JNUG

YOUR JNUG PLUGI think with all the turmoil gold is the safest bet. typically gold sky rockets in times of war. We are floating somewhere close to fair value. JNUG typically is hard to trade because they will do stock splits and the price changes. I remember Jnug was at 6$ just a few years ago. So just remember the price of this stock means nothing. essentially if you trading JNUG or JDST/NUGT ect. ect. your trading gold directly and its important to check out my other signals on gold. This is a good sign that we will see a bounce here. Sometimes JNUG will forecast a move for gold. The actual gold chart make take out new lows before reversing, where as here this trendline may hold.

Easy money to long here. With the JNUG ETF you aren't aloud to short unless you meet capital requirements so to short you must trade the JDST chart so the only signals technically anyone can provide here are long opportunities.

Thanks for your support everyone. Happy Trading. Please les me know any other stock/ETFs you want to see me post. Have a good week!

NEM BUY+++++ way oversoldStill no change in view, NEM went lower than expected but appears to still have long term support in place and resistance around $53 range. We should see a retracement back to $63.68 .5 fibonacci range in coming weeks/ months. Copper and Gold miners are way oversold and been taken out to the woodshed with an artificially inflated dollar on the backs of $33 trillion national debt and trillions in funny money printing which will ultimately be the dollars demise. I have October 21st $52.50 calls. GL

GOLD INVERSE EFTs -Time to go long GOLD 3X ( JNUG / JDST )AMEX:JNUG

This chart analysis would serve as a guide to a swing trader or investor

seeking or continuing trades in the 3x gold EFTs JNUG and JDST.

Bu setting up the ratio between the two over time, pivot points

can serve as a reference to buy one and sell the other or initial

position.

The chart shows the JNUG price for May 2022, April 2021 and August 2020

while presently the JNUG completed a pivot low with a signal

from the RSI swing indicator. Since three weeks ago, the price

is rising albeit with weekly green Doji candles.

The MACD, a lagging indicator, shows an impending K/D

crossover under the histogram.

All in all, ow may be the time to take a trade-in JNUG, which

has risen by 20% in an ascending channel over the past three

weeks.

monitoring 2hr bull flag set up notice the 2 previous bearish cypher patterns. The 1st pattern of the (X) leg appears to be acting as support. I'm looking for gold to get above the 2nd bearish cypher pattern, and Test its X leg for support. If it hold then Im looking for gold to breakout again above $1800 and retest $1840-$1850 area

The AD earlier this morning showed me an ascending triangle to $1840 area. I'm monitoring and do a position

JNUG (D1) Bullish Reversal is Legit!?!JNUG and its well-defined downtrend on the D1 Chart dating back from late-2020 has been broken and all indications support this notion including breaking downtrend resistance, closing above said resistance on the daily chart, as well as holding above that same downtrend former-resistance-now-turned-support for additional confirmation. For the doubters, however, JNUG closing where it did yesterday further adds to the bullish reversal conviction. Have been building a not-insignificantly large JNUG long position for past few weeks, with yesterday's price-action and closing levels making it obvious that, at least for now and perhaps continuing through an indeterminate amount of time over the next several days/weeks/months -- JNUG directional bias strongly to the upside with the bulls seemingly in control as of now. Holding near or above yesterday's closing price upon close of the weekly candle would only add to bullish sentiment. Remaining long JNUG!

JNUG LONG TRIGGER TARGET ON THE DAILYThere is a wolfe wave setup on the Daily time frame. The projected target is calculated by extending a linear line between pivot 1 and 4 and projecting the line. This is represented as the green perforated line, as shown in the chart. The projected target is approx $75 which is expected to reach this price target within 12 days.

LONG Gold from bellow 1600After loosing 21, 34 and 200 EMA on D(aily) and 2D(daily) charts a more bearish downtrend has been confirmed. Althoug I expect shorterm bounce, making a higher low and fiddling around and above 200 EMA on 2D chart (we could be rangebound for a while), I do see a high probability of loosing ground and heading down to 200 EMA on weekly and having a deep dive exploration bellow. This shouldn't last for long, a V bottom wouldnt be a surprise down there, but I will set up orders and wait patiently for them to fill bellow 1600. Its is painfully obvious now, but I was willing to buy current levels a week ago. Lets see what future holds.

I love to use pitchforks as 80% of time the median line gets fiddled with, so... Looking forward to that and scopping up some $GOLD and $JNUG (potentially 50%-75% lower than current prices) for a nice uptrend move from that moment in time.

Stay patient, plant trees, harvest fruits.

Buy orders set.

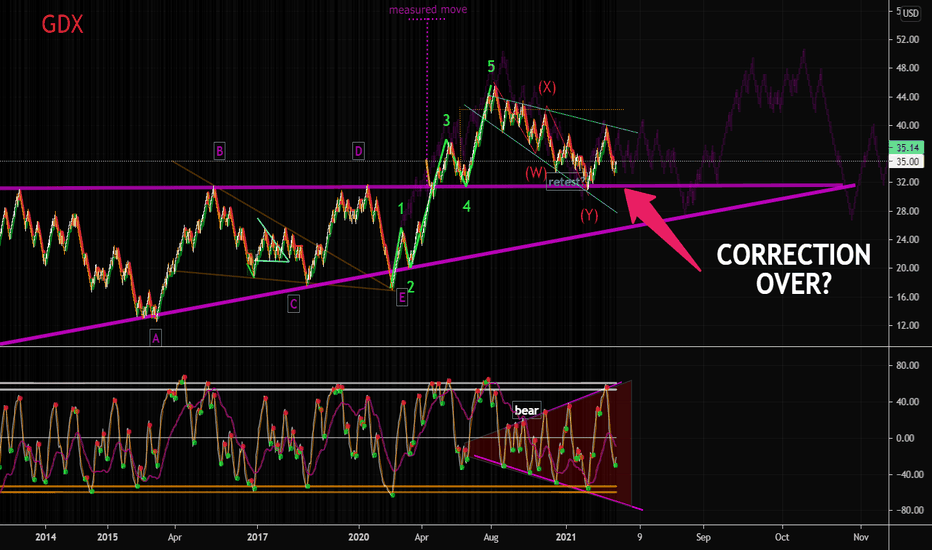

GDX HAS COILED ENERGYThe metals have been stuck in a range for quite a while. Gold Miners ETF (GDX) appears to have made 5 waves up since the crash in 2020 and formed an ongoing complex correction. What do you think? Has GDX bottomed? Take note of the lower stoch/rsi wavetrend indicator and the broadening nature that has occurred since this correction. This looks like a hidden bearish pattern that will eventually break. When it breaks, GDX is likely to move up incredibly strong. Perhaps one more push lower? I don't know... But I'll be ready if it drops again.

For me, I have some medium-longer term targets over 55-60.

GDX, is this a forgotten treasure?Hello everyone,

So Gold is finally back in a buy/accumulation zone, even though DXY may have more room to run I doubt this will translate in to heavy downside for gold. 1650 maybe? However, the stars look alligned once again to buy gold, or in this case GDX (Gold miners ETF). You can see the trade parameters in the chart. But this is definetely an opportunity like no other, whilst everyone is still lookin at Bitcoin, or Stocks, nobody is expecting a resurgence from gold at this point. However as we see volatility is not dead and gold does like volatile times. Even though this trade will take patience, and most likely won't payoff like crypto. The optimal upside is around a 150%, and in a mania case 400-600%. And the risk is -25%, I mean, it's a casual day in crypto or even stocks these days... Buying now is like buying BTC at 10k. Which BTW i've also advised in doing heavily. It's the same mantra as always - Buy low, sell high. However, most will do it the other way around.

Also check out my other ideas, even though I don't post often. When I do it's usually when things are CHEAP or EXPENSIVE.

As always, stay safe and stay liquid.

Has GOLD Caught My Attention? Breakout on the HorizonGold Weekly uptrend is in a current consolidation cycle, hence the up and down movement on the Daily chart with no clear direction as of yet. As we zoom in intraday for multiple time frame analysis, you will see the 2 hour chart(left side) has found support at $1836 and the bands are constricting around the price action. Now with every great consolidation cycle, comes great volatility as we know one thing is true "Volatility is cyclical". So with a bottom in and intraday charts aligning, this intraday breakout IF strong enough, could set the Daily chart up for a strong enough break out, to pour over into the weekly charts to continue the uptrend and breakout of the Weekly chart consolidation Cycle. Gold is on watch, has the potential to move like bitcoin, once the market takes it last breath, this would be a good bottom to establish one self IF it holds. $1900 is the key level to break and hold...All aboard? TVC:GOLD

BTD on $GOLD $GLD $GDX $JNUG $GDXUWe got some good news on the Stim bill today but it hasn't passed FR FR yet.

The House and Senate will vote today on a roughly $900 billion pandemic relief package, with the White House saying President Donald Trump would sign it. The deal includes help for small businesses, the jobless and direct payments to most Americans. The bill that lawmakers will vote on will be attached to a $1.4 trillion measure to fund government operations through the end of the fiscal year. As part of the compromise needed to reach agreement, Democrats allowed a provision to be inserted that would prohibit the Federal Reserve from restarting a program supporting corporate bonds and small businesses due to expire Dec. 31. (no more ink/paper for Powell? )

GOLD- i talked about this a while back, I'm overall bullish on Gold/Gold miner because stimulus passed = more inflation = good for GOLD fundamentally.(yea i know, who cares)

$22.20 has been a nice buying opportunity for this company but you could use that area as stoploss as well.

Entry $22.20 area

Target $25.20

Target 2 $28.20

Stoploss 21.20

GOLD - WHAT IS THE DEAL WITH NOVEMBER?Gold has entered the pivot zone. The hard metal is always a hold to me personally, but it helps to study the charts to get an idea of the algorithmic driving forces and other oddities. In this case, I couldn't help but see this Nov Nov Nov trend and the math behind the madness. The pattern suggests it'll be supportive. Watch it closely the next few weeks. We need to see strength come in to confirm support and upward continuation. Do not dismiss the possibility of a deeper correction.. There's no such thing as "impossible" when in comes to financial assets.. especially in 2020-after all, we did see oil trade MINUS $37 this year. Keep an open mind while in wonderland.