$JOBY pre-mature ejaculation fueled by Hopium- NYSE:JOBY pumped by X/Twitter gurus. They claim themselves to be early picker of innovative company whereas truth is they have massive following which is causing pump and dumps.

- SEC should investigate these X influencers pumping small cap companies and then claiming that they are picking 1000% gainers.

- I don't know how the F, a company making 15 mil in revenue is sitting with 15 billion market cap. Someone needs to investigate these X pumpers and the connection with these companies like NYSE:JOBY execs if they are getting money under the table.

JOBY

ACHR – 50 SMA Bounce with Sympathy Momentum from JOBYNYSE:ACHR – 50 SMA Pullback + Options Play Into Support

Archer Aviation ( NYSE:ACHR ) is showing signs of life right at the 50 SMA, and with competitor NYSE:JOBY ripping to new highs today on news, this could be the sympathy setup traders are looking for.

🔹 Technical Setup

After a strong run, NYSE:ACHR has pulled back in an orderly fashion, now resting on the 50-day moving average — a key support zone.

The stock is sitting on clean support, showing signs of stabilization.

🔹 Sector Tailwind from NYSE:JOBY

NYSE:JOBY is breaking out today on headlines — and NYSE:ACHR often moves in sympathy.

If momentum spills over, this could be the launchpad for NYSE:ACHR to retest prior highs.

🔹 My Trade Plan:

1️⃣ Position: Buying the August 1st $11 calls around the $0.90 area.

2️⃣ Reasoning: Strong reward-to-risk if NYSE:ACHR bounces from here.

3️⃣ Trigger: Watching for a reclaim of the short-term EMAs and increased volume as confirmation.

Why I Like This Setup:

50 SMA bounce + sympathy play = great combo.

Options are cheap, offering leverage without heavy risk.

If this breaks out again, it could move fast — this name has range.

Joby Aviation, Inc.Key arguments in support of the idea:

Over the past quarter, Joby Aviation has made meaningful progress toward certification of its electric air taxi. The company has now completed 62% of Stage 4, advancing 12 ppts in just one quarter. Engineers successfully conducted piloted transition flights, and a series of fault-tolerance tests—where batteries, tilt mechanisms, and even half of the engines were deliberately shut off—ended in safe landings, showcasing the robustness of Joby’s safety systems.

Progress on the certification front is complemented by tangible manufacturing achievements. Five fully functional flight prototypes have already been assembled, with each new unit being produced faster, more efficiently, and at lower cost. Scaling efforts are supported by a strong strategic partnership with Toyota, which plans to invest up to $500 million this year to help Joby refine its production processes. The company’s order backlog stands at approximately 1,500 units.

Joby is looking beyond California for operations. A pilot service is scheduled to launch in Dubai in spring 2026, with the first vertiports already under development. Test flights are expected to begin by mid2025. Simultaneously, a MoU has been signed with Virgin Atlantic, paving the way for future service networks in London and Manchester.

Joby’s monetization strategy is highly flexible—ranging from direct aircraft sales and defense contracts to joint ventures and proprietary passenger routes in partnership with Delta, Uber, and Virgin. The company currently holds $813 million in cash and has a disciplined 2025 spending plan of $500–540 million.

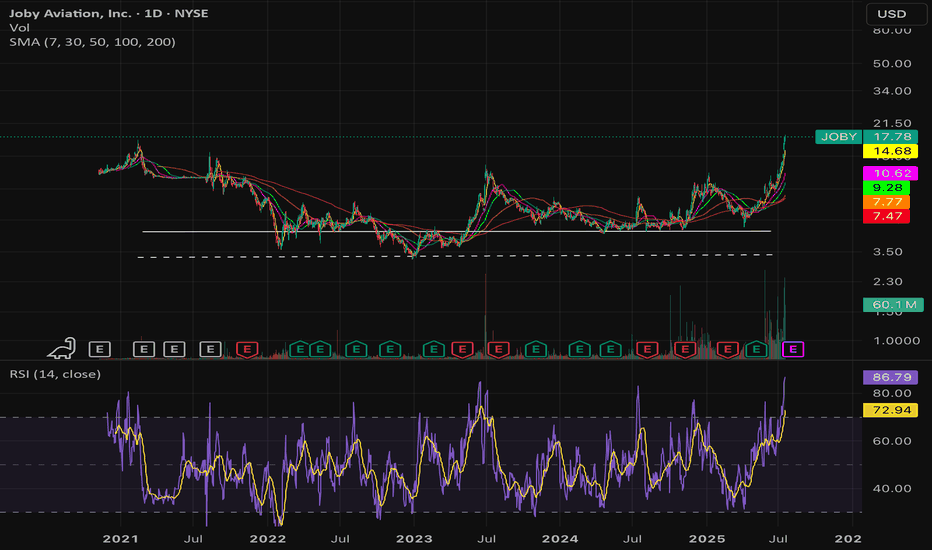

While Archer Aviation (ACHR) didn’t surprise with its latest report, its stock still saw impressive gains. We believe Joby could follow suit—especially given the overlap in their operational zones, as Joby’s stock typically reacts to competitor moves with a slight delay. Investors are beginning to price in the upcoming launch of eVTOL commercial operations, which could periodically trigger strong upward momentum in the stock. Technically, the chart also shows signs of an "inverse head and shoulders" formation.

2-month target price for JOBY is $8.50. We recommend setting a stop loss at $6.10.

JOBY closed above MA200 - Is it good to buy the dip now?BUY ENTRY $6.00 - $6.45

1st TARGET $7.20

2nd TARGET $8.00

STOPLOSS BELOW $5.75

---

OUR BUY CALL OPTIONS

Strike $6 Exp 7/18, price $1.35

Strike $7 Exp 7/18, price $0.90

---

HIGH RISK HIGH REWARD BUY CALL OPTION

Strike $7 Exp 4/17, price $0.35

---

Disclaimer

$JOBY: Strategic Entry into the eVTOL MarketI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Joby Aviation, Inc. ( NYSE:JOBY ): Strategic Entry into the eVTOL Market

Trade Setup:

- Entry Price: $6.91

- Stop-Loss: $3.61

- Take-Profit Targets:

- TP1: $12.76

- TP2: $21.08

Company Overview:

Joby Aviation, Inc. is a leading player in the emerging electric vertical takeoff and landing (eVTOL) aircraft industry. The company focuses on developing zero-emission aircraft to revolutionize urban air mobility. With substantial investments in technology and partnerships, Joby aims to launch commercial operations by 2025.

Earnings Reports:

- In Q3 2024, NYSE:JOBY reported a net loss of **$476.86 million**, as expected for a pre-revenue company heavily investing in research and development.

- Total cash reserves stand at **$1.1 billion**, ensuring sufficient runway for operational and developmental goals.

Valuation Metrics:

- Market Cap: **$6.54 billion**.

- Given its pre-revenue status, traditional valuation metrics like P/E or P/B are not applicable. Instead, the company is valued on its growth potential in the emerging eVTOL market.

Dividends:

- NYSE:JOBY does not pay dividends, prioritizing reinvestment into its development and expansion plans.

Market News:

- Recent announcements include plans to raise **$300 million** through equity sales, strengthening financial resources ahead of the anticipated commercial launch.

- Joby also received its first production airworthiness certificate, a critical milestone toward FAA certification.

Analyst Ratings:

- Analyst consensus: **Moderate Buy**.

- Average price target: **$8.35**, reflecting mixed sentiment due to the stock’s volatility and developmental stage.

Risk/Reward Analysis:

With a stop-loss at **$3.61**, the downside risk is approximately **47.75%**, while the upside potential to TP1 ($12.76) offers a reward of **84.66%**. TP2 at **$21.08** provides an extended reward potential of over **200%**. This setup appeals to long-term investors with high-risk tolerance.

Conclusion:

Joby Aviation represents a compelling opportunity for growth investors looking to capitalize on the eVTOL market's potential. While the stock's volatility and pre-revenue status introduce risk, its significant milestones and industry positioning make it a high-reward prospect.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.

Joby Aviation Surges Over 24% After Major Toyota InvestmentJoby Aviation (NYSE: NYSE:JOBY ) saw its stock soar by over 24% to $5.99 after a significant announcement that Toyota will invest an additional $500 million into the electric air taxi company. This brings Toyota’s total investment in Joby (NYSE: NYSE:JOBY ) to $894 million, underscoring the automaker’s commitment to the future of urban air transportation.

Toyota’s Investment and Strategic Partnership

Toyota’s new investment is not just a financial endorsement but also a strategic partnership aimed at advancing the certification and commercial production of Joby's electric vertical takeoff and landing (eVTOL) aircraft. The investment will come in two equal installments, the first to be completed in 2024 and the second in 2025, further cementing the relationship between the two companies.

Toyota has been involved with Joby (NYSE: NYSE:JOBY ) for almost seven years, providing technical expertise, components, and manufacturing support for the company’s air taxis. Toyota’s engineers are embedded with Joby’s team in California, working closely on the development of these groundbreaking aircraft. This partnership goes beyond just capital infusion, as Toyota also signed a long-term agreement to supply key powertrain and other critical components for Joby’s aircraft.

Other automakers are also eyeing the electric air taxi space, signaling a broader interest in sustainable urban transportation solutions. For instance, Stellantis recently invested $55 million in Archer Aviation, while Delta Airlines has a $60 million stake in Joby, aiming to offer air taxi services for passengers traveling to and from major airports in cities like New York and Los Angeles.

With this backing, Joby Aviation is positioning itself as a leader in the electric air taxi market, which aims to reduce urban traffic congestion and lower carbon emissions. The company has already rolled out its third aircraft from its pilot production line and is expanding its manufacturing capabilities. Joby is targeting a commercial deployment of its air taxis in the next few years.

Technical Aspect: Bullish Momentum

From a technical perspective, Joby’s stock has been in a downtrend since August 2024 but showed a strong reversal with today’s surge. As of this writing, the stock is up over 25%, with a Relative Strength Index (RSI) of 66.19, indicating bullish momentum. The stock has now broken above key moving averages, a positive sign for traders and investors looking at technical patterns.

If the bullish trend continues, NYSE:JOBY could aim to revisit its July highs, as today’s price action suggests a potential shift in the overall market sentiment for the stock. The recent investment news provides a strong fundamental backdrop, and if Joby continues to demonstrate progress in its production and certification milestones, the stock could see sustained upside.

With Toyota’s deepening involvement and the broader market’s growing interest in sustainable air travel, Joby Aviation is positioned to become a major player in the electric aviation space. Investors should keep an eye on upcoming developments, particularly Joby’s progress in certification and commercial production, which could serve as major catalysts for the stock.

Conclusion

Joby Aviation’s (NYSE: NYSE:JOBY ) recent surge in stock price, buoyed by Toyota’s additional $500 million investment, is a positive signal for both the company’s future and its investors. The strong technical performance, with the stock trading above key moving averages and a bullish RSI, suggests that NYSE:JOBY may have broken out of its recent downtrend. Coupled with a strong fundamental outlook, including strategic partnerships with Toyota and Delta Airlines, the company is well-positioned to revolutionize urban air transportation. Keep an eye on this stock as it could be poised for more gains, especially as the market for eVTOL technology heats up.

JOBY Aviation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of JOBY Aviation prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $0.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Joby Aviation Set to Launch An Air-Taxi Service in Dubai By 2026Joby Aviation ( NYSE:JOBY ), a pioneering air-taxi company based in California, has unveiled plans to launch regular air-taxi services in Dubai by 2026. This ambitious endeavor marks a significant leap forward in the evolution of urban mobility, positioning the United Arab Emirates (UAE) at the forefront of cutting-edge transportation technology.

The agreement between Joby Aviation ( NYSE:JOBY ) and the Dubai government represents a historic partnership aimed at revolutionizing the way people move within cities. With operations set to commence as early as next year, Joby ( NYSE:JOBY ) is poised to establish the world's first regularly operating air-taxi service, heralding a new era of aerial transportation.

Joby's remarkable journey towards this milestone has been characterized by a series of pivotal achievements. Notably, the company's innovative air-taxi design was showcased in 2021, highlighting its superior noise reduction capabilities compared to conventional vertical takeoff and landing vehicles. June 2023 witnessed a significant milestone as Joby secured a crucial permit from the Federal Aviation Administration (FAA) for flight testing in the United States, underscoring its commitment to safety and regulatory compliance.

September saw Joby ( NYSE:JOBY ) advancing its production capabilities with the commencement of construction on an aircraft production facility in Ohio, laying the foundation for scalable manufacturing of its revolutionary air taxis. In November, the company made history by conducting the first-ever air taxi flight in New York City, demonstrating the feasibility and potential of urban aerial mobility.

The planned launch of the air-taxi service in Dubai promises to redefine urban transportation, offering unparalleled speed, convenience, and efficiency to passengers. Several strategic locations have been identified as takeoff and landing zones, including Dubai International Airport (DXB), Palm Jumeirah, Dubai Marina, and Dubai Downtown, ensuring seamless connectivity across the city.

Equipped to accommodate a pilot and up to four passengers, Joby's air taxis boast impressive capabilities, capable of reaching speeds of up to 200 mph. This remarkable speed translates to unprecedented time savings, with a journey from Dubai International Airport to Palm Jumeirah reduced to a mere 10 minutes, compared to the current 45-minute car journey.

The announcement has sparked significant investor enthusiasm, with Joby Aviation's stock ( NYSE:JOBY ) surging over 6% in premarket trading to $6.33 per share, reflecting growing confidence in the company's disruptive potential and transformative impact on urban transportation.

As Joby Aviation ( NYSE:JOBY ) continues to push the boundaries of innovation and collaboration, its visionary pursuit of a sustainable, efficient, and accessible urban air mobility ecosystem holds immense promise for cities worldwide. With the skies of Dubai set to be transformed by the advent of air taxis, the future of transportation has never looked more exhilarating or closer within reach.

In summary, Joby Aviation's ( NYSE:JOBY ) bold venture in Dubai represents a monumental stride towards realizing the vision of a seamless, interconnected urban transportation network, propelling humanity towards a future where the sky is no longer the limit.

Joby Aviation / JOBY - Like an AirplaneSome stocks, I've never heard of before, but I come across people talking about them on Twitter, so I decide to take a look at them and keep an open mind.

That is the case with JOBY, and I know nothing about this company, nor about its financials... nor do I care about that.

So long as the markets are being maintained by institutions and haven't been hot potatoed because they're on the verge of bankruptcy, I only care about price action, because I believe that charts are fractals and contain all of the combined information and intelligence of all market participants.

Also, at present I am not looking to invest, because I believe there's a significant market-wide shakeout on the horizon. After that happens will be the time to build commons positions. Right now is just the time to make some trades and build cash.

I hear Joby's Chief is an actual aviation engineer though, and that sounds pretty bullish in the long term.

Anyways, we're (almost) in September now and the entire 2022 can count as something of an accumulation phase for JOBY.

I believe it's primed to take a run over $8 based on the fact that:

1. Swept out short sellers with stops over the March high on Aug. 8

2. Three weeks of "feathery" downturn while maintaining its July pivot structure

3. Unfinished business from November and December lying slightly above a December weekly double top, which is slightly above the Aug. 8 stop sweep.

I also believe the timing is _exceptionally_ good, as the monthly candle is painted like this, and is not likely to actually print like this with two days to go:

I very much doubt it's going to print a big red down candle with a big long wick based on how all of 2022 has already traded at a discount.

Markets at large are set for a significant downturn. However, 'ye ol' $5 stock aviation stocks can go on a 60% tear while the SPX dumps and it won't affect anything, and can provide something of a safe haven.

All the same, it's set up nicely to go for a run. At least, I think if someone was to short here, they'd get themselves a call from margin, for sure.

Other relevant stock calls:

Enovix / ENVX - A Close Shave

&

Peloton / PTON - Pumpy Before Dumpy

&

Blackberry / BB - 'Tis No Bubbling Volcano, But 'Tis a Geyser.

Flying Taxis I think this is a great company and may be a good stonk for buy and hold.

Check it out, JOBY.

Potential a bottom has been found recently. I am happy to see a strong rebound, in the case major indexes suffer more downside in the near term, this chart is in a good position to form a higher low.