Target for $NUGT at different $gold spot prices $GDX $NUGT $JNUGThe ascending triangle in the gold price displayed here:

Has produced the consolidation wedge displayed in the green triangle pattern above in $NUGT.

A return to the recent highs will likely send $NUGT back into the $36 to $38 range.

Gold is, momentarily, no longer inversely correlated with the stock market. Negative real interest rates globally and the inverse correlation with USD is now the primary driving force in the price of gold.

Lower interest rates and (not QE ) QE are repricing the US dollar against major world currencies and gold:

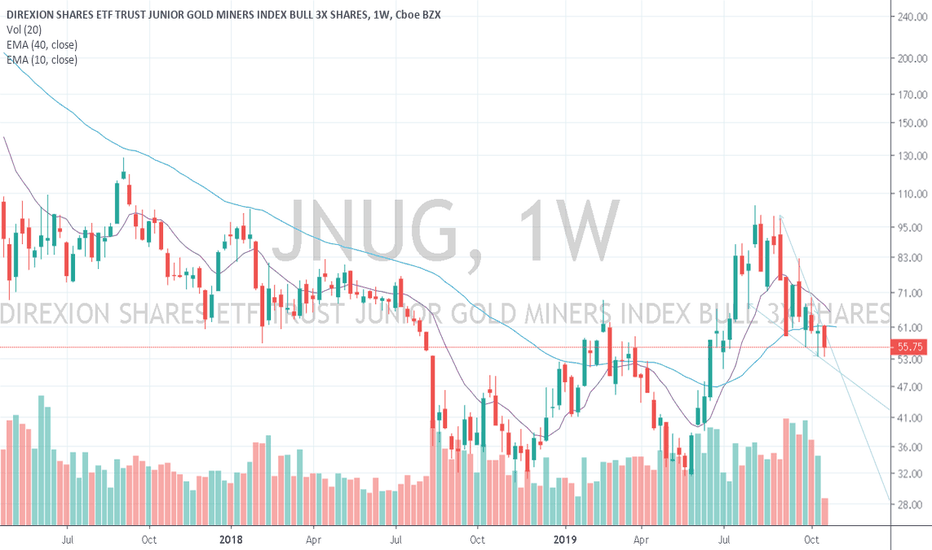

JNUG

JDST bullish; Gold prices likely bearish given US-China deal?JDST looks to be bullish, making higher lows in the recent weeks. Couple reasons why I think it's on the uptrend:

- Phase one of the China trade deal concluded bringing some stability to the world economy; generally this should reduce the demand for gold, lowering prices and increasing JDST, a gold miner BEAR.

- Gold prices have a very strong resistance around 1540 from May of 2012. It's already touched that resistance late September/early August this year and would need some serious momentum or world news to break that resistance, such as the US-China trade deal falling apart. I believe it's more likely that gold prices are on the way down, making an ETF like JDST increase.

What do you think? Please leave a comment with your thoughts!

Cara, the Cannabis Pharma Sector leaderLight weight company with a strong cannabis product niche. Technical bullflag setup, needs macro bull trend to hold up, and then a company specific catalyst to breakout for new ATHs

Gold-Short model GLL low @ 09/2021 - JNUG Bullish next 24 monthsKeep studying & tweaking GLL (Gold Short Model) to try to understand maximum peak in Gold/Miners.

Continue to see 3 hour brschultz model place optimal peak in gold miners in Sept 2021.

Bottom in S&P, Dow, Nasdaq, & Real Estate in Late 2021 as well.

brschultz