $40 billion. I think, this group is best suited for more conservative investors looking for assets offering attractive dividend yields and growing net income, supported by a rich portfolio of FDA approved and experimental drugs.

So, from Big Pharma, I like Pfizer Inc NYSE:PFE , AbbVie Inc NYSE:ABBV , Merck & Co NYSE:MRK and AstraZeneca PLC NASDAQ:AZN . I also want to include Novartis AG NYSE:NVS and Roche Holding AG OTC:RHHBY in this group

sometimes investors need to make exceptions, namely if one larger company buys out a smaller player and/or when a major partnership agreement is concluded, as was the case between Merck and Daiichi Sankyo Company, Limited OTC:DSKYF in 2023.

Also, in the event of a major acquisition or merger, the company's debt may temporarily increase sharply. If its management has previously implemented effective R&D and financial policies, the "net debt/EBITDA ratio"

A remarkable example of a company falling into the "value trap" is Takeda Pharmaceutical Company Limited NYSE:TAK , which overpaid for Shire. This deal did not significantly strengthen or rejuvenate the Japanese company's portfolio of drugs.

As a result, it had to sell off billions of dollars in assets to pay off its debt partially. However, despite all the efforts of Takeda's management, its net debt/EBITDA ratio, although it fell below 5x, remains high, namely about 4.7x at the end of March 2024.

3/ Identifying promising therapeutic areas

In general, the more prevalent a disease is, the larger the total addressable market for a drug and, as a result, the higher the chances that it will become a commercially successful product.

Global spending on cancer medications will reach $377 billion by 2027, followed by immunology, and diabetes will come in third with an estimated spending of about $169 billion

What challenges arise when choosing pharmaceutical companies?

you should also keep in mind that the larger the market, the higher the competition between medicines, as companies strive to grab as big a piece of the pie as possible.

As a result, for drug sales to take off, they need to have significant competitive advantages over the "gold standard." These competitive advantages may include greater efficacy in treating a particular disease, less frequent administration, a more favorable safety profile, and a more convenient route of administration.

So, in recent years, competition in the global spinal muscular atrophy treatment market has intensified. Spinal muscular atrophy is a genetic condition. Currently, three drugs have been approved to combat the disorder, including Biogen Inc.'s (BIIB) Spinraza, Roche/PTC Therapeutics, Inc.'s (PTCT) Evrysdi, and Novartis AG's (NVS) gene therapy Zolgensma.

All three products have similar efficacy, but Evrysdi has a more favorable safety profile and is the more convenient route of administration, namely the oral route, which is reflected in its sales growth rate from year to year.

The second pitfall is the company's pipeline of experimental drugs.

I believe that financial market participants opening an investor presentation that presents a company's pipeline, especially if its market cap is below $5 billion, should also pay close attention to what stage of clinical trial activity its experimental drugs are in.

if a pharmaceutical company has most of its product candidates in the early stages of development, this represents a significant risk because, in this case, institutional and retail investors are often overly optimistic about the prospects for the drugs' mechanisms of action and/or clinical data obtained in a small group of patients. Simultaneously, as is often the case, the higher the optimism, the less favorable the risk/reward profile.

In most cases, the larger and more diverse the patient population, the weaker the efficacy of a drug relative to what was seen in Phase 1/2 clinical trials. This ultimately leads to a downward valuation of its likelihood of approval and casts doubt on its ability to take significant market share from approved medications.

This may subsequently reduce the company's investment attractiveness, making it more difficult to attract financing for its operating activities.

As a result, I recommend excluding any company that, instead of focusing its financial resources on the most promising product candidates, conducts multiple early-stage clinical trials to evaluate the efficacy of its experimental drugs.

In my experience, the most successful pharmaceutical companies focus their efforts on bringing up to three product candidates to market and then reinvesting the revenue from their commercialization into developing the rest of the pipeline.

The table below highlights the following parameters that I use to screen out the least promising companies.

A third factor that investors, especially those new to the investment world, should consider is that large pharmaceutical companies are leaders in certain therapeutic areas, with a rich portfolio of patents covering various mechanisms of action and delivery methods of drugs, making it more difficult and more prolonged for smaller players to find product candidates that could potentially have the competitive advantages.

So, Novo Nordisk A/S NYSE:NVO and Eli Lilly and Company NYSE:LLY have long been leaders in the global diabetes and weight loss drugs markets, and only very recently, they may be joined by Amgen Inc. NASDAQ:AMGN , Roche Holding, and several other companies

4/ Assessing a company's drug portfolio in comparison to competitors

Evaluating the effectiveness, safety profile, and mechanism of action of a medication, as well as comparing clinical data with its competitors, takes a lot of time and effort. I provided examples of drugs and the most promising mechanisms of action in the obesity treatment market. Their manufacturers are Eli Lilly, Novo Nordisk, Roche Holding, Viking Therapeutics, Inc, Amgen, Pfizer, Altimmune, Inc, OPKO Health, Inc, Boehringer Ingelheim, and Zealand Pharma A/S

5/ When market exclusivity for a company's key medications ends

Every financial market participant who is considering investing in pharmaceutical companies should consider the expiration time of key patents of medicines.

Marketing exclusivity represents protection against the entry of a generic version and/or biosimilar of a branded drug into the market, thereby allowing the company to recoup the resources spent on its development and, in the event of its commercial success, also reinvest the money received to accelerate the development of the remaining product candidates.

Where can you find information about patent expiration dates?

All the necessary information is either in 20-Fs/10-Ks or on the FDA website, namely in the "Orange Book" section. let's take Eli Lilly as an example. Open the latest 10-K. Then, the CTRL + F combination opens the ability to find specific words in the document. I usually enter "Expiry Date" or "compound patent" to find the patent section.nvestors can also find information about patents on the FDA website.

As an example, I enter "Mounjaro" in the top line, and a list of patents opens that protect Eli Lilly's blockbuster from the introduction of its generic versions onto the market.hen, clicking on "Appl. No." will open information about the submission date of the patent and when it will expire.

6/ Evaluating the impact of insider share transactions

The next step in selecting the most interesting assets in the healthcare sector is to analyze Form-4s. The CEO, CFO, and other key members of the company's management buy or sell shares from time to time.I am only interested in analyzing purchases since, most often, sales by management are option exercises carried out to pay taxes.

When management starts making large outright purchases of a company's shares, it can signal that it believes in its long-term growth potential.if more than two top managers buy a large block of shares within two weeks of each other, it significantly increases the likelihood of the company's stock price rising in the next two months from the moment of their transactions

But as with everything, there are exceptions, such as in the case of OPKO Health, which is developing a long-acting oxyntomodulin analog for the treatment of obesity together with LeaderMed Group.Over the past 12 months, OPKO's management, especially CEO Phillip Frost, has purchased over 12 million shares.

However, despite this, its stock price has fallen by 27% over the same period. I believe that the key reasons for the divergence between these two facts are investors' lack of confidence in Phillip Frost's ability to make the company profitable again, as well as its low cash reserves. Therefore, companies like OPKO Health have already been eliminated at the second step of selection using Seeking Alpha's screener.

7/ CEO Performance in Business Development

The CEO plays a crucial role in the success of a pharmaceutical company since the pharmaceutical industry is highly dynamic, and the competition between Big Pharma is especially high, I advise readers to pay attention to the track record of the CEO, especially how he copes with force majeure situations, as well as how effective the R&D policy is carried out under his leadership.

8/ Identifying Entry and Exit Points for Long-Term Investments

The eighth step is in addition to the information that was obtained in the previous steps, as well as the analysis of financial risks and various financial metrics of the company, including its net debt, maturity dates of bonds, historical revenue growth rates, EBIT, gross margin, I build a DCF model with the ultimate goal of determining the price target.

it is necessary to conduct a technical analysis of them, as well as the main ETFs that include them. In my opinion, the key ETFs are the SPDR® S&P Biotech ETF AMEX:XBI , Fidelity Blue Chip Growth ETF AMEX:FBCG , iShares Biotechnology ETF NASDAQ:IBB , and VanEck Pharmaceutical ETF $PPH. The purpose of technical analysis is to determine the stop-loss level and entry points at which the risk/reward profile is most favorable. taking profit is not that easy cuz you must master your emotions and greed which damn hard

9/ Creating a Watchlist Based on Risk/Reward Ratio

The purpose of which is to create a watchlist of the companies I have selected based on the previous steps. I make several lists of companies based on their market caps and also rank them according to risk/reward profile, that is, in the first place is the stock that I think has minimal risks and at the same time can bring the greatest potential profit.

I also advise creating small notes on each company, which can include information about risks, support/resistance zones, dates of publication of clinical data, and any thoughts you have that will make your decision more conscious when opening a position

“What’s your secret sauce for choosing pharma stocks?”

Johnson & Johnson (JNJ) - Approaching the Reversal ZoneIn April, we anticipated a pullback for JNJ, and since then, the stock has dropped approximately 7%, aligning with our expectations. The current trend suggests further downward movement, reinforcing our previous analysis.

We are focusing on the support zone ranging from $134 to $116, with a potential lower bound at $109, the Corona-Low. The ongoing pullback could represent the completion of Wave (4) within this target zone, aligning with multiple levels.

We are going to be monitoring this for signs of a reversal within this zone. This zone will be crucial to confirm the next possible upward movement.

J&J Entangled in Talc-Related Lawsuits and Bankruptcy AllegationCore Issues:

* J&J faces numerous lawsuits alleging its talc products contain asbestos and cause cancer.

* The company's utilization of a "Texas two-step" bankruptcy strategy to shield assets from litigation has drawn accusations of fraud.

Recent Developments:

* Cancer victims filed a class action lawsuit on May 22nd, 2024, alleging J&J's fraudulent use of bankruptcy and asset transfers to avoid compensation.

* J&J maintains the safety of its talc and claims the lawsuit disrupts their proposed settlement plan.

Broader Implications:

* This legal battle raises concerns about potential abuses of bankruptcy laws by corporations seeking to evade product liability.

* The case has significant financial ramifications for J&J, with analysts citing negative impacts on stock valuation.

Conclusion:

* The outcome of these lawsuits will determine compensation for victims, J&J's future financial liabilities, and potentially set precedents for corporate responses to mass tort claims.

* Upcoming developments, such as the claimant's vote on the settlement and the court's response to the latest bankruptcy filing, will be crucial in resolving this protracted dispute.

JNJ Johnson & Johnson Options Ahead of EarningsIf you haven`t bought JNJ before the previous earnings:

Then analyzing the options chain and the chart patterns of JNJ Johnson & Johnson prior to the earnings report this week,

I would consider purchasing the 145usd strike price Puts with

an expiration date of 2025-1-17,

for a premium of approximately $7.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Johnson & Johnson's Q1 Triumph: Surpassing ExpectationsJohnson & Johnson (NYSE: NYSE:JNJ ) has kicked off 2024 with a resounding victory, showcasing robust first-quarter earnings that outpaced Wall Street estimates and signaling a promising trajectory for the rest of the year.

The pharmaceutical giant reported an impressive adjusted EPS of $2.71, marking a remarkable 12.4% surge compared to the previous year. This stellar performance surpassed analysts' projections of $2.64, underscoring the company's resilience and strategic prowess.

In terms of revenue, Johnson & Johnson ( NYSE:JNJ ) posted sales of $21.38 billion, reflecting a steady 2.3% increase year over year. While this figure nearly mirrored market expectations, the operational growth of 3.9% and adjusted operational growth of 4.0% underscored the company's underlying strength and adaptability in navigating market dynamics.

One of the standout performers in Johnson & Johnson's portfolio was its Innovative Medicine segment, which witnessed robust operational sales growth of 8.3% to reach $13.6 billion. Notably, sales of key drugs such as Stelara and Darzalex demonstrated resilience, with the latter experiencing a notable 19% surge in revenue.

Moreover, the company's medical devices business proved to be a significant driver of growth, generating sales of $7.82 billion during the quarter, marking a commendable 4.5% year-over-year increase. This uptick was fueled by strong performances in electrophysiology products and cardiovascular solutions, showcasing Johnson & Johnson's ( NYSE:JNJ ) diverse revenue streams and market leadership in healthcare innovation.

In a move sure to delight investors, Johnson & Johnson ( NYSE:JNJ ) announced a 4.2% increase in its quarterly dividend, a testament to its commitment to delivering value to shareholders amidst a challenging economic landscape.

Looking ahead, Johnson & Johnson ( NYSE:JNJ ) raised its fiscal year 2024 guidance, projecting operational sales in the range of $88.7 billion to $89.1 billion and adjusted EPS between $10.57 and $10.72. This optimistic outlook, coupled with the company's track record of delivering on its promises, instills confidence in its ability to navigate future opportunities and challenges.

Despite a slight dip in premarket trading following the earnings release, Johnson & Johnson's ( NYSE:JNJ ) strong performance in Q1 sets a solid foundation for continued success, reaffirming its position as a leader in the healthcare industry and a reliable investment choice for shareholders worldwide.

JOHNSON & JOHNSON Time to start buying.Johnson & Johnson (JNJ) quickly hit the $147.00 Target that we set on our very recent sell call (April 03, see chart below) and is now approaching the bottom of the massive 2-year Channel Down:

Even though based on the very reliable and consistent Sine Waves, the bottom might be a process that can take up to 2-months, the stock is low enough for medium-term investors to start considering adding buys.

On top of that, the 1D RSI is highly oversold below 20.00, the lowest it has been in more than 4 years (since February 28 2020)! As a result and since the Bearish Legs of this Channel Down have ranged within -14.78% and -17.58%, we are turning bullish on this stock, targeting $157.50 (minimum +13.00% rise as with January 22 2024 High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

JNJ has bottomed and can rise by +50%Johnson & Johnson gives a very clear idea of its trend on the 1M timeframe. The price may be under the 1D MA50 but has reached the bottom of the multi year Channel Up that started at the bottom of the 2008-2009 crisis. Being neutral on the 1M technical outlook (RSI = 45.714, MACD = -1.180, ADX = 20.525) has historically been one of the best buy opportunities, in fact the stock has grown by at least +53.04% three time during that time span. We shouldn't also ignore the fact that the 1M MA100 is still holding and has been doing so since June 2012. We are aiming long term for at least +53.04% again (TP = 220.00).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##